25 November 2023 Cash Secured Puts Trades Update #3

Small and large dividend stock and ETF investors can use covered calls and puts trades to generate monthly income from options premiums and options trading.

By Donald E. L. Johnson

Cautious Speculator

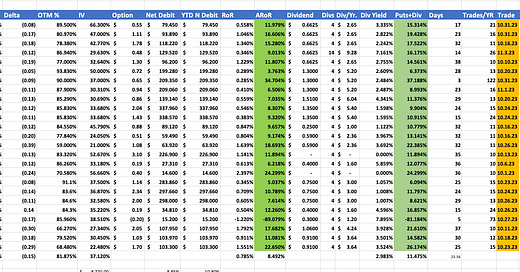

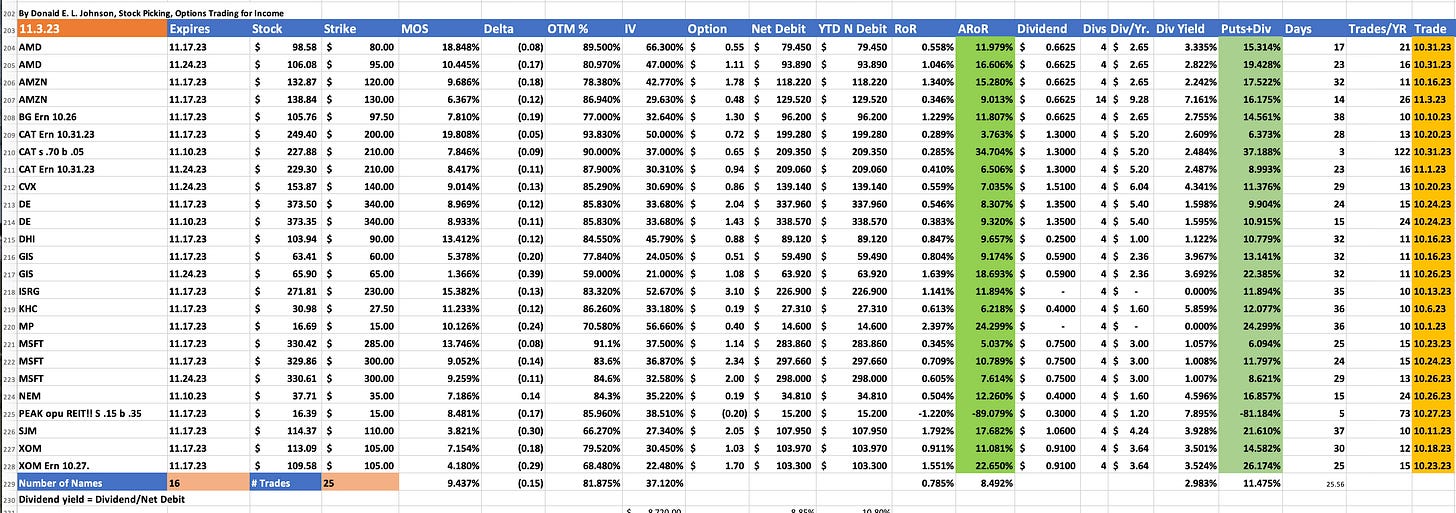

The November cash secured puts portfolio is averaging an 8.492% annualize return on risk.

It is a low return, low risk portfolio created during a market correction.

The options trades were done to generate options premium income in a down market.

With stocks moving higher, I’ll change the way I trade puts.

Since October 1 when I did 36-day cash secured puts trades on Kraft Heinz Co. (KHC) and Mp Materials Corp. (MP), I’ve done 25 puts options trades on 16 stocks.

This is a portfolio traded during October’s market corrections. The goal was to generate income, not to buy stocks at discounts. A lot of small trades help diversify and reduce the risks that puts options will be assigned on stocks that you plan to trade puts on for several months until they become available at lower prices or you find better trades.

Last week, stocks gained. Stocks opened slightly higher Monday. If the rally continues, I’ll sell puts at higher strikes, delta and higher risk that they’ll be assigned. The assumption will be that when stocks rise, there is less risk that they will be assigned. The average margin of safety on this portfolio so far is 9.437%. I might do trades with 5% or 6% MOS. The average delta is -.15. I might sell puts at strikes with -.20 delta. The markets will tell us what to do, or not.

This edition of the newsletter updates previous posts about my November expiration puts trades. I’m trying to show how I traded puts in down markets like we had in October.

These are all options premiums income trades on both high dividend stocks and low or no dividend stocks. I’ve already closed at a small loss a puts trade on Healthpeak Properties Inc. (PEAK) because it is a real estate investment trust I no longer want to own. After I sold PEAK puts, the company announced a big and expensive merger that may take a long time to help the stock, if it ever does. Also, I made a mistake when I did the PEAK trade in an IRA account, which doesn’t make sense for a tax-sheltered REIT.

The average returns on these trades are low because I have been selling way out of the money strike puts in weak markets. The risks that these trades will be exercised are low. Low risks of assignment come with low returns. See my post on selling puts in a bear market.

Average annualized returns are running at 8.492%, down from October’s average 11.722% ARoR. My year to date average ARoR is13.15%. ARoR assumes I can get the same monthly returns every month over the next 12 months.

So far this year I’ve done 160 cash secured puts trades on 57 stocks and exchange traded funds.

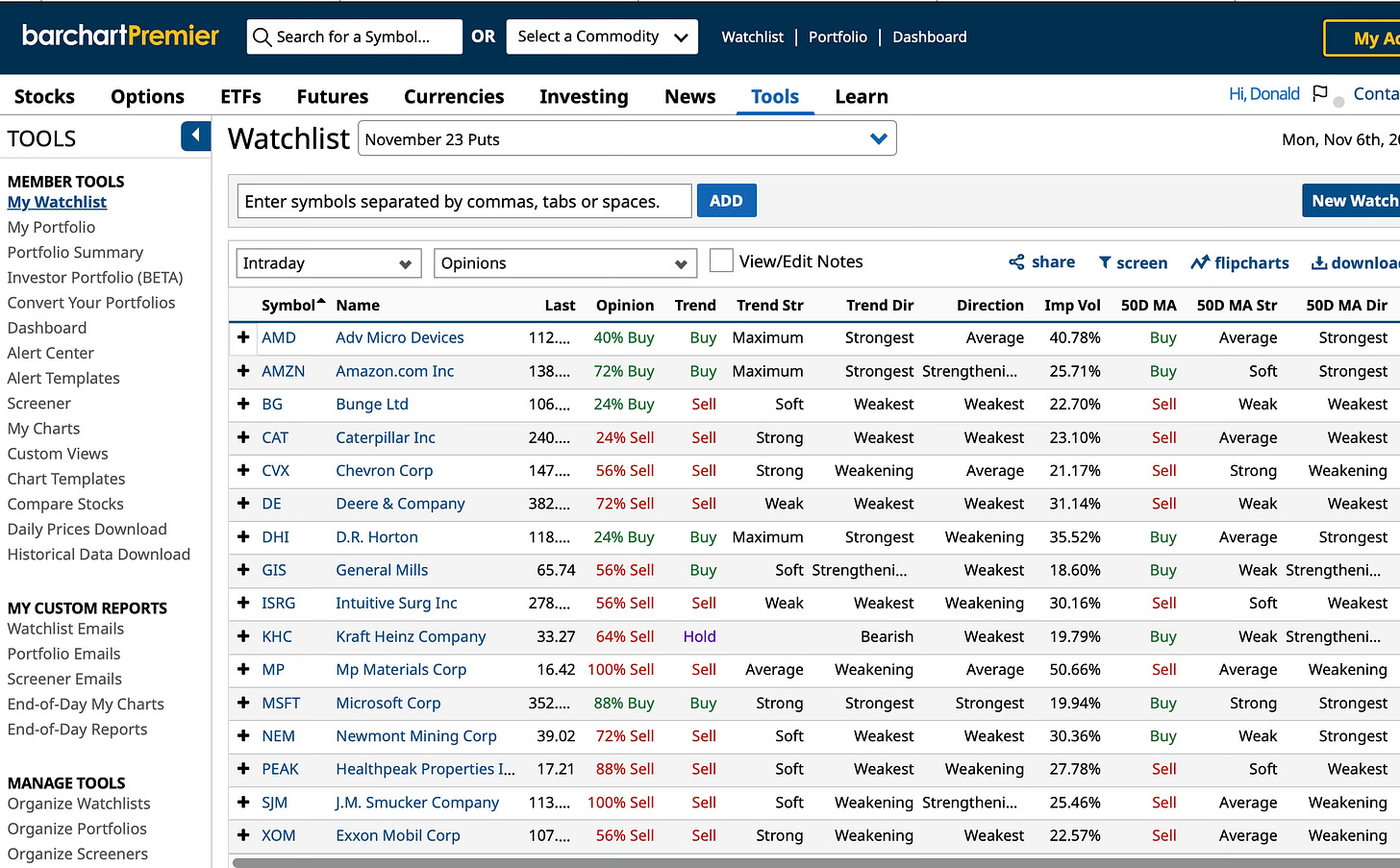

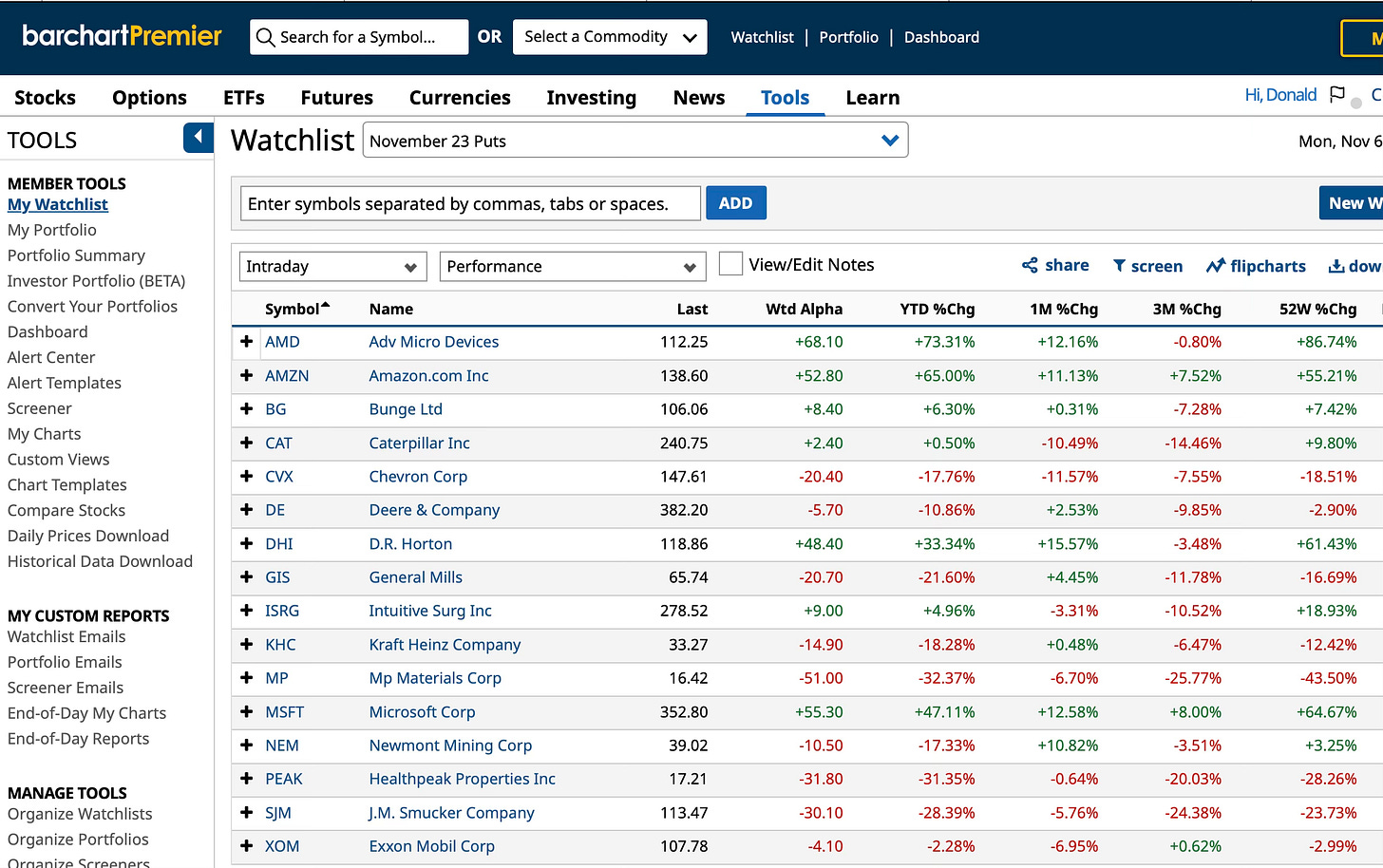

Five stocks in the November portfolio are buys on Barchart.com. They are Bunge Ltd. (BG), Amazon.com Inc. (AMZN), D.R. Horton (DHI), Microsoft Corp. (MSFT) and Advanced Micro Devices (AMD).

The 11 sells are Intuitive Surgical (ISRG), KHC, MP, J.M. Smucker Co. (SJM), Caterpillar (CAT), General Mills (GIS), Exxon Mobil Corp. (XOM), Deere & Co. (DE), Newmont Mining Corp. (NEM), PEAK and Chevron Corp. (CVX).

During the last month 9 of the 19 stocks gained.

I respond to comments on the comments section where readers’ comments are posted. That is, if you have a question about this article or other comments, I'll discuss your questions with you in the comments section below this article.

LINKs:

Home Page. See my more than 150 articles on options trading, stock picking and watch lists. If you read several of these articles, you’ll learn how my strategies are meant to work. No guarantees. Links to useful web sites are on the lower right corner of the home page. Scroll down.

Follow @RealDonJohnson on twitter.com and FaceBook.com. Or follow me on Substack.com/Notes where my byline is my handle.

5 Bullish Stocks For Covered Calls, Puts Stock Options Trades

Jim Cramer's 4 Best Covered Calls Stocks

How I'm Trading Amazon Covered Calls, Cash Secured Puts Stock Options For Options Premium Income

32 October 2023 Covered Calls Trades Update #2

October 2023 Cash Secured Puts Trades Update #2

10 November 2023 Covered Calls Trades Update #1

20 November 2023 Cash Secured Puts Trades Update #2

7 November 2023 Covered Calls Trades Are Yielding 13.3%

10 November 2023 Cash Secured Puts Trades Update #1

5 November 2O23 Cash Secured Puts Options Trades

27 October 23 Covered Calls Options Trades Update #1

16 October 2023 Puts Options Trades Update #

How To Turn An Over Valued Stock Into A Covered Calls And Puts Premiums Winner

8 October 2023 Covered Calls Trades Yield 24.3% Annualized Returns On Risk

10 October 2023 Puts Options Trades

Selling in The Money Covered Calls Can Yield Big Annual Returns on Risk. By Donald E. L. Johnson

How to Beat Inflation Tax, Bear Market Tax With Dividend Stocks, Covered Calls, Cash Secured Puts, by Donald E. L. Johnson.

How I Analyze Bullish Puts Options Trades With Stock Rover, By Donald E. L. Johnson.

Wars Breed Inflation, Rising Interest Rates, Market Turmoil, By Donald E. L. Johnson.

Calls vs Puts Options: What’s the Difference?

A video on how to place options trades on TDAmeritrade.com’s Think or Swim trading platform.

Excellent return considering October's volatility !

@Kevin, I've never written about setting up my screens. If you call Barcharts support, they'll help you set up the screens you want. There are some videos available on Barchart.com that help, too.

I hope this helps. If you have specific questions, I'll try to help.