By Donald E. L. Johnson

Cautious Speculator

Traders of covered calls and puts can turn a bad ISRG trade into a winner.

The goal is to have the stock called with a small gain and good options premium income.

If the stock can’t be called with a gain, the goal is to collect enough covered calls and puts options premiums to put the net debit below the stock’s price when it is sold.

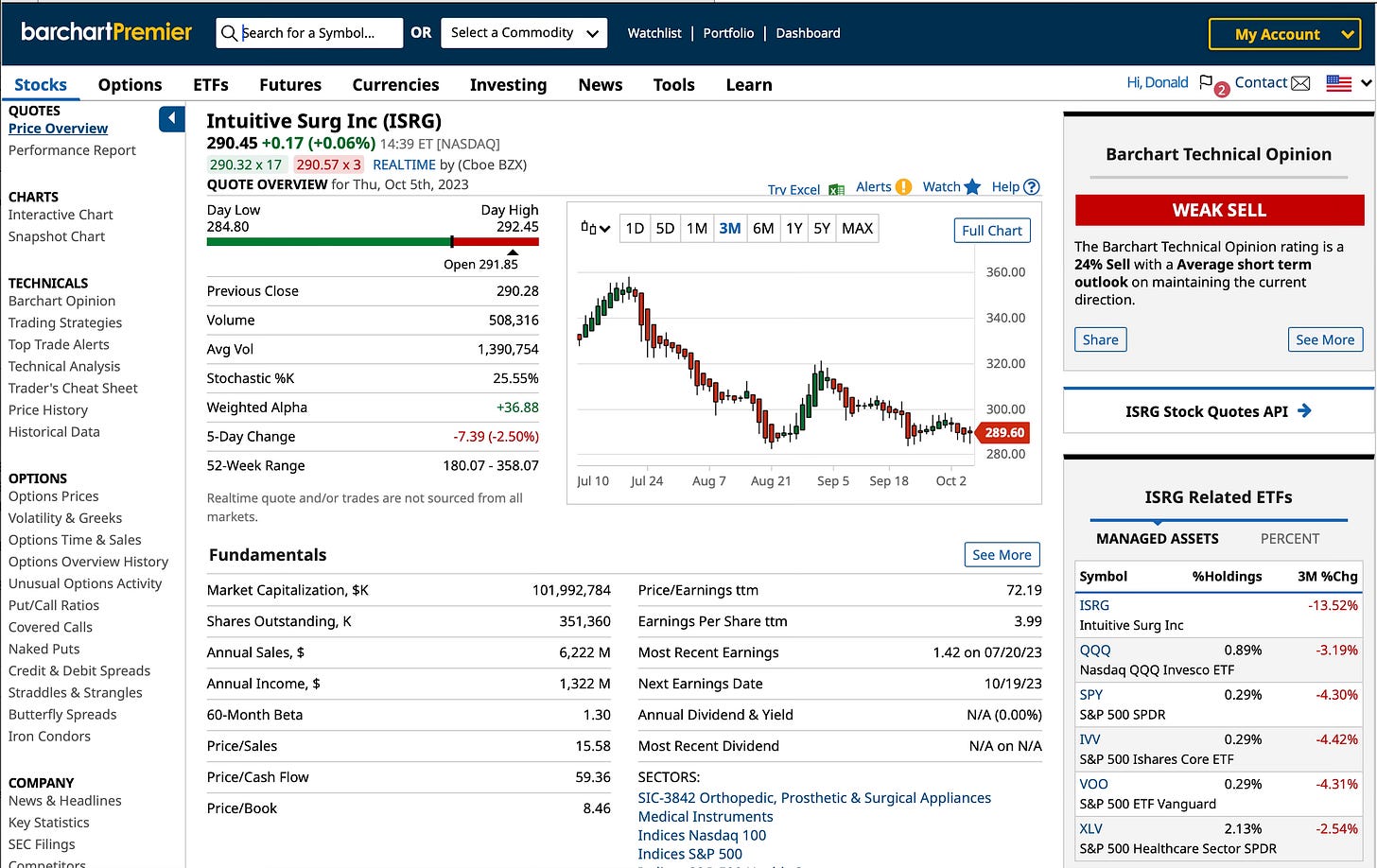

Intuitive Surgical is over valued with a very high price to free cash flow and PE ratios.

If income and dividend stock investors bought Intuitive Surgical Inc. (ISRG) at $305 in August, they’re looking at a $290.75 price at the moment.

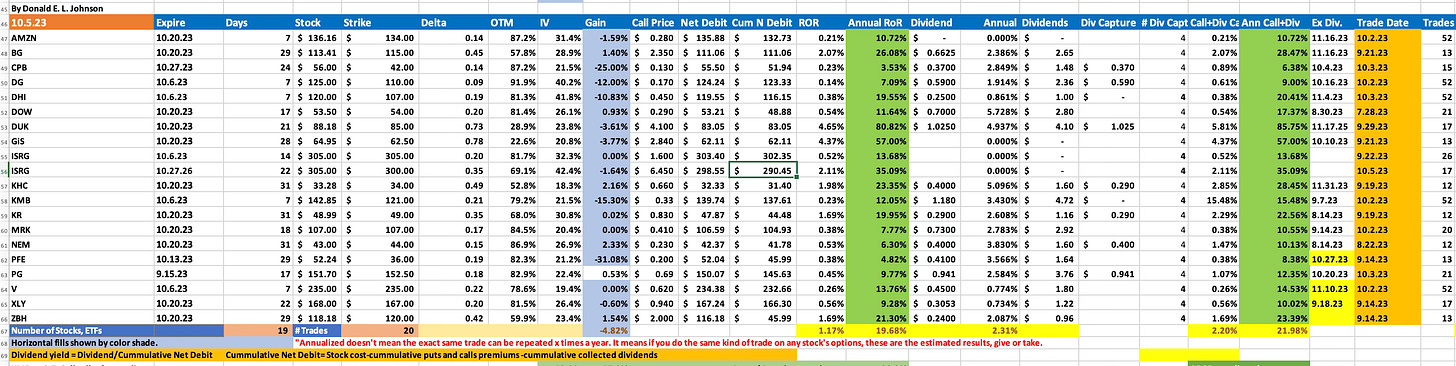

That is where I am, and my spreadsheet shows where ISRG is in my October covered calls watch list.

Here is what I’m doing to turn a bad trade into an income winner with a potential net gain even though I might sell the stock at $300 if it is called. If I wasn’t trading ISRG covered calls and cash secured puts, selling at $305 would leave me with a $5 per share loss.

But since I bought ISRG, I’ve sold covered calls on it for a total of $11.85 per share in options premiums. At the same time I’ve sold cash secured puts on ISRG for $2.85 in options premiums. $305-11.85-2,85 puts my net debit at $290.45 per share, or a 4.8% unrealized loss. I can keep selling weekly and monthly ISRG covered calls and puts for a long time until my net debit is below the stock price. At the moment, I’m almost at break even on the trade.

Today, when ISRG was $287.75. I sold ISRG 10.27.23 $300 covered calls for $6.50 per share, or $650 per 100-share contract. If I get lucky and short covering takes ISRG back to above $300 per share a the close of trading on 10.27.23, I’ll sell the stock for $300 plus the $6,50 call premium, or $306.50. That would give me a $1.50 gain on the stock and a total of $14.50 per share, or $1,450 in options premium income in 70 days.

The annualized return on risk on today’s covered calls trade is about 35%. There is about a 35% chance (delta .35) that ISRG will be called.

Wall Street sell side analysts have mostly bullish target prices on ISRG. The highest target price is $400, the average mean is $364.44 and the low target price is $270.

On Barchart.com, Will Ashworth is bullish on ISRG and suggested selling ISRG 10.27.23 $265 puts for about $4.20. ISRG is at $290.545 and I’m trying to sell ISRG 10.27.23 $245 puts.

What attract investors to ISRG is that it has no debt and most of its revenues come from service contracts. ISRG’s customers’ cost of switching to emerging competitors like Johnson & Johnson (JNJ) and Medtronic Inc. (MDT) are very high.

However, analysts on Morningstar.com, Valuentum.com and SeekingAlpha.com are calling ISRG a hold, at best. Morningstar’s fair value estimate is $230 a share. Valuentum’s FVE estimate is $254. On SeekingAlpha.com, Tangerine Capital calls ISRG a hold because it is very over valued.

With a price to cash flow ratio of 56.1 and a price to free cash flow ratio of 88.9, ISRG is very over valued. Its PE ratio is a very high 73. In short, it appears that ISRG’s price has gotten ahead of itself while its China business may be at risk and its returns on invested capital continue to shrink.

I respond to comments on the comments section where readers’ comments are posted. That is, if you have a question about this article or other comments, I'll discuss your questions with you in the comments section below this article.

Thanks for reading Stock Picking, Options Trading for Income! Subscribe for free to receive new posts and support my work.

LINKs:

Home Page. See my more than 150 articles on options trading, stocks and watch lists. If you read several of these articles, you’ll learn how my strategies are meant to work. No guarantees. Links to useful web sites are on the lower right corner of the home page. Scroll down.

Follow @RealDonJohnson on twitter.com and FaceBook.com. Or follow me on Substack.com/Notes where my byline is my handle.

September Covered Calls Trades On Dividend Stocks Update #4

September Puts Options Trades Update #5

8 October 2023 Covered Calls Trades Yield 24.3% Annualized Returns On Risk

10 October 2023 Puts Options Trades

September Covered Calls Trades On Dividend Stocks Update #2

September Puts Options Trades Update #3

September Puts Options Trades Update #1

August Naked Puts Options Trades Yielded About 16% In Options Premiums Annualized

August Covered Calls Options Trades Yielded 14.6% In Options Premiums

September Puts Options Trades on 4 Stocks

September Covered Calls Trades On 4 Dividend Stocks

August Covered And Naked Puts Options Trades Update #3

16 Jim Cramer Stocks Are Up 12% to 205% Year To Date

AAPL, AXP, CAT, CSCO, FDX, HON, ICE, OPRA, TJX Covered Calls Update #1

August Covered Calls Trades On 14 Dividend Stocks Update #2

August Covered Calls Trades On 13 Dividend Stocks Update #1

August Covered Calls Trades On Dividend Stocks Yield 12.2% in Options Premiums

August Covered And Naked Puts Options Trades Update # 2

August Covered And Naked Puts Options Trades On Paycom And Other Stocks Update #1

August Covered And Naked Puts Options Trades Yield About 12.8% In Options Premiums.

How Owners of AT&T, Verizon, T-Mobile Can Use Covered Calls, Dividends To Offset Losses Update #1

Selling in The Money Covered Calls Can Yield Big Annual Returns on Risk. By Donald E. L. Johnson

How to Beat Inflation Tax, Bear Market Tax With Dividend Stocks, Covered Calls, Cash Secured Puts, by Donald E. L. Johnson.

How I Analyze Bullish Puts Options Trades With Stock Rover, By Donald E. L. Johnson.

Wars Breed Inflation, Rising Interest Rates, Market Turmoil, By Donald E. L. Johnson.

Calls vs Puts Options: What’s the Difference?

A video on how to place options trades on TDAmeritrade.com’s Think or Swim trading platform.

I love your in depth analysis on your trades. I basically do the exact same types of trades but mostly different stocks. It's good for the mind , soul and don't forget the wallet !