July Covered Calls Trades On Dividend Stocks Update #2

Small and large dividend stock investors can use monthly covered calls to generate steady monthly income from options premiums and options tradi

By Donald E. L. Johnson

Cautious Speculator

Bought CSCO for dividends and will sell covered calls on it if it moves higher.

JEPI is not a good covered calls exchange traded fund.

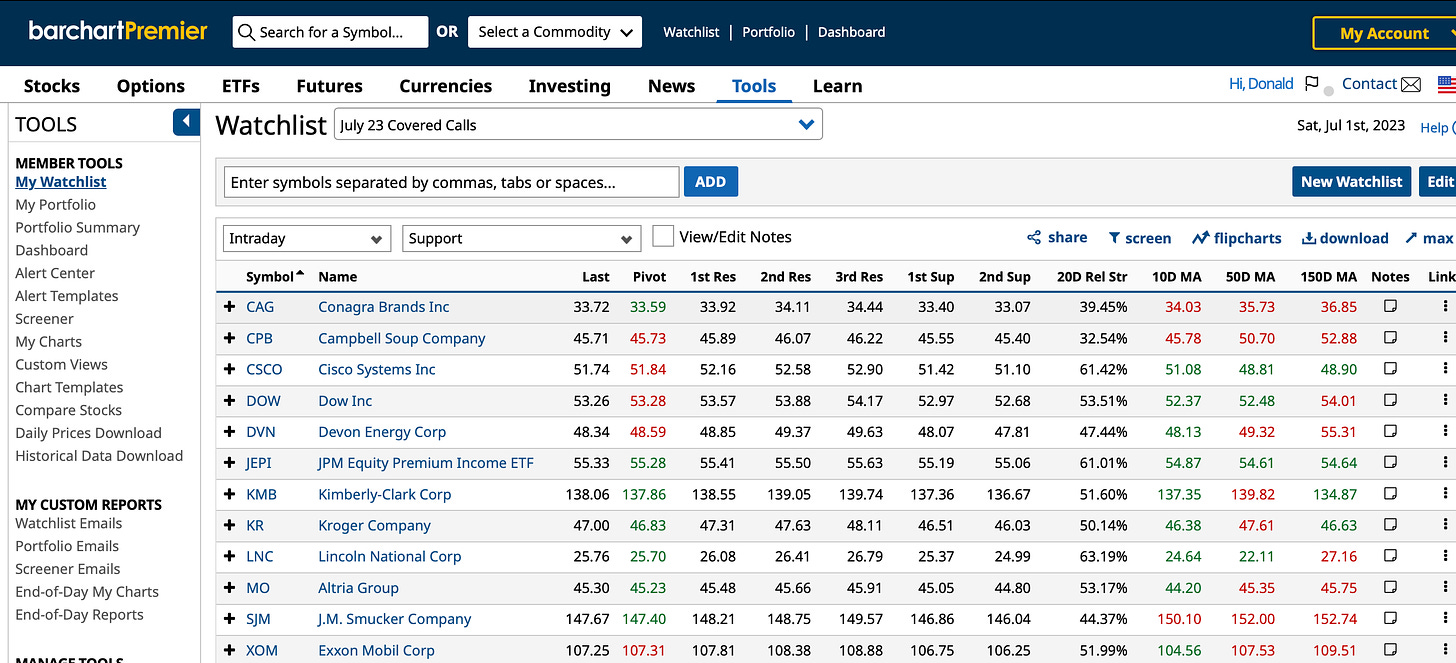

Barchart.com tables help stock pickers.

On Friday I bought Cisco Systems Inc. (CSCO). I plan to write covered calls on the stock after it goes ex-dividend on July 5. It yields about 3.02%. So it is in the July covered calls watch list because I plan to sell calls on it.

In reaction to the Supreme Court’s ruling Friday that student loans can’t be forgiven by President Biden without supporting laws from Congress, I wrote How To Pay Student Loans With CSCO Dividends and Covered Calls Stock Options Premiums. Earlier Friday, I wrote about possible stock picks and covered calls trades in Apple, Caterpillar, Cisco, Fedex, American Express Look Like Strong Momentum Buys. The stocks covered in that article could be used for July covered calls along with or instead of the stocks shown in the spreadsheet below.

My CSCO covered calls trade on Wednesday or later, depending on market conditions, might be to sell CSCO 7.28.23 expiration (24 days) $52 strike (delta .46, out of the money probability of being called 55.10%) covered calls for a return on risk of about 1%, or 12% annualized. The annualized number assumes that the same kind of covered calls trade would be done on any equity with the same results and that it would be done 12 times over the next 12 months.

Whatever I do with CISCO calls at whatever options prices that are available will be reported in the comments section below. Depending on the markets, I may also sell some puts on CSCO and other stocks.

JEPI Covered Calls Trade Did Not Work

Last week, I also decided to take and early and tiny profit on my JPM Equity Premium Income ETF (JEPI) covered calls.

When I did this, the ETF was rising and appeared to be about to be called, which would deny me the monthly dividend. JEPI goes ex-dividend Monday, July 3. It yields about 7.79%. This month’s dividend is $0.3593 per share, down from $0.3654 in June. The dividend has been falling for a few months with the sharp drop in market volatility.

JEPI’s implied volatility is a low 7.33%. Its covered calls are so cheap that they’re not worth selling. The options market is saying JEPI’s price isn’t going anywhere. It’s not worth trading the options. At this point, there is no way to enhance JEPI’s nice dividend with covered calls options premiums. What can work is selling at the money JEPI monthly or 45-day puts to get some options premiums income. If the JEPI drops and the puts are exercised, a trader could get a discount from the current price on the ETF.

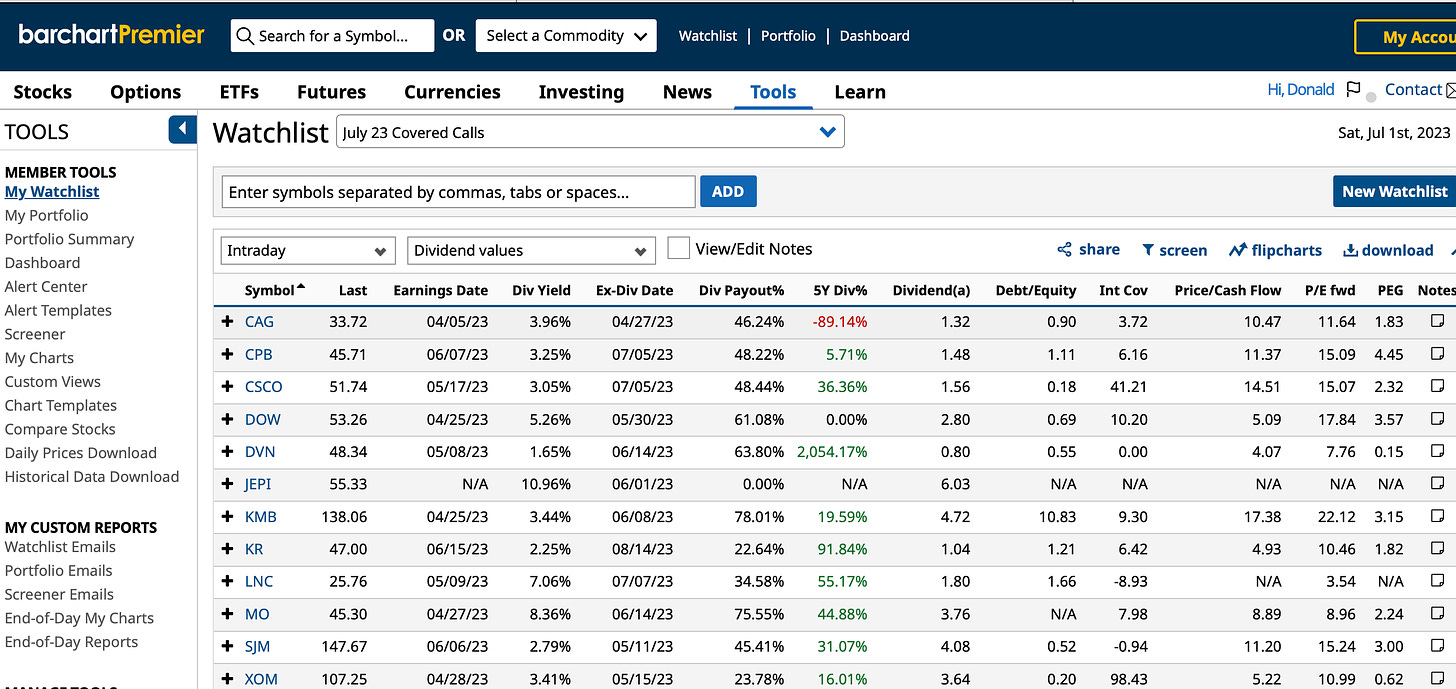

Barchart.com’s paid subscribers like me can use all kinds of metrics to analyze their stocks and stocks they are investigating. The charts below show the metrics I use to evaluate this and other stock lists.

One reason I bought CSCO is that it gets a 72% buy rating from Barchart.com and the other momentum indicators are pretty impressive.

CSCO’s 61.42% relative strength is a buy signal.

Fundamentally, CSCO’s debt to equity ratio is a low 0.18 and its dividend payout ratio is a reasonable 44.44%. The stock is valued at 14.51 times cash flow. So it isn’t that expensive. Again, click on the images and zoom in for better views of the data.

LINKs:

Home Page. See my more than 100 articles on options trading, stocks and watch lists. If you read several of these articles, you’ll learn how my strategies are meant to work. No guarantees. Links to useful web sites are on the lower right corner of the home page. Scroll down.

Follow @realDonJohnson on twitter.com and FaceBook.com. Or follow me on Substack.com/Notes where my byline is my handle.

Selling in The Money Covered Calls Can Yield Big Annual Returns on Risk. By Donald E. L. Johnson

July Dividend Stocks Covered Calls Trades Update #1

12 July Covered Calls Trades on Dividend Stocks.

June Covered Calls Trades Returned 21.6% Annualized.

June Covered Calls Portfolio Update # 3.

June Covered Calls Portfolio Update #2.

June Covered Calls Portfolio Update #1.

11 Dividend Stocks in My June Covered Calls Portfolio.

5 Dividend Stocks for June Covered Calls Trades.

20 Ideas for Adjusting Your Stock and Bond Portfolio, by Christina Lourosa-Ricardo.

How to Beat Inflation Tax, Bear Market Tax With Dividend Stocks, Covered Calls, Cash Secured Puts, by Donald E. L. Johnson.

Wars Breed Inflation, Rising Interest Rates, Market Turmoil, By Donald E. L. Johnson.

Ways to use StockRover.com to analyze stocks

Calls vs Puts Options: What’s the Difference?

A video on how to place options trades on TDAmeritrade.com’s Think or Swim trading platform.

Fed's still hawkish and I'm still bearish.

SO is breaking out so I'm going to let it run before I sell covered calls on it.