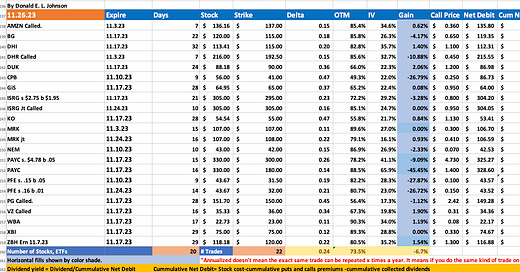

22 November 2023 Covered Calls Trades Yield 12.9% to 15.3%

Small and large dividend stock and ETF investors can use covered calls and puts trades to generate monthly income from options premiums and options trading

By Donald E. L. Johnson

Cautious Speculator

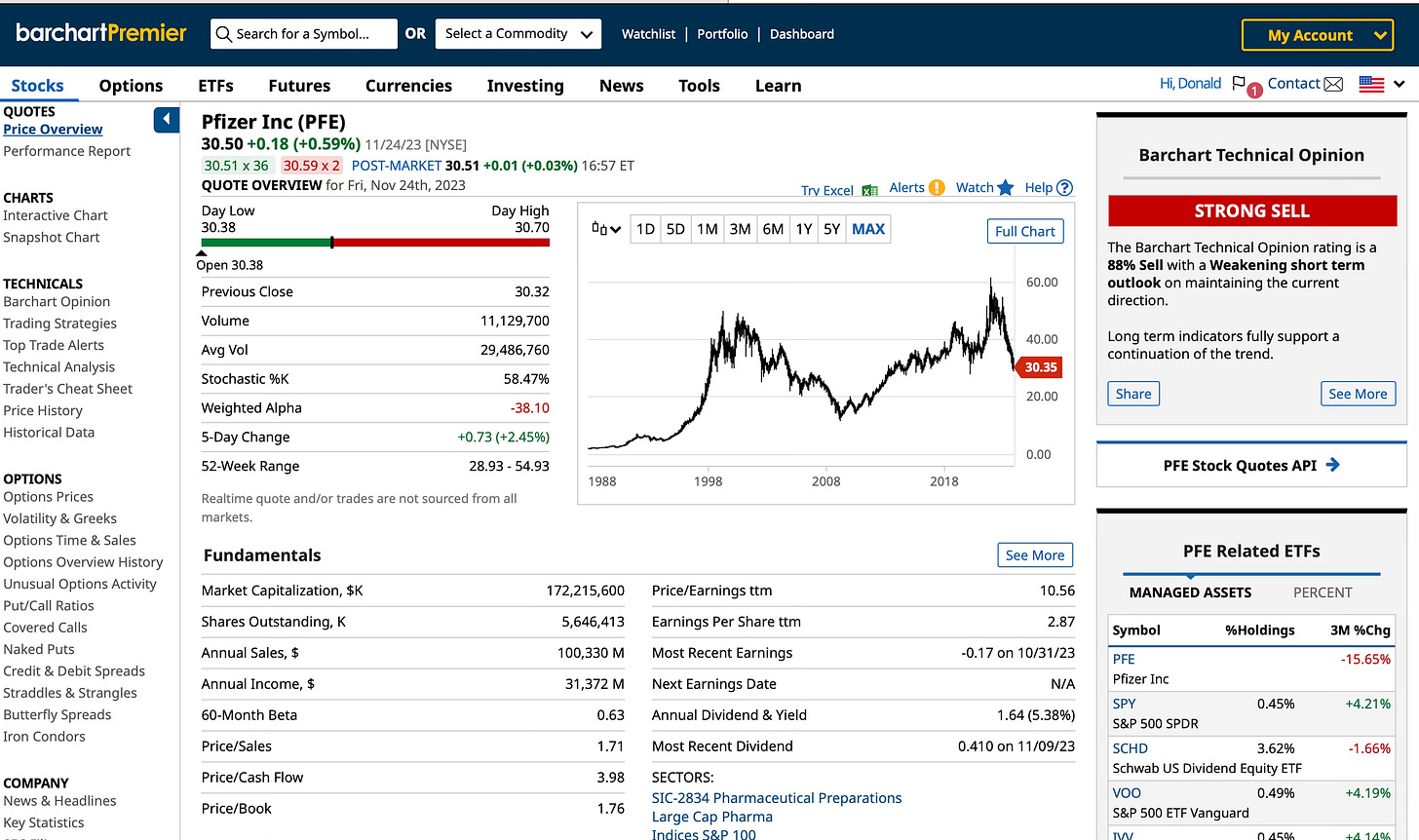

Pfizer’s 52-week price range ($28.93 to $54.93) shows that blue chips and drug stocks can drop sharply when their markets change as PFE’s has.

Selling PFE covered calls and cash secured puts while collecting dividends has softened the pain a bit.

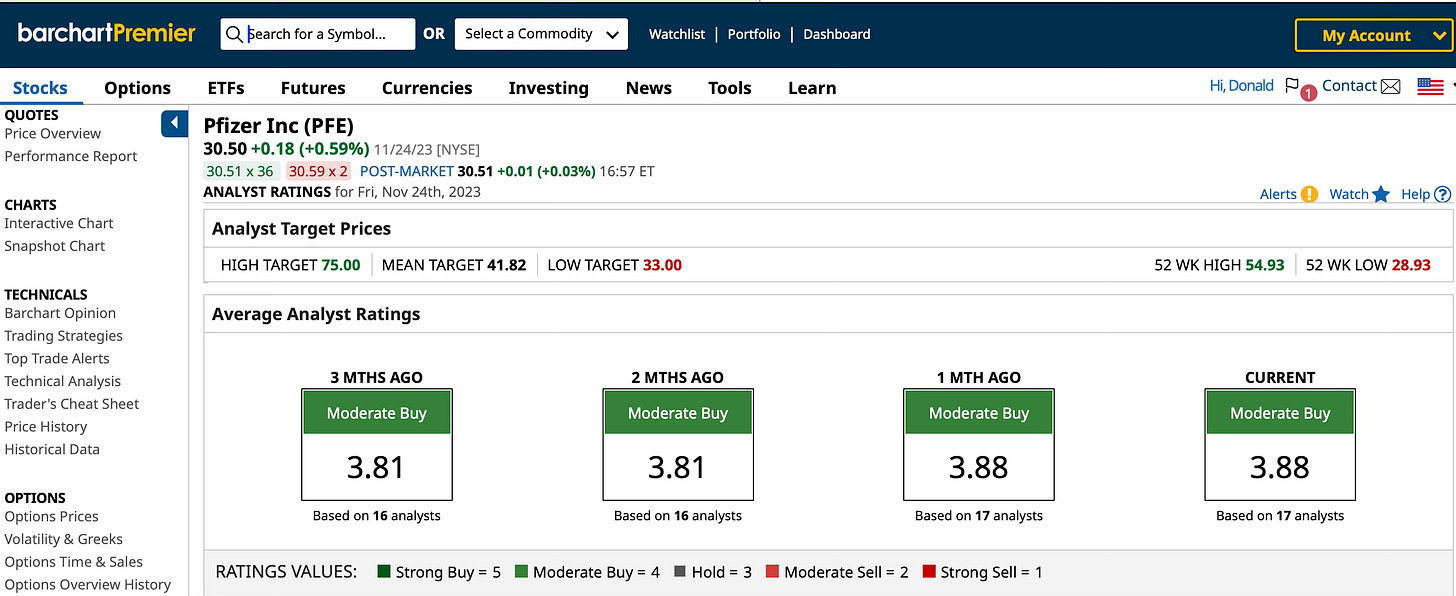

Fair value estimates and analysts’ target prices say PFE is worth about $41, up about 34% from $30.50. PFE’s point and figure chart shows a bearish $27.56 price objective. Nobody can predict stock prices.

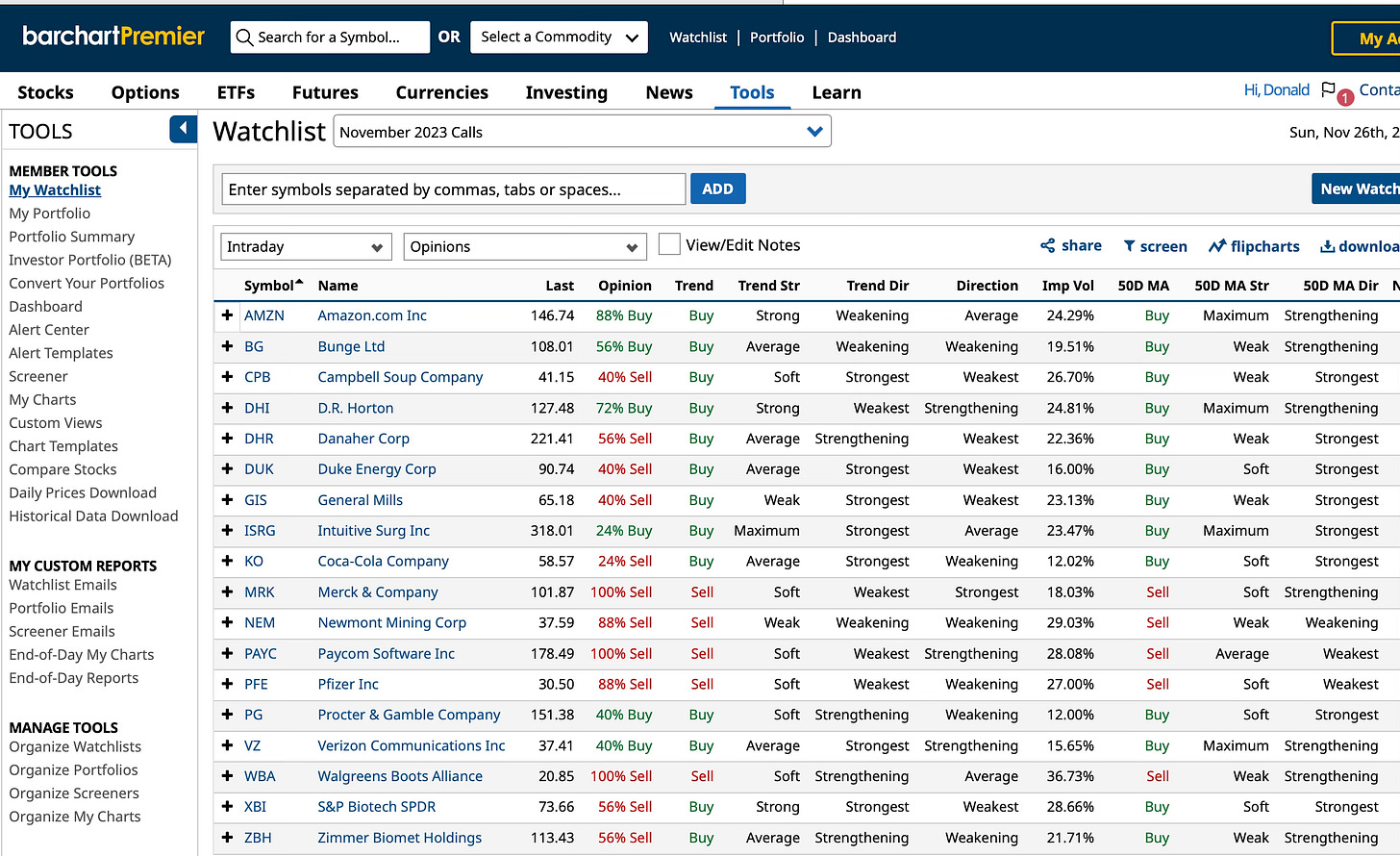

22 November 2023 covered calls trades on 20 stocks provided an average return of 0.7%, or about 12.9% annualized plus average dividends of 2.4%.

While most of my covered calls and puts trades in November worked out pretty much as I hoped, I’m still dealing with one of my biggest disappointments of the year, Pfizer Inc. (PFE).

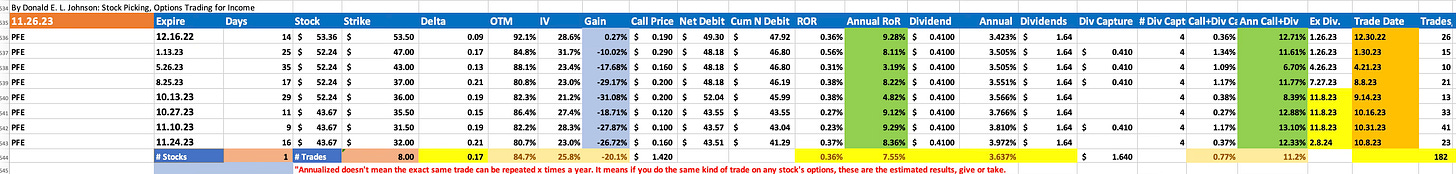

PFE is trading at $30.50 per share, down 43% from my initial cost of $53.50. By averaging the cost down by buying more shares at lower prices, the average cost is down to $43.67. After accounting for covered calls and puts premiums plus dividends collected, PFE’s net debit is $41.29. PFE is down 26.1% from the net debit.

PFE’s point and figure price objective is a bearish $27.56, down 33.3% from the net debit price. Barchart.com rates PFE an 88% sell. That makes me think I can sell covered calls on it for a few times before it snaps back and some analyst think it will.

Analysts think PFE is worth about $41, which would be up about 34% from its closing price on Nov. 24.

How can a major pharmaceutical company like PFE sink so far so fast?

The same way smaller and less impressive companies like PayPal (PYPL), Sofi Technologies Inc. (SOFI) and even Fedex Corp (FDX) have plunged in recent years before rallying.

PFE’s business changed radically this year as its covid vaccine business basically went away. Analysts are expecting PFE to recover in the next 12 to 18 months. And because they are optimistic, my strategy may be to hold on to PFE and try to keep it from being called at a loss.

My biggest mistake on PFE was not to sell it when it was down only 7% to 10%.

The next big mistake was to buy more shares and average the price down.

And the third big mistake may be continuing to sell PFE covered calls when PFE’s options are so cheap, which makes getting the net debit down to where the stock price is.

At this point, PFE is what it is, a stock that yields about 3.972% on my net debit price and about 5.38% on its current price in an IRA.

I choose to accept the market’s valuation. I’m getting a 5.38% yield on the current value of the stock. That is where I am when I consider my alternatives.

There are several things I can do with PFE:

Hold PFE and collect the 5.38% dividend until the stock recovers to the estimated fair value of about $41 and the net debit continues to shrink.

Continue to sell 10-day to 14-day covered calls for whatever I can get at out of the money strikes and deltas that are less likely to be called. For example, I could sell PFE 12.15.23 $33 covered calls for about $0.14 a share. If I do that 23 times a year and collect dividends four times a year, the AROR would be about 8.82%. The net debit would be reduced by another $5 to about $36. If PFE climbs 10% next year, it would be at $34, and my loss would be easier to live with. A .14 delta indicates that there is about a 14% probability that a covered call option will be exercised. It also shows that when a stock price moves $1, the call option price will change about $0.14.

On Nov. 22, I sold PFE 12.15.23 $29 strike puts for $0.30 per share, or a RoR of 0.99% (a 15.712% ARoR) instead of selling covered calls. There is a 25% chance that the puts will be exercised.

Hold PFE but don’t sell covered calls or puts until PFE’s options prices improve and hope PFE’s price will get back to $41 in two or three years.

Sell PFE and invest the proceeds in a better stock. There are no tax loss benefits or penalties for taking losses in an IRA account.

So far my PFE covered calls trades are yielding 0.36% immediate returns on risk, or about 7.55% annualized. Covered calls ARoR plus 3.637% dividends ups the AROR to about 11.2%. If your adjusted Federal and state income tax effective rate is, say, 15%, the tax equivalent AROR is about 12.88%. If your effective income tax bracket is 20%, the tax equivalent ARoR would be about 13.44%.

Unless a better trade comes along, I’m inclined to take the second alternative above and to continue selling a few puts to generate more options premium income. If PFE is called, I’ll move on to other trades. I may sell PFE covered calls this week, depending how the stock and its options change.

In addition to the PFE story, the Amazon.com Inc. (AMZN) calls were exercised at $137 a share. I plan to sell AMZN puts this week.

D.H. Horton (DHI) snapped back quicker than I hoped and was called at a loss. Because of tax loss regulations, I can’t buy DHI back until about Dec. 19.

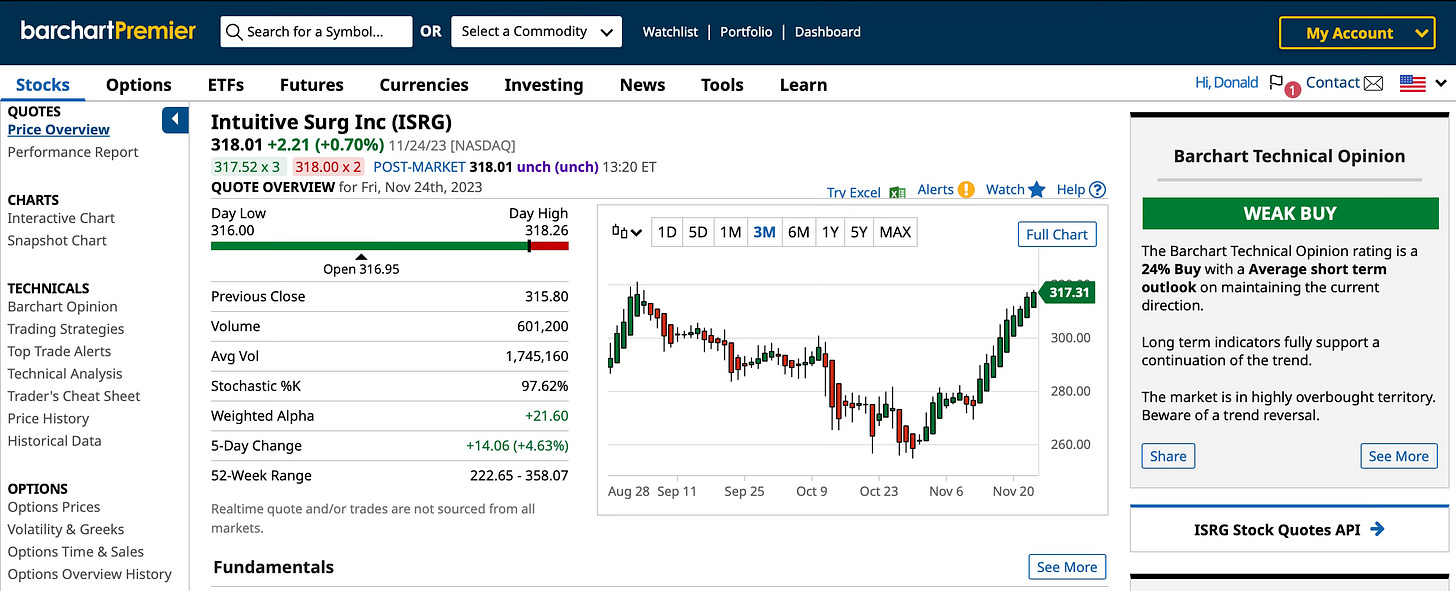

Intuitive Surgical Inc. (ISRG) is another stock that snapped back faster than I expected. I bought ISRG for $305 and sold 11.24.23 $305 covered calls when ISRG was at $292.14 and was rated a 72% sell on Barchart.com.

ISRG was called at $305 Friday when the stock was at $318.01. After accounting for options premiums collect on ISRG, its net debit was $282.50. That means I made $22.50 a share, or $2,250 per 100-share covered calls contract. I bought ISRG and sold the first covered calls on Sept. 22, 2003 and owned it for 63 days. If I could replicate that 7.4% RoR about 5.74 times in 12 months, the ARoR would be about 42%.

After I bought ISRG, I did six ISRG covered calls trades and the puts trade discussed above. ISRG is 24% buy on Barchart.com.

I respond to comments on the comments section where readers’ comments are posted. That is, if you have a question about this article or other comments, I'll discuss your questions with you in the comments section below this article.

LINKs:

Home Page. See my more than 150 articles on options trading, stock picking and watch lists. If you read several of these articles, you’ll learn how my strategies are meant to work. No guarantees. Links to useful web sites are on the lower right corner of the home page. Scroll down.

Follow @RealDonJohnson on twitter.com and FaceBook.com. Or follow me on Substack.com/Notes where my byline is my handle.

15 December Covered Calls Trades Yielding 22.9% to 26.2%

12 Berkshire Hathaway Buys For Covered Calls Options Traders

20 November 2023 Covered Calls Trades Yielding 13.3% to15.9% Update #2

AMZN, META, MSFT And NVDA Posted Big Gains. November Puts Trades Update #4

5 Bullish Stocks For Covered Calls, Puts Stock Options Trades

How I'm Trading Amazon Covered Calls, Cash Secured Puts Stock Options For Options Premium Income

31 November 2023 Cash Secured Puts Trades Yield 10.3% Update #5

25 November 2023 Cash Secured Puts Trades Update #3

20 November 2023 Cash Secured Puts Trades Update #2

10 November 2023 Cash Secured Puts Trades Update #1

5 November 2O23 Cash Secured Puts Options Trades

32 October 2023 Covered Calls Trades Update #2

October 2023 Cash Secured Puts Trades Update #2

10 November 2023 Covered Calls Trades Update #1

7 November 2023 Covered Calls Trades Are Yielding 13.3%

Selling in The Money Covered Calls Can Yield Big Annual Returns on Risk. By Donald E. L. Johnson

How to Beat Inflation Tax, Bear Market Tax With Dividend Stocks, Covered Calls, Cash Secured Puts, by Donald E. L. Johnson.

How I Analyze Bullish Puts Options Trades With Stock Rover, By Donald E. L. Johnson.

Wars Breed Inflation, Rising Interest Rates, Market Turmoil, By Donald E. L. Johnson.

Calls vs Puts Options: What’s the Difference?

A video on how to place options trades on TDAmeritrade.com’s Think or Swim trading platform.