5 Bullish Stocks For Covered Calls, Puts Stock Options Trades

Small and large dividend stock and ETF investors can use covered calls and puts trades to generate monthly income from options premiums and options trading.

By Donald E. L. Johnson

Cautious Trader

This newsletter is about how I find good stocks for trading covered calls and cash secured puts.

This week I found five stocks with buy ratings, bullish price objectives and strong fundamentals.

Finding good stocks for options trading takes time, but that is what we do to make money trading covered calls and puts for options premium and dividend income.

This is a long read. Possible trades are at the end of the post.

No matter what kind of investor you are, stock picking is one of the hardest jobs you have to do before you consider selling covered calls or cash secured puts stock options.

My first step was to review my stock portfolio and those of Jim Cramer on CNBC and the 25 stocks on CrossingWallStreet.com.

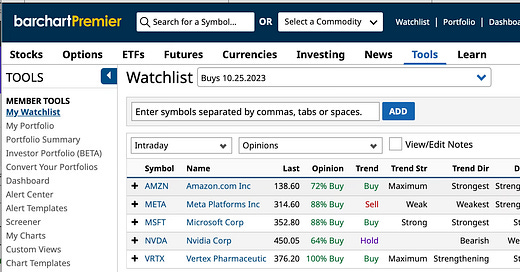

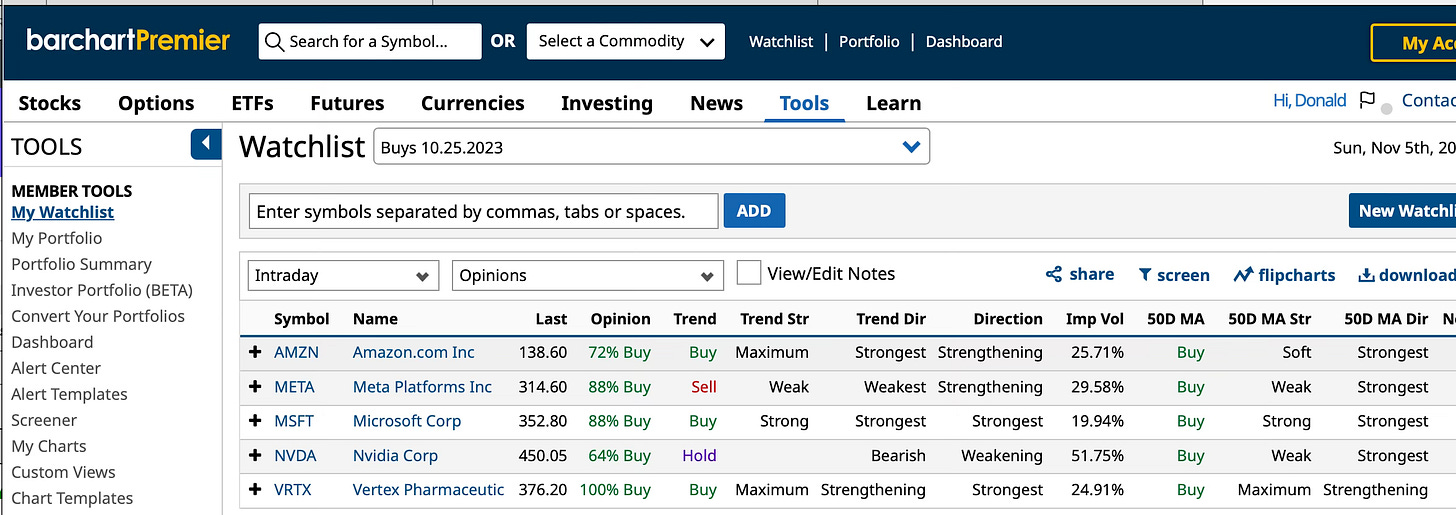

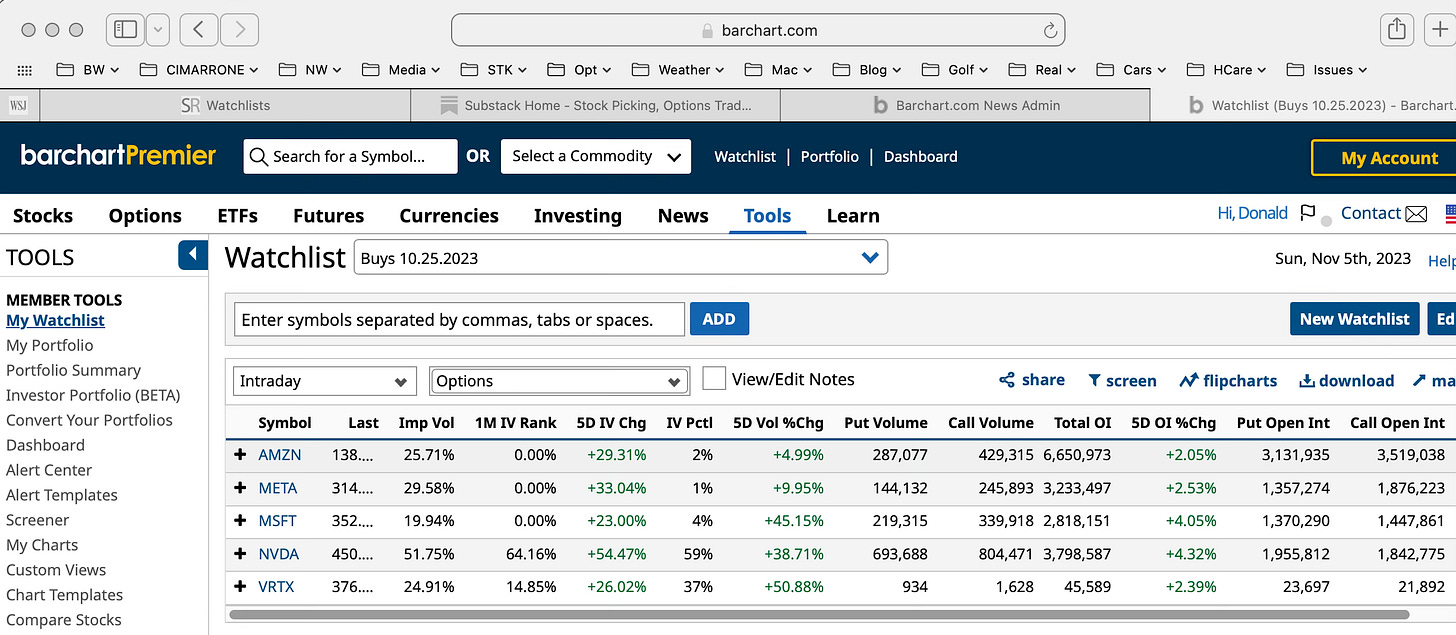

I came up with 25 names of stocks that are in bullish trends and wound up with these five stocks. Notice that they all have good buy ratings on Barchart.com.

All of the stocks but Microsoft Corp. (MSFT) have pretty high implied volatility scores, which means options sellers can get good prices when they sell covered calls and cash secured puts.

First I checked the stocks’ technical ranks (SCTR) on StockCharts.com. A stock ranked above 60 is considered a strong buy.

Amazon.com Inc. (AMZN) got a 72.5 ranking. Meta Platforms Inc. (META) got a 92.8. (MSFT) got an 84.2. Nvidia Corp. (NVDA) looks over bought at 97.3. And Vertex Pharmaceuticals (VRTX) is the cheapest on the list at 75.9.

AMZN is almost over bought at a 67.6 relative strength rating. META’s RSI is 57.1; MSFT’s RSI is an overbought 73.2; NVDA’s RSI is 62.66; and VRTX’s RSI is 66.69. Anything over 70 is over bought.

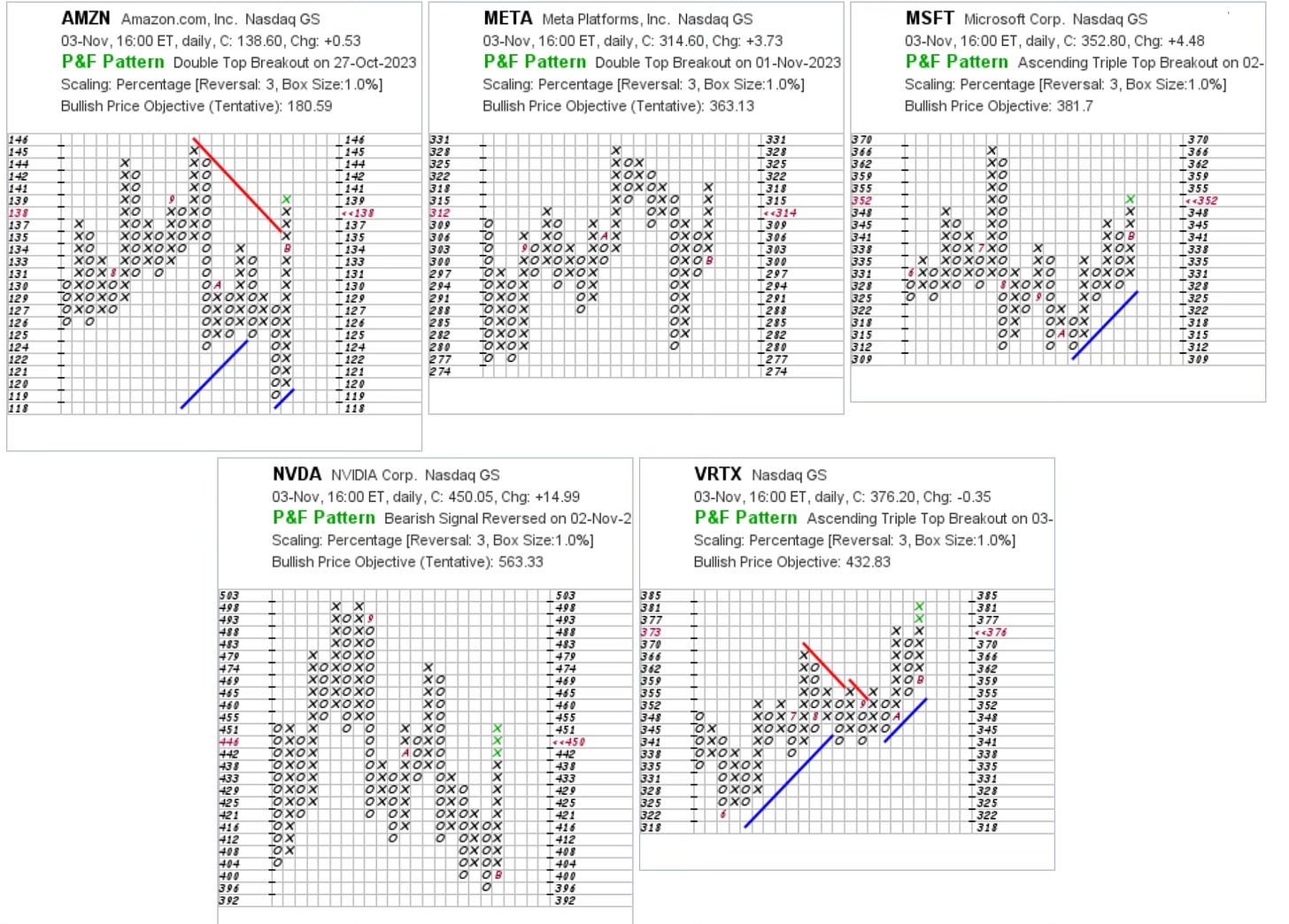

Next, I looked at the price objectives for each stock on StockChart.com’s point and figure charts. AMZN and NVDA look pretty over extended. But I may wait for dips to buy or sell puts on any of them. This may be a good time for me to sell out of the money puts for options premiums income. That depends on what the markets do in the next few days.

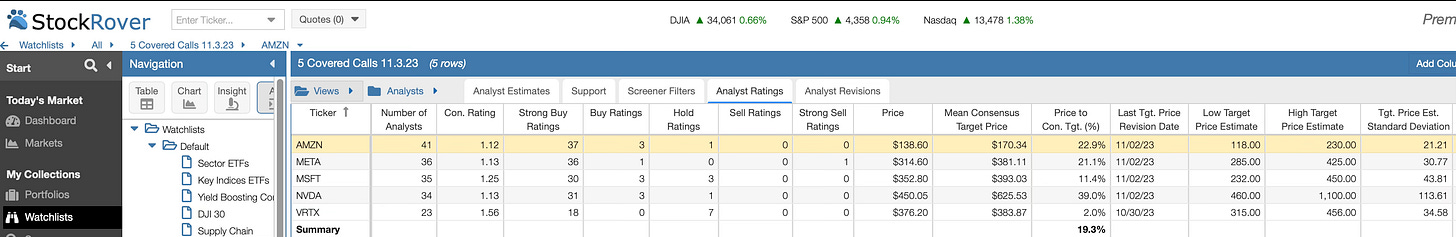

Before digging into fundamentals, I looked at the Barchart.com opinion ratings shown in the first table above.

Then I looked at the options trading volume and open interest numbers. Some of the stocks I was considering don’t have enough options liquidity for me to get quick and good fills on my trade orders. So they aren’t on this list of buys.

VRTX is the type of stock I usually avoid when it comes to options trading. But I've been in and out of this great company’s stock and options several times. I am out at the moment but plan to sell OTM puts early this week. See my planned trade below. I’ll post the trade in comments below.

I use Barchart.com, StockCharts.com, StockRover.com, OptionsPlay.com Valuentum.com, Morningstar.com and SeekingAlpha.com as well as reports available for free from my brokerage firms to find and evaluate stocks. Combined with some free and affordable newsletters on Substack.com, these subscription services are a lot cheaper than a Bloomberg terminal. They are all I need to get the job done.

StockRover.com lets me create the tables and use the metrics that are important to me. Wall Street analysts are always bullish if they can be. When they are bullish, they’re usually too bullish until a bad earnings report hits the wires. Nevertheless, I always check their ratings and target prices for stocks. To get ratings on ETFs and mutual funds, I use Morningstar.com.

Then I look at valuation, income, balance sheet and other data that is available on StockRover.com and on Barchart.com.

As I do all of the above, I decide whether I'm trading for capital gains and premiums as with the stocks shown here. These are pretty low yielding and no dividend stocks. Usually, I’m trading high dividend stocks that are easy to turn into 10% to 15% annualized yield stocks by collecting dividends and selling covered calls and cash secured puts. Yes, I often do all three things on the same stock.

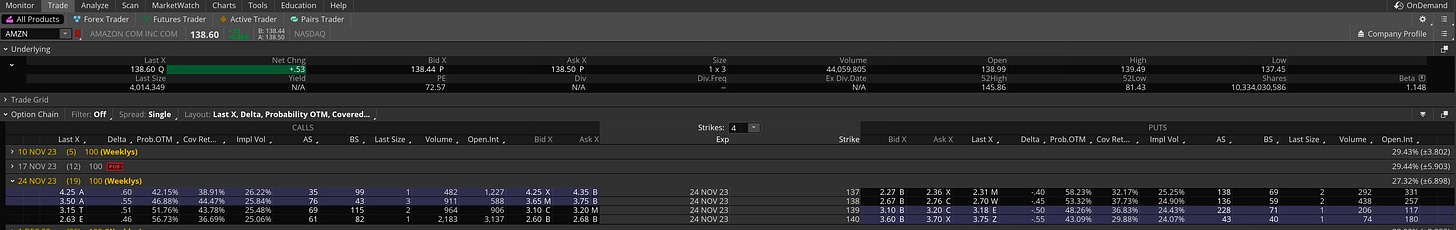

My Schwab/ThinkorSwim trading platform is setup to show the trading and risk management metrics as well as the potential returns on individual stocks. With a glance at minute, hourly, weekly and monthly charts on the platform, I can evaluate a trade and do it quickly because I’ve had a lot of practice over the last 17 years.

But it usually takes me a couple of hours to fully evaluate a trade, get it filled and record it on my spreadsheets. Writing and editing a blog like this takes me two, three and sometimes five hours. This one is running to about seven hours because I decided to plan some trades, I’m afraid.

Beginners can paper trade and practice trading until they’re ready to do their first trades. Most platforms offer YouTube and other videos about how to use their platforms and trade covered calls and cash secured puts.

Sample Trades

AMZN closed at $138.80 on 11.27.23. I’m short AMZN 11.17.23 $120 and $130 strike puts that yield annualized returns on risk of 15.3% and 9% respectively. I want to sell more AMZN puts at discounts because it looks a bit extended. Support is at $134 to $130, or delta -.27 to -.15. I am considering selling one AMZN 11.24.23 (18 days) $130 strike (delta -.15) put at about $0.70 a share.

That would give me an AROR of about 9.6%, depending on prices and the direction of the stock when I do the trade. The -.15 delta indicates that there is about a 15% probability that the stock will be below the strike when the option expires and I’ll be assigned the stock at $130 a share, or $13,000 per 100-share option contract.

META closed Friday at $314.60, or $31,460 per call contract. I’ve generally ignored the stock because I don’t like the way they run their business. But it is a hot stock and I want to try to collect covered calls premiums and maybe a small short term capital gain on a covered call trade. I could just buy the stock and let it rise or fall without limiting my potential profit, which is what happens when covered calls are sold.

With META’s PnF chart price objective at $363.13 and Barchart.com’s strong buy rating at 88%, I’m feeling a bit optimistic about META’s stock. And I don’t want to get caught in a bear trap. So I’m thinking of buying META at about $314 and selling META 11.24.23 (18 days) $320 a share strike (delta 50.5) covered calls for about $8.80 a share, or $880 per 100-share call options contract. That would give me an ARoR of about 54%. ARoR assumes that I can do the same kind of trade with the same results over 365 days divided by 18 days equals about 21 times in the next 12 months. Other than it’s a way to look at how good a trade it is, the ARoR metric is pretty meaningless, I think.

The bid on the call option is $8.70 and the asking price is $8.90. That looks like a narrow spread that can be sold by offering the call option at the mid point of the bid and ask prices, or $8.80. This shows that META’s options are pretty liquid at the $130 strike price.

MSFT closed Friday at $352.80, or $35,280 per 100-share options contract. About 10 days ago I sold MSFT 11.17.23 $285 and $300 strike puts and then I sold MSFT 11.24.23 $300 strike puts. I’m not ready to sell any more MSFT puts until the ones I have expire worthless or are put to me. If the stock gains some more this week, the options prices could fall to $0.05 or less and I could buy them back early and sell MSFT puts again.

A trader who is looking to buy MSFT and wants to buy it at a 10% discount could sell 12.15.23 (39 days) $315 strike (delta -.09) puts for about $1.30 a share. That would yield about a 3.36% ARoR.

If a trader was looking for a 4.3% discount, or margin of safety, on MSFT, the 12.15.23 trade could be done at about $335 strike (delta -.22) puts. The ARoR would be about 9.1%.

NVDA looks too over bought to me so I won’t trade it or its options.

At $376.20, VRTX is a 100% buy and the PnF price objective is $432 a share. I might sell VRTX 11.24.23 (18 days) $355 strike (delta -.18) puts option. The $1.80 bid, $3.40 asked prices indicate the trade might be done for the mid point price of about $2.60 a share, give or take.

I’d probably try to get $2.80 or less if the stock sharply higher. I might get a higher options price if VRTX drops $5.

After I place an order, I’ll wait awhile to give it a chance to be filled. When someone ups the bid price, I lower my ask price. After some haggling by placing and replacing orders with different prices, we settle on a price and the order gets filled.

I’ve been known to cancel orders quickly if they don’t get filled. And I’ve waited for hours for the stock price and options price to move my way until the order is filled. After awhile if feels like you’re playing an online game. To me, it is like playing bridge.

I respond to comments on the comments section where readers’ comments are posted. That is, if you have a question about this article or other comments, I'll discuss your questions with you in the comments section below this article.

Is this too much information? If nothing else, I’ve written a plan for myself. We’ll see if I execute it. Watch the comments section.

Thanks for reading Stock Picking, Options Trading for Income! Subscribe for free to receive new posts and support my work.

LINKs:

Home Page. See my more than 150 articles on options trading, stock picking and watch lists. If you read several of these articles, you’ll learn how my strategies are meant to work. No guarantees. Links to useful web sites are on the lower right corner of the home page. Scroll down.

Follow @RealDonJohnson on twitter.com and FaceBook.com. Or follow me on Substack.com/Notes where my byline is my handle.

Jim Cramer's 4 Best Covered Calls Stocks

How I'm Trading Amazon Covered Calls, Cash Secured Puts Stock Options For Options Premium Income

32 October 2023 Covered Calls Trades Update #2

October 2023 Cash Secured Puts Trades Update #2

10 November 2023 Covered Calls Trades Update #1

20 November 2023 Cash Secured Puts Trades Update #2

7 November 2023 Covered Calls Trades Are Yielding 13.3%

10 November 2023 Cash Secured Puts Trades Update #1

5 November 2O23 Cash Secured Puts Options Trades

27 October 23 Covered Calls Options Trades Update #1

16 October 2023 Puts Options Trades Update #

How To Turn An Over Valued Stock Into A Covered Calls And Puts Premiums Winner

8 October 2023 Covered Calls Trades Yield 24.3% Annualized Returns On Risk

10 October 2023 Puts Options Trades

Selling in The Money Covered Calls Can Yield Big Annual Returns on Risk. By Donald E. L. Johnson

How to Beat Inflation Tax, Bear Market Tax With Dividend Stocks, Covered Calls, Cash Secured Puts, by Donald E. L. Johnson.

How I Analyze Bullish Puts Options Trades With Stock Rover, By Donald E. L. Johnson.

Wars Breed Inflation, Rising Interest Rates, Market Turmoil, By Donald E. L. Johnson.

Calls vs Puts Options: What’s the Difference?

A video on how to place options trades on TDAmeritrade.com’s Think or Swim trading platform.

Is anybody reading these comments?

11.7.23. Near close. AMZN $143.11. Sold AMZN 11.24.23 (17 days) $135 puts for $0.63. Delta -.14.

META $319.11. Sold META 11.24.23 $310 puts (delta -.29 For $3.50.

MSFT $361..04. Sold MSFT 11.24.23 $342.50 puts delta -.13 for $1.17 a share.

CAT $234.90. Sold CAT 11.24.23 $220 puts delta -.11 for $0.70 a share.

I have expiring puts on CAT, MSFT and AMZN, which was called last week at $137. META is a new position for me.