15 December Covered Calls Trades Yielding 22.9% to 26.2%

Small and large dividend stock and ETF investors can use covered calls and puts trades to generate monthly income from options premiums and options trading

By Donald E. L. Johnson

Cautious Speculator

The stock market is giving covered calls options traders opportunities to trade for higher yields if they are comfortable taking higher risks that their stocks may correct (dip) or be called.

Amazon continues to be a good covered calls and cash secured puts options stock.

This is a good time to look for stocks with bullish momentum and good options volatility and liquidity.

Several of the initial 15 stocks in the Denver portfolio expire early in the month and will be rolled over into trades that expire later in the month.

The first 15 covered calls trades that expire in December are yielding 22.9% annualized in calls options premiums. Throw in the average 3.3% annual dividend yields and the total potential annual returns or risk is about 26.2%.

Six of the trades expire on Dec. 1 and are likely to be rolled over into later December expirations in 7 to 10 day trades. Nine of the trades expire on Dec. 15 and will be rolled into late December or early January expirations to generate additional options premiums income for the month.

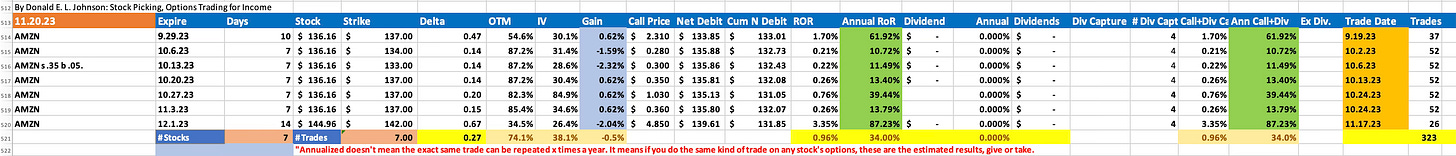

After a reader posted a comment and question about what I’m doing with AMZN, I replied in the comments section:

Today I checked out the CoveredCallAdvisor.com site. He had just done an in the money covered calls trade on Amazon. Check out the link to learn how he regularly and successfully sells ITM covered calls. Like this newsletter, his blog is free.

I did my version of his trade: I bought AMZN at $144.96. Then I sold AMZN 12.1.23 $142 covered calls for $4.85 a share. If AMZN is below the $142 strike when the calls expire, I’ll keep the full $4.85 a share in options premiums.

If AMZN dips below $142 and AMZN is not called, my AROR will be about 35%. The net debit on the trade is $144.96-4.85 =$140.11. (If the AMZN calls expire worthless with the stock above the $142 strike, my AROR will be around 15%.)

But before I did this trade, I collected $8.26 in AMZN puts and calls premiums. So my AMZN net debit is $136.70 - $4.85 on today's trade, or $131.85. I think I'll wind up with a positive RoR on all of my AMZN trades.

I may sell some more AMZN puts that will expire next month, depending on what the stock does. It's looking over bought to me.

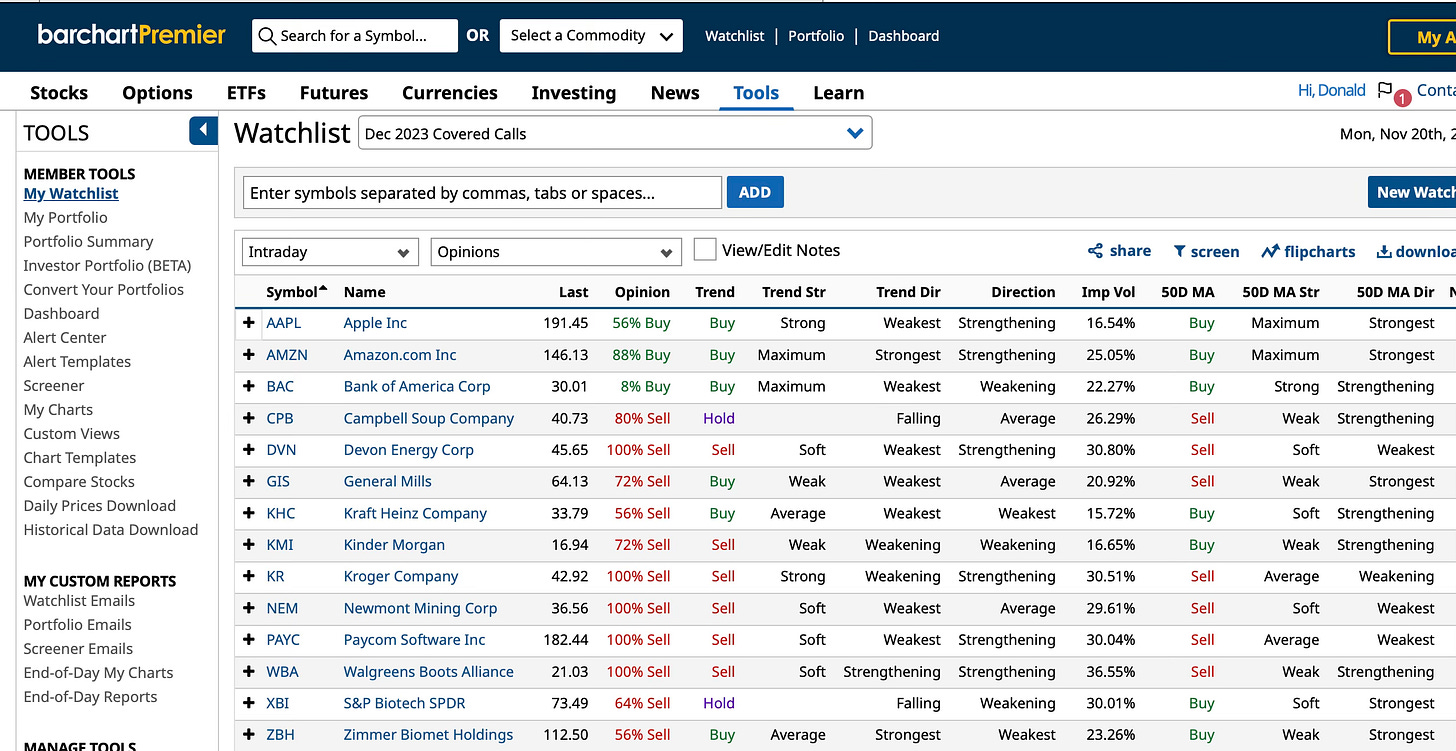

This month stocks have been rallying. To take advantage of the rally, I am trading covered calls at higher deltas and closer to the money. This strategy increases the probability that some of my stocks will be called with small, short-term gains and with higher returns on risk than I was getting earlier this year. I’ve also searched for several stocks with good bullish momentum. If they dip a bit I’ll consider buying them and writing covered calls on them and also selling cash secured puts on some of them.

As a result of this research, I bought and wrote covered calls on Apple Inc. (AAPL), AMZN and Bank of America Corp. (BAC). I started with a list of 19 stocks that are in various portfolios that I follow. Then I narrowed the list down to the stocks with the best point and figure charts price objectives, buy ratings on Barchart.com and ratings by Wall Street’s sell side analysts. If I trade these stocks, I’ll cover them in the next update on the December covered calls trades.

The reason that there are so many sell rated stocks in the December portfolio is that they’ve rolled over since I bought them and started selling cash secured puts and covered calls on them. Some pay very good dividends and I write out of the money calls on them to reduce the risk that they’ll be called before I’m ready to sell them.

Depressed stocks can bottom out and rally quickly. That is what happed to my D.R Horton (DHI). Another big loser, Intuitive Surgical (ISRG) will be called Friday at the price I paid for it after staging a big rally this month. I may buy it back and sell covered calls on it. Or I may sell ISRG puts or sell both calls and puts. It depends on what the stock is doing when I decide whether to do the trades, or not. In any case, ISRG is acting like a hot stock again.

I’ve done a few cash secured puts trades, but today was an up day in the markets and I spent the day rolling covered calls trades that expired last week into the December expiration trades shown above. I’ll spend the next few days selling puts.

I respond to comments on the comments section where readers’ comments are posted. That is, if you have a question about this article or other comments, I'll discuss your questions with you in the comments section below this article.

LINKs:

Home Page. See my more than 150 articles on options trading, stock picking and watch lists. If you read several of these articles, you’ll learn how my strategies are meant to work. No guarantees. Links to useful web sites are on the lower right corner of the home page. Scroll down.

Follow @RealDonJohnson on twitter.com and FaceBook.com. Or follow me on Substack.com/Notes where my byline is my handle.

12 Berkshire Hathaway Buys For Covered Calls Options Traders

20 November 2023 Covered Calls Trades Yielding 13.3% to15.9% Update #2

AMZN, META, MSFT And NVDA Posted Big Gains. November Puts Trades Update #4

25 November 2023 Cash Secured Puts Trades Update #3

5 Bullish Stocks For Covered Calls, Puts Stock Options Trades

Jim Cramer's 4 Best Covered Calls Stocks

How I'm Trading Amazon Covered Calls, Cash Secured Puts Stock Options For Options Premium Income

32 October 2023 Covered Calls Trades Update #2

October 2023 Cash Secured Puts Trades Update #2

10 November 2023 Covered Calls Trades Update #1

20 November 2023 Cash Secured Puts Trades Update #2

7 November 2023 Covered Calls Trades Are Yielding 13.3%

10 November 2023 Cash Secured Puts Trades Update #1

5 November 2O23 Cash Secured Puts Options Trades

Selling in The Money Covered Calls Can Yield Big Annual Returns on Risk. By Donald E. L. Johnson

How to Beat Inflation Tax, Bear Market Tax With Dividend Stocks, Covered Calls, Cash Secured Puts, by Donald E. L. Johnson.

How I Analyze Bullish Puts Options Trades With Stock Rover, By Donald E. L. Johnson.

Wars Breed Inflation, Rising Interest Rates, Market Turmoil, By Donald E. L. Johnson.

Calls vs Puts Options: What’s the Difference?

A video on how to place options trades on TDAmeritrade.com’s Think or Swim trading platform.

Thanks as always Donald! I did B/W's on AMZN last month and did well with it...today I bought LYB and sold DEC 100 calls on it. It goes x-div this Friday for $1.22. Will see. Have a great Thanksgiving!

Brewmeister

@Brewmeister. Bought LYB $94.50. Solid LYB 12.15.23 $95 covered calls for $1.15. RoR 1.22%, ARoR 19.3%. Ex Dividend 11.24.25 $1.25. Net debit on options trade $93.42. Dividend yield on net debit is 5.352%. If the dividend is collected, the net debit would be $93.42-1.25 = $92.27. IRA trade.

Also bought SU for $32.50. Sold SU 12.22.23 $32 calls for $1.12. Ex Dividend 11.30.23 for $1.12 a share.

With NEM cost at $39 and the price at $37.41, I sold NEM 12.15.23 $36 puts for .56. MOS 3.936%. ARoR 23.714%.

With PFE at $30.30, I sold PFE 12.15.23 $29 puts at $0.30. 15.71% ARoR on 23-day trade.