12 Berkshire Hathaway Buys For Covered Calls Options Traders

Small and large dividend stock and ETF investors can use covered calls and puts trades to generate monthly income from options premiums and options trading

By Donald E. L. Johnson

Cautious Speculator

Income investors pick stocks with bullish momentum and sell covered calls and cash secured puts stock options on them.

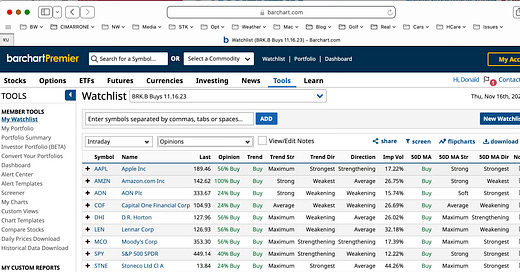

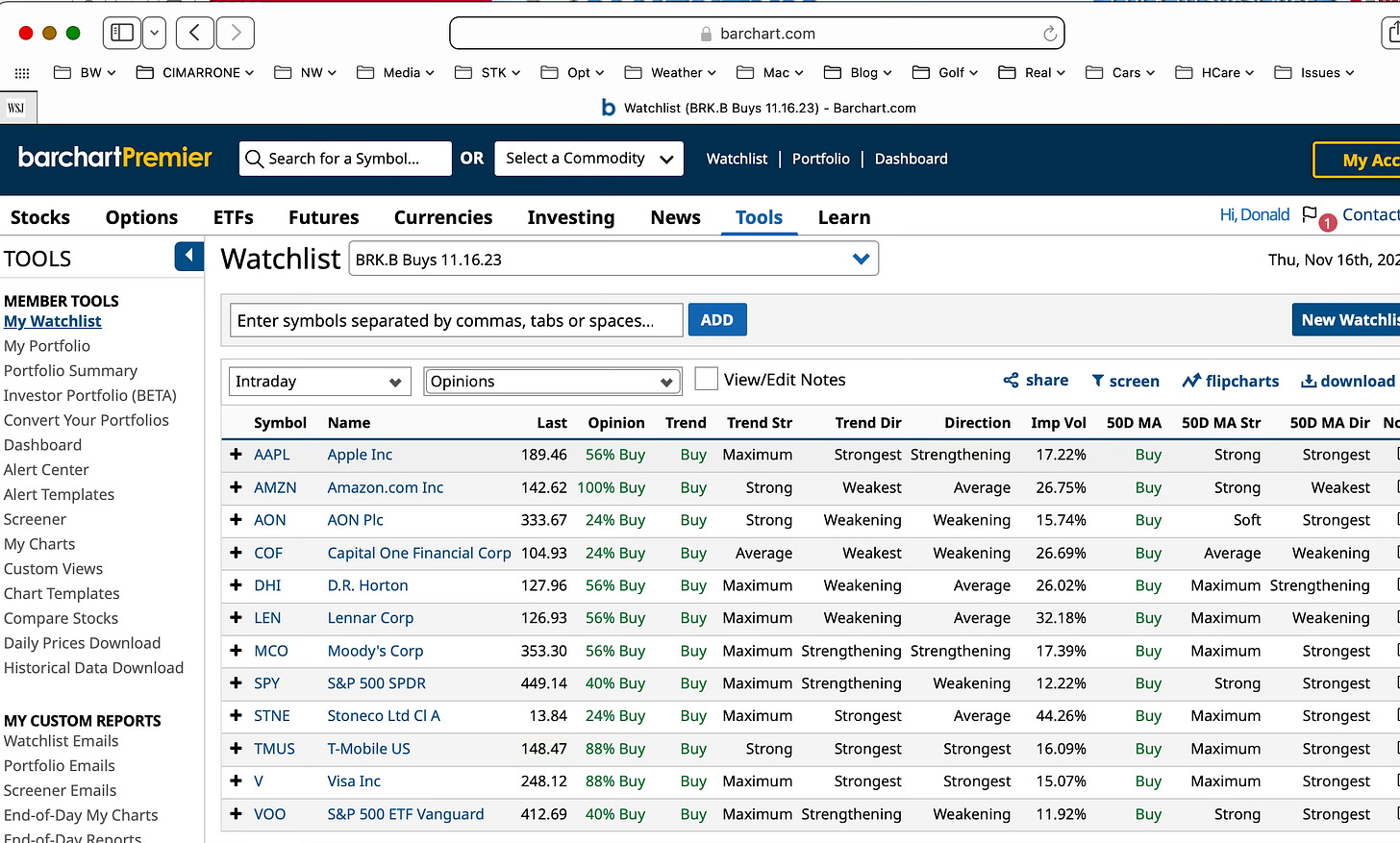

Berkshire Hathway owns 12 equities that have bullish price objectives and technicals.

I own and sell covered calls and puts on several Berkshire stocks.

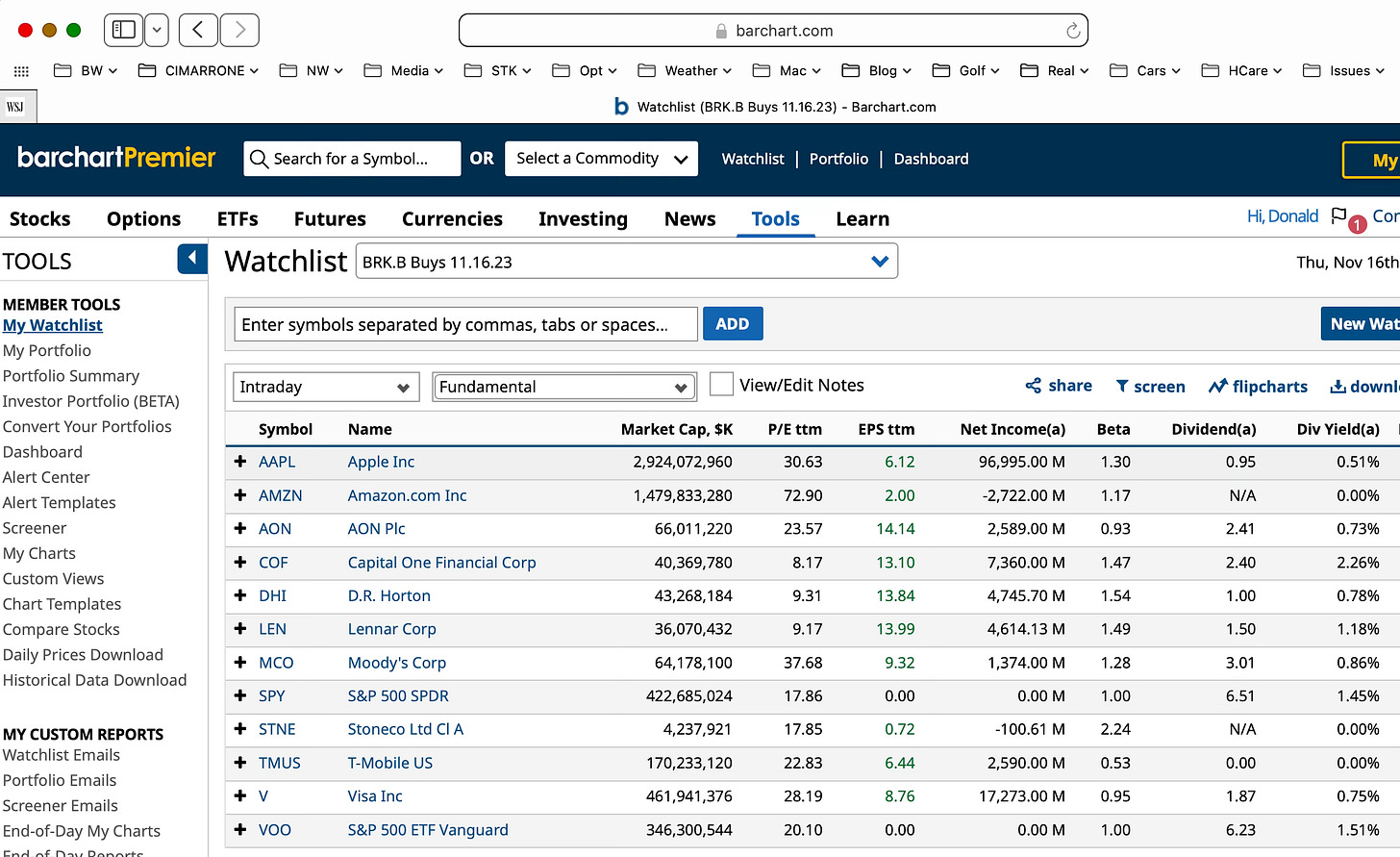

Investors who trade covered calls stock options for options premium income might consider 10 bullish stocks and 2 bullish exchange traded funds owned by Warren Buffett’s Berkshire Hathaway (BRK/b) as of September 30.

On SeekingAlpha.com, John Vincent discusses in great detail how Berkshire changed its portfolio during the third quarter and shows all of the stocks that it owned as of Sept. 30.

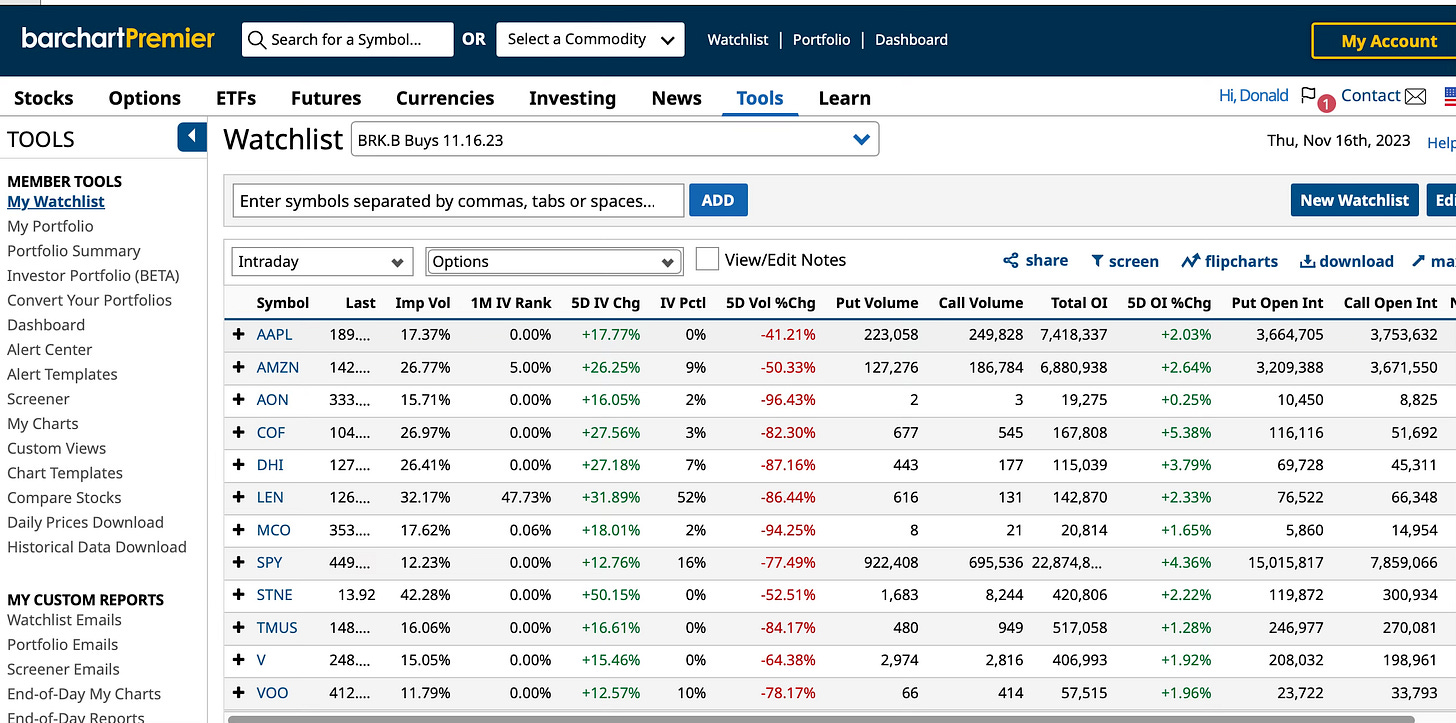

These 12 equities are both bullish and good opportunities for traders of covered calls and cash secured puts because their puts and calls options are actively traded and liquid. Several also are deep because a trader can trade strikes more than 10% out of the money if they want to reduce the risk of having their puts and calls exercised.

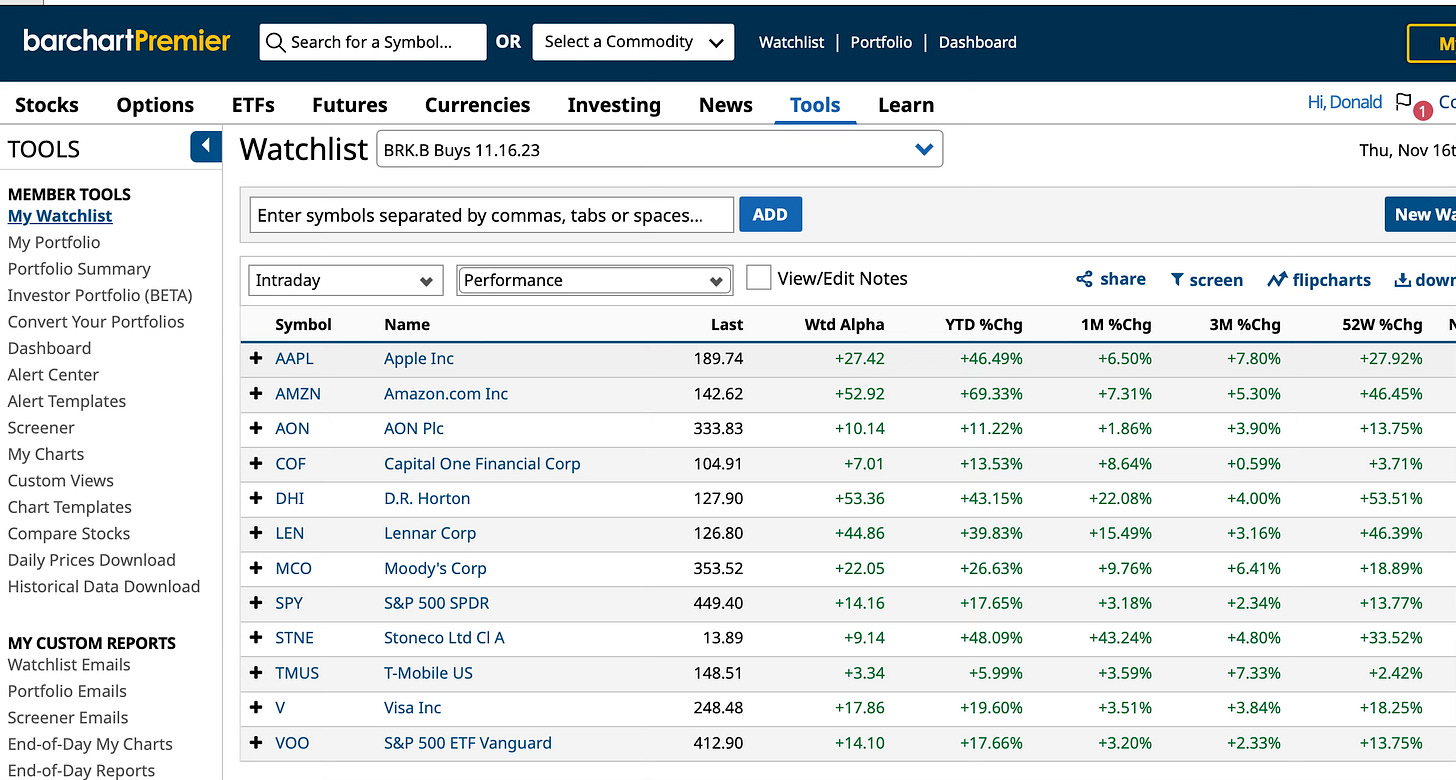

All 12 of the equities are up year to date and over the last one, three and twelve months.

While fundamentals and what analysts are predicting for stocks, what is most important is what millions of traders think. Point and figure charts reflect both recent action and bullish and bearish price objectives that change as the equities’ prices change.

All of these equities have bullish price objectives at this writing.

On StockCharts.com, Apple Inc.’s (AAPL) bullish PnF chart price objective (not target), is $236.45. Amazon.com (AMZN) $201.92. AON Plc. (AON) $405. Capitol One Financial Corp. (COF) $143.13. D.R. Horton Inc. (DHI) $159.43. Lennar Corp. (LEN) $156.98. Moody’s Corp. (MCO) $457.13. S&P 500 SPDR (SPY) $531.31. Stoneco Ltd. CI A (STNE) $13.31. T-Mobile US (TMUS) $165.90. Visa Inc. (V) $287.50. S&P 500 ETF Vanguard (VOO) $485.72.

I own and/or trade puts and calls on AAPL, AMZN and DHI. I wrote about how I trade AMZN here and here.

StockCharts.com publishes a StockCharts Technical Ranking (SCTR) based on momentum. SCTR scores above 60 are strong buys. Eleven of the 12 equities have strong buy rankings. AON is just a buy. All of these stocks have strong buy relative strength (RSI) scores.

Selling covered calls and cash secured puts on these equities turns them into options premiums income trades. They are growth stocks that pay small dividends.

On Nov. 15 I bought AAPL and Bank of America (BAC) and sold covered calls on them. I also rolled forward covered calls on another Berkshire stock, Kroger (KR). My other Berkshire investments and options positions include Chevron (CVX), Coca Cola (KO), Kraft Heinz (KHC), Proctor & Gamble (PG) and Verizon Communications (VZ).

AAPL was bought at $188.10. In this buy/write trade, I sold AAPL 12.1.2023 expiration (16 days) $190 strike covered calls (delta 0.40 per share, with a 60% probability that the option will expire out of the money) for $1.74 per share, or $174 per 100-share calls option. The implied volatility was a low 16%. The return on risk if the call options aren’t exercised is .93%, or 21% annualized if the trade is replicated 23 times in the next 12 months. The delta suggests that there is a 40% probability that the calls will be exercised.

BAC was bought for $29.66. In another b/w trade, I sold BAC 12.1.23 $29.50 (slightly in the money) covered calls for $0.64, or $64 per option contract. The delta was 0.56 and the OTM probability was 45.1%. The implied volatility was 21.7%. RoR was 2.16% and AROR if the trade is replicated 23 times in the next year was 49.22%.

I did my fifth covered calls trade on KR, which I bought for $48.99 a share. In a 16-day trade, I sold KR 12.1.23 $49 covered calls (delta .15, OTM 86.7%, IV 27%) for $0.29 a share, or $29 per option. The RoR was .53% and the ARoR was 12.11%. The cumulative net debit after collecting options premiums and KR dividends is $43.93 per share.

I respond to comments on the comments section where readers’ comments are posted. That is, if you have a question about this article or other comments, I'll discuss your questions with you in the comments section below this article.

LINKs:

Home Page. See my more than 150 articles on options trading, stock picking and watch lists. If you read several of these articles, you’ll learn how my strategies are meant to work. No guarantees. Links to useful web sites are on the lower right corner of the home page. Scroll down.

Follow @RealDonJohnson on twitter.com and FaceBook.com. Or follow me on Substack.com/Notes where my byline is my handle.

20 November 2023 Covered Calls Trades Yielding 13.3% to15.9% Update #2

AMZN, META, MSFT And NVDA Posted Big Gains. November Puts Trades Update #4

25 November 2023 Cash Secured Puts Trades Update #3

5 Bullish Stocks For Covered Calls, Puts Stock Options Trades

Jim Cramer's 4 Best Covered Calls Stocks

How I'm Trading Amazon Covered Calls, Cash Secured Puts Stock Options For Options Premium Income

32 October 2023 Covered Calls Trades Update #2

October 2023 Cash Secured Puts Trades Update #2

10 November 2023 Covered Calls Trades Update #1

20 November 2023 Cash Secured Puts Trades Update #2

7 November 2023 Covered Calls Trades Are Yielding 13.3%

10 November 2023 Cash Secured Puts Trades Update #1

5 November 2O23 Cash Secured Puts Options Trades

Selling in The Money Covered Calls Can Yield Big Annual Returns on Risk. By Donald E. L. Johnson

How to Beat Inflation Tax, Bear Market Tax With Dividend Stocks, Covered Calls, Cash Secured Puts, by Donald E. L. Johnson.

How I Analyze Bullish Puts Options Trades With Stock Rover, By Donald E. L. Johnson.

Wars Breed Inflation, Rising Interest Rates, Market Turmoil, By Donald E. L. Johnson.

Calls vs Puts Options: What’s the Difference?

A video on how to place options trades on TDAmeritrade.com’s Think or Swim trading platform.