10 November 2023 Cash Secured Puts Trades Update #1

Small and large dividend stock and ETF investors can use covered calls and puts trades to generate monthly income from options premiums and options trading.

By Donald E. L. Johnson

Cautious Speculator

Stock markets are correcting. How far down stocks will go nobody knows.

Many investors use market corrections to create watch lists of stocks they might buy when the bear market ends.

Another strategy is to sell out of the money naked out of the money naked puts at strikes that look attractive.

My strategy is to sell puts and covered calls on stocks most weeks to create an options and stock portfolio that is diversified and spreads the risk of investing and selling options for premium income.

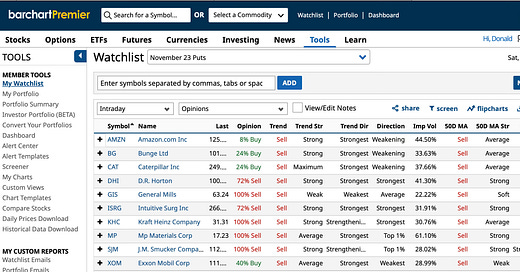

10 naked puts trades are averaging annualized returns on risk of about 12.1%. That beats inflation, most money markets and most other dividend stocks’ yields.

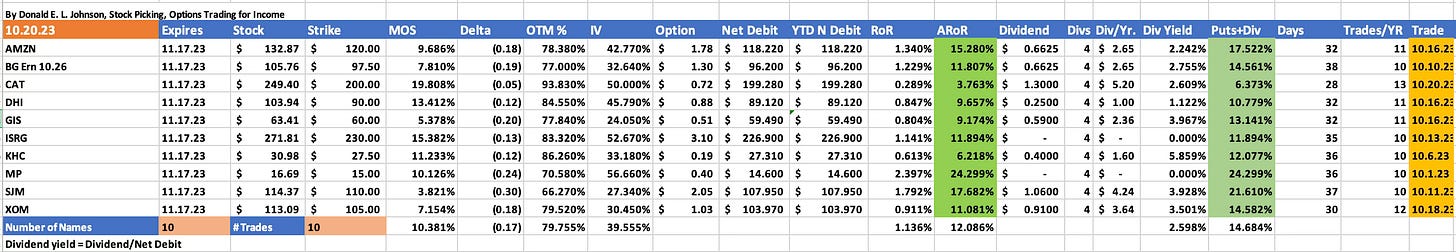

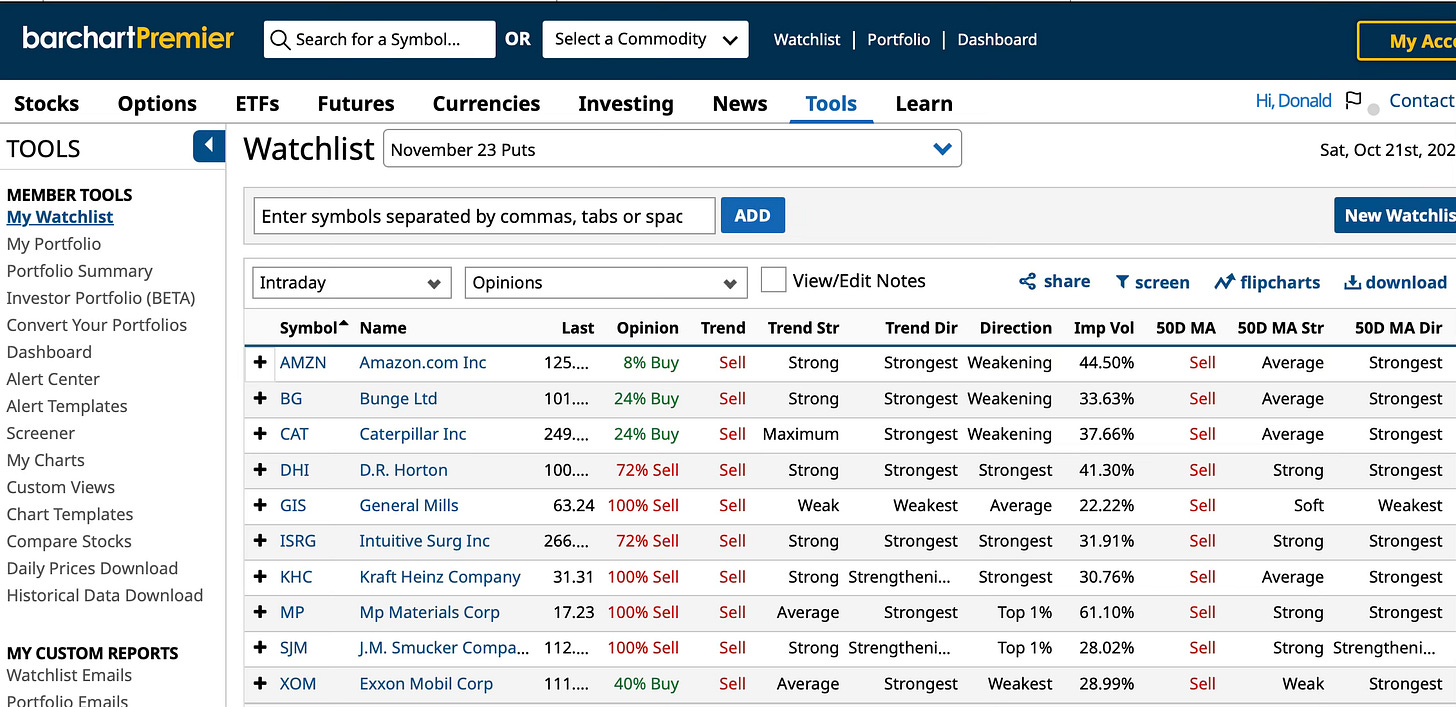

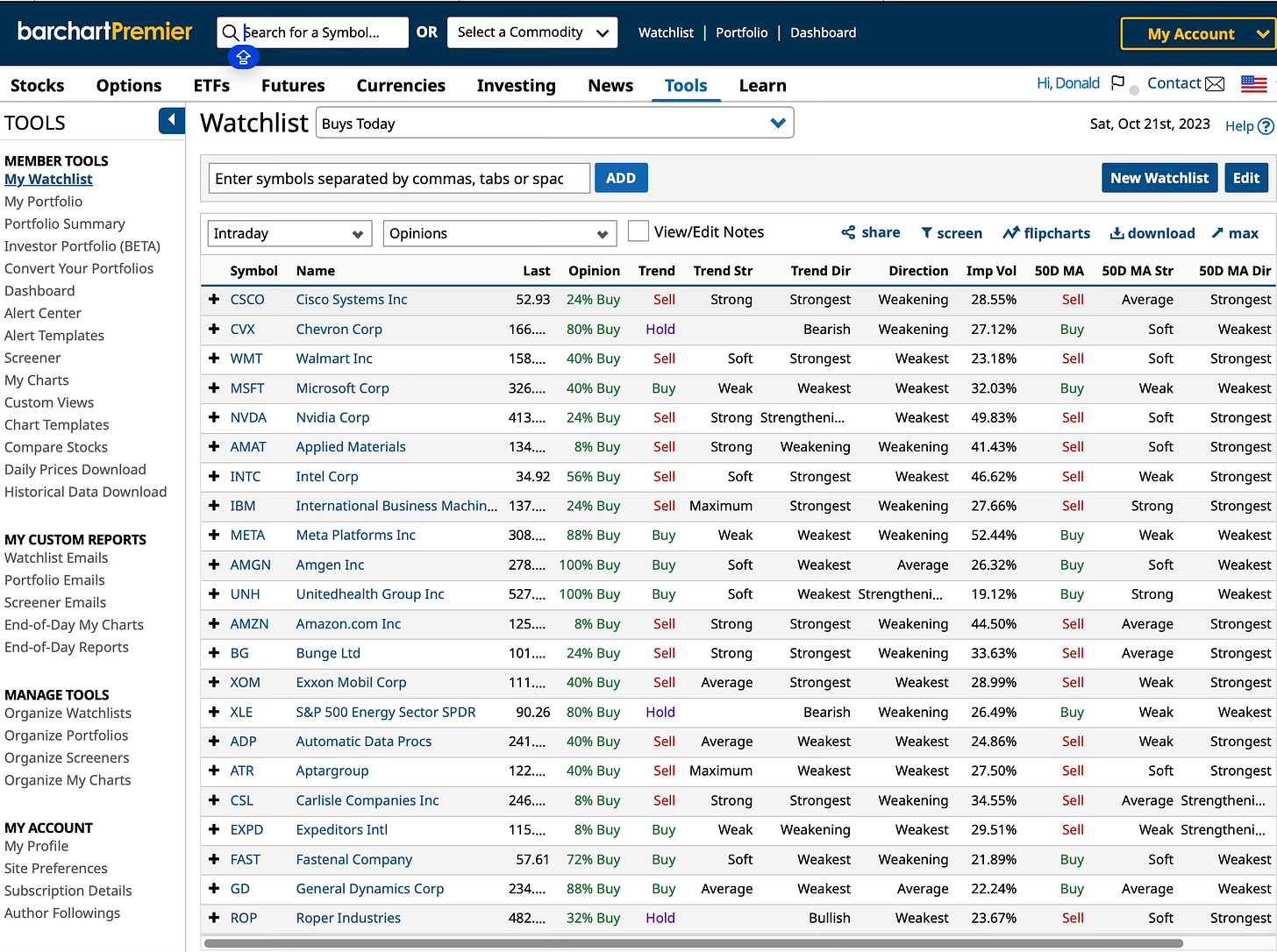

Only eight of the Dow Jones Industrials average 30 blue chip stocks have buy ratings on Barchart.com. Of those, only three have both buy ratings and buy trend signals.

They are Amgen Inc. (AMGN), UnitedHealth Group (UNH) and Microsoft Corp. (MSFT). And of so called critical exchange traded funds, only three have bullish ratings. They are S&P 500 Energy Sector (XLE), CBOE Volatility Index ($VIX) and S&P Oil & Gas Equipment and Services (XES).

When markets are correcting, a lot of experienced dividend stock investors create watch lists of stocks they want to buy after they bottom and show signs of bottoming out.

I do that. See below. I also nibble at stocks on the way down by selling cash secure puts options on mostly dividend stocks that I want to own or want buy at discounts. In some cases, I’m averaging down my net debits. Selling naked puts is a bullish trade because the seller contracts to buy the underlying stocks at the strike price if the puts options on them expire while the stocks’ prices are below the puts options strike prices.

Last week I added five stocks to my November puts trade portfolio. Each of these five trades is discussed below.

Annualized returns on risk on the 10 November naked puts trades are averaging about 12.1%. If assigned, these 10 stocks’ dividend yields would be an average of about 2.6%.

Here are buy candidates with buy ratings on Barchart.com. Most of these stocks have liquid options for selling covered calls and puts options for premium income.

I own Amazon.com Inc. (AMZN) and have been selling and will continue to sell covered calls on it. I’ll post my November covered calls trades on Sunday.

When I sold puts on AMZN, it was a 40% buy on Barchart.com. The point and figure chart on StockCharts.com had a bearish $87.50 price objective on AMZN. Its relative strength index was a barely bullish 41. Morningstar.com rated AMZN three stars out a possible five and gave it a fair value estimate of $108. Analysts rated AMZN a strong buy. The highest target price posted by a Wall Street analyst was $161. The mean target price was $131 and the low target was $110. When I sold the AMZN 11.17.23 $120 strike puts, AMZN was trading for $132.87. There is an 18% probability that the AMZN puts will be assigned and a 78.4% probability that the stock won’t be assigned. At the $120 strike price, the margin of safety, or discount if the stock is assigned is about 9.7%. I like AMZN and it has liquid and deep options. The annualized return on risk on this trade or similar ones with similar returns is about 15.3%. That assumes the trade can be replicated with the same results 11 times a year.

Last year I sold Caterpillar Inc. (CAT) at a big profit to take advantage of tax losses. Since then, I’ve been looking to buy it back at about $210 or less. I’ve been selling naked puts on it all year and last week rolled my CAT October puts into November at a $200 strike price at a high 19% MOS because I don’t know how low the market will drop. In return for making a low risk trade, I’ll get a low AROR of about 3.8%, which is higher than CAT’s 2.6% yield on the $199.28 a share net debit. I may sell more CAT puts if the stock looks like it will stay above $210 or $220.

On Barchart, CAT is a 24% buy. The PnF chart price objective is $250.42. CAT is a two star stock on Morningstar.com, which means it’s over priced. The Valuentum.com buying index (VBI) is a moderate buy at six of a possible 10. Analysts rate CAT a moderate buy. The highest analyst’s target price is $350. Analysts’ mean target price is $279.42 and the low target is $208, just above my $200 strike. CAT was trading at $249.40 when I sold the puts.

I own D. R. Horton. (DHI), the home builder, and sell covered calls on it. My cost was $120. After collecting DHI dividends and covered calls and puts premiums on it, my net debit is $116.15 per share. To generate more puts premium income and lower the average purchase price as well as the net debit if DHI is assigned on Nov. 17, I sold DHI 11.17.23 $90 strike puts for $0.88, or a 9.6% AROR. The MOS is a relatively safe 13.4% and the probability that the DHI puts will be assigned was about 12% when I did the trade. DHI pays a 1.122% dividend. It goes ex-dividend on Nov. 4 and reports earnings on Nov. 7.

DHI is a 72% sell on Barchart. It was at $103.94 when I sold the $90 strike puts. The PnF price objective was a bearish $102.69. The RSI was a bearish and nearly oversold 34.7. Analysts rate DHI a moderate buy. The highest analyst target price is $164, the mean target of the 19 analysts surveyed is $140.47, and the low analyst target price is $98. High mortgage rates are hurting new home sales. Small inventories of existing homes for sale are helping new home sales. As long as I can get a good AROR in covered calls and puts premiums plus the small dividend, I’ll be in DHI.

General Mills (GIS) is another stock I’m trading puts and covered calls on. My cost on GIS is $64.95 and my net debit is $61.92. With GIS at $63.41, I sold 11.17.23 $60 puts for $0.51 a share. The AROR is 9.2% and the dividend is 3.97%. The MOS is 5.4% while the probability that the GIS puts will be assigned is about 20%.

This is a more risky trade because GIS is a 100% sell on Barchart. The PnF bearish price objective is $63.71, or about where it was when I did this trade. Eighteen analysts rate GIS a hold. The high analyst target price is $96, the mean is $73.18 and the low target price is $58. Morningstar rates GIS a four star stock with a FVE of $78. That rating plus the probably too optimistic ratings by analysts make me want to own more GIS.

I’ve been in and out of Exxon Mobil (XOM) for a long time. It was called at $112 as share on Sept. 8. Now I’m selling puts on it. About a week ago, XOM 10.20.23 expiration puts looked like they would be assigned, but the stock popped and the options expired worthless.

On 10.17.23, knowing that the XOM October $110 strike puts would expire worthless, I rolled my XOM puts by selling XOM 11.17.23 $105 puts at $1.03 per share. The ARoR is about 11.1%, and the dividend yield on the $103.970 net debit will be 3.5% if XOM is assigned. The MOS on this 30-day trade is 7.1545. The -.18 delta implies that there is about an 18% probability that XOM will be assigned. I’m bullish on energy and XOM.

The PnF chart price objective on XOM is a bullish $128.37. It was at $113.09 when I sold the puts. It closed Friday at $111.08.

XOM is an 80% buy on Barchart. Analysts rate XOM a moderate buy. The highest analyst target price is $150, the mean price of the 16 analysts is $128.67 and the lowest target price is $105, or my puts strike price.

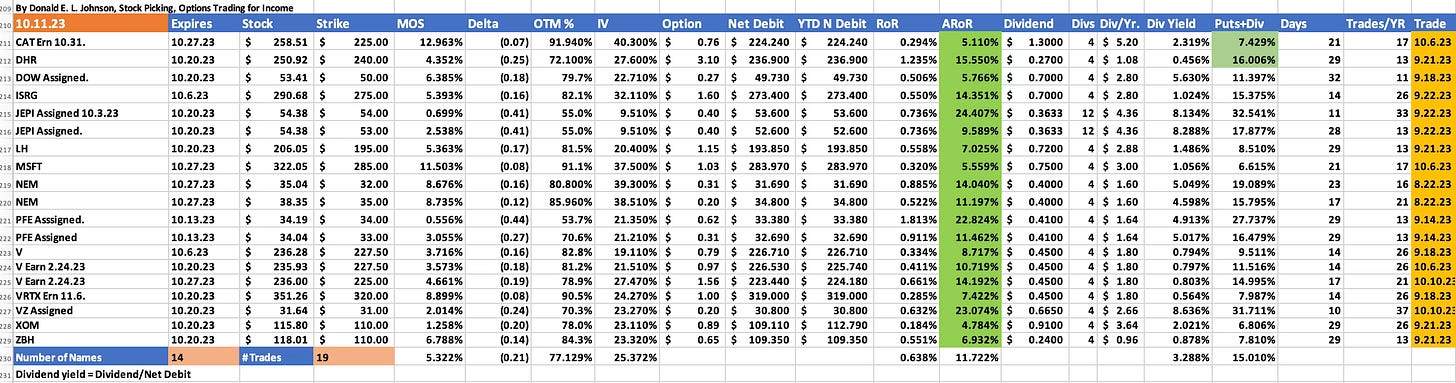

Most of my 14 October puts trades on 19 stocks have expired. On Oct. 27 puts trades will expire on CAT, MSFT, Newmont Mining Co. (NEM) and Visa Inc. (V). I expect to roll most of those trades late next week.

As noted in the spreadsheet above, several of my October puts were assigned. They were Dow Inc. (DOW), JPM Equity Premium Income ETF (JEPI), Pfizer (PFE) and Verizon Communications Inc. (VZ). I’ll be selling covered calls on them but JEPI, which doesn’t have liquid options, for options premiums income.

I respond to comments on the comments section where readers’ comments are posted. That is, if you have a question about this article or other comments, I'll discuss your questions with you in the comments section below this article.

Thanks for reading Stock Picking, Options Trading for Income! Subscribe for free to receive new posts and support my work.

LINKs:

Home Page. See my more than 150 articles on options trading, stock picking and watch lists. If you read several of these articles, you’ll learn how my strategies are meant to work. No guarantees. Links to useful web sites are on the lower right corner of the home page. Scroll down.

Follow @RealDonJohnson on twitter.com and FaceBook.com. Or follow me on Substack.com/Notes where my byline is my handle.

5 November 2O23 Cash Secured Puts Options Trades

27 October 23 Covered Calls Options Trades Update #1

16 October 2023 Puts Options Trades Update #

How To Turn An Over Valued Stock Into A Covered Calls And Puts Premiums Winner

8 October 2023 Covered Calls Trades Yield 24.3% Annualized Returns On Risk

10 October 2023 Puts Options Trades

Selling in The Money Covered Calls Can Yield Big Annual Returns on Risk. By Donald E. L. Johnson

How to Beat Inflation Tax, Bear Market Tax With Dividend Stocks, Covered Calls, Cash Secured Puts, by Donald E. L. Johnson.

How I Analyze Bullish Puts Options Trades With Stock Rover, By Donald E. L. Johnson.

Wars Breed Inflation, Rising Interest Rates, Market Turmoil, By Donald E. L. Johnson.

Calls vs Puts Options: What’s the Difference?

A video on how to place options trades on TDAmeritrade.com’s Think or Swim trading platform.

Beware. Like all investing, trading stocks and options is risky. I’m an active private speculator who trades covered calls and sells puts on stocks for my accounts. I am not a professional analyst nor a financial advisor. I don't take and won't take responsibility for how other people trade. This article is for educational purposes only. It is not advice. The data presented looked accurate at publication time except for intra-day fluctuations, but I can’t guarantee the accuracy. Traders should do their due diligence. I reserve the right to trade any of the listed stocks and options at any time. I receive no compensation for producing this content nor for any links.