20 November 2023 Cash Secured Puts Trades Update #2

Small and large dividend stock and ETF investors can use covered calls and puts trades to generate monthly income from options premiums and options trading.

By Donald E. L. Johnson

Cautious Speculator

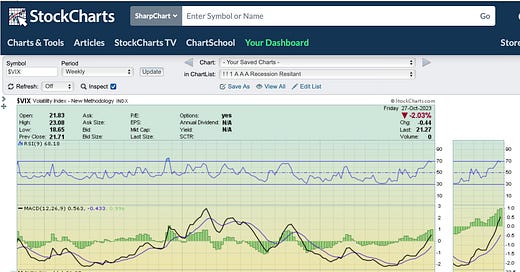

The VIX is at 21.27, back to where it was last March.

Cash secured puts options are relatively high.

This is a good time for risk takers to sell puts and covered calls stock options on depressed dividend stocks.

Volatility, as measured by the CBOE Vix, is the highest it has been since late last March.

High volatility gives sellers of cash secured puts high options prices and high risks of having sold puts options assigned unless the strikes are deeply out of the money.

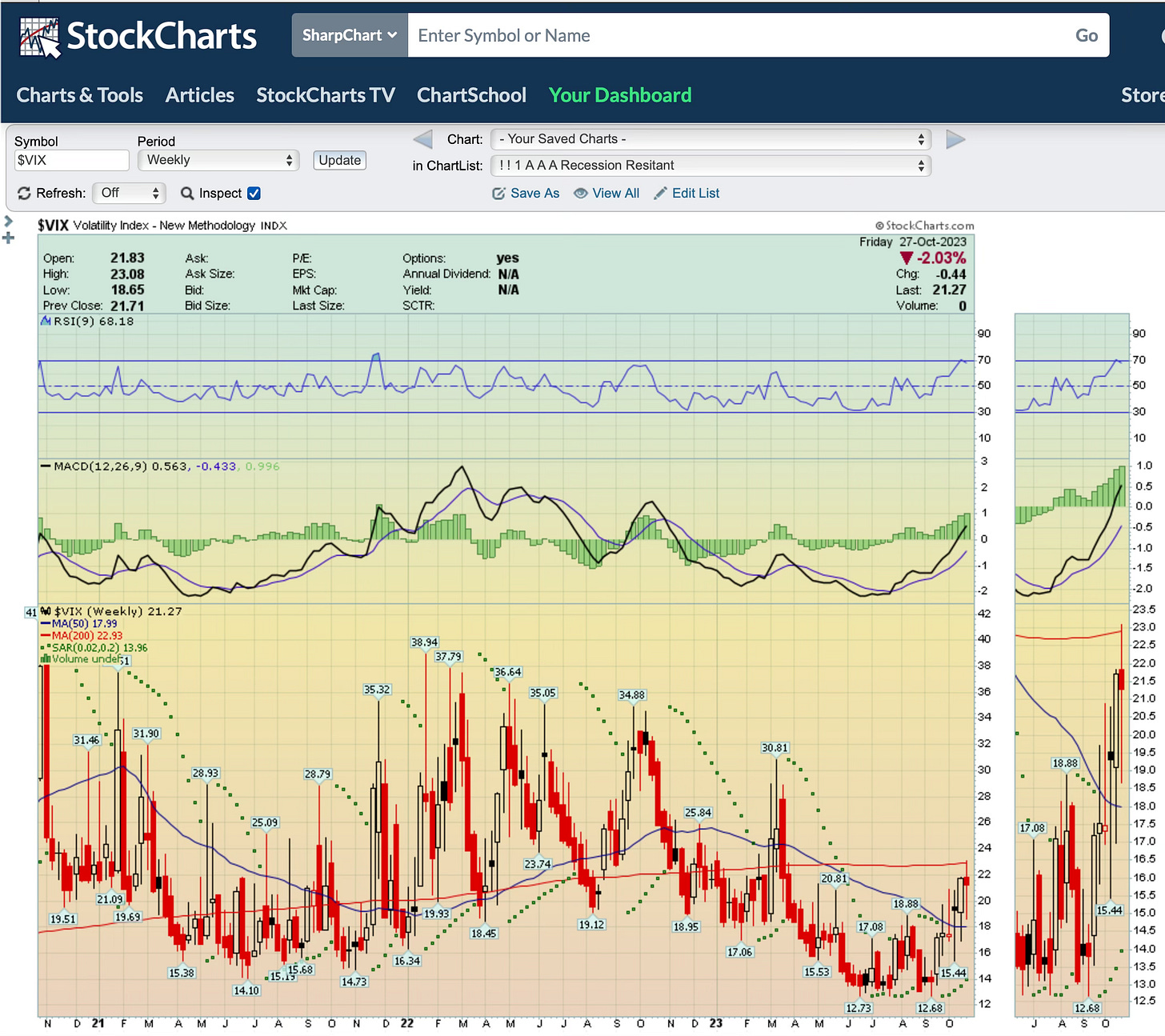

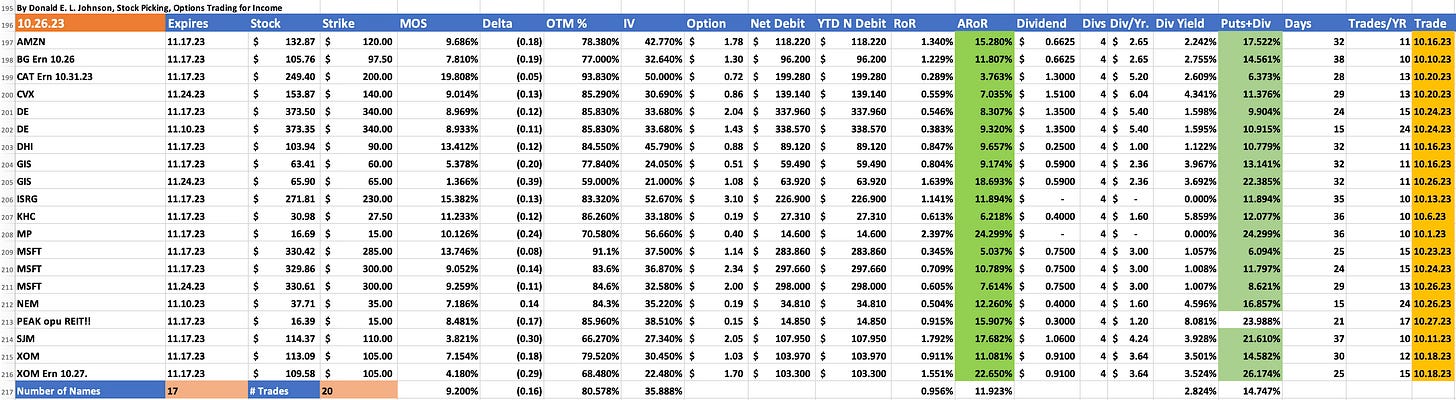

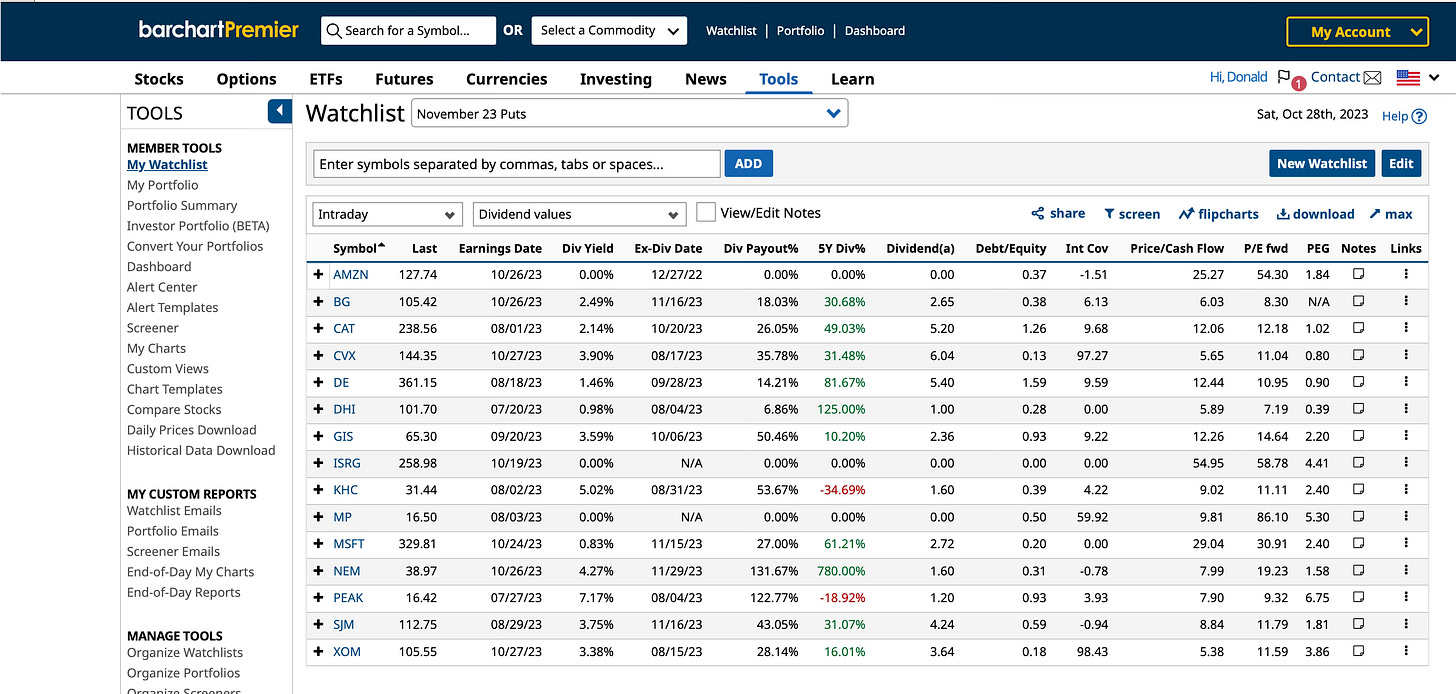

Last week I sold about puts options on Deere & Co. (DE), General Mills (GIS), Microsoft Corp. (MSFT), Newmont Mining Corp. (NEM) and Healthpeak Properties Inc. (PEAK). These puts expire in November along with puts options on Amazon.com Inc. (AMZN), Bunge Ltd. (BG), Caterpillar Inc. (CAT), Chevron Corp. (CVX), D.R. Horton (DHI) Intuitive Surgical Inc. (ISRG), Kraft Heinz Co. (KHC), Mp Materials Corp. (MP), J.M. Smucker Co. (SJM) and Exxon Mobil (XOM).

Note that I’ve sold multiple strikes and dates on DE, GIS, MSFT and XOM. I’m trying to meet my monthly options premiums income goals with trades on fewer dividend and dividend growth stocks like MSFT.

On Oct. 21, I posted about my first 10 November expiration puts trades in Update #1.

I’ve raised my monthly options premiums and dividend income goals to get better returns on my cash.

Selling puts is a bullish trade, and I’m committing more of my cash to puts options on mostly high quality stocks and a couple of speculative stocks like MP and PEAK.

The 20 puts options trades have averaged a 9.2% margin of safety (MOS, which is the same as the discount). The average delta is -0.16, which is the probability that a puts contract will be assigned if a stock closes below the strike price. Delta also indicates how much an options price will move for every dollar change in the stock. The average OTM is 80.578% and the average implied volatility is a high 35.888%.

The average immediate return on risk (RoR) is 0.956%, or 11.93% annualized if similar trades can provide similar returns for the next 12 months. If all of these trades were assigned, the average dividends would be 2.824%, compared with about 2% dividends on the Dow Jones Industrials Average 30 stocks.

The average trade duration is 28.75 days. I own AMZN, BG, GIS, DHI, ISRG, KHC, NEM and SJM.

Most of these puts trades are on stocks that are correcting and are trading below their estimated fair values and below analysts’ target prices. I’m trying to sell puts at strikes that are less likely to be assigned, but surprises do happen and have been hitting me a bit more this year than usual.

Most of these stocks pay dividends and except for NEM and Peak have low dividend payout ratios. Except for CAT, which has a big finance company that distorts its payout ratio and PEAK, which is a Real Estate Investment Trust that owns some medical office properties, the debt to equity ratios look pretty safe.

None of these stocks have outrageously high price to free cash flow ratios. Few are over bought and some are over sold.

I respond to comments on the comments section where readers’ comments are posted. That is, if you have a question about this article or other comments, I'll discuss your questions with you in the comments section below this article.

Thanks for reading Stock Picking, Options Trading for Income! Subscribe for free to receive new posts and support my work.

LINKs:

Home Page. See my more than 150 articles on options trading, stock picking and watch lists. If you read several of these articles, you’ll learn how my strategies are meant to work. No guarantees. Links to useful web sites are on the lower right corner of the home page. Scroll down.

Follow @RealDonJohnson on twitter.com and FaceBook.com. Or follow me on Substack.com/Notes where my byline is my handle.

7 November 2023 Covered Calls Trades Are Yielding 13.3%

10 November 2023 Cash Secured Puts Trades Update #1

5 November 2O23 Cash Secured Puts Options Trades

27 October 23 Covered Calls Options Trades Update #1

16 October 2023 Puts Options Trades Update #

How To Turn An Over Valued Stock Into A Covered Calls And Puts Premiums Winner

8 October 2023 Covered Calls Trades Yield 24.3% Annualized Returns On Risk

10 October 2023 Puts Options Trades

Selling in The Money Covered Calls Can Yield Big Annual Returns on Risk. By Donald E. L. Johnson

How to Beat Inflation Tax, Bear Market Tax With Dividend Stocks, Covered Calls, Cash Secured Puts, by Donald E. L. Johnson.

How I Analyze Bullish Puts Options Trades With Stock Rover, By Donald E. L. Johnson.

Wars Breed Inflation, Rising Interest Rates, Market Turmoil, By Donald E. L. Johnson.

Calls vs Puts Options: What’s the Difference?

A video on how to place options trades on TDAmeritrade.com’s Think or Swim trading platform.