August Covered And Naked Puts Options Trades Yield About 12.8% In Options Premiums

Small and large investors in dividend stocks can use covered calls and puts trades to generate monthly income from options premiums and options trading.

By Donald E.L. Johnson

Cautious Speculator

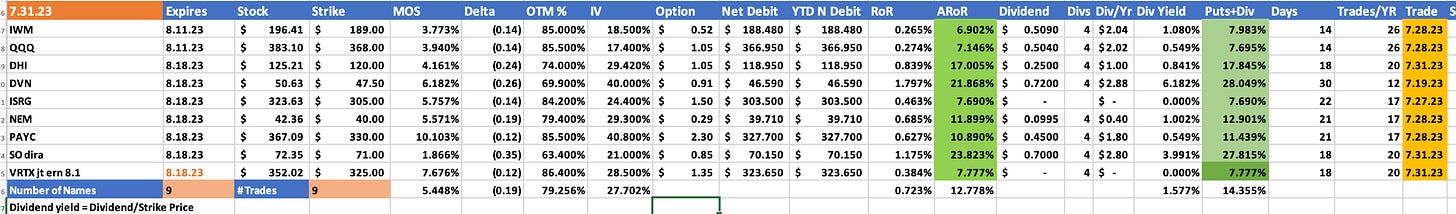

My August puts trades could yield 12.78% in options premiums income if they are not assigned.

Seven of the nine trades are for 18 days duration, one is for 25 days and a third is for 4 days.

I own three of the stocks that I have sold covered puts on.

These trades are for investors who are comfortable with the risks that come with investing in equities, stock options and other things. Compared with more complex options trades, selling puts and covered calls is relatively simple and less risky. This article is intended to be educational, not trading advice. Do your due diligence.

Since late last week I have opened nine cash secured puts trades on stocks and exchange traded funds. The average return on risk is about 0.723%, or about 12.78% annualized. The average annual dividend yields on the seven stocks and two ETFs is about 1.58%. Traders get “annualized returns on risk” when they manage to get the same RoR every month during the next 12 months regardless of what they’re trading.

The two ETFs are Russell 2000 Ishares ETF (IWM) and Nasdaq QQQ Invesco ETF (QQQ). IWM is bullish on 88% of Barchart.com’s 13 technical indicators, and QQQ’s 13 technical indicators are 100% buys. QQQ looks stronger than IWM.

Stocks with 100% buy ratings include D.R. Horton (DHI), Southern Co. (SO) and Vertex Pharmaceuticals (VRTX). Paycom Software Inc. is an 88% buy, Intuitive Surgical Inc. (ISRG) is a 56% buy and Devon Energy Corp. (DVN) is an 8%. buy.

These are momentum and growth stocks, not high yielding dividend equities. I’m trading them for premium income, not for dividends.

Their debt to equity ratios are relatively low. ISRG and PAYC price to cash flow ratios are high because they are popular with bullish investors. That makes them more risky than the others equities I’m trading. Higher risks bring higher options trading returns. That is, their puts options are relatively high priced in this low volatility market.

ISRG’s resistance is at $330.84 and its support is at $319.83. PAYC’s resistance is $379..63 and its support is about $363.17. ISRG closed Monday at $324.40. PAYC closed $368.76.

PAYC has the highest but not extreme implied volatility at 37.26%. IWM has the lowest IV at 17.86% and relatively low options prices.

The portfolio is diversified with the two ETFs, stocks that represent various market sectors and a moderate range of implied volatilities and relative risks.

Like all kinds of investing and life, trading covered calls and puts involve risks that must be managed. I try to manage risks with diversified portfolios of puts and covered calls, high yielding ETFs and cash.

I already own DVN, NEM and SO and would buy more shares of those stocks if they were assigned at the strike prices. All three are good dividend stocks.

I respond to comments on the comments section where readers’ comments are posted. That is, if you have a question about this article or other comments, I'll discuss it with you in the comments section below this article.

LINKs:

Home Page. See my more than 100 articles on options trading, stocks and watch lists. If you read several of these articles, you’ll learn how my strategies are meant to work. No guarantees. Links to useful web sites are on the lower right corner of the home page. Scroll down.

Follow @RealDonJohnson on twitter.com and FaceBook.com. Or follow me on Substack.com/Notes where my byline is my handle.

Selling in The Money Covered Calls Can Yield Big Annual Returns on Risk. By Donald E. L. Johnson

August Covered Calls Trades On Dividend Stocks Yield 12.2% in Options Premiums

July Puts Options Trades On Dividend Stocks Yield 10.5% in options premiums.

July Covered Calls Options Trades on Dividend Stocks Returned 9.97% Plus Dividends, Capital Gains

July Covered Calls Trades on Dividend Stocks Update #5

July Covered Calls Trades on Dividend Stocks Update #4

July Covered Calls Trades on Dividend Stocks Update #3

July Dividend Stocks Covered Calls Trades Update #2

July Dividend Stocks Covered Calls Trades Update #1

12 July Covered Calls Trades on Dividend Stocks.

June Covered Calls Trades Returned 21.6% Annualized.

June Covered Calls Portfolio Update # 3.

June Covered Calls Portfolio Update #2.

June Covered Calls Portfolio Update #1.

11 Dividend Stocks in My June Covered Calls Portfolio.

5 Dividend Stocks for June Covered Calls Trades.

20 Ideas for Adjusting Your Stock and Bond Portfolio, by Christina Lourosa-Ricardo.

How to Beat Inflation Tax, Bear Market Tax With Dividend Stocks, Covered Calls, Cash Secured Puts, by Donald E. L. Johnson.

Wars Breed Inflation, Rising Interest Rates, Market Turmoil, By Donald E. L. Johnson.

Ways to use StockRover.com to analyze stocks

Calls vs Puts Options: What’s the Difference?

A video on how to place options trades on TDAmeritrade.com’s Think or Swim trading platform.

Morningstar.com lowers its fair value estimate for PAYC to $370 from $388. https://www.morningstar.com/stocks/paycom-earnings-firm-posts-mixed-results-amid-module-conversion-headwinds

Analysts’ Opinions Are Mixed on These Technology Stocks: Paycom (PAYC), Pinterest (PINS) and Alight (ALIT). https://www.tipranks.com/news/blurbs/analysts-opinions-are-mixed-on-these-technology-stocks-paycom-payc-pinterest-pins-and-alight-alit