5 November 2O23 Cash Secured Puts Options Trades

Small and large dividend stock and ETF investors can use covered calls and puts trades to generate monthly income from options premiums and options trading.

By Donald E. L. Johnson

Cautious Speculator

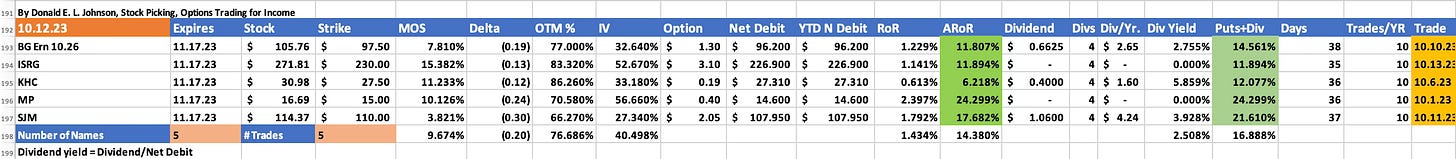

The first five November puts trades average returns are about 14.38%

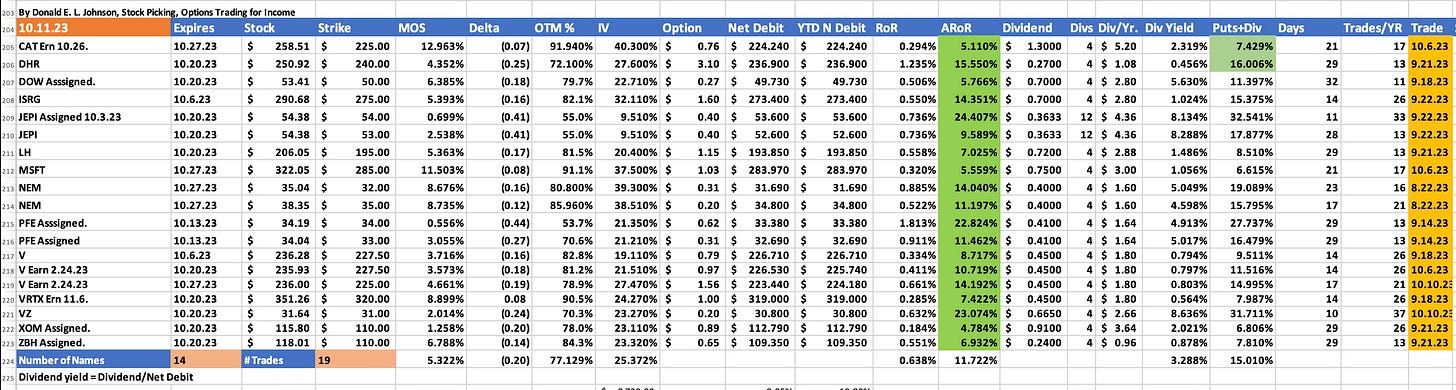

Returns on 19 October trades are averaging about 11.722%

Most of the trades are on higher yielding dividend stocks that are volatile enough to produce good options premiums income.

That the stocks are mostly bearish makes them more risky and potential long-term winners.

The five initial November 2023 cash secured puts options trades are generating about 14.38% in annual returns on risk. This assumes the trades will be replicated in the next 12 months by similar trades and results. The five stocks’ average dividends yield about 2.5% annually.

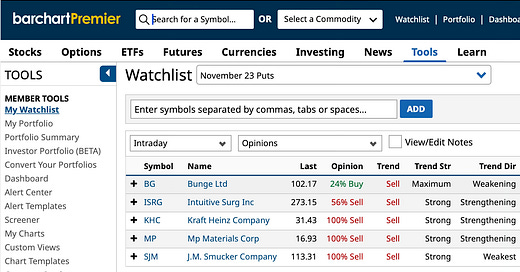

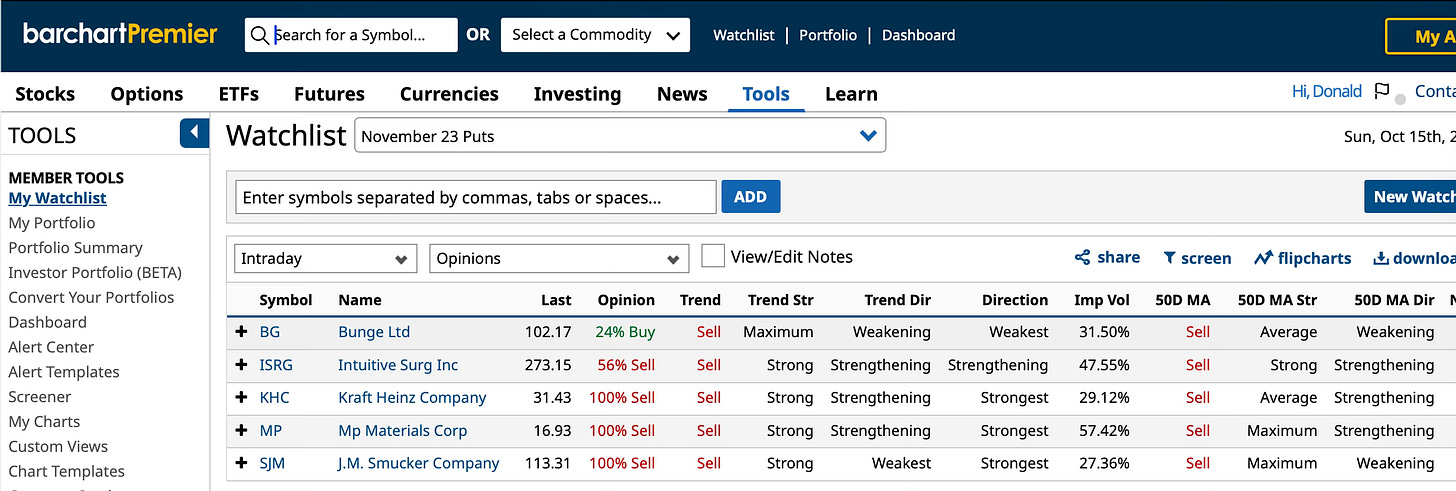

The stocks include Bunge Ltd. (BG), Intuitive Surgical Inc. (ISRG), Kraft Heinz Co. (KHC), Mp Materials Co. (MP) and J.M. Smucker Co. (SJM). I own all of these stocks but MP, which is a small speculative trade. If the puts are assigned, I will buy the stocks at an average discount, or margin of safety, of about 9.674%. I also sell covered calls on the four stocks that I own.

In these markets, I’m selling puts on stocks that are mostly in down trends. The idea is to buy low and sell high if the stocks rally in the next few months or years. In the meantime, most of them are volatile enough to produce good options premiums income by selling covered calls on them. Because the stocks are in down trends, they are more likely to be assigned at the strike prices and some may produce initial losses along with dividend and options premium income.

Over time, most losses can be over come by collecting dividends and covered calls options premiums. And in a few months, dividend stocks may rally if the Fed and Congress get spending and inflation under control.

That is, instead of cutting my losses short by selling losers, I keep selling covered calls on them and collecting their dividends. Eventually, the net debits will be less than the current stock prices and even the original purchase prices as I recently explained.

But wars like those in Ukraine and Israel can be inflationary around the world. No one can predict prices. All we can do is trade and manage our risks, which may become higher before they subside. We all have to trade within our tolerance for risks.

My strategy is to trade for dividend and options premiums income and to manage my risks as best I can. In addition to bottom fishing, trading for options premiums and dividend income, holding cash is a reasonable way to hedge against sinking markets. I do some of that, too.

My open October puts trades will expire during the next two weeks. Then I’ll roll most of the trades that expire worthless into November puts trades. If any of the October puts trades are assigned, I’ll either sell covered calls on them, sell the stocks or hold them until they rally and I can get better covered calls options premium prices on them.

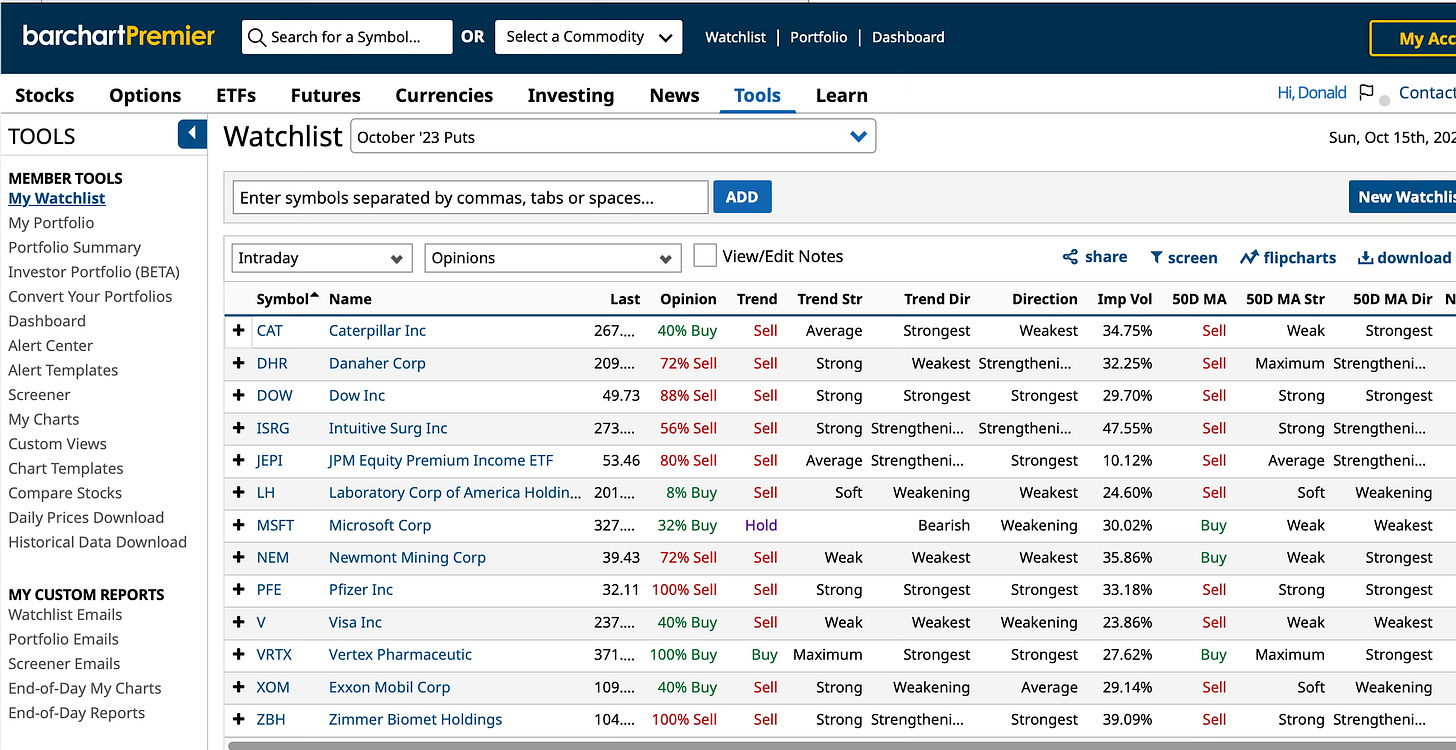

The 19 October puts trades on 14 stocks are yielding options premiums that produce average returns on risk of about 11.722%. The stocks dividend yields average about 3.288%.

I respond to comments on the comments section where readers’ comments are posted. That is, if you have a question about this article or other comments, I'll discuss your questions with you in the comments section below this article.

Thanks for reading Stock Picking, Options Trading for Income! Subscribe for free to receive new posts and support my work.

LINKs:

Home Page. See my more than 150 articles on options trading, stock picking and watch lists. If you read several of these articles, you’ll learn how my strategies are meant to work. No guarantees. Links to useful web sites are on the lower right corner of the home page. Scroll down.

Follow @RealDonJohnson on twitter.com and FaceBook.com. Or follow me on Substack.com/Notes where my byline is my handle.

27 October 23 Covered Calls Options Trades Update #1

16 October 2023 Puts Options Trades Update #

How To Turn An Over Valued Stock Into A Covered Calls And Puts Premiums Winner

8 October 2023 Covered Calls Trades Yield 24.3% Annualized Returns On Risk

10 October 2023 Puts Options Trades

Selling in The Money Covered Calls Can Yield Big Annual Returns on Risk. By Donald E. L. Johnson

How to Beat Inflation Tax, Bear Market Tax With Dividend Stocks, Covered Calls, Cash Secured Puts, by Donald E. L. Johnson.

How I Analyze Bullish Puts Options Trades With Stock Rover, By Donald E. L. Johnson.

Wars Breed Inflation, Rising Interest Rates, Market Turmoil, By Donald E. L. Johnson.

Calls vs Puts Options: What’s the Difference?

A video on how to place options trades on TDAmeritrade.com’s Think or Swim trading platform.