By Donald E. L. Johnson

Cautious Speculator

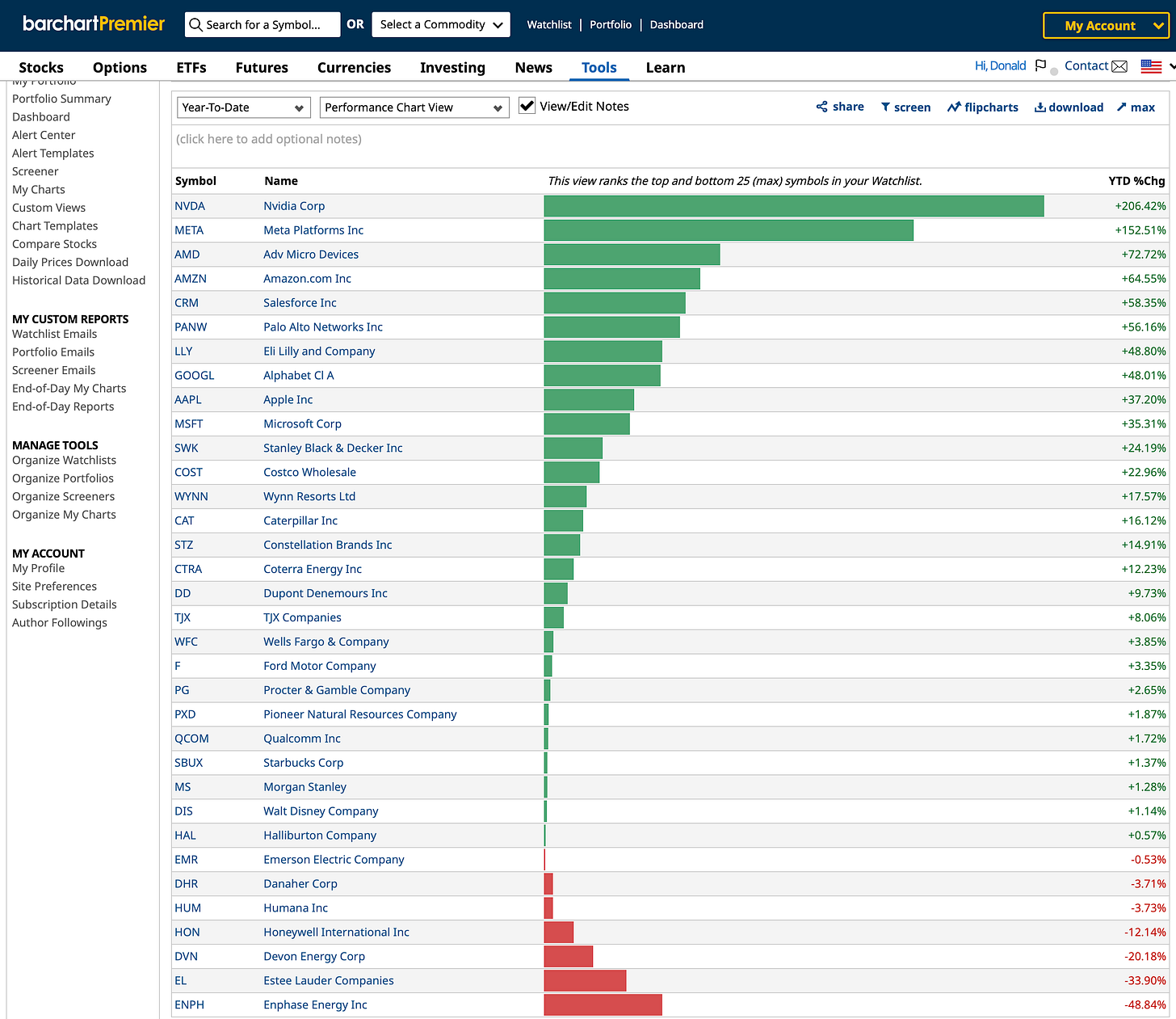

Jim Cramer has a lot of detractors and skeptics, but a lot of his stocks are doing very well year to date.

NVDA, META, AMD and AMZN are his biggest YTD winners.

Four of his stocks are 100% buys and two are 100% sells on Barchart.com.

CNBC’s Jim Cramer and his Charitable Trust Club have a lot of critics, but year to date, 16 of the 33 stocks that he has traded are up 12% to 205%. Another 11 stocks are up 0.41% to 9.68%. And seven of his investments are down 0.59% to 48.81%.

I look for stock ideas and possible covered calls and cash secured puts trades in Cramer’s and other stock picking guru’s portfolios.

Cramer trades in out of his stocks frequently. He has to have something to talk about on TV, and that apparently is his trading style. He seems to be a buy and hold investor in Apple (AAPL). Microsoft (MSFT) and Disney (DIS).

The 33 stocks on this list have been mentioned in his daily e-mails to prospects and former free subscribers like me. Only his club members know how much money he makes on his investments and what his investments are and have been.

Nvida Corp. (NVDA) is the biggest year to date winner. Meta Platforms Inc. (META), Advanced Micro Devices (AMD) and Amazon (AMZN) are the next three winners YTD.

Over the last month, the other winners have been Eli Lilly (LLY), Humana Inc. (HUM), Pioneer Natural Resources (PDX), Caterpillar (CAT), Coterra Energy (CTRA), Halliburton Co. (HAL), Danaher Corp. (DHR), Constellation Brands (STZ), Alphabet CI A (GOOGL), Emerson Electric Co. (EMR), Dupont Denemours Inc. (DD), Proctor & Gamble Co. (PG), Costco Wholesale (COST), AMZN, TJX Co. (TJX), Morgan Stanley (MS) and Devon Energy Corp. (DVN).

Emphases Energy Inc. (ENPH) is the biggest loser. I don’t think ENPH is in the portfolio any more. Cramer hasn’t mentioned it in his emails with his other energy holdings since August 1.

As shown above, 17 of the 33 stocks have been sinking over the last month.

This StockRover.com table shows that the stocks Cramer owns and has owned have an average price earnings ratio (PE) of 24.4, a price to cash flow (P/CF) ratio of 16.8, a price to free cash flow (P/FCF) ratio of a relatively high 33.9 and a 6.0% cash flow yield.

AMZN’s P/FCF is a very high 445.6. LLY’s is 153 and NVDA’s is 215.6. Those numbers distort the average for the portfolio. They show that the three companies are very popular with investors, and they probably show that their stock prices are very over bought and investors in them are anticipating exceptional growth for several years. If they don’t perform, they’ll be punished. The question is, when will Cramer and others decide to take profits on them?

When I last wrote about Cramer’s portfolio on March 19, he had one stock, NVDA, with a 100% buy rating on Barchart.com. DVN and PDX had 100% sell ratings.

At this point, 4 of the 33 stocks get 100% buy ratings from Barchart.com. They are GOOGL, AMZN, LLY and COST. Two stocks have 100% ratings. They are Estée Lauder (EL) and ENPH. Eleven get 8% to 100% sell ratings.

Cramer and his staff work hard to pick good stocks. He seems to hold some losers a little longer than he should, but who doesn’t? Nobody is perfect.

When I see 100% buy ratings I look for dips and corrections. When I see 100% sell ratings, I look at valuation metrics to see whether the stocks are correcting or worth their depressed prices and not much more.

Between my portfolio updates, I report my thoughts and trades in the comments section of this and other posts.

I respond to comments on the comments section where readers’ comments are posted. That is, if you have a question about this article or other comments, I'll discuss your questions with you in the comments section below this article.

Thanks for reading Stock Picking, Options Trading for Income! Subscribe for free to receive new posts and support my work.

LINKs:

Home Page. See my more than 100 articles on options trading, stocks and watch lists. If you read several of these articles, you’ll learn how my strategies are meant to work. No guarantees. Links to useful web sites are on the lower right corner of the home page. Scroll down.

Follow @RealDonJohnson on twitter.com and FaceBook.com. Or follow me on Substack.com/Notes where my byline is my handle.

AAPL, AXP, CAT, CSCO, FDX, HON, ICE, OPRA, TJX Covered Calls Update #1

August Covered Calls Trades On 14 Dividend Stocks Update #2

August Covered Calls Trades On 13 Dividend Stocks Update #1

August Covered Calls Trades On Dividend Stocks Yield 12.2% in Options Premiums

August Covered And Naked Puts Options Trades Update # 2

August Covered And Naked Puts Options Trades On Paycom And Other Stocks Update #1

August Covered And Naked Puts Options Trades Yield About 12.8% In Options Premiums.

How Owners of AT&T, Verizon, T-Mobile Can Use Covered Calls, Dividends To Offset Losses Update #1

July Puts Options Trades On Dividend Stocks Yield 10.5% in options premiums.

July Covered Calls Options Trades on Dividend Stocks Returned 9.97% Plus Dividends, Capital Gains

July Covered Calls Trades on Dividend Stocks Update #5

July Covered Calls Trades on Dividend Stocks Update #4

July Covered Calls Trades on Dividend Stocks Update #3

July Dividend Stocks Covered Calls Trades Update #2

July Dividend Stocks Covered Calls Trades Update #1

12 July Covered Calls Trades on Dividend Stocks.

Selling in The Money Covered Calls Can Yield Big Annual Returns on Risk. By Donald E. L. Johnson

How to Beat Inflation Tax, Bear Market Tax With Dividend Stocks, Covered Calls, Cash Secured Puts, by Donald E. L. Johnson.

How I Analyze Bullish Puts Options Trades With Stock Rover, By Donald E. L. Johnson.

Wars Breed Inflation, Rising Interest Rates, Market Turmoil, By Donald E. L. Johnson.

Calls vs Puts Options: What’s the Difference?

A video on how to place options trades on TDAmeritrade.com’s Think or Swim trading platform.

8.16.23. wsj.com has a very bearish article on EL. Estes Lauder bet on China is not looking so pretty. https://www.wsj.com/articles/estee-lauders-big-bet-on-china-is-looking-not-so-pretty-184ac149?mod=business_feat1_retail_pos4

8.16.23. Cramer just disclosed that GE HealthCare (GEHC) is owned by his investment club. It doesn't have a Barchart.com buy or sell rating, but it is trading under its 50 day moving average.

StockRover.com shows that GEHC's price is $70.67, RSI is 22.1, PE is 19.6, P/CF is 15.6, P/FCF is 18.9, dividend yield is 0.2%, Cash Flow Yield is 6.4%, FCF Yield is 5.3%, 2% of its stock float has been shorted.