How I Analyze Bullish Puts Options Trades With Stock Rover

Small and large dividend stock investors can use covered calls and puts trades to generate monthly income from options premiums and options trading.

By Donald E. L. Johnson

Cautious Speculator

Stock picking is the first and most important step in finding covered calls stock options and cash secured puts options trades.

Ideas come from a lot of sources, and the ones that look most promising are checked out on StockRover.com and other subscription services.

This article explains how I use the new version of StockRover. com to evaluate options trading opportunities and risks.

Stock Picking is the most important step in finding and creating profitable bullish puts options and covered calls stock options trades. Most of my stock picks and options trades are done to generate a stream of options premiums income on large cap dividend stocks.

This week, however, I’ve focused on buying under value stocks that have traded puts and calls options and look like they may provide good capital gains over the next few weeks, months and years. I’m doing a lot of small options trades to diversify my risks.

When I get an idea for a trade, I turn to investing services like StockRover.com, Barchart.com, StockCharts.com, OptionsPlay.com, SeekingAlpha.com and Morningstar.com. I subscribe to wsj.com, Bloomberg.com and WashingtonPost.com. CNBC.com is mostly free, and I watch all three cable TV business channels.

This article focuses on some tables I created and use on StockRover.com, which recently released its Version 10.

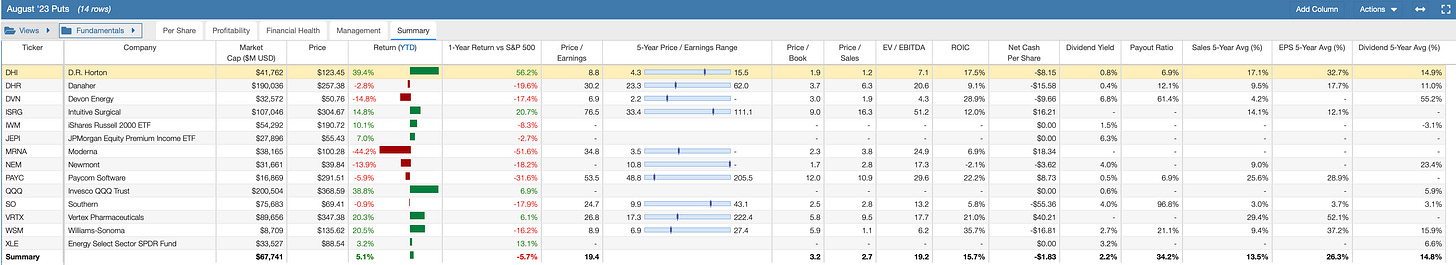

These are my cash secured puts trades for August, so far. I’ve done four new trades this week as I have reported in the comments section of August Covered And Naked Puts Options Trades On Paycom And Other Stocks Update #1.

The first thing I do after I get an idea for a puts or calls trade is to check out the stock’s options liquidity and volatility and daily and weekly charts on my trading platform.

Then I check the fundamentals of the stock or exchange traded fund. I’m especially interested in the price to free cash flow, the debt to equity, dividends and dividend payout ratios. On Stock Rover, subscribers can create tables like these with the metrics that are important to them.

While current prices and options prices are better indicators of the future value of a stock or ETF than analysts usually too optimistic target prices, I think a lot of traders pay attention to how analysts are valuing the equities they trade. So I want to know what they’re thinking.

In this table, the lower the analysts’ consensus ratings are, the stronger the buy recommendations. In this table, Danaher (DHR) has the best consensus rating of 1.42. Williams Sonoma (WSM) has a rating of 3.35, which is a hold at best. I sold puts on both stocks and JP Morgan Equity Premium ETF (JEPI) this week.

After I’ve checked out the charts and other indicators, I look at current prices compared with their 50- and 120-day moving averages. I also like to check earnings and buyback yields.

In addition to looking at these and other tables, I check analysts’ opinions on brokers’ web sites, Morningstar.com, Barchart.com and SeekingAlpha.com.

For example, today Morningstar.com made a convincing case that Moderna (MRNA) is deeply under valued despite the risks that new technology and other things may slow its growth.

With a resurgence of Covid-19 cases and the approach of another flu season, if it’s not already here, I expect an increase in demand for the new Covid vaccine variant that will be released next month. That should help MRNA’s stock price.

Between my weekly portfolio updates, I report my thoughts and trades in the comments section of this and other posts. When I do trades, I announce them in the comments section.

I respond to comments on the comments section where readers’ comments are posted. That is, if you have a question about this article or other comments, I'll discuss your questions with you in the comments section below this article.

Thanks for reading Stock Picking, Options Trading for Income! Subscribe for free to receive new posts and support my work.

Thanks for reading Stock Picking, Options Trading for Income! Subscribe for free to receive new posts and support my work.

LINKs:

Home Page. See my more than 100 articles on options trading, stocks and watch lists. If you read several of these articles, you’ll learn how my strategies are meant to work. No guarantees. Links to useful web sites are on the lower right corner of the home page. Scroll down.

Follow @RealDonJohnson on twitter.com and FaceBook.com. Or follow me on Substack.com/Notes where my byline is my handle.

August Covered Calls Trades On 13 Dividend Stocks Update #1

August Covered And Naked Puts Options Trades On Paycom And Other Stocks Update #1

How Owners of AT&T, Verizon, T-Mobile Can Use Covered Calls, Dividends To Offset Losses Update #1

Selling in The Money Covered Calls Can Yield Big Annual Returns on Risk. By Donald E. L. Johnson

August Covered Calls Trades On 13 Dividend Stocks Update #1

August Covered And Naked Puts Options Trades Yield About 12.8% In Options Premiums.

August Covered Calls Trades On Dividend Stocks Yield 12.2% in Options Premiums

July Puts Options Trades On Dividend Stocks Yield 10.5% in options premiums.

July Covered Calls Options Trades on Dividend Stocks Returned 9.97% Plus Dividends, Capital Gains

July Covered Calls Trades on Dividend Stocks Update #5

July Covered Calls Trades on Dividend Stocks Update #4

July Covered Calls Trades on Dividend Stocks Update #3

July Dividend Stocks Covered Calls Trades Update #2

July Dividend Stocks Covered Calls Trades Update #1

12 July Covered Calls Trades on Dividend Stocks.

20 Ideas for Adjusting Your Stock and Bond Portfolio, by Christina Lourosa-Ricardo.

How to Beat Inflation Tax, Bear Market Tax With Dividend Stocks, Covered Calls, Cash Secured Puts, by Donald E. L. Johnson.

Wars Breed Inflation, Rising Interest Rates, Market Turmoil, By Donald E. L. Johnson.

Ways to use StockRover.com to analyze stocks

Calls vs Puts Options: What’s the Difference?

A video on how to place options trades on TDAmeritrade.com’s Think or Swim trading platform.

Beware. Like all investing, trading stocks and options is risky. I’m an active private speculator who trades covered calls and sells puts on stocks for my accounts. I am not a professional analyst nor a financial advisor. I don't take and won't take responsibility for how other people trade. This article is for educational purposes only. It is not advice. The data presented looked accurate at publication time except for intra-day fluctuations, but I can’t guarantee the accuracy. Traders should do their due diligence. I reserve the right to trade any of the listed stocks and options at any time. I receive no compensation for producing this content nor for any links.

.