How I'm Trading Amazon Covered Calls, Cash Secured Puts Stock Options For Options Premium Income

Small and large dividend stock and ETF investors can use covered calls and puts trades to generate monthly income from options premiums and options trading.

Amazon is a strong, well managed and growing conglomerate.

Amazon’s stock is looking over bought, but the way investors are buying the stock, it has great bullish momentum.

My AMZN calls look like they’ll be exercised today.

I’m selling AMZN puts.

Amazon.com Inc. (AMZN) closed Thursday at $138.07 per share. If AMZN closes above $137 today, my AMZN 11.3.23 expiration $137 strike calls will be called.

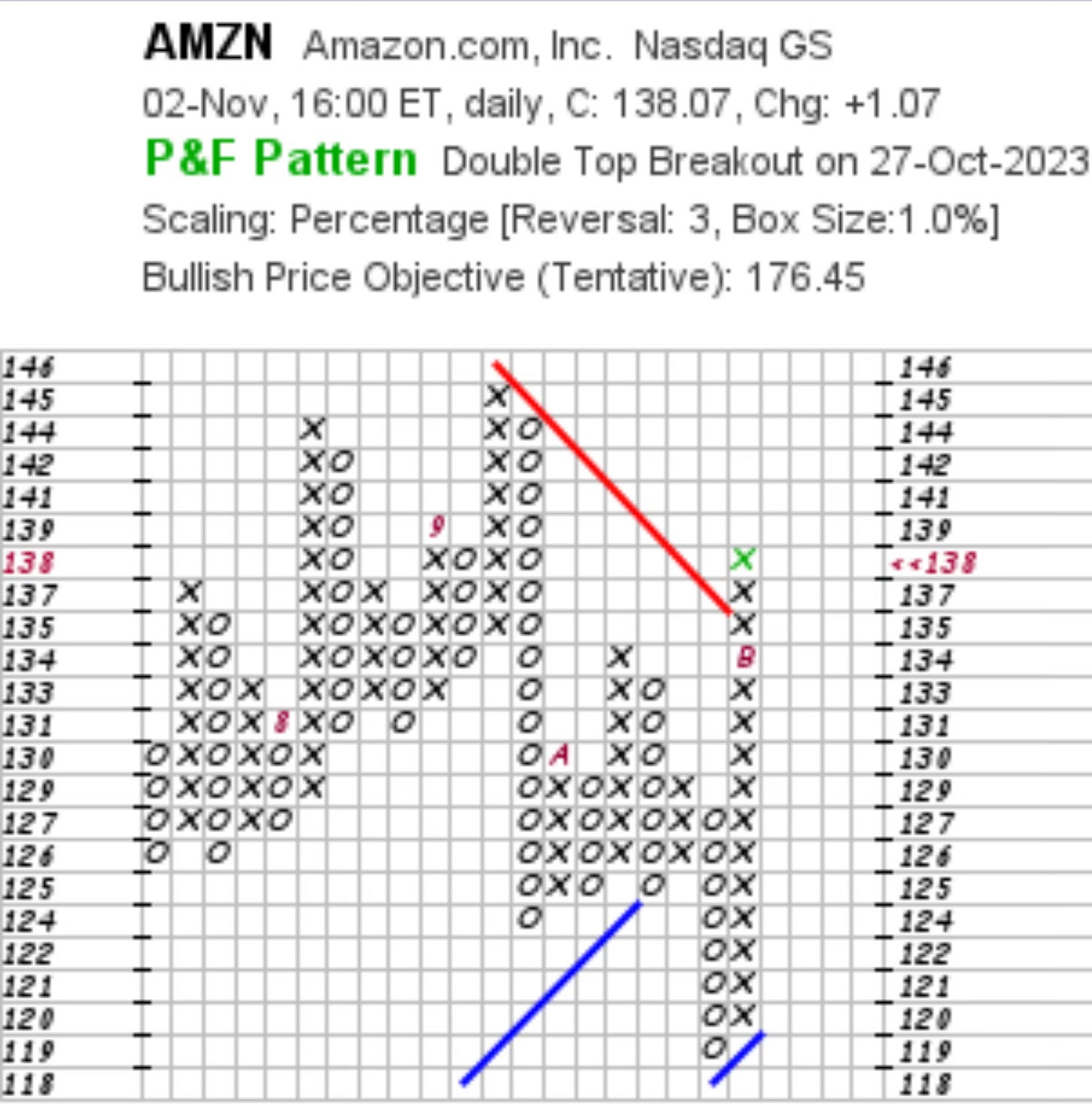

AMZN’s point figure chart price objective is $176.43 on StockCharts.com. Point & Figure charts are used by some investors to time their purchases and sales of stocks and exchange traded fund. This is because PnF charts do an excellent job of showing market sentiment about an equity.

AMZN looks over valued but its bullish momentum is strong, and its relative strength is a bullish 67.4. A RSI over 60 is a buy signal. That is because investors know that it is a well managed, growing conglomerate deep into artificial intelligence technology, cloud technology, retail and e-commerce businesses and the transportation and last mile home delivery businesses. We get a lot of their card board.

Since September 9, I’ve sold weekly AMZN covered calls six times. I bought AMZN for $136.16 a share. After collecting puts and calls options premiums, the cumulative net debit is $130.69 per share, or $13,069 per 100-share options contract.

The annual return on risk on these trades averaged 25.13%. ARoR ranged from 10.72% on the 10.6.23 expiration trade to 69.52% on the AMZN 9.29.23 10-day trade’s 61.92% ARoR. The ARoR calculation assumes that someone is disciplined enough to do basically the same kind of trade every week or month for the next 12 months. I’ve never done the same kind of individual trades with the same results repeatedly over 12 months but my portfolio returns are fairly consistent because I do a lot of small, diversified puts and calls trades.

On these AMZN trades, the deltas, which suggest the probability that a covered call will be called have averaged .21. They ranged from .14 to .47, or 14% to 47% probabilities. Out of the money probabilities averaged a 80.6%. They ranged from 54.6% to 87.2%.

Implied volatilities on AMZN covered calls trades averaged 40%. They ranged from 31.4% to 84.9%. High volatilities indicate that the risk of having a covered call exercised is high. In these trades, I was hoping the stock would be called and give me a short term gain. That is what is likely to happened today. If AMZN is called today, I’ll make a 0.62% short term taxable gain. If I could do that trade 52 times in the next 52 weeks, my ARoR would be 52 times 0.62%, or 32.2%.

On Oct. 31, I sold AMZN 11.17.23 $120 strike puts for $1.78 a share, or a 1.34% RoR. If I did trades like that 32-day trade 11 times a year, the ARoR would be about 15.3%. With AMZN at $132.87 when I sold those puts, the probability that they would expire out of the money and not be exercised was about 78.58%. With AMZN at $138.87 at Thursday’s close, the OTM probability is about 96%.

Today, I sold AMZN 11.17.23 delta .12 $130 strike puts for about a 9% ARoR. If I was more interested in buying AMZN and in getting a higher RoR, I could sell AMZN 11.17.23 delta .26 $134 strike puts for about a 22% ARoR.

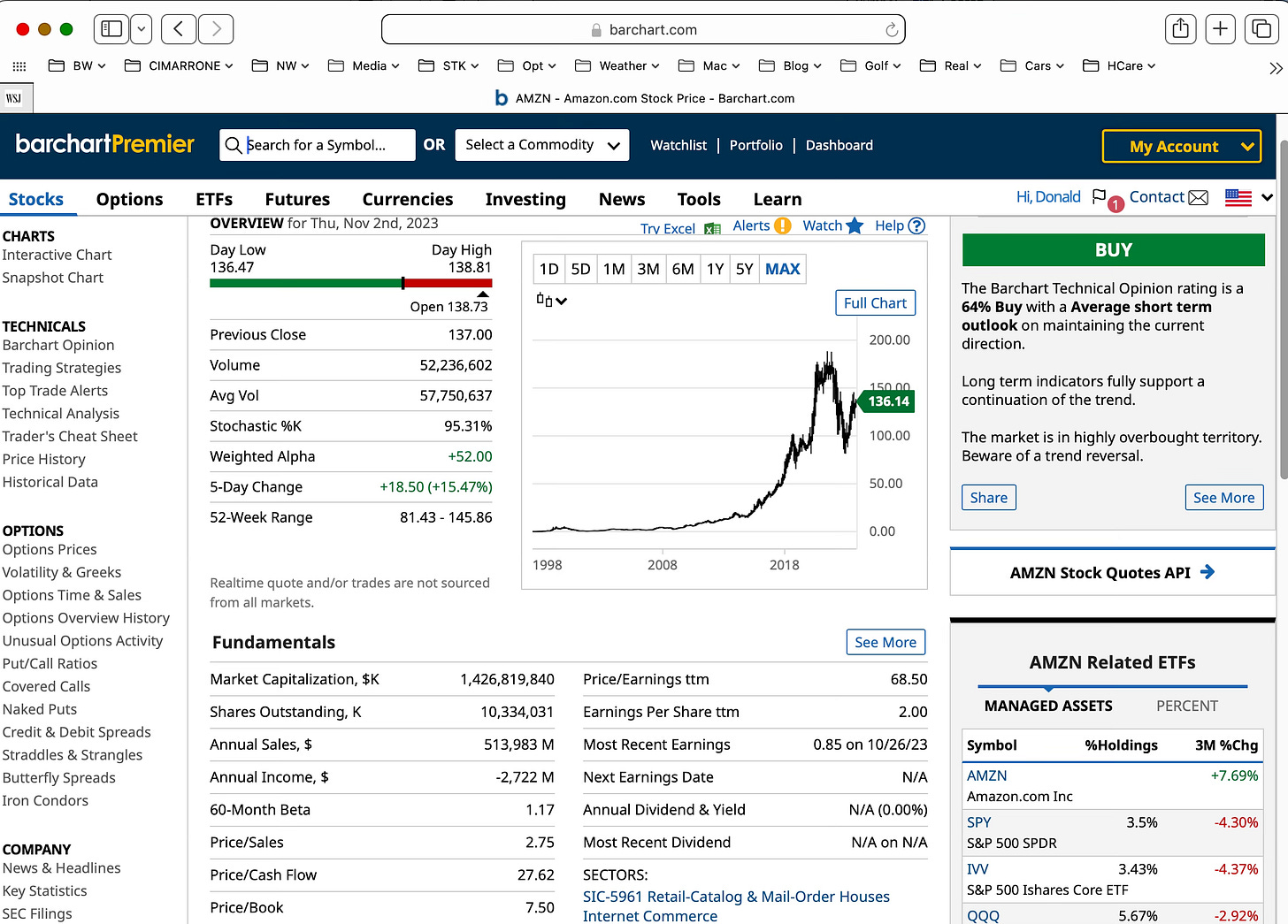

AMZN is trading above its 50-day moving average of $132.37 and its 200-day moving average of $118.37.

One reason I sold AMZN puts at the $130 strike is I’m not ready to buy AMZN at a higher price.

Valuentum.com’s fair value estimate on AMZN is $100. In other words, Valuentum’s discounted cash flow calculator is saying AMZN is over bought. Morningstar.com’s three star rating suggests that AMZN is fairly valued with a FVE of $155. Different discount rates, cost of capital and free cash flow growth expectations and other assumptions account for the differences in the fair value estimates.

Barchart.com tracks 13 charts and other technical indicators on stocks and ETFs. At the moment, 64% of those indicators are saying AMZN is a buy.

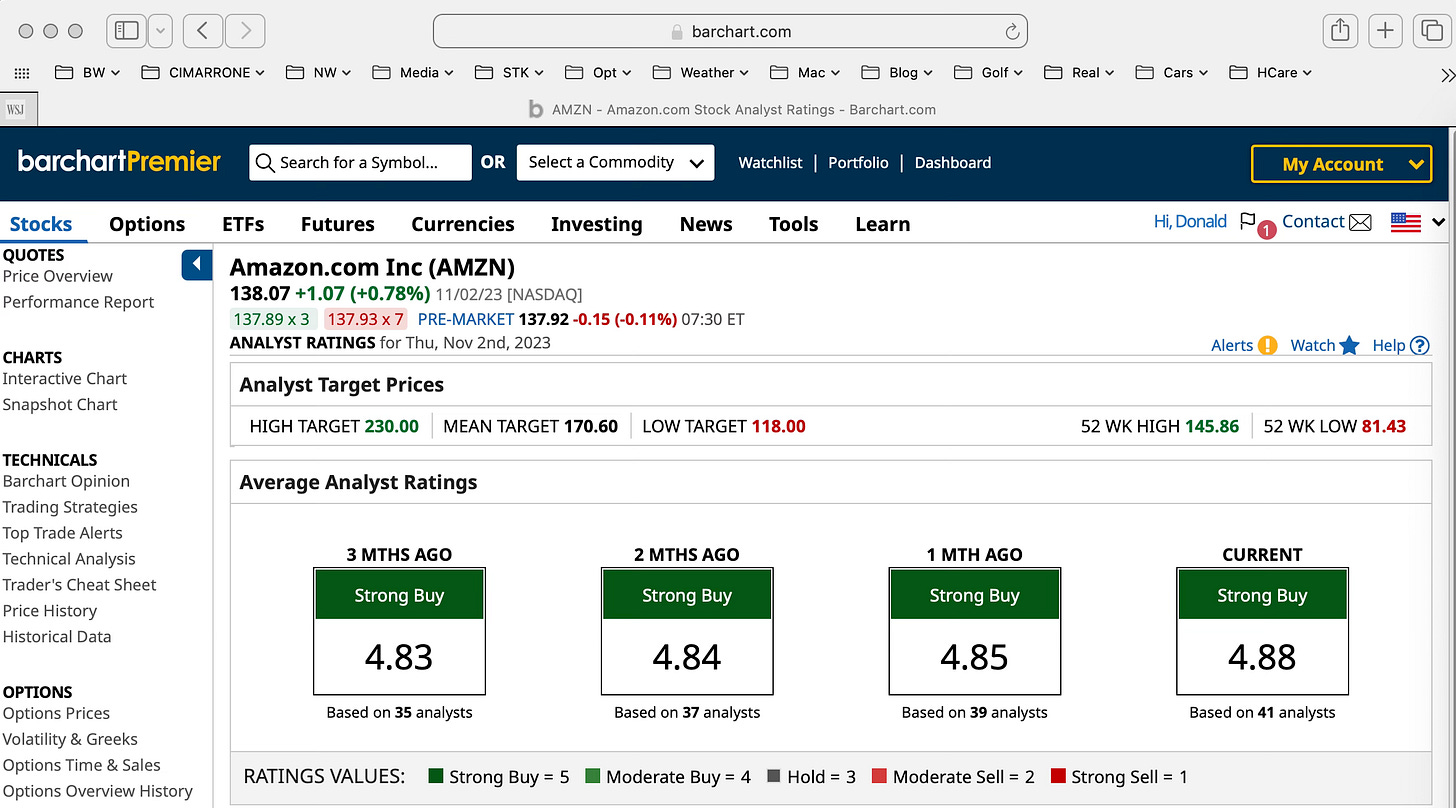

AMZN is followed by 41 Wall Street sell side analysts. They rate AMZN Strong buy. The most bullish analyst has a $230 target price. The mean, or average target price is $170. The low target is $118.

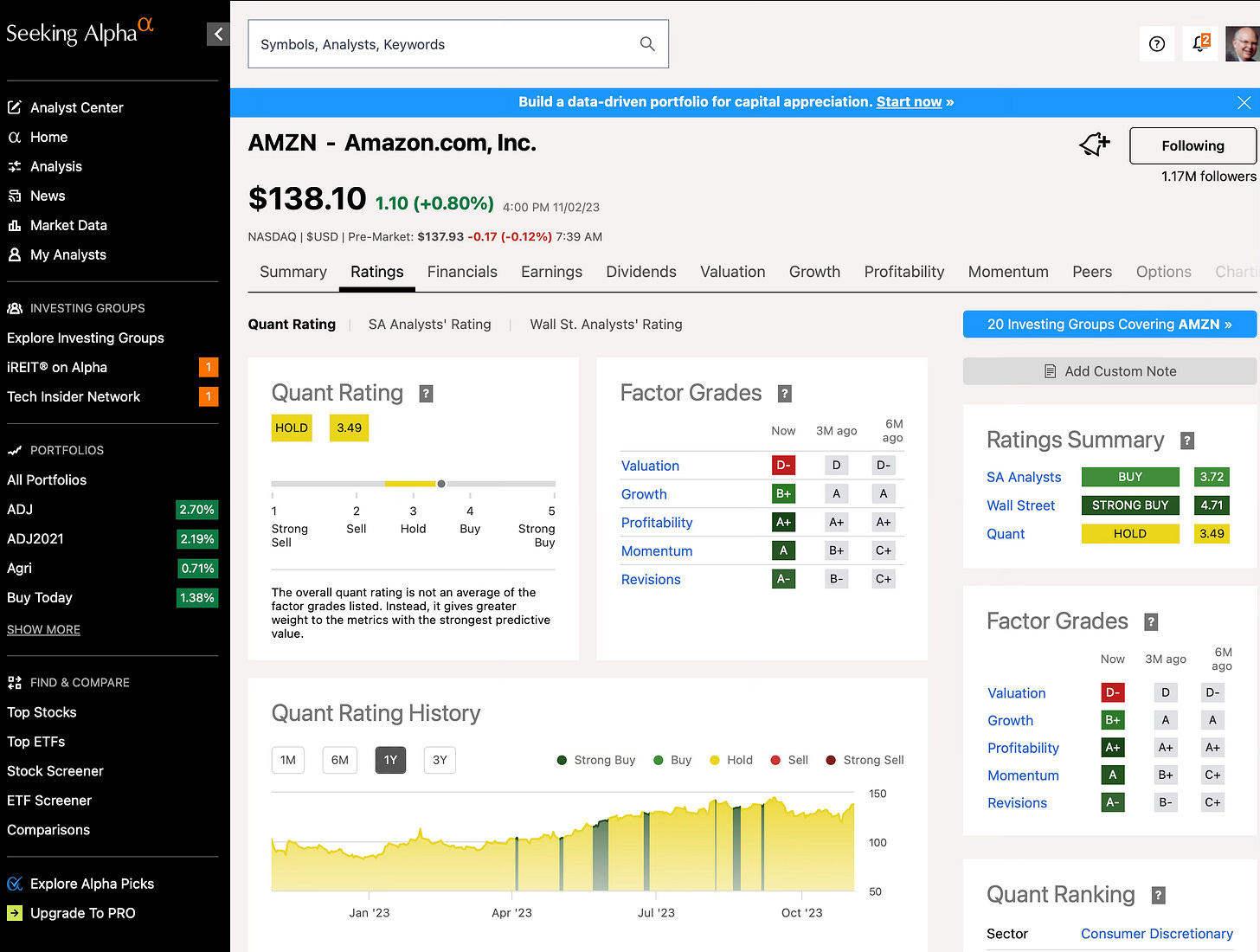

AMZN has 1.17 million followers on SeekingAlpha.com. That’s a big herd. SA analysts are less bullish on AMZN than Wall Street’s analysts. The quant rating on AMZN is a hold and the average valuation rating is a D-.

SA has several bullish articles on AMZN.

I respond to comments on the comments section where readers’ comments are posted. That is, if you have a question about this article or other comments, I'll discuss your questions with you in the comments section below this article.

Thanks for reading Stock Picking, Options Trading for Income! Subscribe for free to receive new posts and support my work.

LINKs:

Home Page. See my more than 150 articles on options trading, stock picking and watch lists. If you read several of these articles, you’ll learn how my strategies are meant to work. No guarantees. Links to useful web sites are on the lower right corner of the home page. Scroll down.

Follow @RealDonJohnson on twitter.com and FaceBook.com. Or follow me on Substack.com/Notes where my byline is my handle.

32 October 2023 Covered Calls Trades Update #2

October 2023 Cash Secured Puts Trades Update #2

10 November 2023 Covered Calls Trades Update #1

20 November 2023 Cash Secured Puts Trades Update #2

7 November 2023 Covered Calls Trades Are Yielding 13.3%

10 November 2023 Cash Secured Puts Trades Update #1

5 November 2O23 Cash Secured Puts Options Trades

27 October 23 Covered Calls Options Trades Update #1

16 October 2023 Puts Options Trades Update #

How To Turn An Over Valued Stock Into A Covered Calls And Puts Premiums Winner

8 October 2023 Covered Calls Trades Yield 24.3% Annualized Returns On Risk

10 October 2023 Puts Options Trades

Selling in The Money Covered Calls Can Yield Big Annual Returns on Risk. By Donald E. L. Johnson

How to Beat Inflation Tax, Bear Market Tax With Dividend Stocks, Covered Calls, Cash Secured Puts, by Donald E. L. Johnson.

How I Analyze Bullish Puts Options Trades With Stock Rover, By Donald E. L. Johnson.

Wars Breed Inflation, Rising Interest Rates, Market Turmoil, By Donald E. L. Johnson.

Calls vs Puts Options: What’s the Difference?

A video on how to place options trades on TDAmeritrade.com’s Think or Swim trading platform.