16 October 2023 Puts Options Trades Update #1

Small and large dividend stock and ETF investors can use covered calls and puts trades to generate monthly income from options premiums and options trading.

By Donald E. L. Johnson

Cautious Speculator

October puts trades yielding 10.9% annualized.

CAT October puts yielding 5.1% annualized.

MSFT October puts yielding 5.6% annualized.

Few, if any, October puts trades will be exercised.

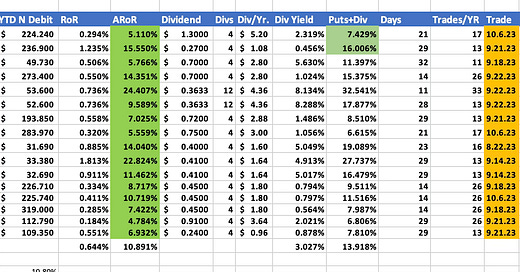

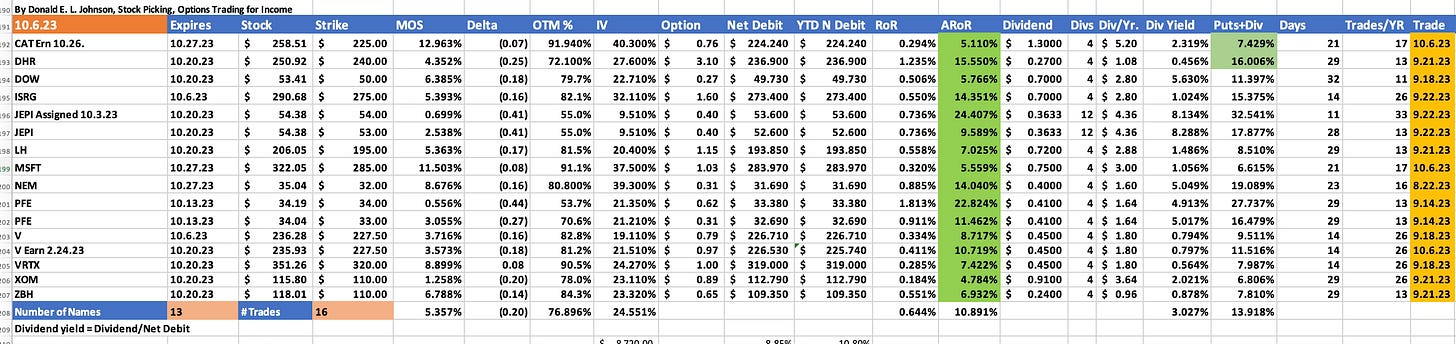

Cash secured puts options trades that will expire in October will provide options premium income of about 0.644%, or 10.918% annualized.

So far there have been 16 trades on 12 stock and one exchange traded fund.

I post my spreadsheet at the top of my articles so readers can quickly see the trades and decide whether they want to read the whole piece.

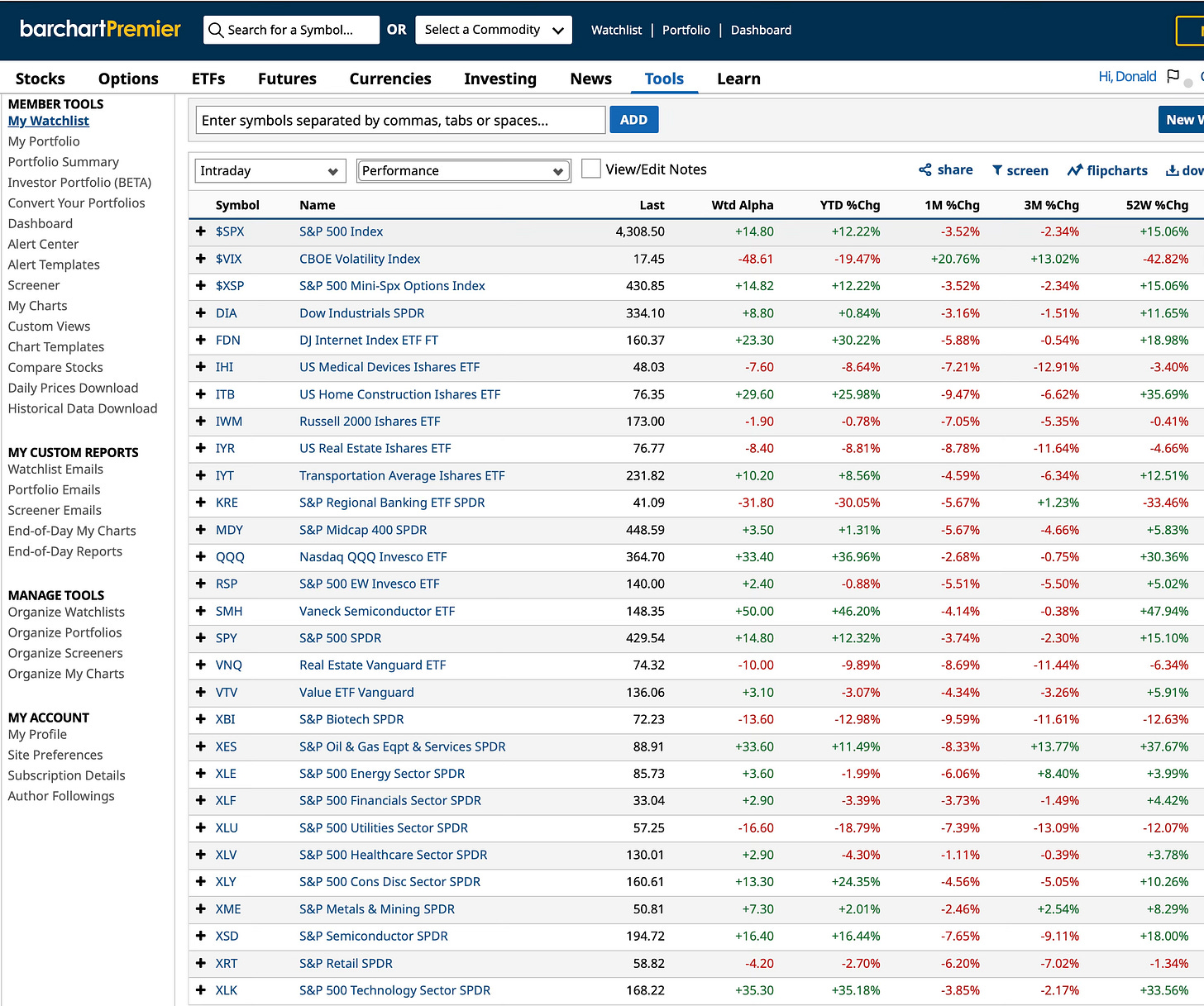

This Barchart.com table shows that all of the stocks in the list but Vertex Pharmaceuticals (VRTX) are trending sells. Caterpillar Inc. (CAT), Laboratory Corp of America (LH), Microsoft Corp. (MSFT), Visa Inc. (V) and VRTX sport Barchart Buy ratings. A 100% buy or sell rating means that all 13 momentum indicators tracked by Barchart are giving either buy or sell ratings.

There are sell ratings on Danaher Corp. (DHI), Dow Inc. (DOW), Intuitive Surgical Inc. (ISRG), JPM Equity Premium Income ETF (JEPI), Newmont Mining Corp. (NEM), Pfizer Inc. (PFE), Exxon Mobil Corp. (XOM) and Zimmer Biomet Holdings (ZBH).

The markets have been correcting for several weeks. Most sectors have been sliding for the last three months or longer.

On Friday, after the strong jobs report came out, stocks dropped sharply and sent the CBOE Volatility Index (VIX) to over 19 from around 12.73 about a month ago. That meant options premiums were back to last May’s highs. After stocks rallied later in the day, the VIX sank and premium prices fell.

CAT has been on my watch list since I sold it last year for around $210 a share. I’d like to buy it at about $210 or less, but to get at least a 5.1% annualized return on risk, I sold CAT 10.27.23 expiration (21 days duration) $225 strike (delta -.07) for $0.76 a share, or $76 per 100-share contract. The strike is 12.96% below the $258.50 that CAT was at when I did this trade. Because the trade is secured by the cash cost of buying the stock at the strike price, this is about $22,500 per puts options contract.

The plan on this trade is to make some money, not to buy the stock at $225. The low delta and 12.96% margin of safety pretty much ensure that CAT won’t be assigned, unless it and the markets fall out of bed during the next three weeks, which seems unlikely. CAT’s options are liquid and deep. That makes it pretty easy to do a trade that is unlikely to be exercised in these markets.

Before I do a trade like this, I look at the stock’s price momentum and charts and how it’s being rated by Barchart.com, Valuentum.com, Morningstar.com and writers and commenters on SeekingAlfa.com.

When it comes to momentum, StockCharts.com’s point and figure charts show what traders and investors think of the stock. CAT’s PnF chart has a bearish price objective (not a target) of $229. I may be able buy it for less, but only time will tell.

Analysts rate CAT a moderate buy with a 3.58 rating out of a possible 5. The highest target price published by a sell side analyst is $350. The mean target price is $280, and the lowest target price is $208. Sell side analysts are optimistic and frequently revise their targets as prices move with or against their target prices.

Morningstar.com thinks CAT is over valued and gives it a 2 star out of a possible 5 rating. Its fair value estimate for CAT is $223.

Vauentum.com rates CAT a moderate buy with a Valuentum Buying Index rating of 6 out of a possible 10. Its FVE on CAT is $262.

Discounted cash flow ratings are all over the place because they reflect different short-term, long term growth, expenses and discount rates assumptions.

Nobody can predict prices or interest rates, and anyone can make educated guesses. Since we can’t predict prices, the have to trade with the best information we can find including analysts’ ratings, target prices and fair value estimates.

After I traded the CAT puts early Friday, I sold the MSFT and V puts as shown in the spreadsheet.

Again, the goal on these trades is to generate options premiums income on these trades and hope they won’t be assigned so that after the puts options expire I can sell puts on these stocks again. If they’re assigned, I’ll sell covered calls on them for options premium income. None of them pay high dividends.

I respond to comments on the comments section where readers’ comments are posted. That is, if you have a question about this article or other comments, I'll discuss your questions with you in the comments section below this article.

Thanks for reading Stock Picking, Options Trading for Income! Subscribe for free to receive new posts and support my work.

LINKs:

Home Page. See my more than 150 articles on options trading, stock picking and watch lists. If you read several of these articles, you’ll learn how my strategies are meant to work. No guarantees. Links to useful web sites are on the lower right corner of the home page. Scroll down.

Follow @RealDonJohnson on twitter.com and FaceBook.com. Or follow me on Substack.com/Notes where my byline is my handle.

How To Turn An Over Valued Stock Into A Covered Calls And Puts Premiums Winner

8 October 2023 Covered Calls Trades Yield 24.3% Annualized Returns On Risk

10 October 2023 Puts Options Trades

September Covered Calls Trades On Dividend Stocks Update #4

September Puts Options Trades Update #5September Covered Calls Trades On Dividend Stocks Update #2

September Puts Options Trades Update #3

September Puts Options Trades Update #1

Selling in The Money Covered Calls Can Yield Big Annual Returns on Risk. By Donald E. L. Johnson

How to Beat Inflation Tax, Bear Market Tax With Dividend Stocks, Covered Calls, Cash Secured Puts, by Donald E. L. Johnson.

How I Analyze Bullish Puts Options Trades With Stock Rover, By Donald E. L. Johnson.

Wars Breed Inflation, Rising Interest Rates, Market Turmoil, By Donald E. L. Johnson.

Calls vs Puts Options: What’s the Difference?

A video on how to place options trades on TDAmeritrade.com’s Think or Swim trading platform.