October 2023 Cash Secured Puts Trades Update #2

Small and large dividend stock and ETF investors can use covered calls and puts trades to generate monthly income from options premiums and options trading.

By Donald E. L. Johnson

Cautious Speculator

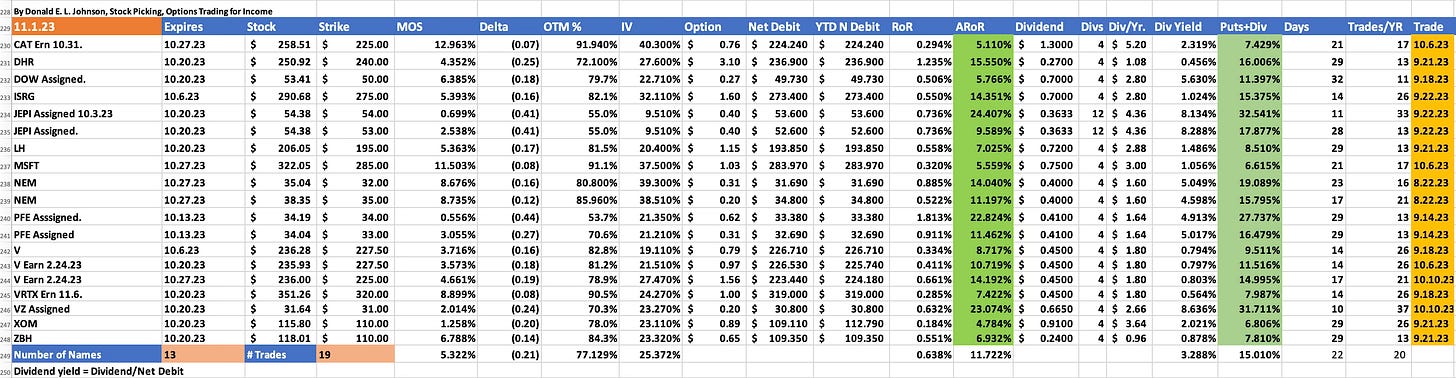

October puts sales generated annualized options premiums income of 11.722%

Four of the 19 puts trades were assigned at discounted prices.

Doing a lot of small trade each month diversifies the risks that naked puts trades will be assigned, or sold to the puts sellers.

October cash secured puts trades generated an average of 11.722% in annualized returns on risk.

I try to update readers on my trades a few times each month so readers can get a feel for how I trade over time and how the trades work out.

The 19 options trades involved 1 exchange traded fund and 12 dividend stocks. ARoR assumes similar trades will get similar results an average of every 22 days on an average of 20 trades a year.

Doing as many small trades a month as possible diversifies the risks of writing cash secured puts options and having stocks assigned, or sold to you. I took assignments on one ETF and three stocks. They were Dow Inc. (DOW), JPM Equity Premium Income ETF (JEPI), Pfizer Inc. (PFE) and Verizon Communications Inc. (VZ).

These puts were sold with the expectation that they would be sold to me at the margins of safety, or discounts from the equities’ prices at the time the trades were done. Puts options are assigned when they expire with the prices of the underlying ETFs and stocks below the puts options strike prices.

When stocks are bought at discounts, annual dividend rates are a bit higher than they were when the trades were done.

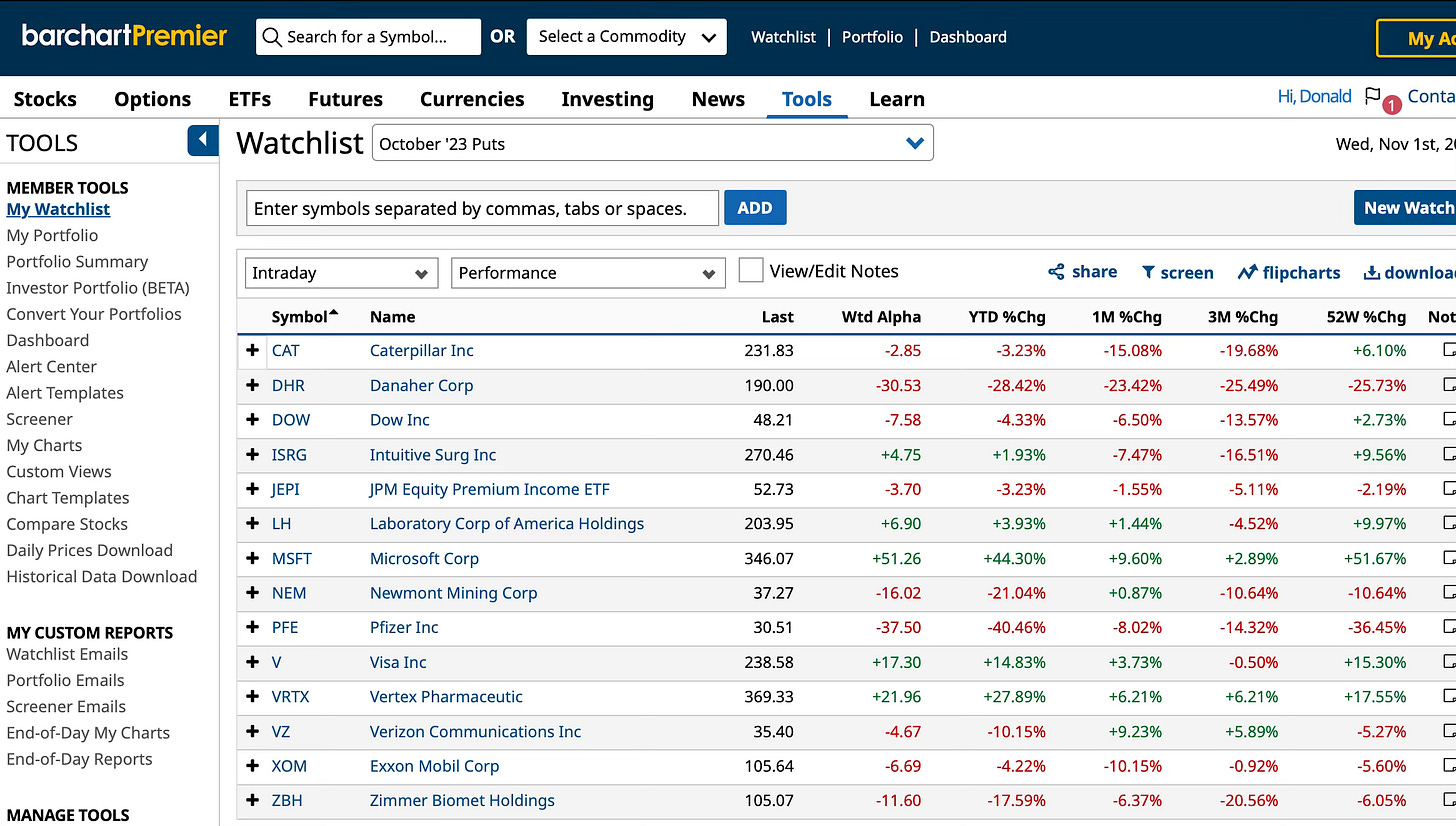

This table shows how the October puts stocks performed in October. VZ was up 9.23%. Microsoft Corp (MSFT) was up 9.6%. Vertex Pharmaceutical (VRTX) gained 6.21%. Visa (V) rose 3.79%, Laboratory Corp of America (LH) rose 1.44% and Newmont Mining Corp. (NEM) rose 0.87%.

Danaher Corp. (DHR) lost 23.42% after spinning off Veralto Corp (VLTO). Both stocks dropped after the spin off.

Caterpillar (CAT) fell 15.08%, Exxon Mobil (XOM) fell 10.15%, PFE fell 8.02%, Intuitive Surgical Inc. (ISRG) fell 7.475, DOW fell 6.5%, Zimmer Biomet Holdings (ZBH) fell 6.37% and JEPI was off 1.55%.

There were no realized gains or losses on these trades during October.

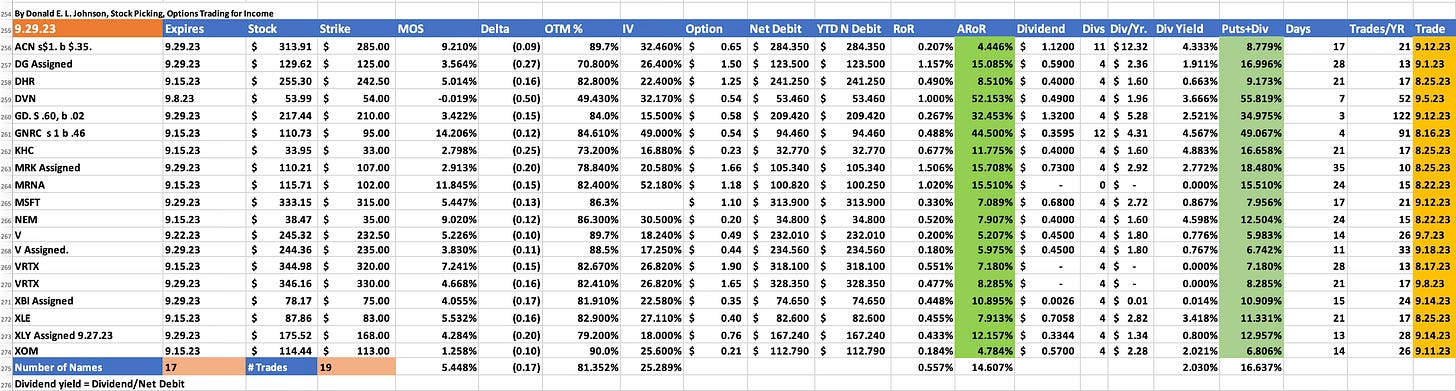

In September the ARoR was 14.607% on 19 trades that involved 3 exchange traded funds and 16 stocks.

I respond to comments on the comments section where readers’ comments are posted. That is, if you have a question about this article or other comments, I'll discuss your questions with you in the comments section below this article.

Thanks for reading Stock Picking, Options Trading for Income! Subscribe for free to receive new posts and support my work.

LINKs:

Home Page. See my more than 150 articles on options trading, stock picking and watch lists. If you read several of these articles, you’ll learn how my strategies are meant to work. No guarantees. Links to useful web sites are on the lower right corner of the home page. Scroll down.

Follow @RealDonJohnson on twitter.com and FaceBook.com. Or follow me on Substack.com/Notes where my byline is my handle.

10 November 2023 Covered Calls Trades Update #1

20 November 2023 Cash Secured Puts Trades Update #2

7 November 2023 Covered Calls Trades Are Yielding 13.3%

10 November 2023 Cash Secured Puts Trades Update #1

5 November 2O23 Cash Secured Puts Options Trades

27 October 23 Covered Calls Options Trades Update #1

16 October 2023 Puts Options Trades Update #

How To Turn An Over Valued Stock Into A Covered Calls And Puts Premiums Winner

8 October 2023 Covered Calls Trades Yield 24.3% Annualized Returns On Risk

10 October 2023 Puts Options Trades

Selling in The Money Covered Calls Can Yield Big Annual Returns on Risk. By Donald E. L. Johnson

How to Beat Inflation Tax, Bear Market Tax With Dividend Stocks, Covered Calls, Cash Secured Puts, by Donald E. L. Johnson.

How I Analyze Bullish Puts Options Trades With Stock Rover, By Donald E. L. Johnson.

Wars Breed Inflation, Rising Interest Rates, Market Turmoil, By Donald E. L. Johnson.

Calls vs Puts Options: What’s the Difference?

A video on how to place options trades on TDAmeritrade.com’s Think or Swim trading platform.