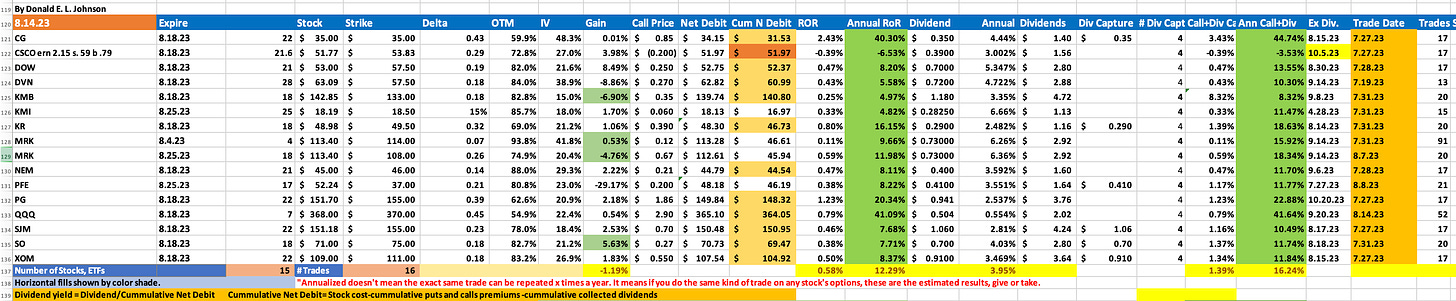

August Covered Calls Trades On 15 Dividend Stocks Update #3

Small and large dividend stock and ETF investors can use covered calls and puts trades to generate monthly income from options premiums and options trading.

By Donald E. L. Johnson

Cautious Speculator

August covered calls trades options premiums are generating annualized returns of about 12.3%. Their average dividends are about 3.95%.

12 August covered calls trades expired worthless Friday.

Next week I’ll decide whether to sell August or September calls on these stocks and six that were assigned on Friday.

I’ll post about the September covered calls and puts trades in the next day or two.

Stocks are looking weak, but many may be over sold and ready to bounce sometime in the next five days.

Nobody can predict prices, which is why trading stocks, ETFs and options is risky.

For many dividend stock and income investors, this may be a good time to not trade, as Danny Merkel advises in his excellent analysis of the market’s technicals.

Traders of covered calls and cash secured puts, however, can either take short term losses and profits or used the options markets to generate puts and calls options premium income on the stocks they want to own and own, which is what I do most of the time.

On Friday, 12 of my covered calls options expired worthless. That means I get to keep the covered calls options premiums on those trades.

Three other covered calls trades will expire next Friday, August 25, 2023. Merck & Co. (MRK) and Pfizer Inc. (PFE) looks like they will be called unless I buy the calls back. I might do that instead of taking losses on the stocks. Their target prices are above my net debit prices. Therefore it makes more sense to keep collecting their dividends and covered calls options premiums on them.

I have to decide how to trade covered calls on the 12 stocks plus 6 others that I bought Friday when my puts options were assigned to me.

I may sell weekly covered calls that expire on 8.25.23 or September 15 expiration calls. I’ll report on my August trades in the comments section on this post. And I will write posts on my September covered calls and puts trades in the next day or two.

Last week, I posted comments on these covered calls trades on Cisco Systems (CSCO), Exxon Mobil (XOM) and Nasdaq QQQ Invesco ETF (QQQ):

8.14.23. QQQ puts were assigned Friday at $368. Subtract the $1.05 per share puts premium, which put the net debit at $366.95. With QQQ at $368.75, I sold QQQ 8.18.23 (7 days instead of 4 because I do this trade only once a week) $370 strike covered calls for $2.90 per share. That reduces the net debit to $364.05. Return is 0.79%, or times 52 trades a year, the annualized RoR would be about 41%. The potential gain of 0.54% if QQQ is called would product an annualized gain of about 20% if the same trade could be done 52 times a year.

8.16.23. XOM $108.16. XOM 8.16.23 $111 calls weren't called. So I got the $0.91 per share dividend. Ex-Dividend 8.15.23. This is the second XOM $0.91/share dividend I've collected. XOM 8.25.23 $109 puts might be assigned. I bought XOM for $109 and sold for $1.10 a share, which is higher than the dividend I would have received if I had bought XOM at around $111.50 last week. After collecting covered calls options premiums and dividends, my net debit is $104.92.

8.16.23. CSCO beat on earnings and revenues. But disappointing guidance initially sent CSCO down 3%. At the moment it's $52.76, down $0.39, or 0.73%. I'm glad I bought the calls back and took my profit on CSCO. I'll wait a couple of days to decide what to do with the stock

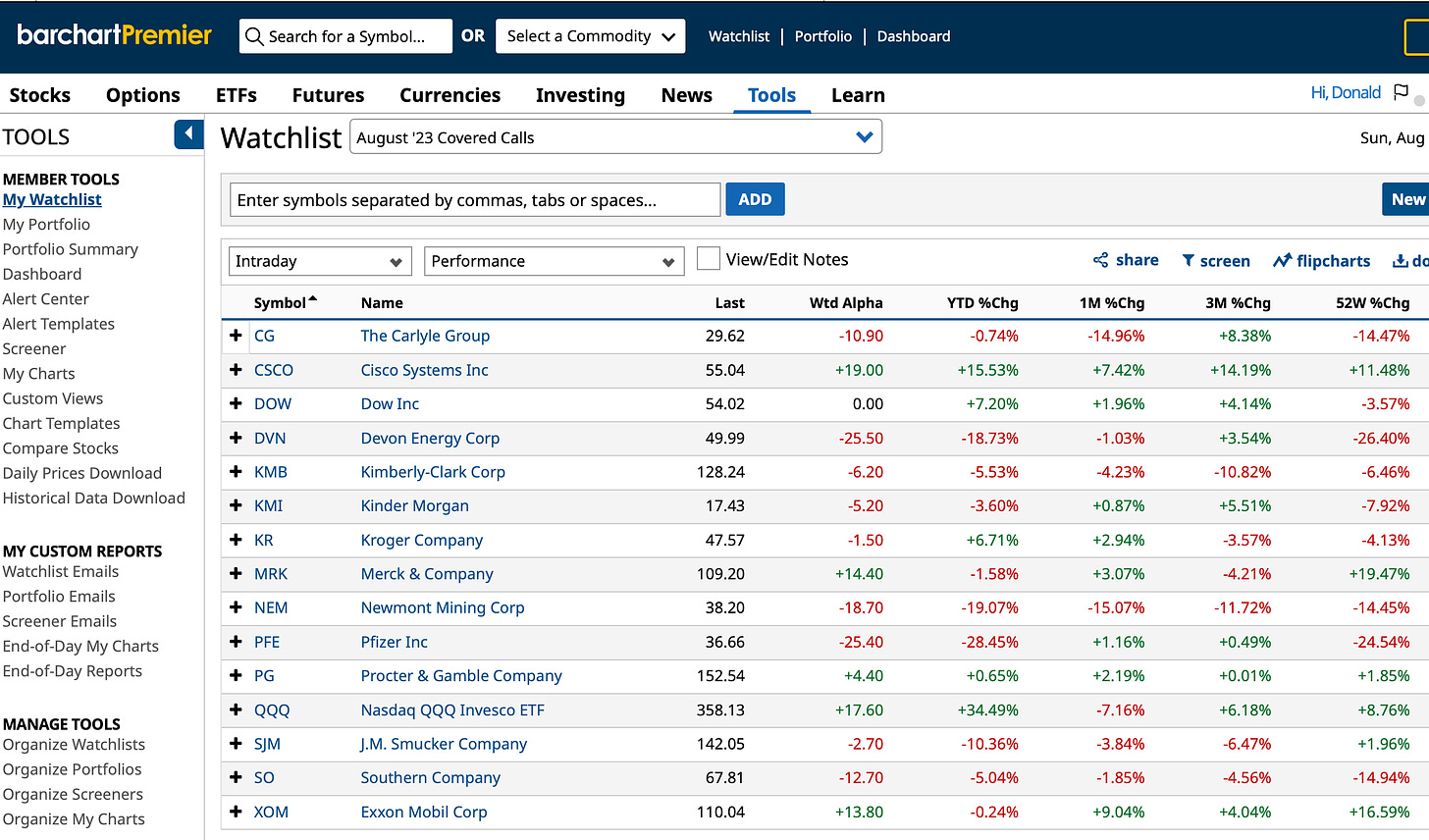

This table shows how the August covered calls stocks have performed over the last 52 weeks. Nine of the stocks are down year to date and six are up.

Year to date winners are CSCO, Dow Inc. (DOW), Kroger (KR), Proctor & Gamble (PG) and, of course, QQQ.

Losers include The Carlyle Group (CG), Devon Energy (DVN), Kimberly-Clark (KMB), Kinder Morgan (KMI), MRK, PFE, J.M. Smucker (SJM), Southern Co. (SO) and XOM.

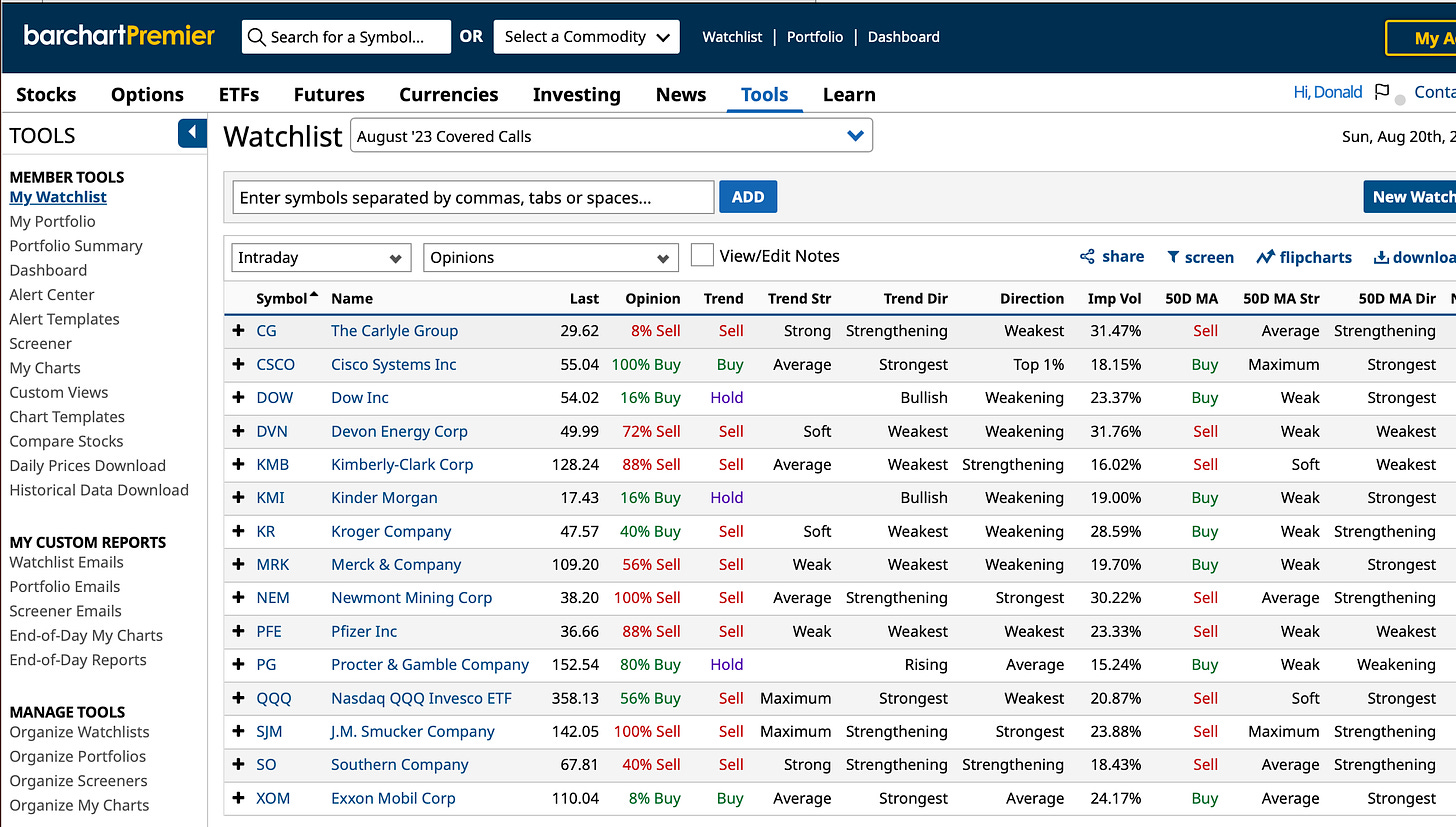

Seven of the stocks have buy ratings and eight have sell ratings on Barchart.com.

Between my portfolio updates, I report my thoughts and trades in the comments section of this and other posts.

I respond to comments on the comments section where readers’ comments are posted. That is, if you have a question about this article or other comments, I'll discuss your questions with you in the comments section below this article.

Thanks for reading Stock Picking, Options Trading for Income! Subscribe for free to receive new posts and support my work.

LINKs:

Home Page. See my more than 100 articles on options trading, stocks and watch lists. If you read several of these articles, you’ll learn how my strategies are meant to work. No guarantees. Links to useful web sites are on the lower right corner of the home page. Scroll down.

Follow @RealDonJohnson on twitter.com and FaceBook.com. Or follow me on Substack.com/Notes where my byline is my handle.

August Covered And Naked Puts Options Trades Update #3

16 Jim Cramer Stocks Are Up 12% to 205% Year To Date

AAPL, AXP, CAT, CSCO, FDX, HON, ICE, OPRA, TJX Covered Calls Update #1

August Covered Calls Trades On 14 Dividend Stocks Update #2

August Covered Calls Trades On 13 Dividend Stocks Update #1

August Covered Calls Trades On Dividend Stocks Yield 12.2% in Options Premiums

August Covered And Naked Puts Options Trades Update # 2

August Covered And Naked Puts Options Trades On Paycom And Other Stocks Update #1

August Covered And Naked Puts Options Trades Yield About 12.8% In Options Premiums.

How Owners of AT&T, Verizon, T-Mobile Can Use Covered Calls, Dividends To Offset Losses Update #1

July Puts Options Trades On Dividend Stocks Yield 10.5% in options premiums.

July Covered Calls Options Trades on Dividend Stocks Returned 9.97% Plus Dividends, Capital Gains

July Covered Calls Trades on Dividend Stocks Update #5

July Covered Calls Trades on Dividend Stocks Update #4

July Covered Calls Trades on Dividend Stocks Update #3

July Dividend Stocks Covered Calls Trades Update #2

July Dividend Stocks Covered Calls Trades Update #1

12 July Covered Calls Trades on Dividend Stocks.

Selling in The Money Covered Calls Can Yield Big Annual Returns on Risk. By Donald E. L. Johnson

How to Beat Inflation Tax, Bear Market Tax With Dividend Stocks, Covered Calls, Cash Secured Puts, by Donald E. L. Johnson.

How I Analyze Bullish Puts Options Trades With Stock Rover, By Donald E. L. Johnson.

Wars Breed Inflation, Rising Interest Rates, Market Turmoil, By Donald E. L. Johnson.

Calls vs Puts Options: What’s the Difference?

A video on how to place options trades on TDAmeritrade.com’s Think or Swim trading platform.

Thank you. I’m a newbie. I’ve been searching for guidance on this exact method.

8.25.23. My QQQ 8.25.23 $362 calls were exercised after QQQ closed at $364.02.

MRK closed at $110.21. My MRK 8.25.23 $108 calls will be exercised. My net debit on the stock is $108.24. So Iost $0.24 on the MRK trade.