August Covered Calls Trades On 14 Dividend Stocks Update #2

Small and large dividend stock investors can use covered calls and puts trades to generate monthly income from options premiums and options trading.

By Donald E. L. Johnson

Cautious Speculator

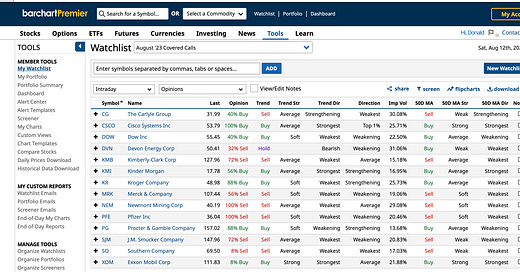

Annualized options premiums returns on risks on 15 August covered calls trades could be about 12%, not including realized or unrealized stock gains or losses.

Last week I sold covered calls on MRK and PFE.

My covered calls on PG and XOM may be called with gains this week.

With the markets in retreat on profit taking in response to mixed reports on inflation and uncertainty about interest rates last week, I sold covered calls on my two pharmaceutical stocks, Merck & Co. (MRK) and Pfizer (PFE).

If all 15 covered calls trades expire worthless this month, the average return on risk will be about 0.66%, or about 12% annualized. AROR assumes that these options premiums results can be achieved every month of 12 months, not including realized or unrealized gains or losses on the equities involved in the trades.

The 14 equities in the August portfolio pay an average of about 4.17% in annual dividends.

Trading stocks, exchange traded funds, covered calls and cash secured puts is for investors who are comfortable with taking those risks and who take the time to learn to manage their risks. I think this strategy is relatively low risk compared with other and more complex options strategies. It can take as little or as much work and time as an investor wants to put into it. For me, it’s pretty much a full time activity because I spend a lot of time looking for trades and I write this newsletter. This is not advice. It is educational because I try to show how I make trading decisions. I am a private speculator, not a financial professional. I take no responsibility for how readers or anyone else trades.

Reading this 1,280-word post will take about 6 minutes. Studying it could take more time.

As I sold the MRK and PFE covered calls, I posted these comments on last week’s covered calls trades update:

8.7.23. MRK $104.96. I sold MRK 8.25.23 (18 days) $108 calls for $0.67. ARoR is about 9.66%. Delta .26, OTM 74.9%, IV 20.4%. Barchart strong 72% sell. Analyst average rating is strong buy at 4.53. High target is $135, Mean $124.95, low $113. My cost $113.41. Net debit is about $112.62.

8.8.23. PFE $35.15. Sold PFE 8.25.23 (17 days) $37 calls for $0.20. Delta .21, OTM 80.82%, IV 23%. AOR about 8.22%. Dividend on net debit about 3.55%. If it is called, fine, I'll take the loss and put the money in a better opportunity.

Buying stocks and selling covered calls on them didn’t make much sense to me during the week’s ups and downs in stocks. So I did several sales of cash secured puts as I reported in the comments section on my second update on my August puts trades.

I do a lot of small trades to diversify my risks. A dozen of my covered calls trades will expire on Friday, 8.18.23. They include: The Caryle Group (CG), Cisco Systems Inc. (CSCO), Dow Inc. (DOW), Devon Energy (DVN), Kimberly-Clark (KMB), Newmont Mining Corp. (NEM), Proctor & Gamble (PG), Southern Co. (SO) and Exxon Mobil (XOM).

Kinder Morgan (KMI), MRK and PFE covered calls will expire on 8.25.23.

As of Friday’s close, it appears that the covered calls that are most likely to be called next Friday are XOM 8.1.23 $111 strike calls, which is why I sold XOM 8.25.23 $109 strike puts last week.

XOM closed Friday at $$111.83. XOM is an 8%, or weak buy that looks like it is strengthening, according to Barchart.com. My XOM cost is $109 and the cumulative net debit is $106.74. XOM could be called before it goes ex-dividend on Tuesday, 8.15.23. Net debit is the cost of the equity less collected and expected options premium income.

If I get lucky and collect XOM’s $0.91 dividend and the $2 gain plus the $0.55 call premium on the XOM covered call trade, I’ll make $3.66 a share, or $3,660 per 100-share call options contract. If I XOM is called and I lose the $0.91 dividend, I’ll still make $2.55 a share. Last week, I sold XOM 8.25.23 $109 puts for $1.10 a share, which would cover the lost dividend.

PG closed Friday at $157.02. My PG 8.18.23 $155 calls look like they’ll be called. I paid $151.70 for the stock and the cumulative net debit after deducting collected options premiums is $148.32 a share. PG is an 88% buy on Barchart.com, and I’ll probably sell puts on it after the calls expire.

A lot can happen to stock and options prices in the next five days of trading, which is one thing that makes trading covered calls interesting.

Between my portfolio updates, I report my thoughts and trades in the comments section of this and other posts.

I respond to comments on the comments section where readers’ comments are posted. That is, if you have a question about this article or other comments, I'll discuss your questions with you in the comments section below this article.

Thanks for reading Stock Picking, Options Trading for Income! Subscribe for free to receive new posts and support my work.

LINKs:

Home Page. See my more than 100 articles on options trading, stocks and watch lists. If you read several of these articles, you’ll learn how my strategies are meant to work. No guarantees. Links to useful web sites are on the lower right corner of the home page. Scroll down.

Follow @RealDonJohnson on twitter.com and FaceBook.com. Or follow me on Substack.com/Notes where my byline is my handle.

August Covered Calls Trades On 13 Dividend Stocks Update #1

August Covered Calls Trades On Dividend Stocks Yield 12.2% in Options Premiums

August Covered And Naked Puts Options Trades Update # 2

August Covered And Naked Puts Options Trades On Paycom And Other Stocks Update #1

August Covered And Naked Puts Options Trades Yield About 12.8% In Options Premiums.

How Owners of AT&T, Verizon, T-Mobile Can Use Covered Calls, Dividends To Offset Losses Update #1

July Puts Options Trades On Dividend Stocks Yield 10.5% in options premiums.

July Covered Calls Options Trades on Dividend Stocks Returned 9.97% Plus Dividends, Capital Gains

July Covered Calls Trades on Dividend Stocks Update #5

July Covered Calls Trades on Dividend Stocks Update #4

July Covered Calls Trades on Dividend Stocks Update #3

July Dividend Stocks Covered Calls Trades Update #2

July Dividend Stocks Covered Calls Trades Update #1

12 July Covered Calls Trades on Dividend Stocks.

Selling in The Money Covered Calls Can Yield Big Annual Returns on Risk. By Donald E. L. Johnson

How to Beat Inflation Tax, Bear Market Tax With Dividend Stocks, Covered Calls, Cash Secured Puts, by Donald E. L. Johnson.

How I Analyze Bullish Puts Options Trades With Stock Rover, By Donald E. L. Johnson.

Wars Breed Inflation, Rising Interest Rates, Market Turmoil, By Donald E. L. Johnson.

Calls vs Puts Options: What’s the Difference?

A video on how to place options trades on TDAmeritrade.com’s Think or Swim trading platform.

8.16.23. CSCO beat on earnings and revenues. But disappointing guidance initially sent CSCO down 3%. At the moment it's $52.76, down $0.39, or 0.73%. I'm glad I bought the calls back and took my profit on CSCO. I'll wait a couple of days to decide what to do with the stock.

8.16.23. XOM $108.16. XOM 8.16.23 $111 calls weren't called. So I got the $0.91 / share dividend. Ex-Dividend 8.15.23. This the second XOM $0.91/share dividend I've collected. XOM 8.25.23 $109 puts might be assigned. I bought XOM for $109 and sold for $1.10 a share, which is higher than the dividend I would have received if I had bought XOM at around $111.50 last week. After collecting covered calls options premiums and dividends, my net debit is $104.92.