AMZN, META, MSFT And NVDA Posted Big Gains. November Puts Trades Update #4

Small and large dividend stock and ETF investors can use covered calls and puts trades to generate monthly income from options premiums and options trading.

By Donald E. L. Johnson

Cautious Speculator

Bullish momentum and bullish price targets signaled that some hot stocks might move higher. Four of the 5 covered last week did.

I sold puts on three of the stocks.

And I sold more puts on Caterpillar and Deere.

Sometimes it pays to trade stocks with bullish point and figure price objectives, bullish fair value estimates and good to strong buy ratings from stock analysts. And sometimes bullish trades on technically strong stocks don’t work short term.

In an attempt to show how I pick stocks last week, I explained why five high fliers might be buys and good trades for covered calls and cash secured puts traders. I elaborated on that post with 13 comments on the article.

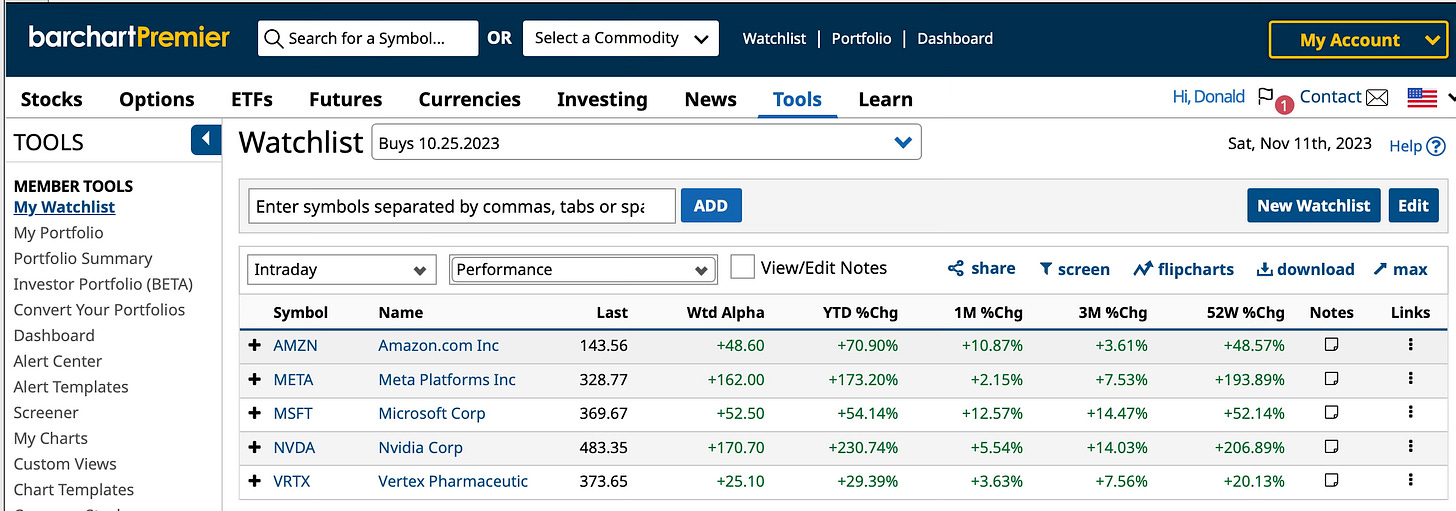

Four of the five stocks gained last week. Amazon.com (AMZN) rose to $143.56 from $138.60; Meta Platforms Inc. (META) rose to $328.77 from $314.60; Microsoft Corp. (MSFT) rose to $369.67 from $352.80; and Nvidia Corp. (NVDA) rose to $483.35 from $450.05. Vertex Pharmaceuticals (VRTX) fell to $373.65 from $376.20 even though or maybe because it had a 100% buy rating on Barchart.com. It still does.

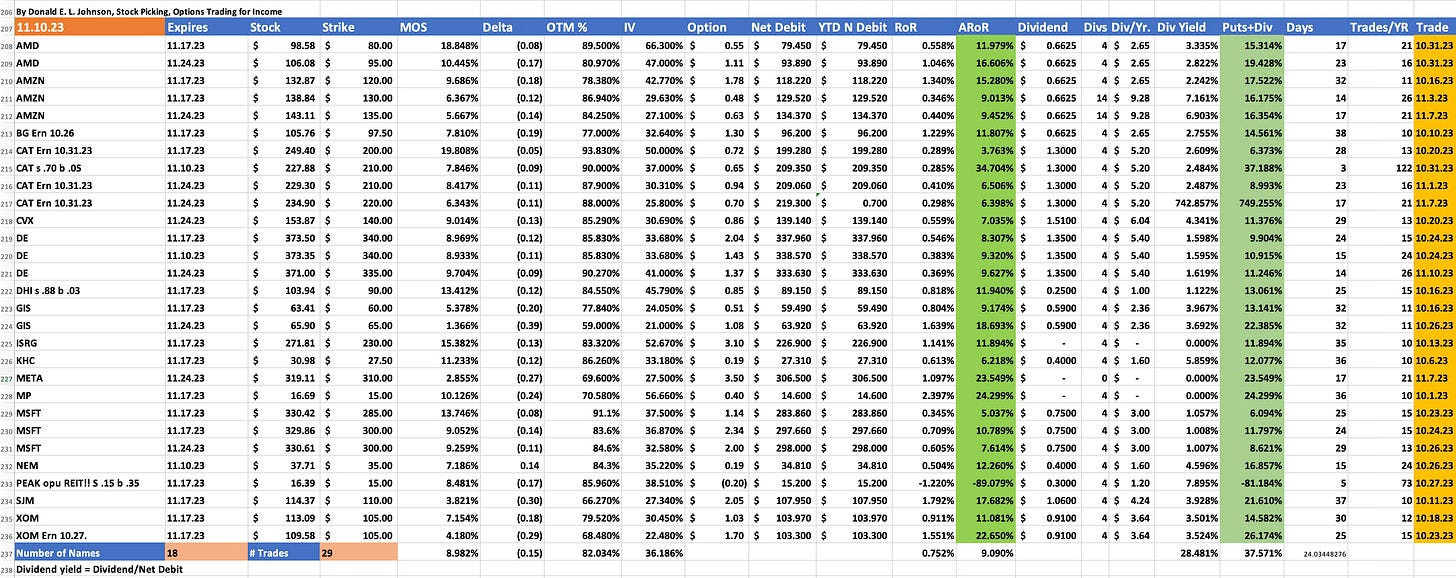

After I posted the article, I sold puts on AMZN, Caterpillar Inc. (CAT) and Deere & Co. (DE). These were roll over trades that will replace puts trades that expired on 11.10.23 or will expire on 11.17.23. I also sold puts on META and tried to sell puts on VRTX but the order didn’t get filled.

The 29 puts trades on 18 stocks that will expire this month are yielding an average of 9.1% in options premiums, annualized. ARoR assumes that I can achieve or exceed the 0.752% average RoR every month over the next 12 months.

Obviously, if I’d bought any of the five stocks that I covered last week, I would have made nice gains on four of the trades and lost money on VRTX. I chose to sell puts for options premium income instead of speculating on the stocks when it was hard to guess where the markets were going. Trading stocks and options is risky and I try to manage my risks by selling covered calls and cash secured puts.

Newmont Mining Corp (NEM) closed Friday at $34.20 was assigned at $35 on 11.10.23. Next week I’ll sell covered calls on the newly acquired NEM shares. My net debit on NEM, which I’ve owned for a few months, is $38.90. With Exxon Mobil Corp. (XOM) at $103.75, they could be assigned at $105 on 11.17.23. If they’re assigned, I’ll sell covered calls on them.

I respond to comments on the comments section where readers’ comments are posted. That is, if you have a question about this article or other comments, I'll discuss your questions with you in the comments section below this article.

LINKs:

Home Page. See my more than 150 articles on options trading, stock picking and watch lists. If you read several of these articles, you’ll learn how my strategies are meant to work. No guarantees. Links to useful web sites are on the lower right corner of the home page. Scroll down.

Follow @RealDonJohnson on twitter.com and FaceBook.com. Or follow me on Substack.com/Notes where my byline is my handle.

25 November 2023 Cash Secured Puts Trades Update #3

5 Bullish Stocks For Covered Calls, Puts Stock Options Trades

Jim Cramer's 4 Best Covered Calls Stocks

How I'm Trading Amazon Covered Calls, Cash Secured Puts Stock Options For Options Premium Income

32 October 2023 Covered Calls Trades Update #2

October 2023 Cash Secured Puts Trades Update #2

10 November 2023 Covered Calls Trades Update #1

20 November 2023 Cash Secured Puts Trades Update #2

7 November 2023 Covered Calls Trades Are Yielding 13.3%

10 November 2023 Cash Secured Puts Trades Update #1

5 November 2O23 Cash Secured Puts Options Trades

Selling in The Money Covered Calls Can Yield Big Annual Returns on Risk. By Donald E. L. Johnson

How to Beat Inflation Tax, Bear Market Tax With Dividend Stocks, Covered Calls, Cash Secured Puts, by Donald E. L. Johnson.

How I Analyze Bullish Puts Options Trades With Stock Rover, By Donald E. L. Johnson.

Wars Breed Inflation, Rising Interest Rates, Market Turmoil, By Donald E. L. Johnson.

Calls vs Puts Options: What’s the Difference?

A video on how to place options trades on TDAmeritrade.com’s Think or Swim trading platform.