August Covered And Naked Puts Options Trades Update # 2

Small and large investors in dividend stocks can use covered calls and puts trades to generate monthly income from options premiums and options trading

By Donald E. L. Johnson

Cautious Speculator

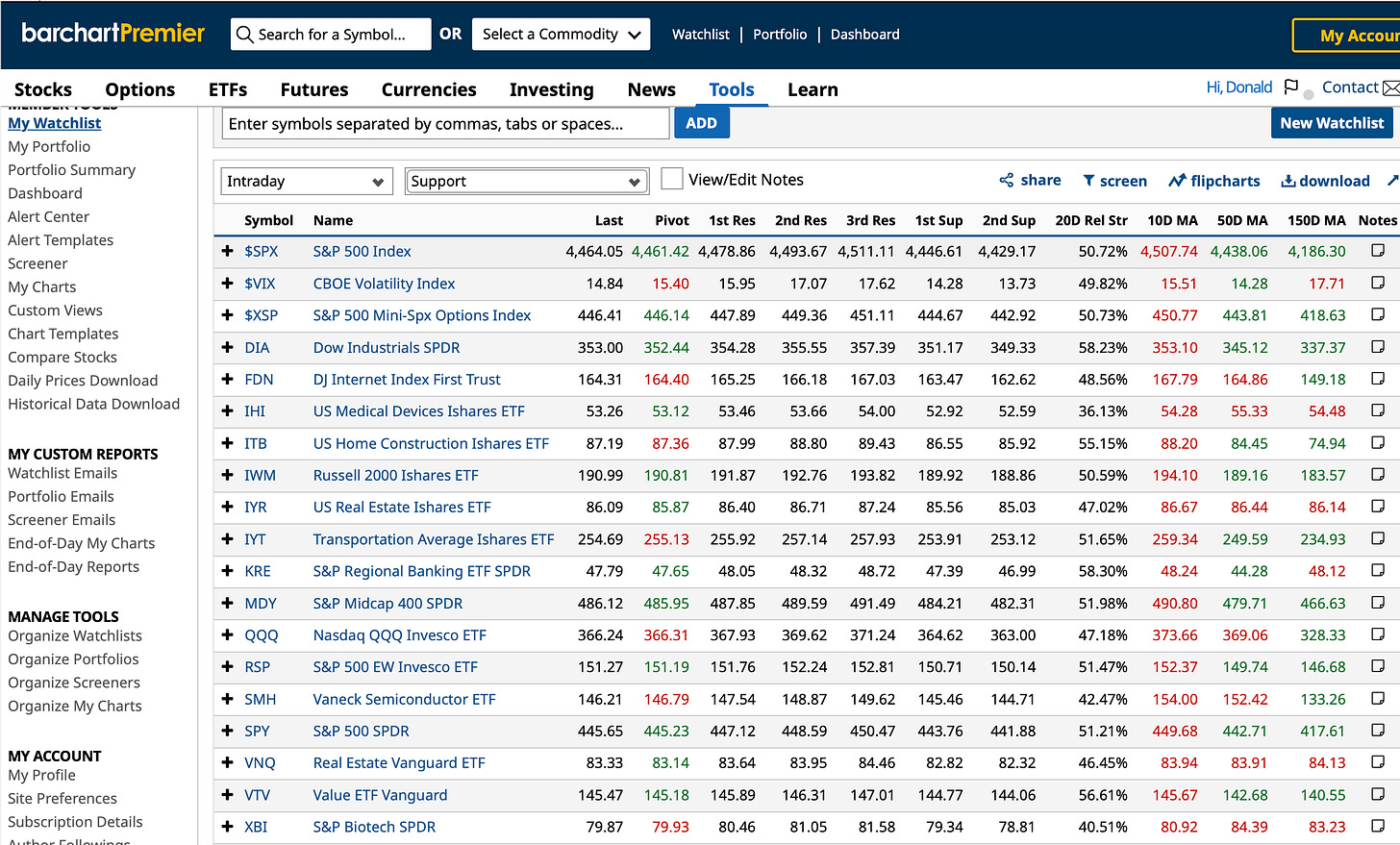

Major stock indexes tracked by the ETFs SPY, IWM, MDY and QQQ retreated last week.

My IWM and QQQ puts expired Friday.

I sold puts on DHR, JEPI, MRNA, WSM, XLE and XOM and bought back my expiring IWM puts. PAYC is my big loser for the month.

Profit taking and growing concern that a resurgence in energy prices may cause the Federal Reserve Board to stick to its anti-inflation policy caused major exchange traded funds indexes to retreat last week.

Selling cash secured puts is a bullish trade because the seller contracts to buy a stock or ETF at the strike price if the stock closes below the strike price when the option expires.

I used the weaker prices to sell cash secured puts as outlined below and shown in this spreadsheet. After I did each trade, I reported the trade in the comments section of my last update on this months trades. These are my edited comments:

8.7.23. JPM Equity Premium Income ETF (JEPI) $55.43. I sold JEPI 8.18.23 expiration(11 days) $55 strike puts for $0.13/share. Delta -.25. Out of the money probability (OTM) 74.8%. Implied volatility 8.3%. Annual return on risk about 7.782%. The -.25 delta indicates that that there is about a 25% probability that the puts will be assigned because JEPI closes below the $55 strike price on 8.18.23, or next Friday.

8.7.23. S&P 500 Energy Sector SPR (XLE) $87.15. Sold XLE 8.18.23 (11 days) $84 puts for $0.38/share. Delta -.18. OTM 80.6%. IV 25.6%. ARoR is about 13%.

8.8.23. I sold Danaher Corp. (DHR) 8.18.23 (17 days) $240 puts for $0.85. ARoR about 7.11%. 48% buy rating. Target price high $325, mean $288, low $240. CrossingWallStreet.com buy below price is $270. Analysts’ average strong buy rating is 4.58. The 50-day moving average is $242. Morningstar’s rating is 3*. Its FVE is $265. Annual dividend on net debit of $239.150 is about 0.452%.

8.9.23. Williams-Sonoma (WSM) $138.61. I sold WSM 8.25.23 (16 days) $121 strike puts for $0.75. ARoR about 11%. Delta -.10, OTM 88%, IV 49.7%. Analysts' rating a weak 2.61. High target price $146, Mean $120, Low $95. M* FVE $209. 4*. Buychart.com strong 88% buy rating.

8.10.23. Moderna Inc. (MRNA) $101.37. Sold MRNA 8.25.23 (15 days) $91 puts @ $0.58. ARoR about 13.9%.

Morningstar.com’s home page touts MRNA as 60% undervalued. M* 5*, FVE $266. Barchart 100% sell rating. Analysts give MRNA moderate buy rating of 3.69. Analysts high target price is $430, mean $181.72. Low $82.

8.11.23. I bought back my Russell 2000 Ishares (IWM) 8.11.23 $189 puts for $.07 just in case the markets tank on the close. I sold the puts for $0.52.

My Nasdaq QQQ Invest ETF (QQQ) 8.11.23 $368 puts are in the money. I think I'll take the QQQ shares and write covered calls on them Monday. The goal, over time, is to sell ATM and later OTM calls at strikes that will let me break even or make a profit on the trade.

8.11.23. XOM $111.64. I sold Exxon Mobil Corp. (XOM) 8.25.23 (14 days) $107 puts for $1.10. ARoR about 25%. Delta -.30, OTM 68%, IV 23.7%. M* 3*, FVE $118. Analysts high target price $145, mean $125.94, low $107. Average analyst rating is 3.78, moderate buy. Barchart 8%, or weak, buy rating. My XOM 8.18.23 $111 calls may be called next week before it goes ex dividend on 8.15.23.

Barchart.com rates stocks based on the percentage of 13 momentum technical indicators that are bullish or bearish. For example, if all 13 charts and other momentum indicators are bullish, a stock or ETF gets a 100% buy rating. If 8% of the indicators are sell ratings, the equity gets an 8% sell rating.

Some of my trades are on stocks and ETFs that are strong buys, and others are on equities that are strong sells.

Generally, I try to trade puts and calls on stocks and ETFs that have bullish momentum. But sometimes I look at stocks with 100% sell ratings and check their fundamentals, charts and other indicators and decide to speculate on a bounce back over the next one to four weeks. Other times, equities with 100% buy ratings look over bought and I try to sell the puts at strikes that 5% to 10% or more discounts from the current prices of those equities. I try to be flexible, and I take some moderate risks.

That is why I did the Moderna Inc. (MRNA) trade.

In last week’s update, I discussed my failed puts trade on Paycom Software Inc. (PAYC). The stock is at $292, down $75, or 20.46% from the $367.09 it was on 7.28.23 when I sold the puts for $2.30 a share. If I am assigned the stock at $292, my loss will be $35.45 a share, or $3,545 on the 100-share puts option contract. That amounts to about a 9.7% loss on the trade versus the 20.46% loss I would have taken if I had bought the shares instead of selling the puts.

PAYC seems to be consolidating around $290. Analysts still are bullish on it, and so am I.

If I had taken assignment on PAYC on 8.11.23 at $292, I could have sold PAYC 9.15.23 $300 strike covered calls for about $8.10 a share. That would have given me about a 29% annual return on risk (ARoR). There is about a 42% chance that PAYC will be called on 9.15.23 at $300. The out of the money probability is about 61.2% and the implied volatility is about 33%. The $810 per contract in covered calls options premiums on the covered calls trade would cut my loss by about 22%.

The risk, of course, is that PAYC sinks further and expands my loss. If that happens, I’ll take the covered calls premiums after the September calls expire worthless and sell PAYC October calls. This will reduce my net debit as long as I can sell PAYC calls at decent call options prices. I’m expecting that PAYC’s implied volatility and its options prices will stay high for quite awhile.

This discussion is meant to be educational, not trading advice. I’m thinking out loud. No two minds think alike as anyone who’s been married as long as I have knows. But it helps to think about scenarios and a to write out a plan. All plans are changed as new information and data become available. That is why I can’t predict how I will change my mind before the PAYC puts options expire on Friday.

Between my portfolio updates, I report my thoughts and trades in the comments section of this and other posts.

I respond to comments on the comments section where readers’ comments are posted. That is, if you have a question about this article or other comments, I'll discuss your questions with you in the comments section below this article.

Thanks for reading Stock Picking, Options Trading for Income! Subscribe for free to receive new posts and support my work.

LINKs:

Home Page. See my more than 100 articles on options trading, stocks and watch lists. If you read several of these articles, you’ll learn how my strategies are meant to work. No guarantees. Links to useful web sites are on the lower right corner of the home page. Scroll down.

Follow @RealDonJohnson on twitter.com and FaceBook.com. Or follow me on Substack.com/Notes where my byline is my handle.

August Covered Calls Trades On 13 Dividend Stocks Update #1

August Covered And Naked Puts Options Trades On Paycom And Other Stocks Update #1

How Owners of AT&T, Verizon, T-Mobile Can Use Covered Calls, Dividends To Offset Losses Update #1

August Covered Calls Trades On 13 Dividend Stocks Update #1

August Covered And Naked Puts Options Trades Yield About 12.8% In Options Premiums.

August Covered Calls Trades On Dividend Stocks Yield 12.2% in Options Premiums

July Puts Options Trades On Dividend Stocks Yield 10.5% in options premiums.

July Covered Calls Options Trades on Dividend Stocks Returned 9.97% Plus Dividends, Capital Gains

July Covered Calls Trades on Dividend Stocks Update #5

July Covered Calls Trades on Dividend Stocks Update #4

July Covered Calls Trades on Dividend Stocks Update #3

July Dividend Stocks Covered Calls Trades Update #2

July Dividend Stocks Covered Calls Trades Update #1

12 July Covered Calls Trades on Dividend Stocks.

Selling in The Money Covered Calls Can Yield Big Annual Returns on Risk. By Donald E. L. Johnson

How to Beat Inflation Tax, Bear Market Tax With Dividend Stocks, Covered Calls, Cash Secured Puts, by Donald E. L. Johnson.

How I Analyze Bullish Puts Options Trades With Stock Rover, By Donald E. L. Johnson.

Wars Breed Inflation, Rising Interest Rates, Market Turmoil, By Donald E. L. Johnson.

Calls vs Puts Options: What’s the Difference?

A video on how to place options trades on TDAmeritrade.com’s Think or Swim trading platform.

8.18.23. ISRG $286.54. Puts assigned at $305. Barchart rating is a 24% buy. That trend is weakening a bit. Analysts' average rating is 4.33. High target price is $400, mean is $364 and low is $270. The stock is down 6% from the $305 purchase price. The net debit ($305-$1.50 puts options price per share) is $303.50. I'll write covered calls on ISRG because I expect it to rally.

8.18.23. PAYC $279.31. PAYC was put to me at $330 a share. It is down about 15% from the price I bought it at. Analysts rate the stock at a moderate buy, or an average rating of 4.29 out of a possible 5. The high target price is $450 a share. The mean target is $385.88 and the low target is $310. PAYC will have to rise about 11% to hit $310, 18% to hit $330 and 38% to hit the mean target price of $385.88.

I can sell PAYC 9.15.23 $320 covered calls for about $1.20 a share or PAYC 10.20.23 $330 covered calls for about $2.40 a share. I want to give the stock room to bounce without being called when I sell covered calls over the next year or so.

I'm expecting the stock to recover while my net debit price, which is $327.70, falls as I sell covered calls and collect $0.37 a quarter in dividends. The net debit is $330 minus the $2.30 in puts options premiums I collected when PAYC was at $367.09 and I sold the puts on 7.28.23.