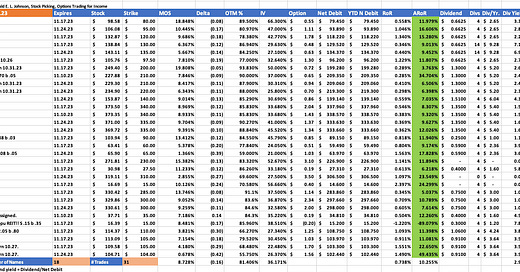

31 November 2023 Cash Secured Puts Trades Yield 10.3% Update #5

Small and large dividend stock and ETF investors can use covered calls and puts trades to generate monthly income from options premiums and options trading

By Donald E. L. Johnson

Cautious Speculator

Selling Exxon Mobil cash secured puts and covered calls produces good returns on risk.

So far in 2023 I done seven XOM puts trades and five XOM covered calls trades.

With energy markets and XOM looking weak, it’s time for me to take a pause in trading XOM and its stock options.

31 November cash secured puts trades on 18 stocks yielded an average of 0.738% returns on risk, or about 10.255% annualized.

Exxon Mobil (XOM) and the energy sector looked pretty bullish during most of 2023.

That made XOM’s liquid puts and calls options and its 3.6% dividend attractive to investors in dividend stocks who sell cash secured puts and covered calls to generate options premiums income.

This month I did three puts trades on XOM. Year to date, I’ve done seven puts and 5 covered calls options trades on XOM. Combined, those 12 trade generated $9.89 a share in options premium income in an IRA account. Selling puts is a bullish trade because the investor contracts to buy an equity at a strike price if the price of the equity closes below the strike on the day the puts option expires.

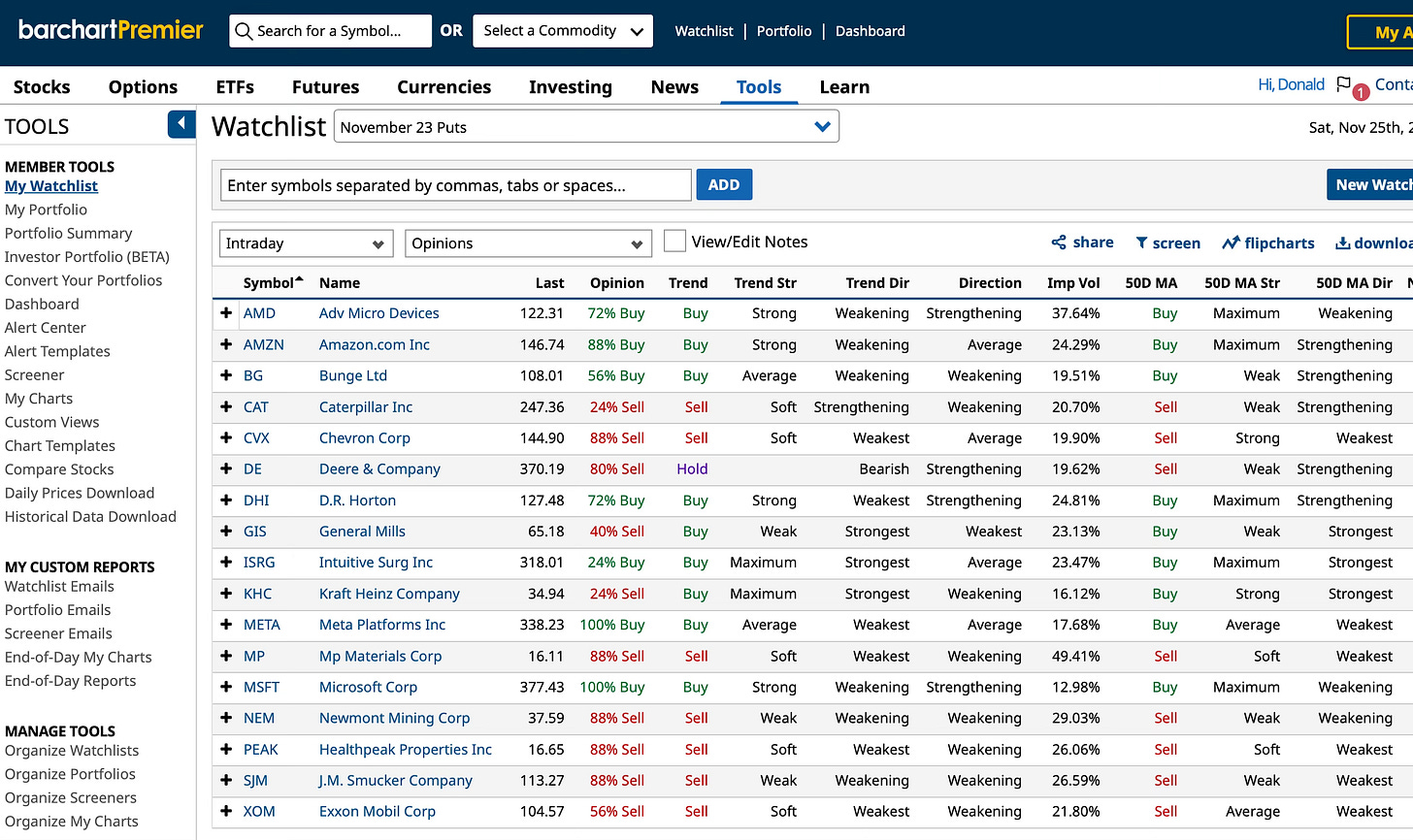

In November, I traded XOM puts at strikes that were 0.678% to 7.154% below the stock price when the trades were done. I expected and at the time I did the trades I wanted to buy XOM at the $104 and $105 strikes. By the last day of trading in the puts on November 24, I didn’t want XOM to be assigned because it looks like it is going lower. On Barchart.com, it is a 56% sell and the trend is a sell.

With XOM at $104.57 at Friday’s close, the point and figure chart price objective is $95.07 on StockCharts.com. XOM is a three star stock on MorningStar.com with a $118 fair value estimate.

I plan to reduce my exposure to energy sector equities until they bottom out as I think they will sooner than later. That is, I won’t do any more XOM or Chevron (CVX) trades for a while.

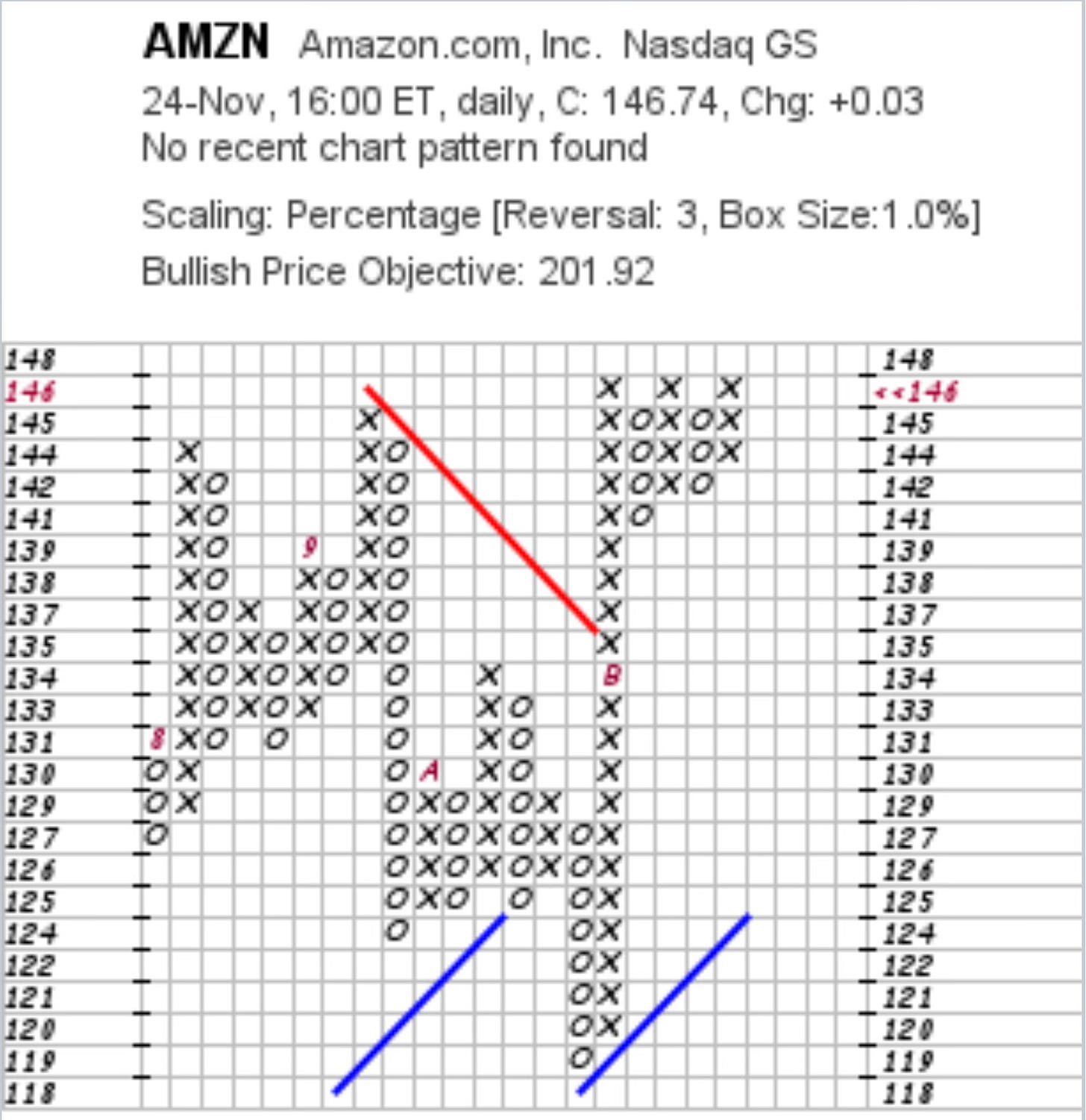

I also did three puts trades on Amazon.com Inc. (AMZN) during November after AMZN was called from me at the $137 a share strike price on November 3. I did seven covered calls trades on AMZN beginning on Sept. 9.

AMZN’s PnF chart price objective is a bullish $201.80. It closed Friday at $146.74

I have done an in the money AMZN 12.1.23 $142 strike covered call trade, and it looks like AMZN will be called this week with a nice return on risk. I’ll probably sell AMZN puts again this week even though the stock looks extended, it still hasn't broken out of its three-top point and figure chart formation. Resistance is at about $147 or $148. Support is at about $142.

Notice that during November I did four puts trades on Caterpillar Inc. (CAT) and four on Deere & Co. (DE)

All of these trade worked in that the puts options expired worthless. I’ve been selling puts on CAT and DE for some time with the hope that I could buy them at lower prices. But CAT’s a 24% sell and DE is an 80% sell and I’m waiting for them to dip some more before I trade their puts or covered calls again.

Microsoft Corp. (MSFT) is a 100% buy. It looks over bought with an extended point and figure chart and $356.90 price objective. It closed Friday at $377.43. Its relative strength index rating is at 68.6, just below the 70 overbought indicator. I did three puts trades on MSFT in November and I’ve done seven this year. I sold MSFT last year at a nice profit and haven’t been able to get into it again at my price this year. I’ll sell MSFT December expiration puts when it dips.

This month I also made some successful puts trades on strong stocks like Advanced Micro Devices (AMD), Intuitive Surgical Inc. (ISRG) and Meta Platforms Inc. (META).

I have rolled AMD and META puts into December. And I’ve done December puts trades on Kinder Morgan (KMI), Newmont Mining (NEM) and Palo Alto Networks Inc. (PANW). I’ll report more on my December puts trades soon.

I respond to comments on the comments section where readers’ comments are posted. That is, if you have a question about this article or other comments, I'll discuss your questions with you in the comments section below this article.

LINKs:

Home Page. See my more than 150 articles on options trading, stock picking and watch lists. If you read several of these articles, you’ll learn how my strategies are meant to work. No guarantees. Links to useful web sites are on the lower right corner of the home page. Scroll down.

Follow @RealDonJohnson on twitter.com and FaceBook.com. Or follow me on Substack.com/Notes where my byline is my handle.

15 December Covered Calls Trades Yielding 22.9% to 26.2%

12 Berkshire Hathaway Buys For Covered Calls Options Traders

20 November 2023 Covered Calls Trades Yielding 13.3% to15.9% Update #2

AMZN, META, MSFT And NVDA Posted Big Gains. November Puts Trades Update #4

25 November 2023 Cash Secured Puts Trades Update #3

5 Bullish Stocks For Covered Calls, Puts Stock Options Trades

Jim Cramer's 4 Best Covered Calls Stocks

How I'm Trading Amazon Covered Calls, Cash Secured Puts Stock Options For Options Premium Income

32 October 2023 Covered Calls Trades Update #2

October 2023 Cash Secured Puts Trades Update #2

10 November 2023 Covered Calls Trades Update #1

20 November 2023 Cash Secured Puts Trades Update #2

7 November 2023 Covered Calls Trades Are Yielding 13.3%

10 November 2023 Cash Secured Puts Trades Update #1

5 November 2O23 Cash Secured Puts Options Trades

Selling in The Money Covered Calls Can Yield Big Annual Returns on Risk. By Donald E. L. Johnson

How to Beat Inflation Tax, Bear Market Tax With Dividend Stocks, Covered Calls, Cash Secured Puts, by Donald E. L. Johnson.

How I Analyze Bullish Puts Options Trades With Stock Rover, By Donald E. L. Johnson.

Wars Breed Inflation, Rising Interest Rates, Market Turmoil, By Donald E. L. Johnson.

Calls vs Puts Options: What’s the Difference?

A video on how to place options trades on TDAmeritrade.com’s Think or Swim trading platform.