How To Pick 12 Good Stocks For 2024 Covered Calls, Cash Secured Puts Trades

Small and large dividend stock and ETF investors can use covered calls and puts trades to generate monthly income from options premiums and options trading.

By Donald E. L. Johnson

Cautious Speculator

Which stocks should you use for trading covered calls and cash secured puts in 2024?

Look at the ones you owned in 2023 and 2023 or the stocks and ETFs owned by your favorite mutual funds or exchange traded funds.

Use several online services to find the stocks that fit your investing style and income goals.

This article uses some 90 stocks and ETFs during 2023 to show how I’m searching for stocks I want to trade in 2024.

You probably own some of the best stocks for you.

One of the best ways to pick stocks, exchange traded funds and mutual funds for total returns, dividends and puts and calls options premiums is to look at the equities that you traded in 2023. The trick is to narrow the list down to the 5 to 12 stocks you plan to trade in 2024. Assume that you will find others that are more suitable during the year.

During the last 12 months or so, I’ve traded cash secured puts and covered calls on some 90 stocks:

ME, ABT, ACN, AMD, AVAV, AFL, AA, MO, AMZN, AMGN, AAPL, T, BAC, BG, CPB, CG, CAT, CVX, CSCO, KO, CAG, COPP, DHR, DE, DVN, DFS, DG, D, DOW, DHI, DUK, XOM, FAST, FCX, GNRC, GD, GIS, GILD, XYLD, PEAK, HSY, IBM, ISRG, QQQ, SLV, TLT, IWM, ITB, JNJ, JPM, JEPI, KMB, KMI, KR, LH, LNC, LMT, LOW, LYB, MRK, META, MSFT, MRNA, MS, MP, NEM, PANW, PAYC, PFE, PSX, PG, QCOM, DGX, RTX, SCHW, XLE, XLY, SJM, SO, DIA, XES, XBI, SU, USB, VLTO, VZ, FRTX, V, WBA, WSM, ZBH.

Barchart.com, StockRover.com, MorningStar.com, StockCharts.com and SeekingAlpha.com all offer the ability to create watch lists and look at hundred of different historical and forward looking metrics. The way I use this list is to create a watch list and paste the symbols into the list. Usually, you can post all of the symbols at once. Morningstar makes users paste one symbol at a time.

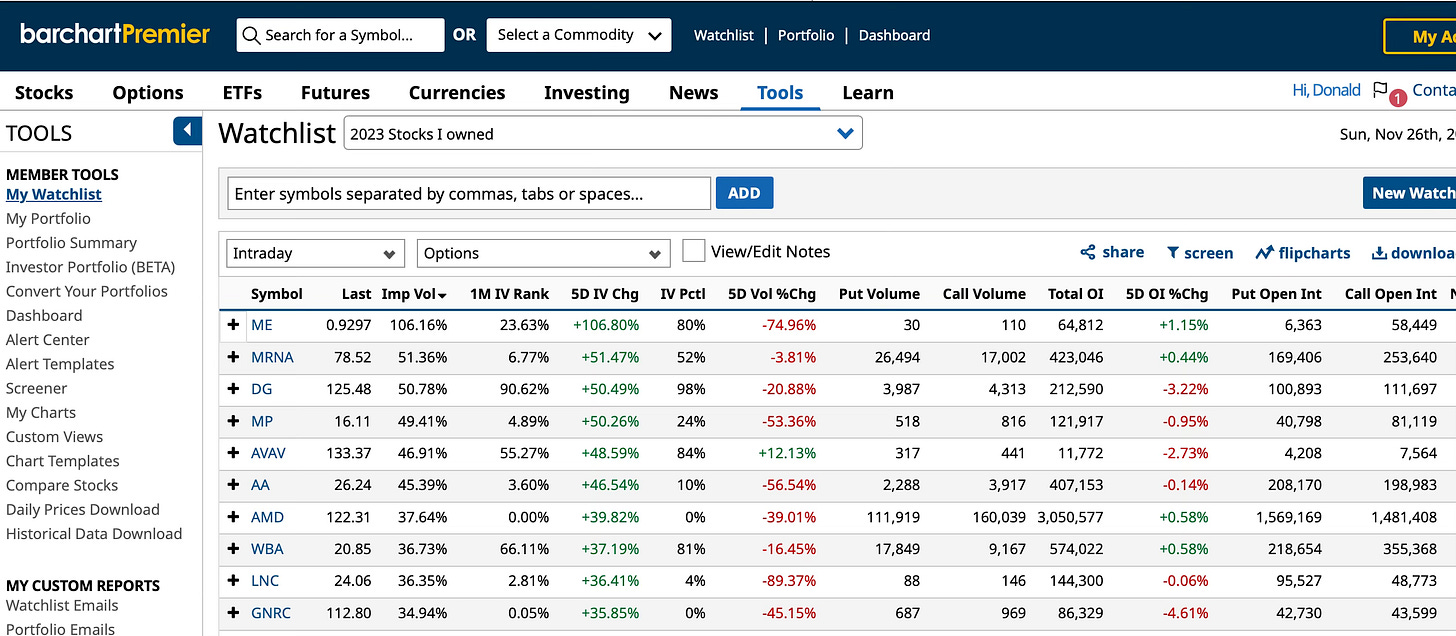

These are the top buy rated stocks on Barchart.com, which is one of my first stops in searches for good stocks. Because I’m using a list of stocks I’ve owned and traded options on, I know that most of these stocks have pretty liquid options.

Options traders looking for stocks with high implied volatilities and high options price can create this Barchart.com table and click on the IV column heading to get a list of the most volatile stocks and ETFs on the list.

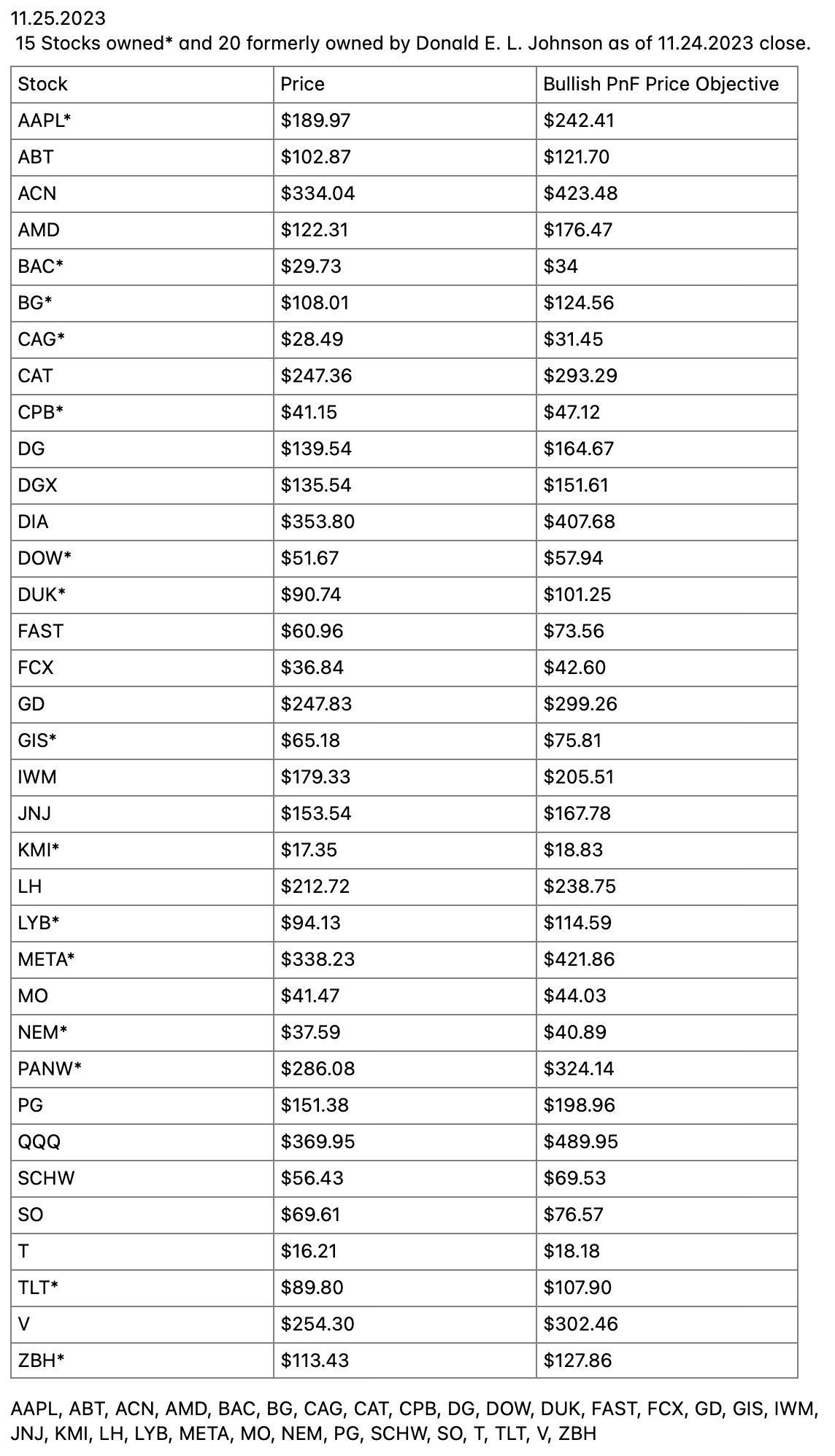

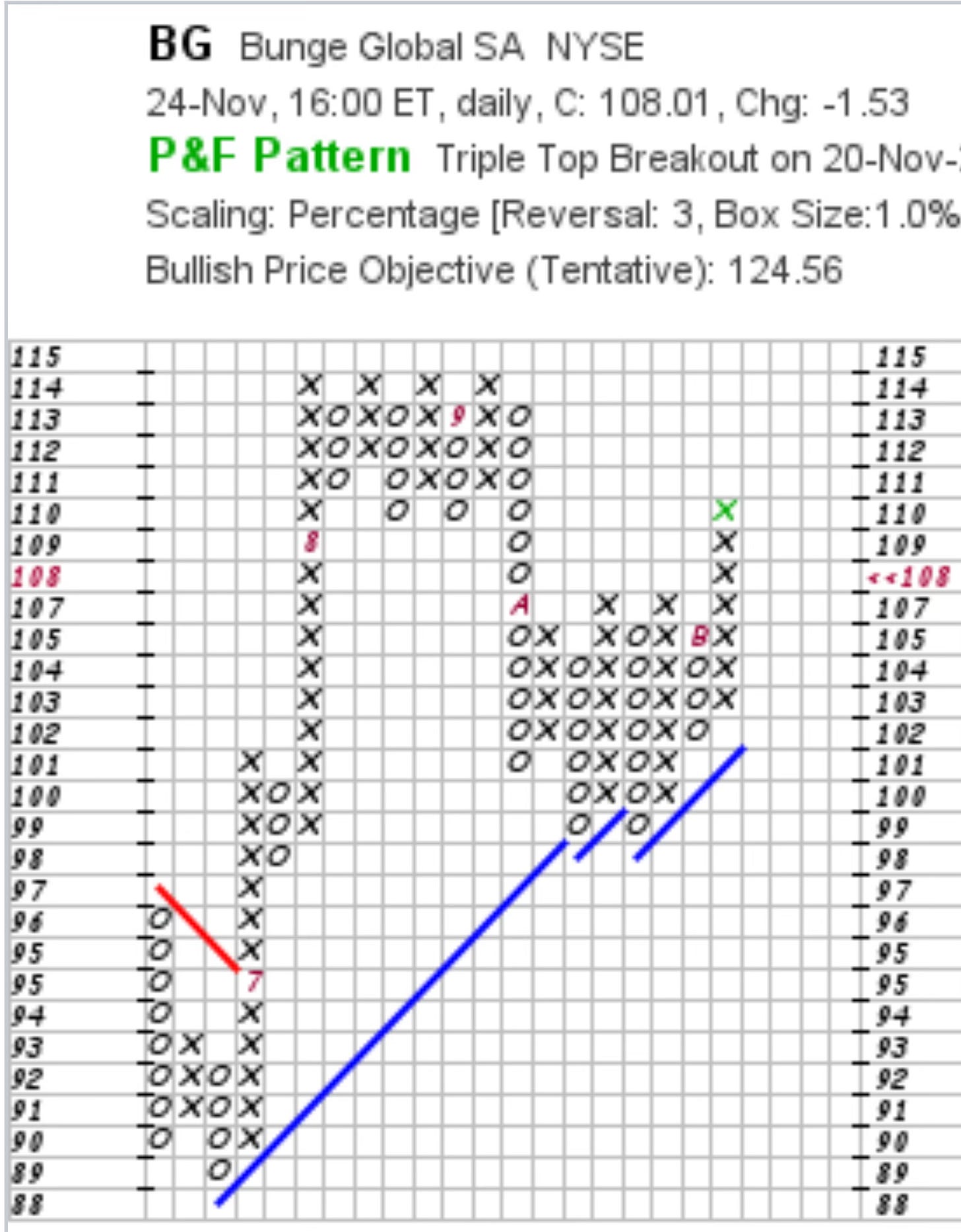

Next, I go to StockCharts.com, click on its “CandleGlance” tab and then on percentage point and figure charts. There I find which of my stocks have bullish PnF chart price objectives. I created this table because it is easier to examine than a computer page full of 90 charts. The symbols below the table can be pasted in to watch lists.

Then I go to StockCharts.com’s summary page to look for stocks that have bullish relative strength, dividend 20- and 200-day moving averages data. Stocks with RSI over 70 are considered over bought. I prefer to trade strong buys that are 55 to 65 RSIs or a bit higher, which are shown on the online version of this chart.

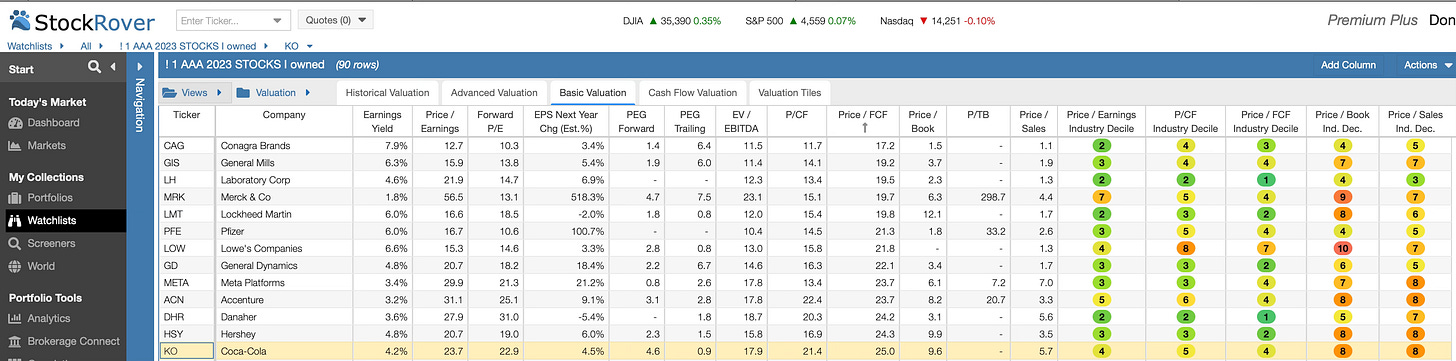

On StockRover.com, I’ve created several views and tables that show the metrics that are important to me. I look for low (P/FCF= 10 to 20 or a bit higher) to reasonable price to free cash flow ratios to determine whether stocks are trading at fair value and have room to rise, or not.

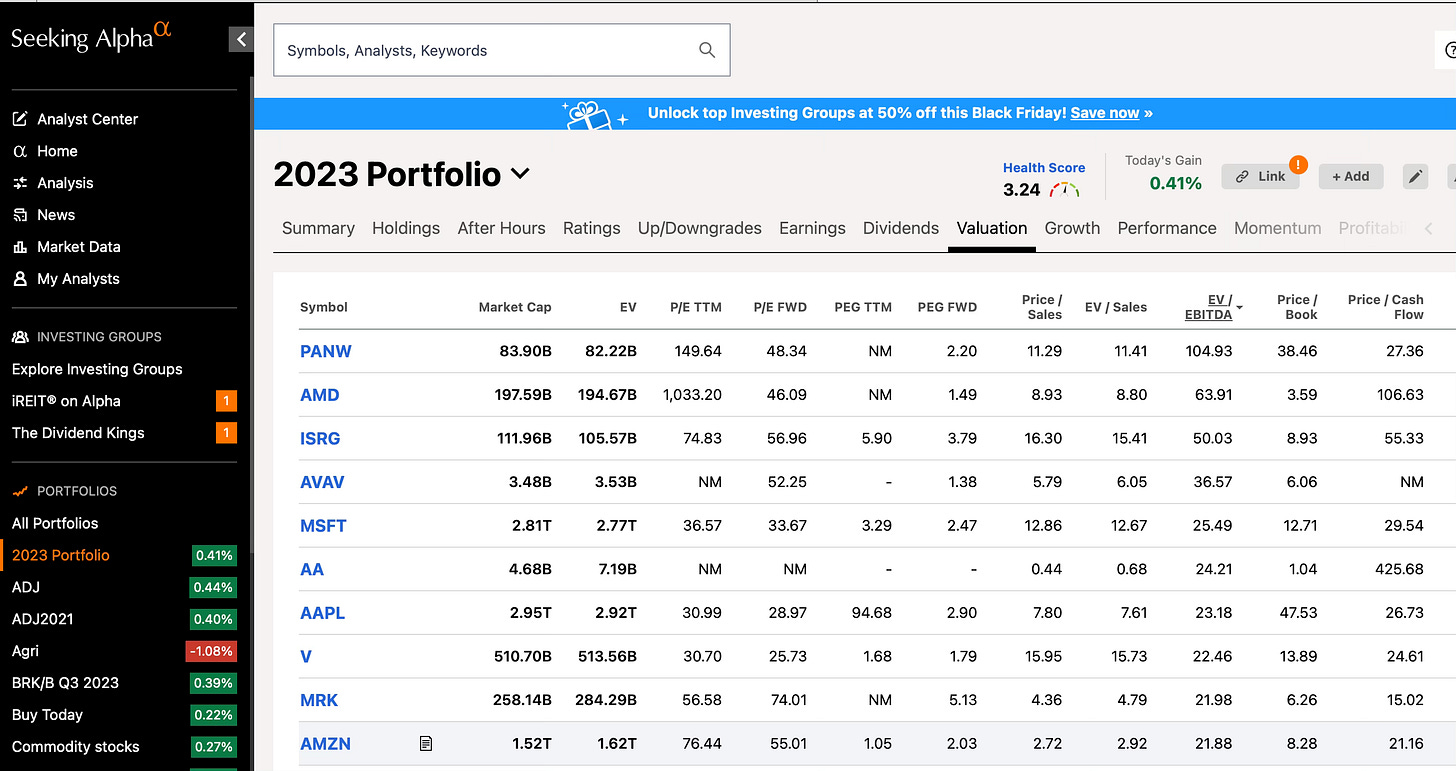

SeekingAlpha.com gives investors other ways to look at valuation. Here, I’ve ranked stock by their EV/EBITDA ratios.

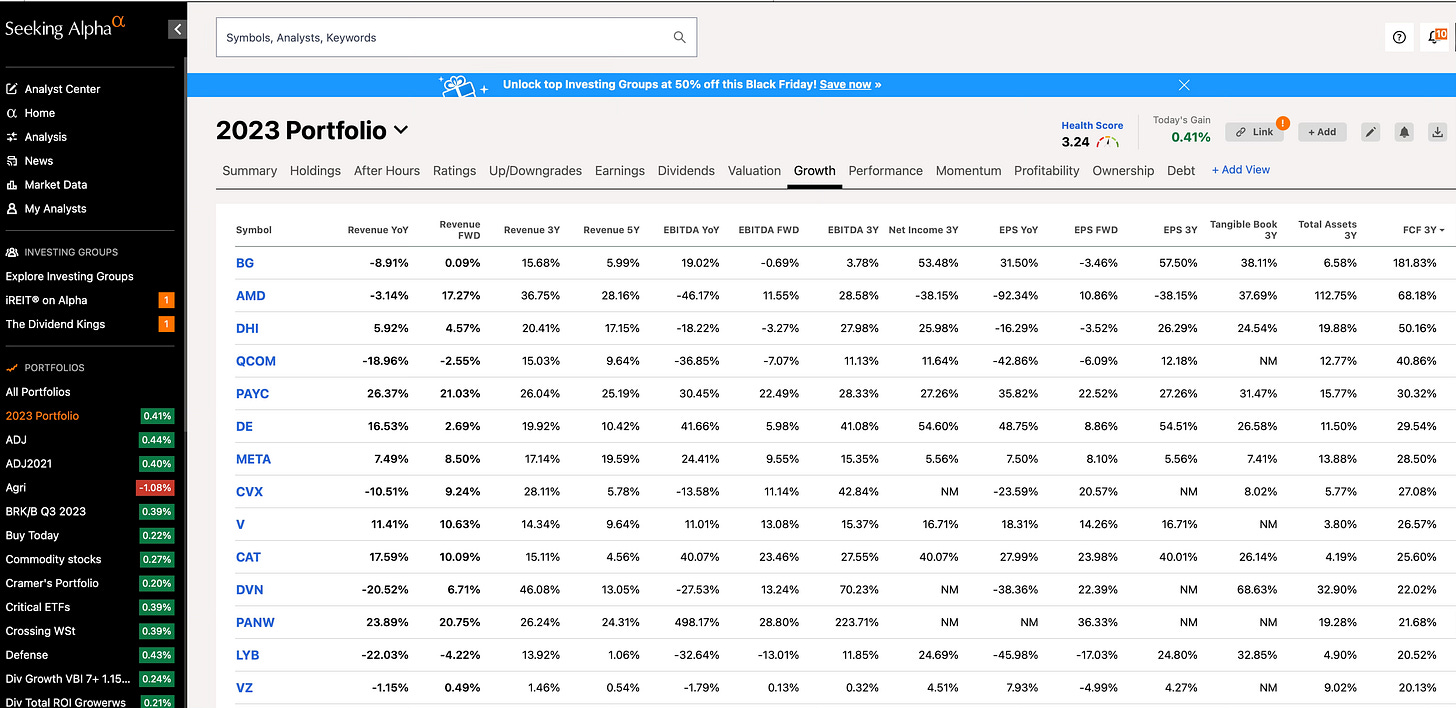

This view ranks stocks by the three-year free cash flow growth.

As I investigate these tables, I look for articles about these equities and their industries on Barchart.com, Morningstar.com, Valuentum.com, SeekingAlpha.com and in online searches.

Trading 92 stocks and ETFs in 12 months takes a lot of research and trading time. I thought I would cut the number of stocks I would trade this year, but as I adjust my strategies to fit what I see as market conditions, I am prone to diversify too much. I currently own about 40 equities. Twelve to 20 makes more sense because it is easier to follow a small number of names than 40 to 90 names.

To see what I’m doing versus what I’m saying, check out my recent posts on the home page.

Along with looking at the stock you have traded in the last year or two, you might look at stocks owned by Warren Buffett’s Berkshire Hathaway (BRK.b), your favorite mutual funds or exchange traded funds or other stock gurus. This is a way to delegate diving into the minutia of each company to professional portfolio managers and analysts and analyzing the analysts.

I respond to comments on the comments section where readers’ comments are posted. That is, if you have a question about this article or other comments, I'll discuss your questions with you in the comments section below this article.

LINKs:

Home Page. See my more than 190 articles on options trading, stock picking and watch lists. If you read several of these articles, you’ll learn how my strategies are meant to work. No guarantees. Links to useful web sites are on the lower right corner of the home page. Scroll down.

Follow @RealDonJohnson on twitter.com and FaceBook.com. Or follow me on Substack.com/Notes where my byline is my handle.

15 December Covered Calls Trades Yielding 22.9% to 26.2%

12 Berkshire Hathaway Buys For Covered Calls Options Traders

20 November 2023 Covered Calls Trades Yielding 13.3% to15.9% Update #2

AMZN, META, MSFT And NVDA Posted Big Gains. November Puts Trades Update #4

5 Bullish Stocks For Covered Calls, Puts Stock Options Trades

How I'm Trading Amazon Covered Calls, Cash Secured Puts Stock Options For Options Premium Income

22 November 2023 Covered Calls Trades Yield 12.9% to 15.3%

31 November 2023 Cash Secured Puts Trades Yield 10.3% Update #5

25 November 2023 Cash Secured Puts Trades Update #3

20 November 2023 Cash Secured Puts Trades Update #2

10 November 2023 Cash Secured Puts Trades Update #1

5 November 2O23 Cash Secured Puts Options Trades

32 October 2023 Covered Calls Trades Update #2

October 2023 Cash Secured Puts Trades Update #2

10 November 2023 Covered Calls Trades Update #1

7 November 2023 Covered Calls Trades Are Yielding 13.3%

Selling in The Money Covered Calls Can Yield Big Annual Returns on Risk. By Donald E. L. Johnson

How to Beat Inflation Tax, Bear Market Tax With Dividend Stocks, Covered Calls, Cash Secured Puts, by Donald E. L. Johnson.

How I Analyze Bullish Puts Options Trades With Stock Rover, By Donald E. L. Johnson.

Wars Breed Inflation, Rising Interest Rates, Market Turmoil, By Donald E. L. Johnson.

Calls vs Puts Options: What’s the Difference?

A video on how to place options trades on TDAmeritrade.com’s Think or Swim trading platform.

You are the man!