August Covered Calls Options Trades Yielded 14.6% In Options Premiums

Small and large dividend stock and ETF investors can use covered calls and puts trades to generate monthly income from options premiums and options trading.

By Donald E. L. Johnson

Cautious Speculator

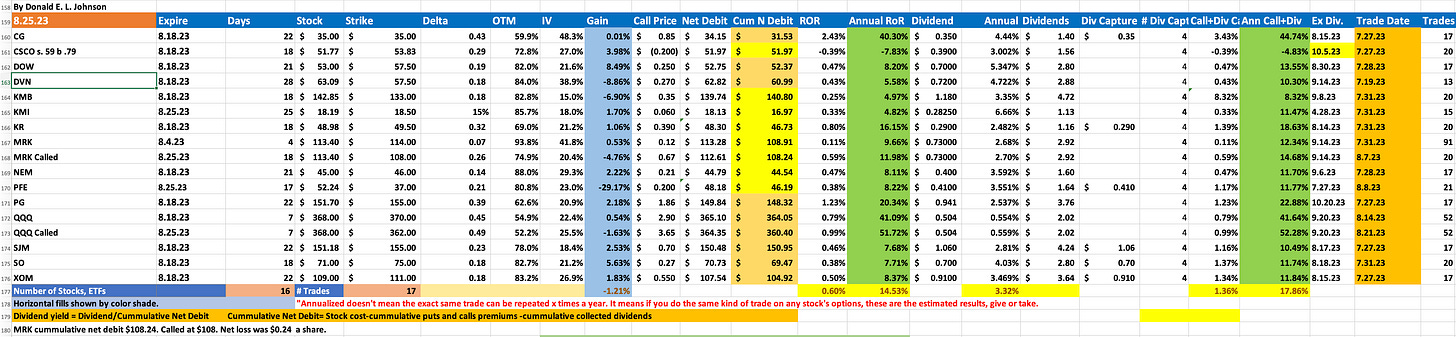

Average annualized options premiums returns on August covered calls trades totaled 14.61% up from 9.97% in July and a bit higher than the year-to-date returns of 14.48%.

Total returns were increased 53.3% by dividends collected during August. Net realized capital gains increased the month’s total income another 17.2% over the options premiums income.

The 14 stocks’ and one ETF’s average annual dividend yields are about 3.75%.

MRK and QQQ covered calls were exercised.

August covered calls trades on dividend stocks and one ETF generated and average of 0.5% options premiums returns, or 14.61% annualized.

Annual dividend yields on the 14stocks and a ETF averaged another 3.32%. Call options premiums plus dividends were a potential 17.93% annualized. Annual RoR assumes that the same results can be realized every month during the next 12 months.

During August, there were 17 covered calls trades on 14 stocks and one ETF.

My year to date annualize covered calls options premium returns are averaging 14.48%. Premiums plus dividends annualized are averaging about 17.8%. Year to date, I’ve done 108 covered calls trades on 66 stocks. Educational articles about those trades and the risks involved in doing such trades are on the home page.

Merck & Co. (MRK) and Nasdaq QQQ Invesco ETF (QQQ) were called. I did two covered calls trades on each of them.

In addition to MRK and QQQ, I did covered calls trades on The Carlyle Group (CG), Cisco Systems (CSCO), Dow Inc. (DOW), Devon Energy Corp. (DVN), Kinder Morgan (KMI), Kroger Co. (KR), Newmont Mining Corp. (NEM), Pfizer Inc. (PFE), Proctor & Gamble Co. (PG), J.M. Smucker (SJM), Southern Co. (SO) and Exxon Mobil Corp. (XOM). I also collected money market monthly interest income and dividends on other investments.

Between my weekly portfolio updates, I report my thoughts and trades in the comments section of this and other posts. When I do trades, I post reports in the comments section on the most recently published articles.

Several months of collecting puts and calls on MRK reduced the net debit to $108.24 per share. That left me with a $0.24 per share loss on the MRK trade. On Friday, I sold MRK 9.29.23 expiration puts for $1.66 a share. MRK closed Friday at $110.21.

Selling QQQ puts and calls reduced QQQ’s net debit to $360.40. It was called at $362, giving me a $1.60 a share profit. On Friday, QQQ closed at $364.02.

I respond to comments on the comments section where readers’ comments are posted. That is, if you have a question about this article or other comments, I'll discuss your questions with you in the comments section below this article.

Thanks for reading Stock Picking, Options Trading for Income! Subscribe for free to receive new posts and support my work.

LINKs:

Home Page. See my more than 100 articles on options trading, stocks and watch lists. If you read several of these articles, you’ll learn how my strategies are meant to work. No guarantees. Links to useful web sites are on the lower right corner of the home page. Scroll down.

Follow @RealDonJohnson on twitter.com and FaceBook.com. Or follow me on Substack.com/Notes where my byline is my handle.

September Puts Options Trades on 4 Stocks

September Covered Calls Trades On 4 Dividend Stocks

August Covered And Naked Puts Options Trades Update #3

16 Jim Cramer Stocks Are Up 12% to 205% Year To Date

AAPL, AXP, CAT, CSCO, FDX, HON, ICE, OPRA, TJX Covered Calls Update #1

August Covered Calls Trades On 14 Dividend Stocks Update #2

August Covered Calls Trades On 13 Dividend Stocks Update #1

August Covered Calls Trades On Dividend Stocks Yield 12.2% in Options Premiums

August Covered And Naked Puts Options Trades Update # 2

August Covered And Naked Puts Options Trades On Paycom And Other Stocks Update #1

August Covered And Naked Puts Options Trades Yield About 12.8% In Options Premiums.

How Owners of AT&T, Verizon, T-Mobile Can Use Covered Calls, Dividends To Offset Losses Update #1

July Puts Options Trades On Dividend Stocks Yield 10.5% in options premiums.

July Covered Calls Options Trades on Dividend Stocks Returned 9.97% Plus Dividends, Capital Gains

July Covered Calls Trades on Dividend Stocks Update #5

July Covered Calls Trades on Dividend Stocks Update #4

July Covered Calls Trades on Dividend Stocks Update #3

July Dividend Stocks Covered Calls Trades Update #2

July Dividend Stocks Covered Calls Trades Update #1

12 July Covered Calls Trades on Dividend Stocks.

Selling in The Money Covered Calls Can Yield Big Annual Returns on Risk. By Donald E. L. Johnson

How to Beat Inflation Tax, Bear Market Tax With Dividend Stocks, Covered Calls, Cash Secured Puts, by Donald E. L. Johnson.

How I Analyze Bullish Puts Options Trades With Stock Rover, By Donald E. L. Johnson.

Wars Breed Inflation, Rising Interest Rates, Market Turmoil, By Donald E. L. Johnson.

Calls vs Puts Options: What’s the Difference?

A video on how to place options trades on TDAmeritrade.com’s Think or Swim trading platform.

Thank you for the trade updates. Do you share the spreadsheet template that you use? My skill in spreadsheets is lacking.