August Covered Calls Trades On 13 Dividend Stocks Update #1

Small and large dividend stock investors can use covered calls and puts trades to generate monthly income from options premiums and options trading.

By Donald E. L. Johnson

Cautious Speculator

After some huge rallies, many stocks are looking over valued and prime for price corrections, but no one can predict stock prices.

Six of my 13 August covered calls stocks look over valued.

Stocks with high Barchart.com buy ratings appear to be over extended and ready to correct.

It doesn’t look like any of this months covered calls trades will be called.

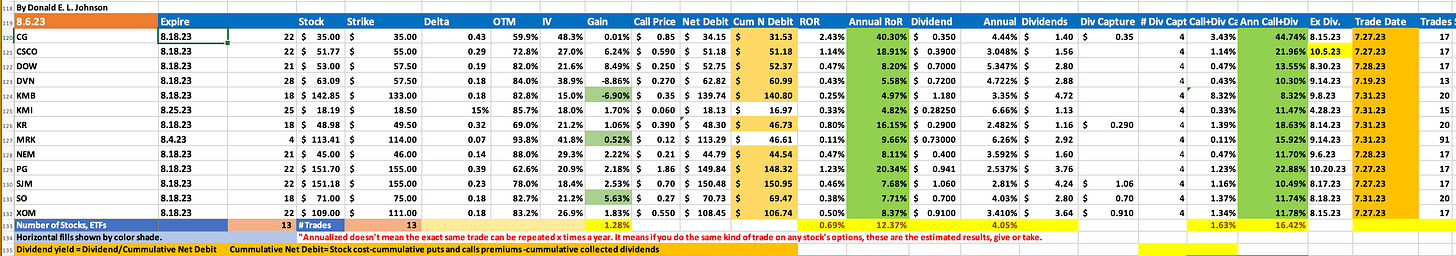

To date, I’ve done 13 covered calls trades on 13 stocks I own, including my July 31 sale of covered calls options on Kinder Morgan (KMI). That KMI $0.06 options premium looks too small to trade, but it represents a 4.82% annual return on risk (ARoR). Add that 4.82% options premium to the 6.66% annual dividend yield on the cumulative net debit and you have an ARoR of 11.6% in an IRA account. ARoR assumes a trader can get the same results on the same kind of trades every month in a year.

To get a taxable equivalent ARoR, multiply your effective tax rate times the 11.6%. Thus, 11.6 times 1.15 equals 13.34% and 11.6 times 1.35 equals 15.7% when the effective federal income tax rates are 15% and 35%.

Caryle Group (CG), Cisco Systems (CSCO), Kimberly-Clark (KMB), Kinder Morgan (KMI) and Kroger (KR) are trading below their fair value estimates, according to this StockRover.com table.

Devon Energy Corp. (DVN), Merck & Co. (MRK), J.M. Smucker Co. (SJM) and Exxon Mobil Corp. (XOM) are trading above their estimated fair values. One site’s fair value estimates are one site’s estimates because each publisher of fair value estimates uses different discount rates and other assumptions when they calculate fair values. There is no fair value estimate for Southern Co. (SO) on StockRover.com.

CG sports a 56% buy rating that is looking weak on Barchart.com. CSCO’s 100% buy rating also is looking weak. Stocks with 100% buy ratings look likely to correct because their recent bull moves appear to be over extended. Proctor & Gamble Co. (PG) has an 88% buy rating that is weakening, and Dow Inc. (DOW) has a weakening 32% buy rating.

I own these stocks because they pay good dividends. It appears that this month’s covered calls trades on these stocks will generate 12.37% annualized returns on risk if they aren’t called. None of these trades look like they’ll be called. That is, this month there probably not be any sales of the stocks with capital gains.

MRK covered calls expired on 8.4.23 and will be rolled over this week to a trade that expires on 8.25.23. Watch the comments section where I’ll report the trade.

I may buy back the calls on CG and DVN this week and roll the trades over to late August or mid September expiration covered calls positions. This would hike my August covered calls options premiums returns on these stocks.

This table shows how the August portfolio stocks have performed during the last month, three months and 52 weeks.

Between my portfolio updates, I report my thoughts and trades in the comments section of this and other posts. When I do trades, I announce them in the comments section.

I respond to comments on the comments section where readers’ comments are posted. That is, if you have a question about this article or other comments, I'll discuss your questions with you in the comments section below this article.

Thanks for reading Stock Picking, Options Trading for Income! Subscribe for free to receive new posts and support my work.

LINKs:

Home Page. See my more than 100 articles on options trading, stocks and watch lists. If you read several of these articles, you’ll learn how my strategies are meant to work. No guarantees. Links to useful web sites are on the lower right corner of the home page. Scroll down.

Follow @RealDonJohnson on twitter.com and FaceBook.com. Or follow me on Substack.com/Notes where my byline is my handle.

August Covered And Naked Puts Options Trades On Paycom And Other Stocks Update #1

How Owners of AT&T, Verizon, T-Mobile Can Use Covered Calls, Dividends To Offset Losses Update #1

Selling in The Money Covered Calls Can Yield Big Annual Returns on Risk. By Donald E. L. Johnson

August Covered And Naked Puts Options Trades Yield About 12.8% In Options Premiums.

August Covered Calls Trades On Dividend Stocks Yield 12.2% in Options Premiums

July Puts Options Trades On Dividend Stocks Yield 10.5% in options premiums.

July Covered Calls Options Trades on Dividend Stocks Returned 9.97% Plus Dividends, Capital Gains

July Covered Calls Trades on Dividend Stocks Update #5

July Covered Calls Trades on Dividend Stocks Update #4

July Covered Calls Trades on Dividend Stocks Update #3

July Dividend Stocks Covered Calls Trades Update #2

July Dividend Stocks Covered Calls Trades Update #1

12 July Covered Calls Trades on Dividend Stocks.

20 Ideas for Adjusting Your Stock and Bond Portfolio, by Christina Lourosa-Ricardo.

How to Beat Inflation Tax, Bear Market Tax With Dividend Stocks, Covered Calls, Cash Secured Puts, by Donald E. L. Johnson.

Wars Breed Inflation, Rising Interest Rates, Market Turmoil, By Donald E. L. Johnson.

Ways to use StockRover.com to analyze stocks

Calls vs Puts Options: What’s the Difference?

A video on how to place options trades on TDAmeritrade.com’s Think or Swim trading platform.

8.10.23. The inflation news is good, but.

I just sent this note to a Bloomberg editor:

Why isn’t anyone assessing the inflationary impact of the UPS contract that will pay some drivers $170,000 a year?

FedEx and Amazon will have to match those wages or come close to it. Other truckers will have to follow. And don’t forget the recent rail labor settlement.

It seems to me that the biggest loser will be Amazon. It willl have to hike prices and change its shipping deals, which will make people reconsider e-commerce vs. local malls?

Just some thoughts.

8.8.23. PFE $35.15. Sold PFE 8.25.23 (17 days) $37 calls for $0.20. Delta .21, OTM 80.82%, IV 23%. AOR about 8.22%. Dividend on net debit about 3.55%. If it is called, fine, I'll take the loss and put the money in a better opportunity.