Jim Cramer's 4 Best Covered Calls Stocks

Small and large dividend stock and ETF investors can use covered calls and puts trades to generate monthly income from options premiums and options trading.

By Donald E. L. Johnson

Cautious Speculator

The first step in options trading is stock picking.

Jim Cramer picks stocks for the investment club that he promotes on CNBC.

Four of those stocks have good bullish momentum and pretty good volatility, which is good for sellers of covered calls and puts.

Traders of covered calls and puts look for stocks in bullish trends combined with high volatility and liquidity.

Options traders can generate good options premium income by picking strong stocks with active and moderately high implied volatility.

Checking out Jim Cramer’s stocks is one way to find some pretty good options stocks. He vets and covers the stocks in his daily promotional newsletter, which is where this list comes from. It is very public.

Note: There are risks in stock and options trading. If your financial advisor actively trades options, discuss your strategy with that advisor. Otherwise, expect the advisor to advise against trading options. He or she wants to control all of your investable funds. That’s human nature. I don’t care what you do. That is up to you, not me. This is an educational newsletter, not an advisory service. My mission is to help readers learn how to pick stocks and trade options. I’m not here to make you money, but I hope you do. I post my trades and update my monthly portfolios so readers can get a feel for how I pick stocks and trade options. Investing is a process and trading is a routine. Everyone has personal financial resources and goals to consider when trading. So what I or anyone else does should be looked at as what can be done, not necessarily what you should do. I post my good and bad trades because I hope that differentiates this newsletter from others and that over time it gives me some credibility. This seems to be working because I have over 600 free subscribers on Substack.com, up from about 400 at the beginning of the year. Please subscribe, tell your friends and share.

Of more than 30 stocks owned and promoted by Jim Cramer’s CNBC investment club, four are in bullish trends and at the same time are relatively highly volatile. For most stocks, volatility comes with corrections in the prices of underlying stocks and goes when stocks settle down and move sideways to a bit higher.

Bullish trends and high implied volatility are very good for sellers of covered calls and cash secured puts options for options premium income. The higher an option’s implied volatility, the higher the puts and calls options prices. With high returns come higher risks that stocks will correct or their puts and calls options will be exercised.

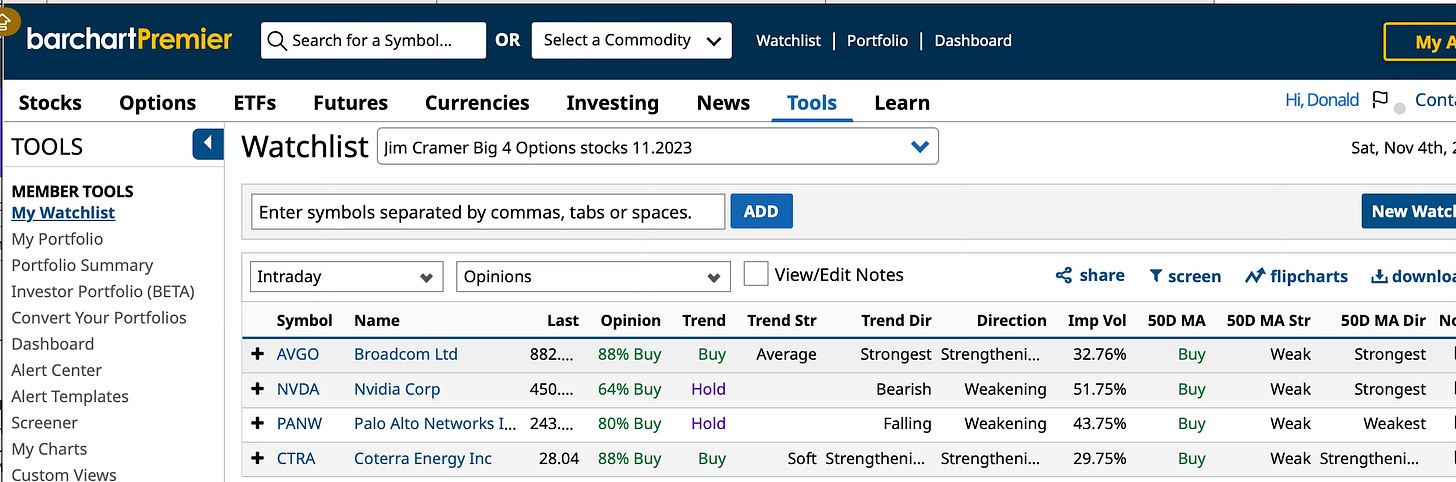

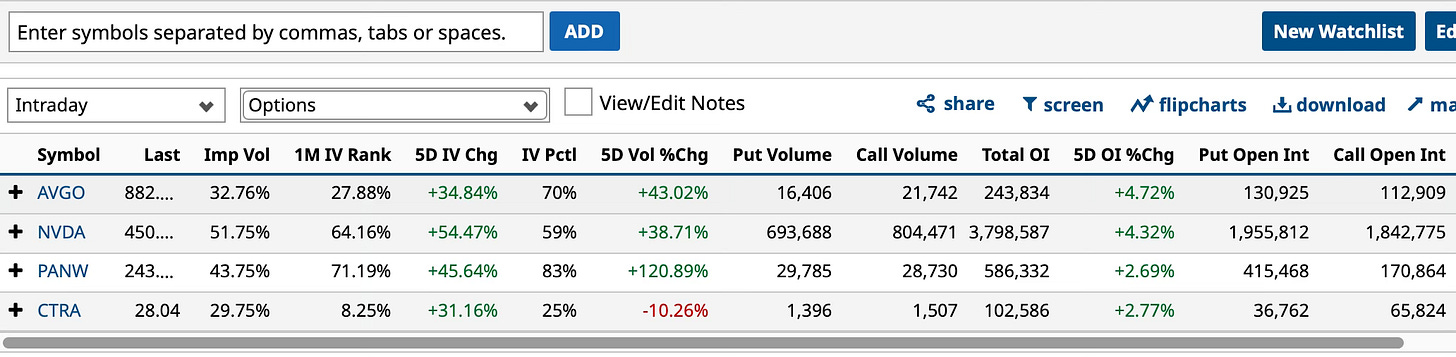

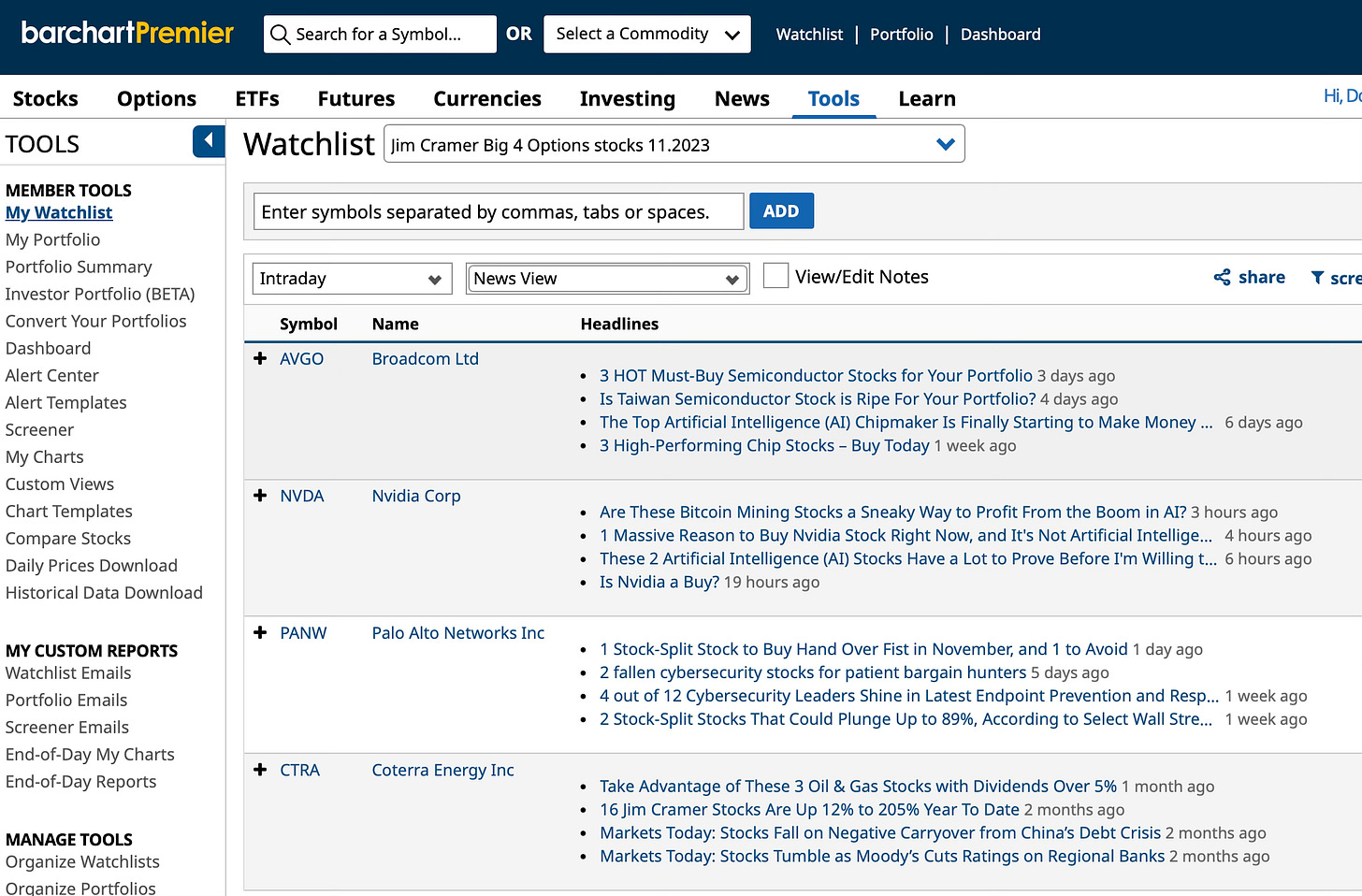

The Cramer Big Four are Nvidia Corp. (NVDA with a 51.75% implied volatility), Palo Alto Networks Inc. (PANW, 43.75%), Broadcom Ltd. (AVGO, 32.76%) and Coterra Energy Inc. (CTRA, 29.75% buy).

On Barchart.com, the Cramer Big Four have buy ratings: NVDA at 64%, PANW 80%, AVGO 88% and CTRA 88%. Barchart tracks 13 momentum metrics for individual stocks and exchange traded funds. A 100% buy rating means all 13 metrics are bullish.

All four stocks sport positive to outstanding weighted Alphas, which means they’re out performing the market.

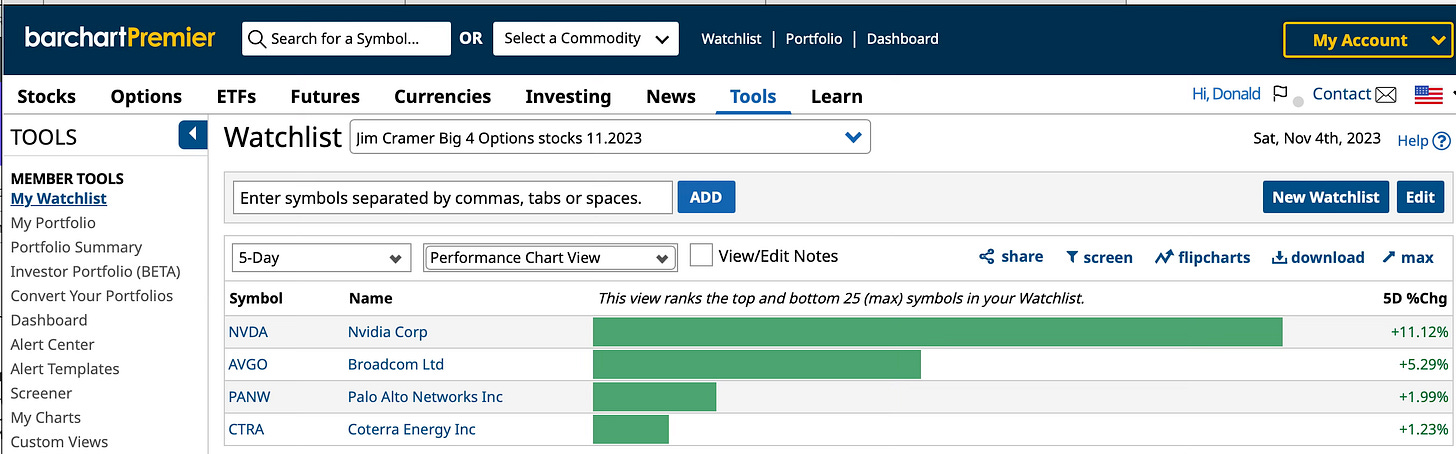

In the last month the four stocks have gained 3.42% (NVDA) to 8.33% (AVGO). Year to date, they’re up 14.12% (CTRA) to 207.96% (NVDA). Only CTRA is down over the 52 weeks (-8.4%).

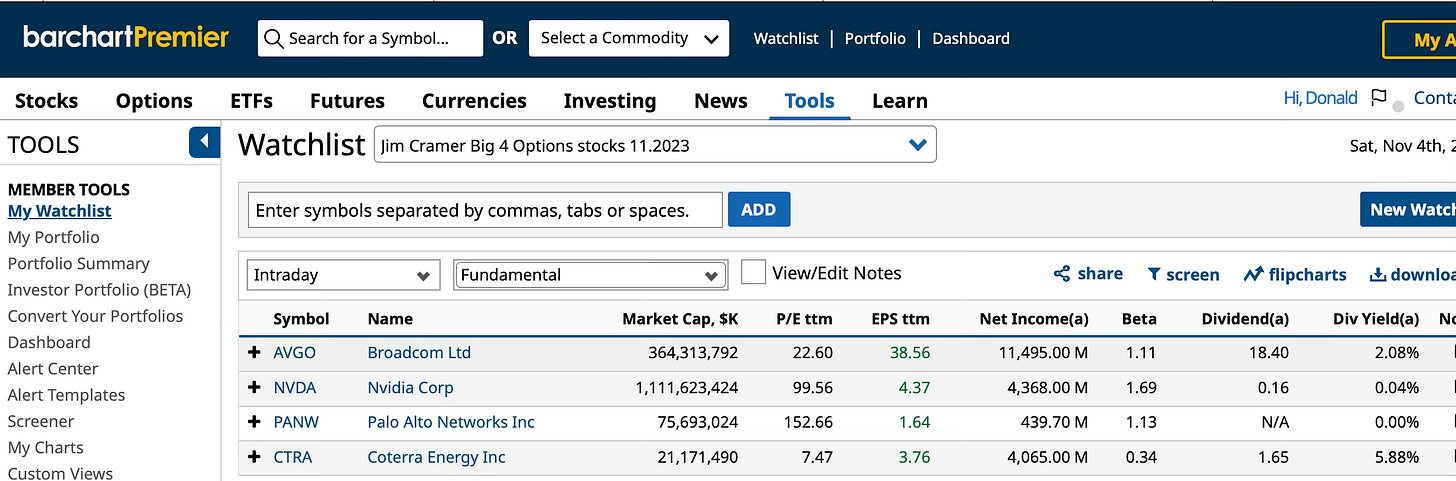

CTRA’s 7.47 PE ratio is the lowest of the four stocks. PANW’s PE is the highest at 152.66.

And CTRA’s options volume is the least liquid of the four stocks.

Here are some articles that have been posted on Barchart.com for traders who want to do some due diligence on these stocks. SeekingAlpha.com, Morningstar.com and Valuentum.com offer in depth reports on some of these stocks.

I respond to comments on the comments section where readers’ comments are posted. That is, if you have a question about this article or other comments, I'll discuss your questions with you in the comments section below this article.

Thanks for reading Stock Picking, Options Trading for Income! Subscribe for free to receive new posts and support my work.

LINKs:

Home Page. See my more than 150 articles on options trading, stock picking and watch lists. If you read several of these articles, you’ll learn how my strategies are meant to work. No guarantees. Links to useful web sites are on the lower right corner of the home page. Scroll down.

Follow @RealDonJohnson on twitter.com and FaceBook.com. Or follow me on Substack.com/Notes where my byline is my handle.

How I'm Trading Amazon Covered Calls, Cash Secured Puts Stock Options For Options Premium Income

32 October 2023 Covered Calls Trades Update #2

October 2023 Cash Secured Puts Trades Update #2

10 November 2023 Covered Calls Trades Update #1

20 November 2023 Cash Secured Puts Trades Update #2

7 November 2023 Covered Calls Trades Are Yielding 13.3%

10 November 2023 Cash Secured Puts Trades Update #1

5 November 2O23 Cash Secured Puts Options Trades

27 October 23 Covered Calls Options Trades Update #1

16 October 2023 Puts Options Trades Update #

How To Turn An Over Valued Stock Into A Covered Calls And Puts Premiums Winner

8 October 2023 Covered Calls Trades Yield 24.3% Annualized Returns On Risk

10 October 2023 Puts Options Trades

Selling in The Money Covered Calls Can Yield Big Annual Returns on Risk. By Donald E. L. Johnson

How to Beat Inflation Tax, Bear Market Tax With Dividend Stocks, Covered Calls, Cash Secured Puts, by Donald E. L. Johnson.

How I Analyze Bullish Puts Options Trades With Stock Rover, By Donald E. L. Johnson.

Wars Breed Inflation, Rising Interest Rates, Market Turmoil, By Donald E. L. Johnson.

Calls vs Puts Options: What’s the Difference?

A video on how to place options trades on TDAmeritrade.com’s Think or Swim trading platform.