July Puts Options Trades On Dividend Stocks Yield 10.5% In Options Premiums

Small and large dividend stock investors can use covered calls and puts trades to generate monthly income from options premiums and options trading.

By Donald E. L. Johnson

Cautious Speculator

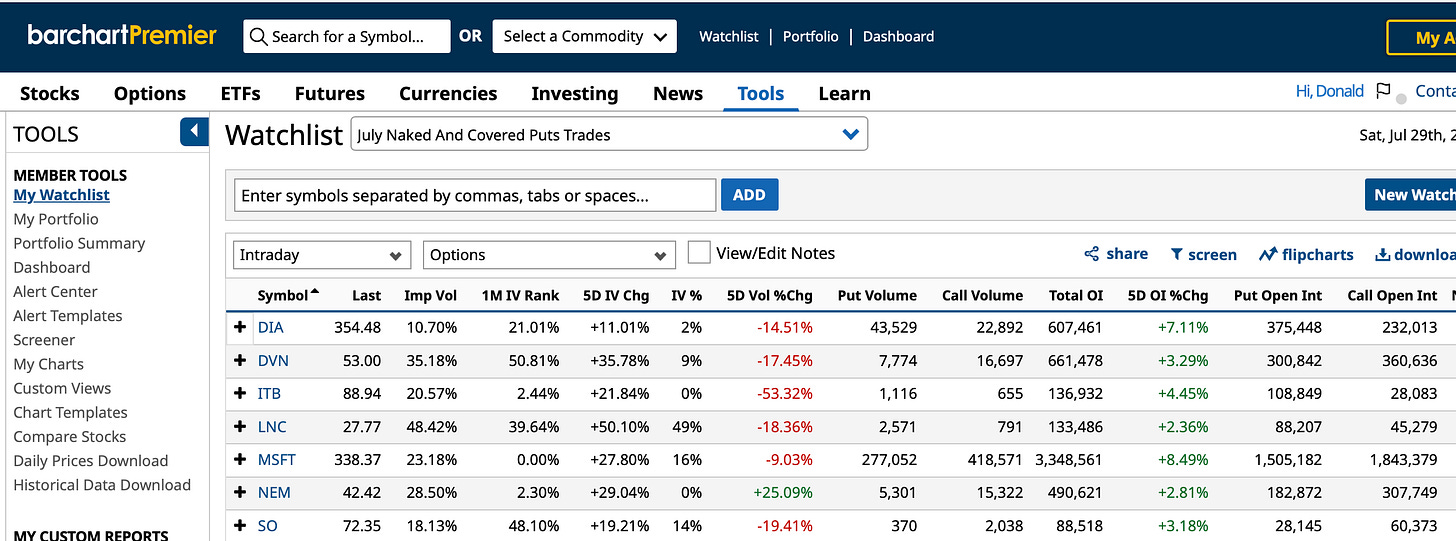

Seven July cash secured puts options trades on five stocks and two ETFs generated 10.5% options premiums returns.

Trading puts options during earnings season reduces risks.

Low volatility and low options prices reduced incentives to trade covered calls and puts during July.

This newsletter is for investors who are comfortable with the risks involved in trading securities and options. It is intended to be educational, not trading advice. Most successful traders read a lot and do their due diligence before trading.

July’s seven cash secured puts options trades that I did on five dividend stocks and two exchange traded funds expired worthless and yielded 10.496% annualized in options premium income for the month.

In other words, all of my sales of puts worked. None of the puts were assigned because all of the equities closed at prices above their strike prices on 7.28.23. Selling put is a bullish trade because the seller of puts contracts to buy puts at the strike price if the puts are assigned.

I reported on my covered calls trades in my previous post. The next two posts will discuss my sales of covered calls and puts that expire in August. See the links below for more details about my trades and how I do them.

During the July I sold puts on two exchange traded funds because it is less risky to trade covered calls and puts on ETFs than on stocks during earnings season. Less risk produces lower returns, but that’s the price you pay for risk management.

For example, I sold Dow Industrials SPDR (DIA) $322 puts for a 3.142% ARoR when DIA was at $337.43. The delta on the trade was -.10. That suggested that there was a 10% probability that the DIA puts would be assigned. I picked the low risk of assignment trade because I didn’t want to own DIA unless I could get it at the $322 strike. That strike was at a 4.573% discount, or margin of safety, from the price of the ETF when I did the 21-day trade.

I also sold puts on US Home Construction Shares ETF (ITB). Both DIA and ITB have 100% buy ratings at Barchart.com.

While the annualized return wasn’t great, it helped me achieve my monthly options premiums income target without taking a huge risk on the trade.

I diversified my risks by doing seven small trades instead of one or two bigger ones. With the low market volatility, options prices have been low. So there wasn’t as much financial incentive to do more trades last month. I’m planning to do more trades that expire in August.

I expect to sell puts on DIA, ITB, Microsoft Corp. (MSFT), Newmont Mining Corp. (NEM) and Southern Co. (SO) but not on Lincoln National Corp. (LNC), which has a weak buy rating and hold ratings from Wall Street Analysts.

I respond to comments on the comments section where readers’ comments are posted. That is, if you have a question about this article, I'll discuss it with you in the comments section below this article.

LINKs:

Home Page. See my more than 100 articles on options trading, stocks and watch lists. If you read several of these articles, you’ll learn how my strategies are meant to work. No guarantees. Links to useful web sites are on the lower right corner of the home page. Scroll down.

Follow @RealDonJohnson on twitter.com and FaceBook.com. Or follow me on Substack.com/Notes where my byline is my handle.

Selling in The Money Covered Calls Can Yield Big Annual Returns on Risk. By Donald E. L. Johnson

July Covered Calls Options Trades on Dividend Stocks Returned 9.97% Plus Dividends, Capital Gains

July Covered Calls Trades on Dividend Stocks Update #5

July Covered Calls Trades on Dividend Stocks Update #4

July Covered Calls Trades on Dividend Stocks Update #3

July Dividend Stocks Covered Calls Trades Update #2

July Dividend Stocks Covered Calls Trades Update #1

12 July Covered Calls Trades on Dividend Stocks.

June Covered Calls Trades Returned 21.6% Annualized.

June Covered Calls Portfolio Update # 3.

June Covered Calls Portfolio Update #2.

June Covered Calls Portfolio Update #1.

11 Dividend Stocks in My June Covered Calls Portfolio.

5 Dividend Stocks for June Covered Calls Trades.

20 Ideas for Adjusting Your Stock and Bond Portfolio, by Christina Lourosa-Ricardo.

How to Beat Inflation Tax, Bear Market Tax With Dividend Stocks, Covered Calls, Cash Secured Puts, by Donald E. L. Johnson.

Wars Breed Inflation, Rising Interest Rates, Market Turmoil, By Donald E. L. Johnson.

Ways to use StockRover.com to analyze stocks

Calls vs Puts Options: What’s the Difference?

A video on how to place options trades on TDAmeritrade.com’s Think or Swim trading platform.

I think October cycle puts should workout fine...although you might see its all in red now... 2 weeks+ to expiry, a market bounce will just put them back to the right spot...

Donald'

I have been selling CC's for years,

on certain stocks , exp never beyond 30 days, and the biggest lost i

had was at the beginning : 17%.

I have learned much since then ,

Dont you use contingency orders ?

Hell, i remember when the market was more volatile

on my most risky positions i had 3 levels of contingency orders GTC,

that way i could go to work, and sleep without stressing about how much

i could win / loose , i knew in advance.

Other positions i have been rolling Options for over 2 years without a break....

I fix myself a minimum 0.79% gain / 14 day target.

Also you will find that at certain times , the use of other Option strategies

along side CC's and CSP's will prove useful to profit from your position.