12 Jim Cramer stocks look like buys

One way to find bullish stocks is to look at stock gurus' stock portfolios. Create watch lists on Barchart.com. Trade the best dividend stocks for your portfolio and income goals.

By Donald E. L. Johnson

Cautious Speculator

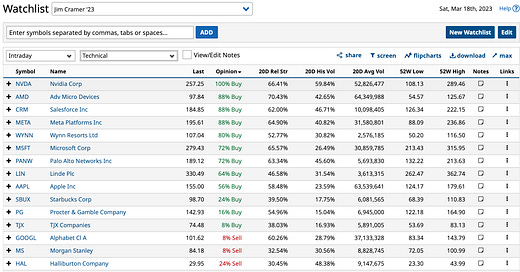

Jim Cramer’s 12 bullish momentum stocks out of the 27 shown here have “buy” ratings at Barstock.com.

Dividend stock investors looking for options premium income can sell covered calls or cash secured puts options on any of Cramer’s stocks.

Many of Cramer’s stocks have a lot of cash, are quite profitable and have strong cash flow and free cash flow statements.

Stock pickers can use screeners and other traders’ portfolios and watch lists in their searches for high yielding dividend stocks and dividend ETFs. We’re also looking for big cap and mega cap stocks that are good prospects for options trading.

CNBC’s Jim Cramer runs and frequently promotes subscriptions to his personal trust’s stock portfolio. The names of the stocks are easily accessible for his paid subscribers.

I reviewed his recent free daily e-mails to subscribers and non subscribers to find 27 of his stocks. There may be more. The number varies as he buys and sells stocks, which he does fairly frequently.

Like all portfolio managers and financial advisors, Cramer has stocks with strong bullish technical signals and a few more that aren’t doing so well.

The four best prospects based on their charts and other technicals are Nvidia (@NVDA), Advanced Micro Devices (@AMD), Salesforce Inc. (@CRM) and Meta (@META).

As dividend stock investors who also are trading covered calls and cash secured puts, we’re looking for the highest yielding dividend stocks instead of dividend growth stocks. We want our money now, and we want it in cash, not in stock buy backs.

The four current dividend leaders are: Morgan Stanley (@MS), Coterra Energy Inc. (@CTRA), Wells Fargo & Company (@WFC), Emerson Electric Company (@EMR) and Proctor & Gamble Company (@PG). I try to go for stocks paying 3% to 4% and a bit higher yielding dividends. All of these companies face challenges in today’s markets.

When it comes to the fundamentals, I focus on the price to free cash flow (P/FCF) ratio and the price to analysts’ mean target prices ratios. The top StockRover.com table excludes Disney (@DIS). It shows that the portfolio’s average P/FCF is 29.5. In the second table, which includes Disney, the P/FCF ratio is an astronomical 97.4.

The average stock in the portfolio without Disney is trading 21.8% below their target prices compared with 22.3% below the average when the stock is included.

That DIS is in the portfolio indicates that Cramer is expecting the stock to rally.

If you’re setting up a screener to find stocks that Cramer might put in his portfolio, consider these average cash flow metrics, which are from StockRover.com:

PE 20.1

Price to cash flow 14.1

Price to free cash flow 23.6

Price/cash flow industry decile 5

P/FCF industry decile 4

Cash flow yield 7.1%

FCF yield 4.2%

FCF as a % of net income 508.6%

Short % of float 1.7%

Of course, Apple Inc. (@AAPL) and Microsoft Corp. (@MSFT) are the gold standards when it comes to owning companies with a lot of cash. On CNBC, Cramer makes a big deal about being in cash rich stocks that can survive a recession and the Fed’s war against inflation.

This table shows how Cramer’s stocks have done over the last year. He hasn’t owned all of them for the full year because he adjusts his portfolio opportunistically, cutting his losses and letting his profits run.

My Trades

On March 17, I had five puts trades assigned on dividend stocks I wanted to buy. So I took them at their discounted strike prices and will sell covered calls on them. They are: KMI, IBM, XOM, DVN and RSG. Puts on MSFT and VRTX expired worthless.

My covered calls on six stocks expired worthless: KMI, DVN, CG, RSG, VRTX and CPB. I’ll roll those trades forward.

Disclosures: I own DVN.

Question: Are you buying bullish momentum stocks or “Cramer’s dogs”, or are you selling OTM puts or calls?

LINKs:

Home Page. See my more than 100 articles on options trading, stocks and watch lists. If you read several of these articles, you’ll learn how my strategies are meant to work. No guarantees. Links to useful web sites are on the lower right corner of the home page. Scroll down.

Follow @realDonJohnson on twitter.com and FaceBook.com.

Selling in The Money Covered Calls Can Yield Big Annual Returns on Risk. By Donald E. L. Johnson

20 Ideas for Adjusting Your Stock and Bond Portfolio, by Christina Lourosa-Ricardo.

How to Beat Inflation Tax, Bear Market Tax With Dividend Stocks, Covered Calls, Cash Secured Puts, by Donald E. L. Johnson.

Wars Breed Inflation, Rising Interest Rates, Market Turmoil, By Donald E. L. Johnson.

Ways to use StockRover.com to analyze stocks

Calls vs Puts Options: What’s the Difference?

A video on how to place options trades on TDAmeritrade.com’s Think or Swim trading platform.

Thanks Donald! For the last year I have typically been selling ITM covered calls 2-3 weeks expiration and containing a dividend within that time frame. ROR is normally 1-2 %. If options expire worthless I will decide whether to sell another option or sell the stock. Sometimes if the stock price has dropped 10% I will buy more shares to lower cost basis and sell calls again. Still learning in this environment! Most important thing is trading good quality stocks.