32 October 2023 Covered Calls Trades Update #2

Small and large dividend stock and ETF investors can use covered calls and puts trades to generate monthly income from options premiums and options trading.

By Donald E. L. Johnson

Cautious Speculator

October covered calls trades generated annualized returns of 17.85%.

Dollar General and Verizon were October’s big winners.

Paycom Software and Pfizer were October’s big losers.

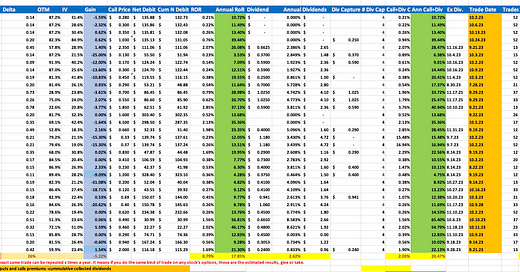

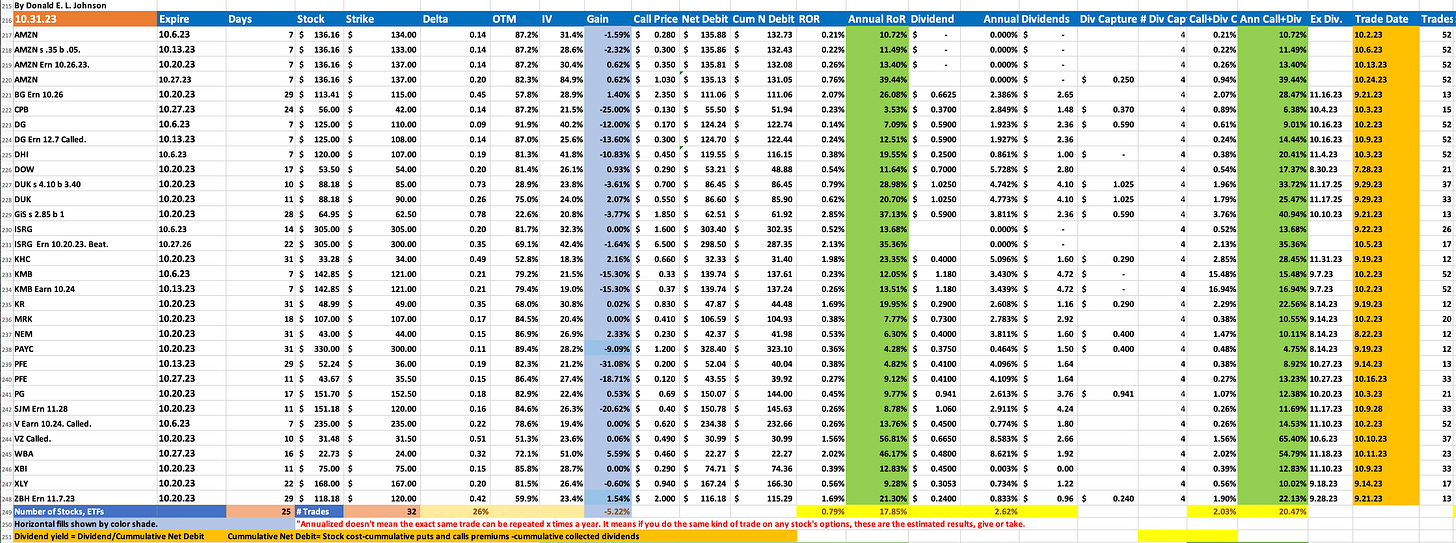

The 32 October 2023 covered calls options trades generated average annualized 17.85% returns in options premium income and 2.62% in dividend income, annualized.

Deltas indicate the probability that calls will be exercised. When the trades on these 23 stocks and 2 exchange traded funds were done, the average delta was a relatively high 26% probability. The deltas when the trades were done ranged from .14 on the Amazon.com (AMZN) call optionto .78 on the General Mills (GIS) trade.

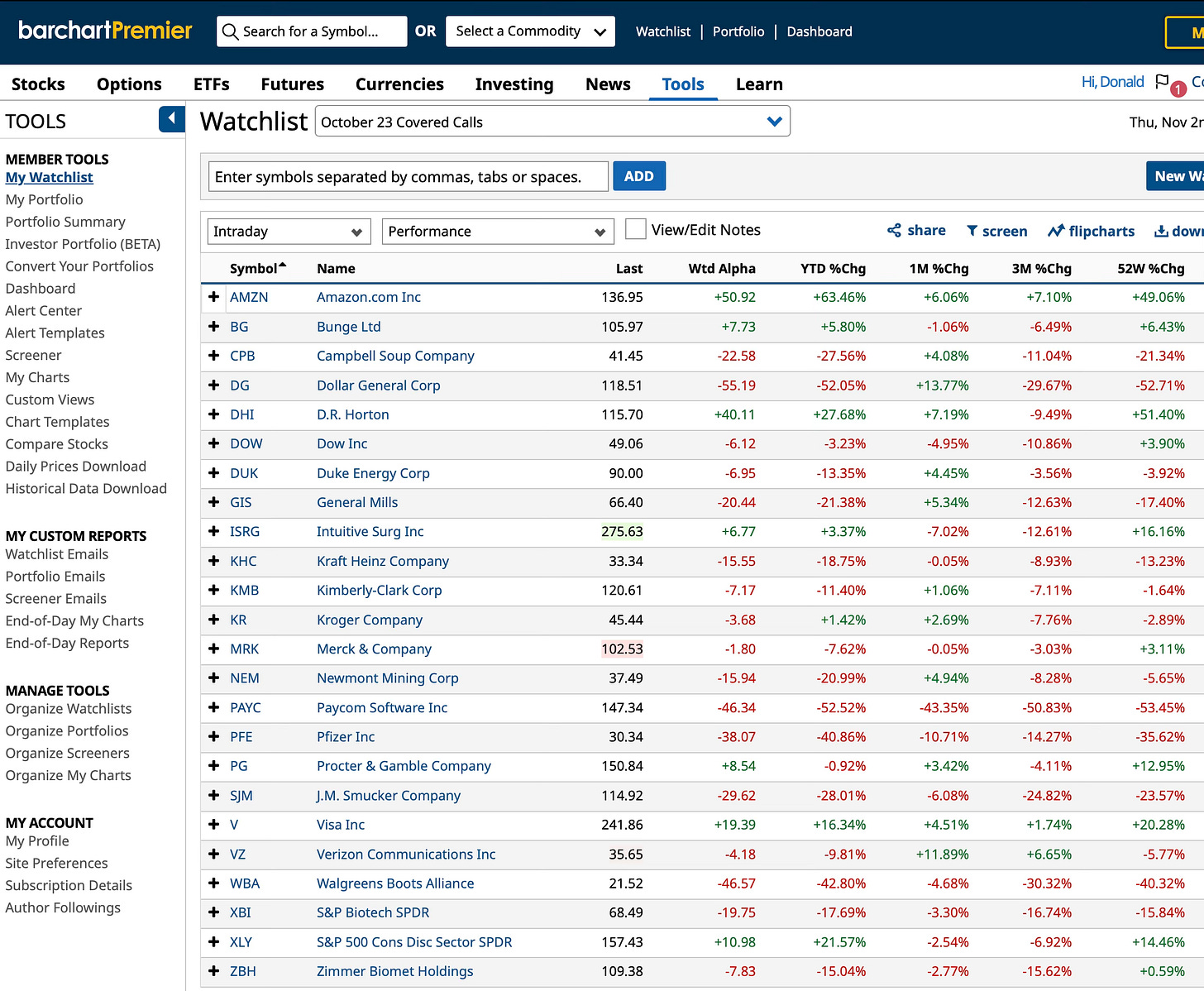

The leading indexes were flat during the last month when the S&P 500 index ($SPX) was up 0.28%.

During the last month, 11 of the stocks and 1 ETF gained in flat markets. They included AMZN, Campbell Soup Co. (CPB), Dollar General Corp. (DG), D.R. Horton (DHI), Duke Energy Corp. (DUK), General Mills (GIS), Kimberly-Clark (KMB), Kroger Co. (KR), Newmont Mining Corp. (NEM), Proctor & Gamble Co. (PG) and Visa Inc. (V).

October’s biggest winner was Dollar General (DG), which was up 27.68%, mostly after it was called on Oct. 6. Verizon (VZ) was up 11.8%. VZ was called on Oct. 20.

Paycom Software Inc. (PAYC) lost 43.35% in the last month. It’s down 55% from the $330 I paid for it. PAYC offered a new product that cost less than its original service, which is being cannibalized by the new, lower-priced service. Analysts don’t seem to think Paycom will recover from this blunder. I’ve been selling high yielding covered calls on PAYC.

On Nov. 1, I bought back the PAYC 11.17.23 $300 calls for $0.05. That left me with a $4.73 per share profit on the PAYC covered calls contract for 100 shares. That cut the trade’s duration to 15 days from 31.

Then, when PAYC was at $153.99, I sold PAYC 11.17.23 $180 strike covered calls for $1.40 a share. That reduced the net debit on PAYC to $316.92 per share. At the moment, the stock is at $148.05, down 53.3% from the net debit price. It will take a long time to make up for this loss by selling PAYC covered calls and cash secured puts for options premiums. Before the end of the year, I may take a tax loss on the trade. Fortunately I own only 100 shares of PAYC. So I’m down about $17,000 on a $33,000 trade.

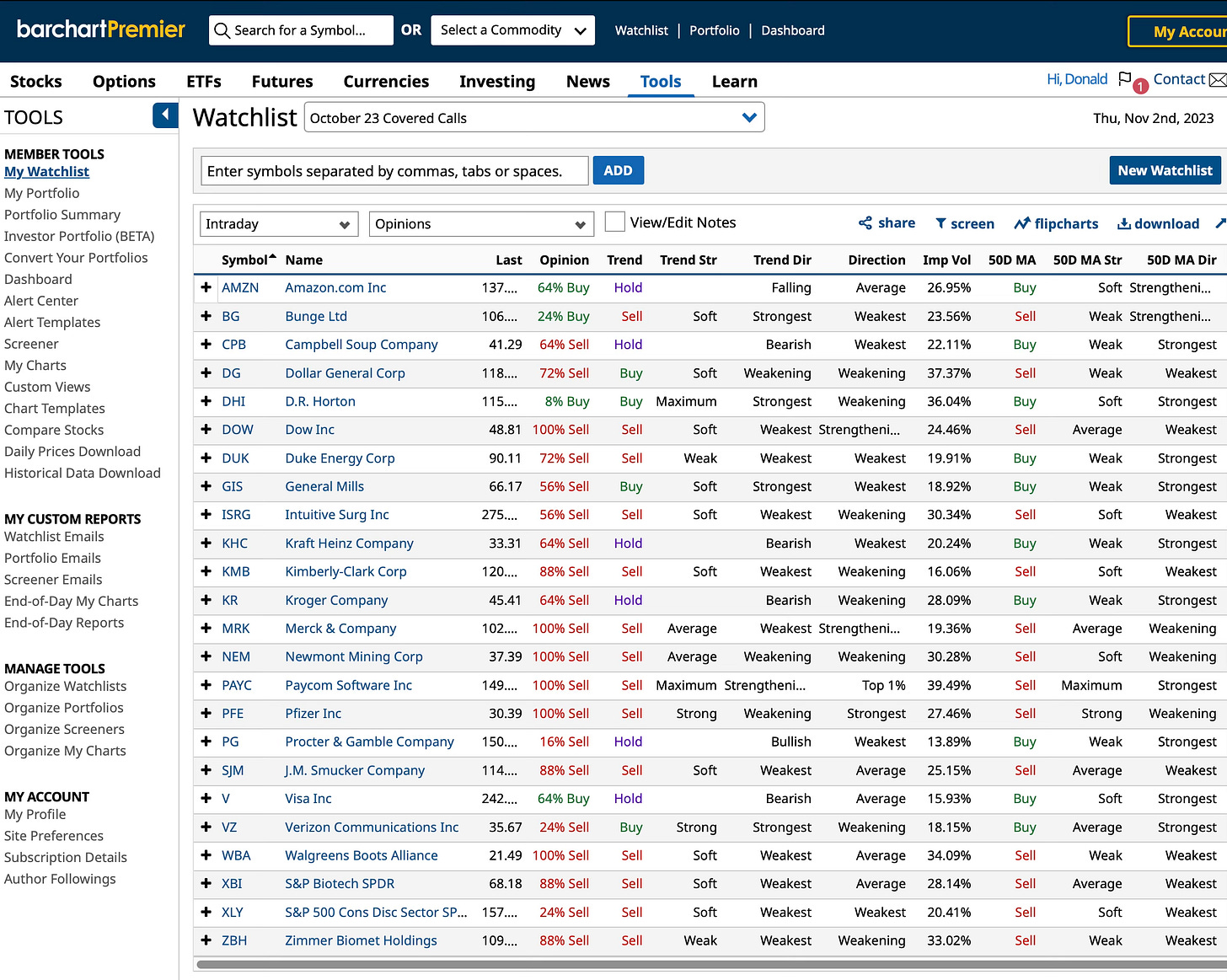

Pfizer Inc. fell 10.71% in the last month on a weak earnings report and weak guidance. In addition to paying a 4.1% dividend, PFE is a good options stock for sellers of covered calls. It goes ex-dividend on Nov. 8. My net debit on PFE is $39.36. Barchart.com rates PFE a 100% sell. The highest target price posted by a Wall Street Analyst is $75. The average target price posted. by analysts is $42.12 and the low target price is $33. PFE is almost over sold with a relative strength index (RSI) of 33.02. If I take a loss on this stock, it will be because I can put the proceeds into a better stock. Because of PFE’s high dividend, it is in a tax sheltered IRA and it is not a candidate for a tax loss sale.

As of this writing, most of these stocks are sells. AMZN and V are 64% buys.

I respond to comments on the comments section where readers’ comments are posted. That is, if you have a question about this article or other comments, I'll discuss your questions with you in the comments section below this article.

Thanks for reading Stock Picking, Options Trading for Income! Subscribe for free to receive new posts and support my work.

LINKs:

Home Page. See my more than 150 articles on options trading, stock picking and watch lists. If you read several of these articles, you’ll learn how my strategies are meant to work. No guarantees. Links to useful web sites are on the lower right corner of the home page. Scroll down.

Follow @RealDonJohnson on twitter.com and FaceBook.com. Or follow me on Substack.com/Notes where my byline is my handle.

October 2023 Cash Secured Puts Trades Update #2

10 November 2023 Covered Calls Trades Update #1

20 November 2023 Cash Secured Puts Trades Update #2

7 November 2023 Covered Calls Trades Are Yielding 13.3%

10 November 2023 Cash Secured Puts Trades Update #1

5 November 2O23 Cash Secured Puts Options Trades

27 October 23 Covered Calls Options Trades Update #1

16 October 2023 Puts Options Trades Update #

How To Turn An Over Valued Stock Into A Covered Calls And Puts Premiums Winner

8 October 2023 Covered Calls Trades Yield 24.3% Annualized Returns On Risk

10 October 2023 Puts Options Trades

Selling in The Money Covered Calls Can Yield Big Annual Returns on Risk. By Donald E. L. Johnson

How to Beat Inflation Tax, Bear Market Tax With Dividend Stocks, Covered Calls, Cash Secured Puts, by Donald E. L. Johnson.

How I Analyze Bullish Puts Options Trades With Stock Rover, By Donald E. L. Johnson.

Wars Breed Inflation, Rising Interest Rates, Market Turmoil, By Donald E. L. Johnson.

Calls vs Puts Options: What’s the Difference?

A video on how to place options trades on TDAmeritrade.com’s Think or Swim trading platform.

By the way I also own PFE but at $33.00 cost basis. That’s why it is so important to trade stocks that have a decent dividend.

Thanks Donald! I am realizing that an option trader learns more in a down market! I have done well with AMZN the last month with weekly covered call options. PAYC is reminiscent of PARA for me....cost basis of $33.00 trading around $11.00...I keep selling calls to lower basis but the premiums have not been that great. Do you think it is wise to set a loss limit on stocks that you are righting options on?