July Covered Calls Options Trades On Dividend Stocks Returned 9.97% Plus Dividends, Capital Gains

Small and large dividend stock investors can use covered calls and puts trades to generate monthly income from options premiums and options trading.

By Donald E. L. Johnson

Cautious Speculator

July covered calls options premiums on Lincoln National were about 71.5% annualized.

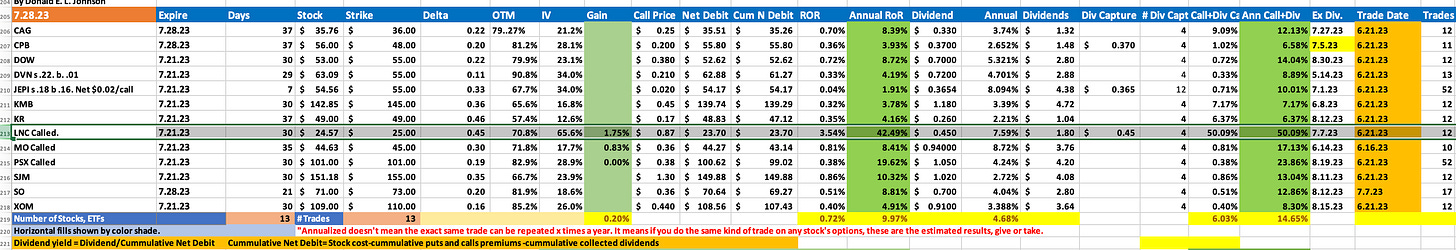

The 13 July covered calls options trades on 13 dividend equities generated annualized returns of about 10%. Capital gains and annualized dividends took the month’s AROR to about 18%.

I’ll publish results for July puts and August puts and calls trades over the weekend.

This stock picking and options premium income newsletter is written for investors who have the cash to buy dividend stocks. It is for folks who have some trading experience that makes them feel comfortable to take the risks involved in trading equities, covered calls and cash secured puts. It is meant to be educational, not trading advice. I write about trades that make sense to me and about trades I do for our accounts.

Low stock volatility again lowered returns on July covered calls options trades on dividend stocks. Because most companies report earnings in July and low volatility kept options premiums prices low, I was less active in the options markets in July.

For more insights to how I trade covered calls and puts, check out the links to my weekly covered calls trades updates below.

I’ve done about a dozen puts and calls options trades that will expire in August. Reports on those trades will be posted over the weekend

Covered calls trades on 12 stocks and one exchange traded fun generated options premiums that were 9.97% of the net debit investments in those equities. Rounded, that’s a nice 10% annual return on risk. But it was below my usual 12% to 15% ARoR.

The annual yields on the 13 equities traded in July was 4.68%. That beautiful number was distorted by the 8.1% dividend yield on JPM Equity Premium Income ETF (JEPI), which turned out to be a waste of time for covered calls traders. I park some of my cash in JEPI and a high yield money market fund.

Three stocks were called and sold at their strike prices because they closed above their strike prices on 7.28.23. They were Lincoln National Corp. (LNC), Altria Group (MO) and Phillips 66 (PSX).

LNC posted a 1.75% gain on the 30-day trade. If other trades produced covered calls gains of 1.75% every month for a year, the ARoR would be about 21%. LNC’s covered calls options premiums produced about a 42% ARoR. It went ex dividend on July 7 for another 7.59% annualized yield.

LNC covered calls options premiums, gain and collected dividends produced a 71.5% ARoR. That is more likely to happen when you trade covered calls on several stocks each month. If I had just traded covered calls on JEPI, my RoR would have been two cents a share on a 100-share contract, or about $2 before commissions and fees.

Because LNC is looking fundamentally weak, I won’t sell puts on it even though it is showing strong bullish momentum and it’s nice dividend.

There are Barchart.com sell ratings on several of my stocks, which are down since I bought them. I’ll continue to hold them for dividends and covered calls trading while I wait for them to rally back to break even or better. If they are called for less than I paid for them, I will move on to better opportunities.

I’ll probably wait for some of the called (sold) stocks to turn bullish before I sell puts on them or buy them back. PSX has a nice buy rating and I’ll sell puts on it.

All of these equities pay good dividends.

Most of the stocks have active and liquid options markets.

None of the stocks are over bought nor over sold according to the 20-day relative strength numbers. The support and resistance prices are useful when traders are entering and exiting trades.

LINKs:

Home Page. See my more than 100 articles on options trading, stocks and watch lists. If you read several of these articles, you’ll learn how my strategies are meant to work. No guarantees. Links to useful web sites are on the lower right corner of the home page. Scroll down.

Follow @RealDonJohnson on twitter.com and FaceBook.com. Or follow me on Substack.com/Notes where my byline is my handle.

Selling in The Money Covered Calls Can Yield Big Annual Returns on Risk. By Donald E. L. Johnson

July Covered Calls Trades on Dividend Stocks Update #5

July Covered Calls Trades on Dividend Stocks Update #4

July Covered Calls Trades on Dividend Stocks Update #3

July Dividend Stocks Covered Calls Trades Update #2

July Dividend Stocks Covered Calls Trades Update #1

12 July Covered Calls Trades on Dividend Stocks.

June Covered Calls Trades Returned 21.6% Annualized.

June Covered Calls Portfolio Update # 3.

June Covered Calls Portfolio Update #2.

June Covered Calls Portfolio Update #1.

11 Dividend Stocks in My June Covered Calls Portfolio.

5 Dividend Stocks for June Covered Calls Trades.

20 Ideas for Adjusting Your Stock and Bond Portfolio, by Christina Lourosa-Ricardo.

How to Beat Inflation Tax, Bear Market Tax With Dividend Stocks, Covered Calls, Cash Secured Puts, by Donald E. L. Johnson.

Wars Breed Inflation, Rising Interest Rates, Market Turmoil, By Donald E. L. Johnson.

Ways to use StockRover.com to analyze stocks

Calls vs Puts Options: What’s the Difference?

A video on how to place options trades on TDAmeritrade.com’s Think or Swim trading platform.