July Covered Calls Trades on Dividend Stocks Update #3

Small and large dividend stock investors can use covered calls and puts trades to generate monthly income from options premiums and options trading.

By Donald E. L. Johnson

Cautious Speculator

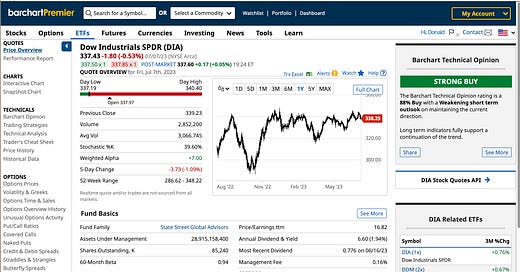

The Dow is down 3.73% over the last five trading sessions.

17 Dow stocks have buy ratings, but most of their bullish trends are weakening.

I rolled my covered calls on Southern (SO) into July.

Five of the 14 July portfolio stocks are up year to date. Seven are up over the last month.

Dow Jones Industrials stocks are trying to break above last November’s highs. Dow Industrials SPDR (DIA), the ETF that tracks the DJIA30 stocks, closed Friday at $337.43. That’s below last November’s $348.22 high and last September’s $286.22 low.

Seventeen of the 30 Dow stocks have buy ratings that range from 8% buy to 100% buy ratings on Barchart.com. Barchart tracks 13 technical indictors.

Five of the 30 DJIA30 stocks are 100% buys. They are Apple Inc. (AAPL), JP Morgan Chase & Co. (JPM), McDonald’s Corp. (MCD), Microsoft Corp. (MSFT) and Visa Inc. (V). I sold puts on Microsoft last week and will cover that in an update on puts trades.

Buy ratings are important, but traders also look at the strength of those indicators. Thus, of the 17 buy rated stocks, Dow Inc. (DOW), is the only one with a strengthening 50 day-moving-average direction. Merck & Co.’s (MRK) 50-day moving average bullish movement is rated “strongest.” See the column on the far right.

Another 12 DJIA30 stocks have buy ratings ranging to 88% from 8%.

The rest of the index’s stocks have sell ratings ranging from 32% sell to the five that have 100% sell ratings. They are Amgen Inc. (AMGN), The Travelers Companies Inc. (TRV), Chevron Corp. (CVX), UnitedHealth Group Inc. (UNH) and Walgreens Boots Alliance (WBA).

Friday’s four winners in my July covered calls portfolio were Devon Energy (DVN), Lincoln National Corp. (LNC), Dow Inc. (DOW) and Exxon Mobil (XOM).

Here is how the July portfolio stocks have performed year to date and during the last 12 months.

My covered calls on Southern Co. (SO) expired on June 30.

On Friday, July 7, I sold SO 7.28.23 $73 strike covered calls for $0.36 a share, or $36 per 100-share contract. The return on risk will be 0.51%, or 8.81% annualized if I do the trades that get the same RoR 17 times a year.

I sold SO calls that have a higher risk of being called with a 0.20 delta. I’m bearish and doubt that SO will be called.

That gave me a higher ROR of about 8.8% annualized. I also sold the calls at the $73 strike so that if the shares are called, I’ll make about a $2 per share profit on the stock plus the collected options premiums and dividends. The cumulative net debt after collecting dividends and puts and calls options premiums is $69.27. After I sold the calls, I sold SO 7.28.23 $68 strike puts for a 7.38% ARoR.

Based on the $69.27 net debit cost of SO, the annual dividend yield is 4.04%. Goldman Sachs recently added SO to its conviction buy list. Year to date, I’ve done four SO covered calls trades and four SO cash secured puts trades. I’m still waiting to sell calls on Cisco Systems Inc. (CSCO), which I recently bought.

Remember, I pick stocks and ETFs that pay relatively high dividends that can be enhanced by selling covered calls and puts for options premiums income. Every month, I sell puts and calls for income regardless of what the markets are doing, but when volatility increases my uncertainty, I become more cautious and do fewer and less risky trades. All stock and options trades are risky. So is life.

LINKs:

Home Page. See my more than 100 articles on options trading, stocks and watch lists. If you read several of these articles, you’ll learn how my strategies are meant to work. No guarantees. Links to useful web sites are on the lower right corner of the home page. Scroll down.

Follow @RealDonJohnson on twitter.com and FaceBook.com. Or follow me on Substack.com/Notes where my byline is my handle.

Selling in The Money Covered Calls Can Yield Big Annual Returns on Risk. By Donald E. L. Johnson

July Dividend Stocks Covered Calls Trades Update #2

July Dividend Stocks Covered Calls Trades Update #1

12 July Covered Calls Trades on Dividend Stocks.

June Covered Calls Trades Returned 21.6% Annualized.

June Covered Calls Portfolio Update # 3.

June Covered Calls Portfolio Update #2.

June Covered Calls Portfolio Update #1.

11 Dividend Stocks in My June Covered Calls Portfolio.

5 Dividend Stocks for June Covered Calls Trades.

20 Ideas for Adjusting Your Stock and Bond Portfolio, by Christina Lourosa-Ricardo.

How to Beat Inflation Tax, Bear Market Tax With Dividend Stocks, Covered Calls, Cash Secured Puts, by Donald E. L. Johnson.

Wars Breed Inflation, Rising Interest Rates, Market Turmoil, By Donald E. L. Johnson.

Ways to use StockRover.com to analyze stocks

Calls vs Puts Options: What’s the Difference?

A video on how to place options trades on TDAmeritrade.com’s Think or Swim trading platform.

Jumboloan, my reply just got zapped. I'll try again.

If my call is exercised at a strike price above my purchase price or my net debit, I'm okay with that. I can buy the stock back or sell puts on it in the hope that I can buy it at a strike price that is below my call strike.

If the call option price on the day before the stock goes ex-dividend indicates that the stock is probably not going to be called, I'll hold on and see what happens.

If the call option price. is below the dividend, the call probably won't be called, but you don't know for sure.

If the stock is trading way above the strike on an ex-dividend day, it probably will be called. Then you have to decide whether it's worth buying the option back at a loss or just let the stock go and sell puts on it.

Thanks for the question.

Jumboloan, Yes, I can get called before ex-dividend. If my strike gives me a bigger RoR than the dividend, I'm ok. If my strike is below my purchase price and the stock gets called, the stock probably is higher than it was when I wrote the call. If the stock is called on a trade where I lose money on the purchase price, I wait 31 days before I trade the stock or options on it again. Then I sell puts on the stock if I still want to own it.

On the ex-dividend day, sometimes the option is trading for less than the dividend and I can buy the option back, collect the dividend and then sell call options at a higher price and later expiration price.

If the stock is called at. a price above my net debit price after I've collected options premiums and dividends, I'll take that profit unless I can trade my way out of it profitably.

If you have a trade in mind, tell me what it is and we can discuss it. This is not trading advice. It is meant to be educational.

Thanks for the question. If I'm not clear, we can discuss this again.