5 Low Priced Stocks' January Covered Calls Options Trades Yield 24.5%, Could Gain 24.8%

Small and large dividend stock and ETF investors can use covered calls and puts trades to generate monthly income from options premiums and options trading

By Donald E. L. Johnson

Cautious Speculator

Covered calls investors should try to trade calls on at least five stocks every month.

The more equities in a month’s stock or stock options portfolio the more likely an investor is likely to make money on the month’s options trades even though one or two trades may not work out.

Investors who don’t want to invest in high priced stocks can trade covered calls on several low priced stocks. Just because a stock has a low price doesn’t mean it is cheap.

The five covered calls trades on this month’s watch list have the potential to attain annualized options premiums returns of 24.5% plus another 24.8% ARoR in capital gains if all of the stocks are called. In addition, their averaged dividend yields are 4.23%.

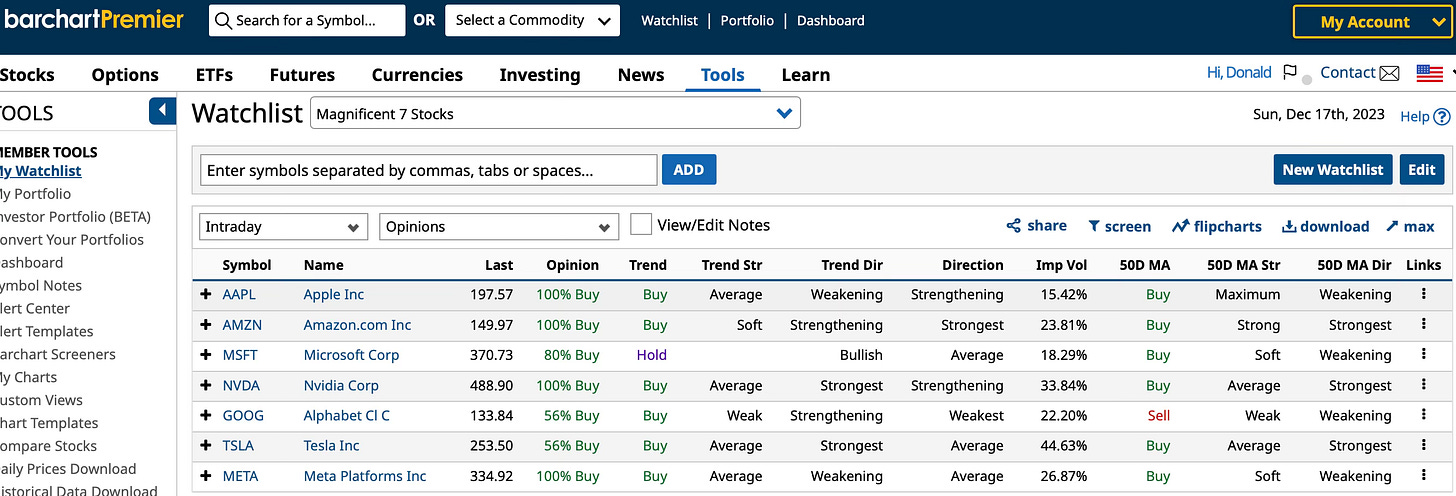

A lot of stocks are over bought and still have room to run higher with the “Magnificent Seven” market leaders, but they could correct at any time for any reason.

Most high dividend yielding stocks still are pretty depressed with an average price to free cash flow ratio of about 15.2 compared with the Dow Jones 30 Industrials’ average P/FCF ratio of about 21.3. Not all low priced stocks are “cheap” and not all high priced stocks are “expensive.”

The problem with the Magnificent Seven and a lot of other stocks is that they are so high priced that few traders of covered calls and cash secured puts stock options have the liquid assets needed to build a large, diversified options portfolio of high priced stocks. Trading one covered calls option on a $500 per share stock requires a $50,000 investment. Ten $50,000 investments in covered calls trades a month would cost $500,000. Of course, the AROR could range from a 10% or more loss to 20% or more profit, give or take.

When a dividend stock investor buys 100 shares of a $100 per share stock or exchange traded fund the trader he has to invest $10,000 to buy a stock and sell one covered call stock option or one naked puts option contract. If the investor buys a $20 per share stock, 100 shares cost $2,000 per covered calls options contract.

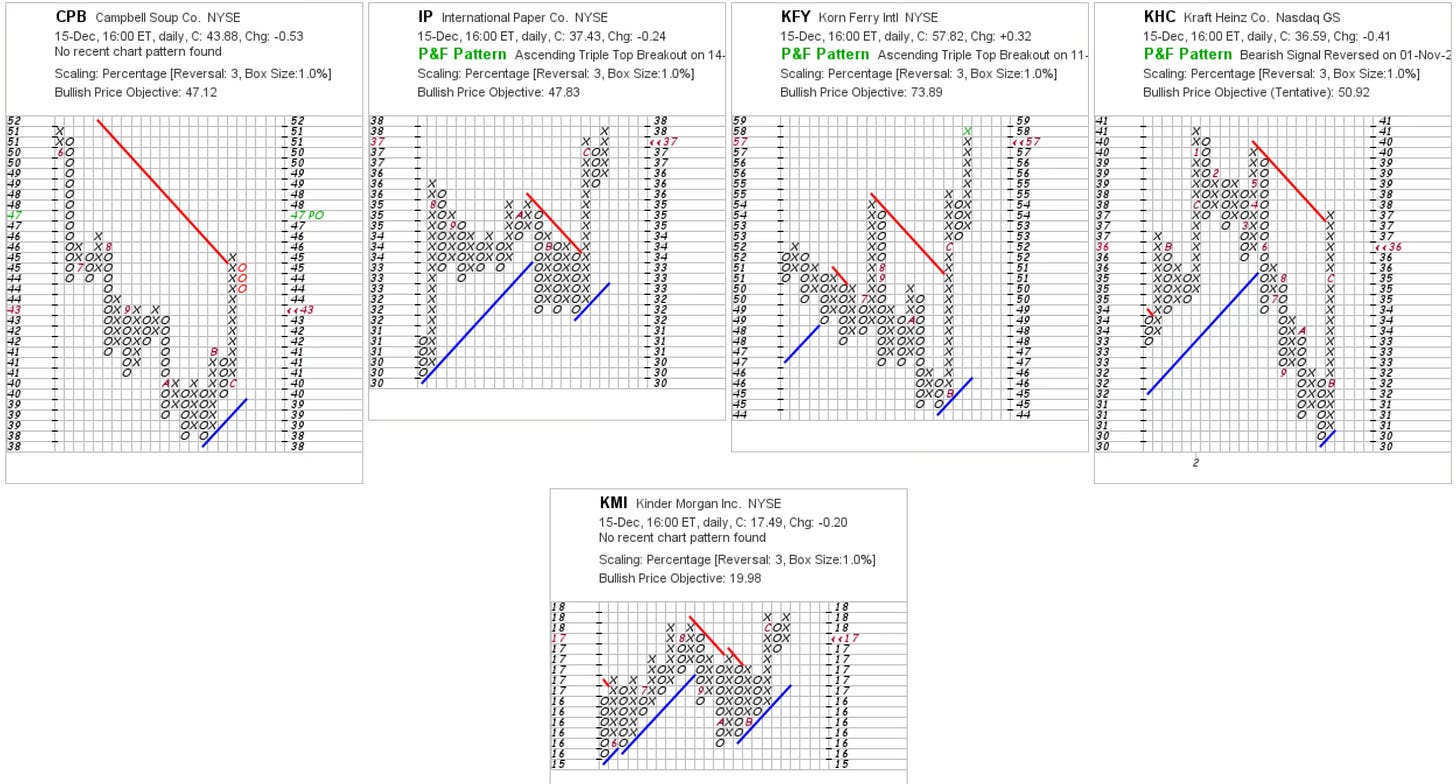

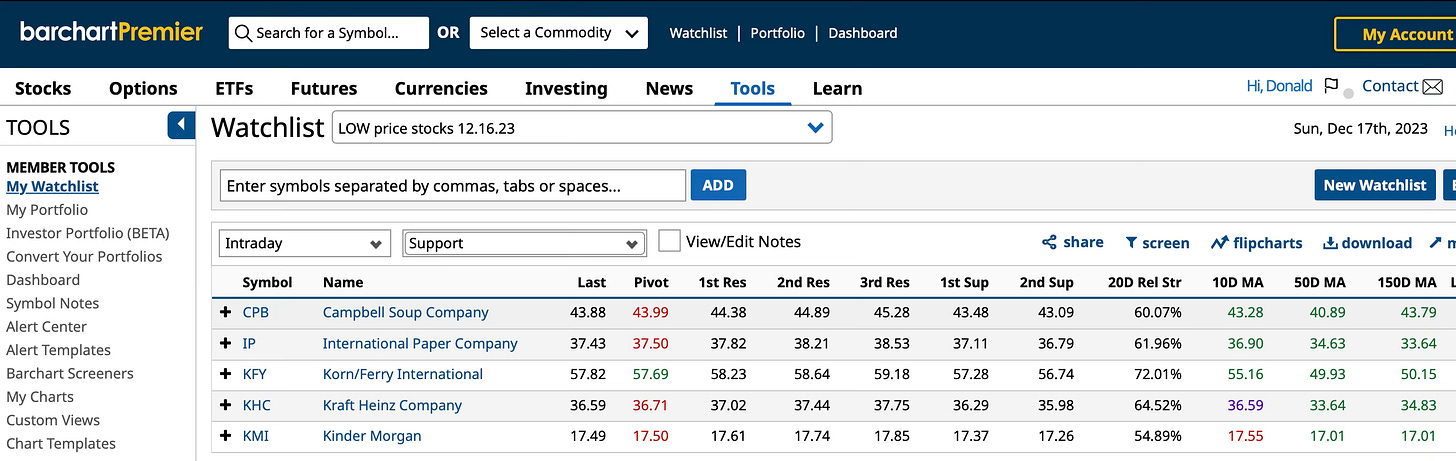

An investor who wants to diversify by trading covered calls on at least five stocks a month could consider Campbell Soup (CPB), International Paper (IP), Korn/Ferry International (KFY), Kraft Heinze Co. (KHC) or Kinder Morgan (KMI).

Combined, a 100 shares of each of the five stocks would cost about $19,321. The net debit after collecting call options premiums and dividends that go ex-dividend between now and January 19 would be about $18,858.

The stocks deltas (column I) are relatively high because the trades I would do are designed to give relatively high returns on risk. If a stock option’s delta is .50, there probably is a 50% chance the the stock will be called. If the out of the money probability is 51.6%, that is the probability that the stock won’t be called. Deltas and OTM probabilities change as stock prices change and they can be wrong.

To get higher returns, trade higher deltas and lower OTM probabilities. To get higher returns, you have to take higher risks that a stock will be called or will go down after you buy it and before it can be called.

The risk for some investors is that some of the stocks will close above their strike prices on Jan. 19 when the call options expire.

A lot of traders do at slightly in the money trades because they want the calls to be exercised. I was happy to have a lot of my covered calls trades last week called. A couple of stocks that were called were under water and I wasn’t ready to sell them. But by the time the covered calls options on the in the money stocks expired, their prices were so high above my strike prices that I let them go and will move on.

If all the calls in this watch list are called on Jan. 19, the call options cash return would be about $463 ($5,556 annualized) and the short-term gains would be about $379 ($4,543 annualized). The $10,104 annualized returns would be about a 52% AROR on the $19,321 investment. Trust me, that’s not likely to happen, but you can hope.

Most likely some of the trades will be called and some won’t.

Another risk is that some of the stocks could close on Jan. 19 well above the strike prices and some could close well below the stock’s purchase and net debit prices.

These risks sometimes can be managed by buying the calls back before they expire at small profits or losses, depending on what the stocks do between when they were called and when the covered calls options expire.

Trading five or more stocks diversifies risks and usually gives the investor a monthly profit even if one or two trades don’t work out as planned.

So far in December, I’ve had 11 stocks called and one puts trade exercised. I’ll discuss those trade in my next posts.

Bullish price objectives on the five stocks’ point and figure charts is about 25% higher than the stocks’ current prices, according to StockCharts.com.

Morningstar.com’s discounted cash flow fair value estimates on the stocks are bullish on CPB, KHC and KMI. They’re lower on IP and KFY. Near term, all of the stocks look bearish, but Morningstar’s bearish FVE numbers may be correct longer term. Nobody can predict stock prices or interest rates with high degrees of confidence. So we have to manage our risks by taking small losses and letting profits run, which is easier to say than to do.

The potential 32-day gain on the five stocks averages 1.93%, or 21.28% annualized if the same kinds of results can be realized over 12 months.

On Barchart.com, all five stocks are looking bullish. The buy ratings range from CPB’s 8% buy to IP’s 88% buy. Only IP is close to being over bought with an 88% buy rating and a relatively strength index rating of 64.58. A rating over 60 is a strong buy and a ratio over 70 is overbought while under 30 is over sold.

Except for KFY, all of these stocks are fairly actively traded. Some investors will avoid KFY because its volume is close to nil. Other investors will go for the potential 39.45% ARoR on the covered calls and a potential 43% annualized gain on KFY on the 32 trade.

The support, resistance and momentum data in this table can be used to pick the stocks and strike that work for you, if any do.

I own CPB and KMI. My KHC was called at a profit last week and I’ll probably sell puts on it.

Compare the high Buy ratings on the Magnificent Seven stocks with the Buy ratings on our five low price stocks. Stocks with 100% buy ratings are close to being over bought, if they aren’t already. A 50% buy rating is a hold to a moderate buy.

Income traders who sell covered calls and cash secured puts want RSI’s over 40 and below 70.

Final point: Instead of buying the stocks and selling covered calls, an income investor may sell cash secured puts. Others will sell covered calls and puts. And others will buy the stocks, collect the dividends and try to make profits on the stocks in longer term trades. I’ve owned KMI for years and CPB and KHC for most of this year.

I also would like to welcome all of the new subscribers who have joined us this year. Happy Holidays and Merry Christmas.

I respond to comments on the comments section where readers’ comments are posted. That is, if you have a question about this article or other comments, I'll discuss your questions with you in the comments section below this article.

LINKs:

Home Page. See my more than 190 articles on options trading, stock picking and watch lists. If you read several of these articles, you’ll learn how my strategies are meant to work. No guarantees. Links to useful web sites are on the lower right corner of the home page. Scroll down.

Follow @RealDonJohnson on twitter.com and FaceBook.com. Or follow me on Substack.com/Notes where my byline is my handle.

How I'm Trading AMZN, JEPI, CAT And DVN Covered Calls Stock Options That Expire In January.

How I'm Trading The Gold Rally With Newmont Covered Calls, Cash Secured Puts Stock Options

How To Pick 12 Good Stocks For 2024 Covered Calls, Cash Secured Puts Trades

15 December Covered Calls Trades Yielding 22.9% to 26.2%

12 Berkshire Hathaway Buys For Covered Calls Options Traders

20 November 2023 Covered Calls Trades Yielding 13.3% to15.9% Update #2

AMZN, META, MSFT And NVDA Posted Big Gains. November Puts Trades Update #4

5 Bullish Stocks For Covered Calls, Puts Stock Options Trades

How I'm Trading Amazon Covered Calls, Cash Secured Puts Stock Options For Options Premium Income

9 December 2023 Cash Secured Puts Stock Options Trades Yield 15.6%

22 November 2023 Covered Calls Trades Yield 12.9% to 15.3%

31 November 2023 Cash Secured Puts Trades Yield 10.3% Update #5

25 November 2023 Cash Secured Puts Trades Update #3

20 November 2023 Cash Secured Puts Trades Update #2

10 November 2023 Cash Secured Puts Trades Update #1

5 November 2O23 Cash Secured Puts Options Trades

10 November 2023 Covered Calls Trades Update #1

7 November 2023 Covered Calls Trades Are Yielding 13.3%

Selling in The Money Covered Calls Can Yield Big Annual Returns on Risk. By Donald E. L. Johnson

How to Beat Inflation Tax, Bear Market Tax With Dividend Stocks, Covered Calls, Cash Secured Puts, by Donald E. L. Johnson.

How I Analyze Bullish Puts Options Trades With Stock Rover, By Donald E. L. Johnson.

Wars Breed Inflation, Rising Interest Rates, Market Turmoil, By Donald E. L. Johnson.

Calls vs Puts Options: What’s the Difference?

A video on how to place options trades on TDAmeritrade.com’s Think or Swim trading platform.

Beware. Like all investing, trading stocks and options is risky. I’m an active private speculator who trades covered calls and sells puts on stocks for my accounts. I am not a professional analyst nor a financial advisor. I don't take and won't take responsibility for how other people trade. This article is for educational purposes only. It is not advice. The data presented looked accurate at publication time except for intra-day fluctuations, but I can’t guarantee the accuracy. Traders should do their due diligence. I reserve the right to trade any of the listed stocks and options at any time. I receive no compensation for producing this content nor for any links.

1 Like

·