9 December 2023 Cash Secured Puts Stock Options Trades Yield 15.6%

Small and large dividend stock and ETF investors can use covered calls and puts trades to generate monthly income from options premiums and options trading.

By Donald E. L. Johnson

Cautious Speculator

Low volatility on most of the best stocks makes finding good cash secured puts trades difficult.

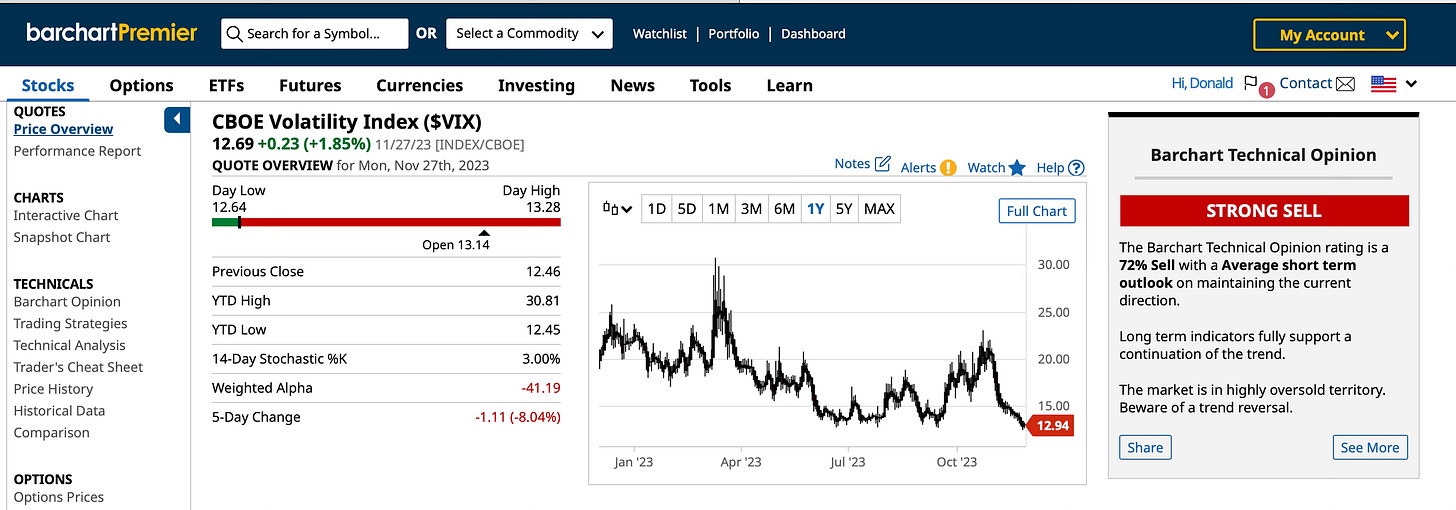

Nine puts trades on six stocks are producing about 15.6% annualized returns.

Led by the moderately high implied volatility of AMD, the nine trades average IV was 30.4% when the trades were filled.

The December naked puts options trades also involve KMI, META, NEM, PANW and PFE.

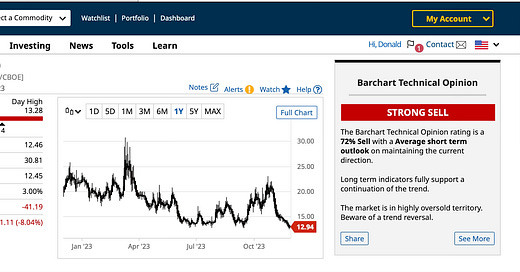

The CBOE Volatility Index ($VIX) Monday slipped to 12.94 from an early November high of almost 22 as a result of the rally in stocks this month.

A low VIX signals that puts and calls options on stocks in the S&P 500 are cheap. That makes it hard for sellers of naked puts and covered call to get good prices when they sell those options.

The initial nine trades on six stocks are producing options premium income that averages 0.808% in RoR, or 15.586% annualized. AROR assumes that every month during the next 12 months, the RoR will be about the same as December’s estimated returns. November’s 31 trades on 18 stocks produced an average ARoR of about 10.255%. Returns vary month to month depending on volatility, stock and options prices and how good your luck is.

I’ve done three December expiration puts trades on Advanced Micro Devices (AMD). It closed Monday at $122.65.

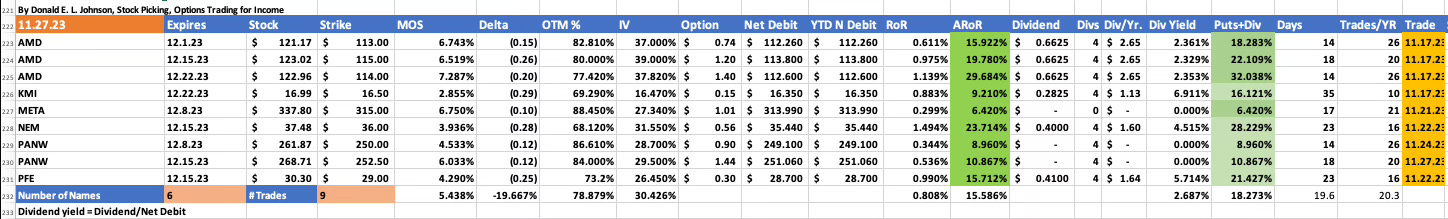

AMD’s bullish point and figure chart price objective on StockCharts.com is $146.47. AMD is a 72% buy on Barchart.com. Morningstar.com rates AMD three stars and its fair value estimate on the stock is $125.

Valuentum.com’s discounted cash flow calculator produces a FVE of $110 per share. AMD’s implied volatility was a relatively high 37% to 39% when I did the trades. The first of three AMD puts trades expires on 12.1.23. Different assumptions and discount rates produce different fair value estimates. Higher volatility puts and calls options trades can be riskier than lower ones depending on the strikes used in the trades.

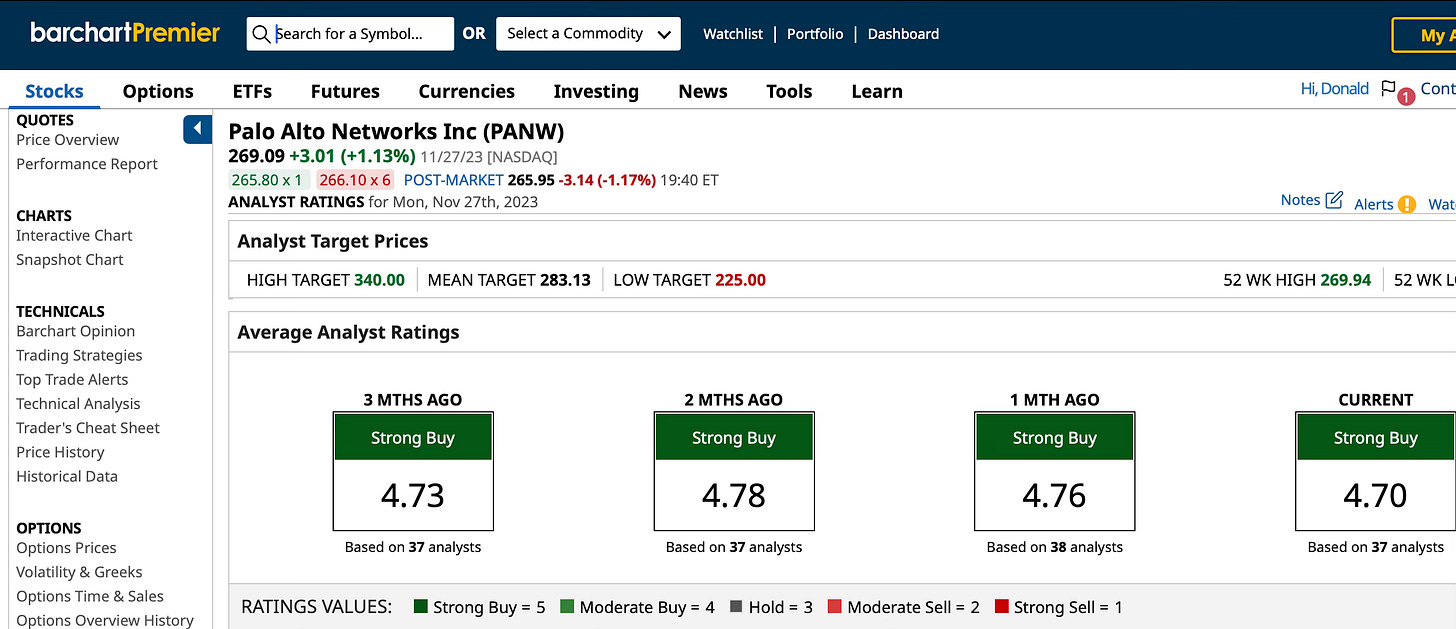

Of the six stocks in the December expiration portfolio, Palo Alto Networks Inc. (PANW) was the only newcomer. I sold 12.8.23 and 12.15.23 expiration puts with $250 and $252 per share strikes. By selling different expiration dates and strike prices, I diversified my options portfolio a bit.

The two PANW trades’ implied volatility was 28.7% to 29.5%. The returns on risk were 0.344% and 0.536%, or 8.96% and 10.867% annualized. Their margins of safety were 4.533% and 6.093%. PANW closed Monday at $269.09.

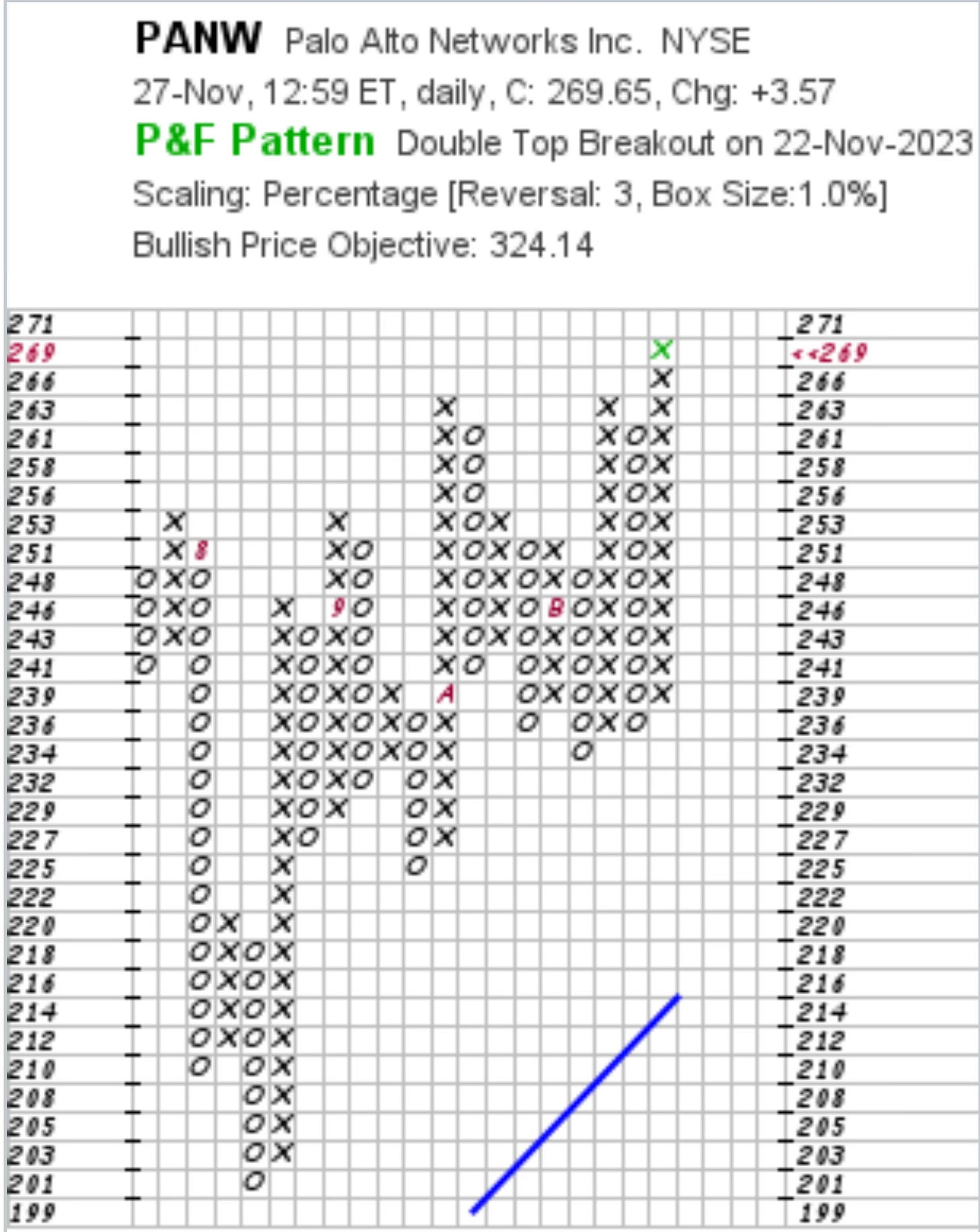

PANW’s bullish point and figure price objective is $324.14.

Four other stocks in the December list include Kinder Morgan (KMI), Meta Platforms Inc. (META), Newmont Mining Corp. (NEM) and Pfizer Inc. (PFE), which I discussed in the previous post. I’ve owned the dividend stocks KMI, NEM and PFE for a long time. META was a new speculative puts trade in November.

I respond to comments on the comments section where readers’ comments are posted. That is, if you have a question about this article or other comments, I'll discuss your questions with you in the comments section below this article.

LINKs:

Home Page. See my more than 190 articles on options trading, stock picking and watch lists. If you read several of these articles, you’ll learn how my strategies are meant to work. No guarantees. Links to useful web sites are on the lower right corner of the home page. Scroll down.

Follow @RealDonJohnson on twitter.com and FaceBook.com. Or follow me on Substack.com/Notes where my byline is my handle.

How To Pick 12 Good Stocks For 2024 Covered Calls, Cash Secured Puts Trades

15 December Covered Calls Trades Yielding 22.9% to 26.2%

12 Berkshire Hathaway Buys For Covered Calls Options Traders

20 November 2023 Covered Calls Trades Yielding 13.3% to15.9% Update #2

AMZN, META, MSFT And NVDA Posted Big Gains. November Puts Trades Update #4

5 Bullish Stocks For Covered Calls, Puts Stock Options Trades

How I'm Trading Amazon Covered Calls, Cash Secured Puts Stock Options For Options Premium Income

22 November 2023 Covered Calls Trades Yield 12.9% to 15.3%

31 November 2023 Cash Secured Puts Trades Yield 10.3% Update #5

25 November 2023 Cash Secured Puts Trades Update #3

20 November 2023 Cash Secured Puts Trades Update #2

10 November 2023 Cash Secured Puts Trades Update #1

5 November 2O23 Cash Secured Puts Options Trades

10 November 2023 Covered Calls Trades Update #1

7 November 2023 Covered Calls Trades Are Yielding 13.3%

Selling in The Money Covered Calls Can Yield Big Annual Returns on Risk. By Donald E. L. Johnson

How to Beat Inflation Tax, Bear Market Tax With Dividend Stocks, Covered Calls, Cash Secured Puts, by Donald E. L. Johnson.

How I Analyze Bullish Puts Options Trades With Stock Rover, By Donald E. L. Johnson.

Wars Breed Inflation, Rising Interest Rates, Market Turmoil, By Donald E. L. Johnson.

Calls vs Puts Options: What’s the Difference?

A video on how to place options trades on TDAmeritrade.com’s Think or Swim trading platform.