September Puts Options Trades Update #5

Small and large dividend stock and ETF investors can use covered calls and puts trades to generate monthly income from options premiums and options trading.

By Donald E. L. Johnson

Cautious Speculato

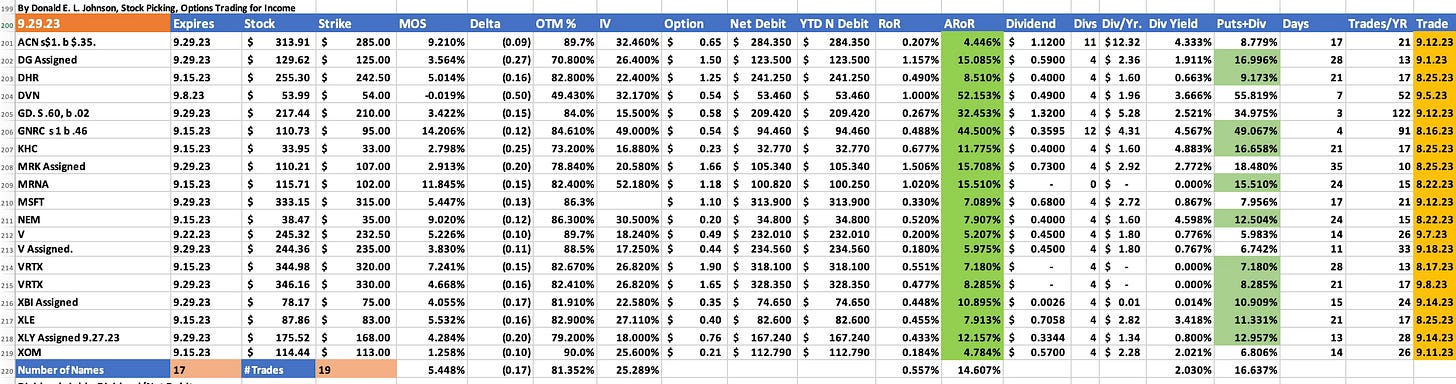

September’s 19 cash secured puts options trades produced annualized returns on risk of about 14.607%.

Four puts trades were closed early to avoid assignments.

Five puts were assigned after the underlying stocks closed below the puts strike prices.

October expiration covered calls will be sold on the assigned stocks.

September 2023 expiration cash secured puts options trades generated 14.607% annualized returns on risk, down from August RoR of 15.984%.

During September there were 19 puts trades on 17 stocks and exchange traded funds. There were 16 puts trades on 16 equities that expired in August.

Accenture Plc. (ACN) puts, which were sold for $1 a share, were bought back for $0.35 a share to avoid having them assigned after the company reported disappoint results and lowered its guidance. The ARoR on the 17-day trade was 4.5%. General Dynamics (GD) and Generac Holdings Inc. (GNRC) puts also were bought back early at profits to avoid assignments when it looked like they might be assigned.

I took assignment on four trades when the stocks and ETFs closed below their stock prices. The assigned stocks were Dollar General Corp. (DG), Merck Co. (MRK) and Visa Inc. (V). The assigned ETFs were S&P Biotech (XBI) and S&P 500 Consumer Discretionary ETF ((XLY). I’ve sold covered calls on XLY and will sell covered calls on the others next week.

Ten puts options expired worthless as planned because the stocks’ prices closed below their puts’ strike prices on the last days of trading those puts options. They included Danaher Corp. (DHR), Devon Energy Corp. (DVN), Kraft Heinz Co. (KHC), Moderna Inc. (MRNA), ), Microsoft Corp. (MSFT), Nemont Mining Corp. (NEM), Visa Inc. (V). Vertex Pharmaceutical (VRTX), S&P Energy Sector SPDA (XLE) and Exxon Mobil (XOM).

Next week I’ll roll many of these puts trades forward into puts options trades that will expire in October. The October puts trades will be updated after I complete most of the planned trades on Monday or Tuesday.

I respond to comments on the comments section where readers’ comments are posted. That is, if you have a question about this article or other comments, I'll discuss your questions with you in the comments section below this article.

Thanks for reading Stock Picking, Options Trading for Income! Subscribe for free to receive new posts and support my work.

LINKs:

Home Page. See my more than 150 articles on options trading, stocks and watch lists. If you read several of these articles, you’ll learn how my strategies are meant to work. No guarantees. Links to useful web sites are on the lower right corner of the home page. Scroll down.

Follow @RealDonJohnson on twitter.com and FaceBook.com. Or follow me on Substack.com/Notes where my byline is my handle.

8 October 2023 Covered Calls Trades Yield 24.3% Annualized Returns On Risk

10 October 2023 Puts Options Trades

September Covered Calls Trades On Dividend Stocks Update #2

September Puts Options Trades Update #3

September Puts Options Trades Update #1

August Naked Puts Options Trades Yielded About 16% In Options Premiums Annualized

August Covered Calls Options Trades Yielded 14.6% In Options Premiums

September Puts Options Trades on 4 Stocks

September Covered Calls Trades On 4 Dividend Stocks

August Covered And Naked Puts Options Trades Update #3

16 Jim Cramer Stocks Are Up 12% to 205% Year To Date

AAPL, AXP, CAT, CSCO, FDX, HON, ICE, OPRA, TJX Covered Calls Update #1

August Covered Calls Trades On 14 Dividend Stocks Update #2

August Covered Calls Trades On 13 Dividend Stocks Update #1

August Covered Calls Trades On Dividend Stocks Yield 12.2% in Options Premiums

August Covered And Naked Puts Options Trades Update # 2

August Covered And Naked Puts Options Trades On Paycom And Other Stocks Update #1

August Covered And Naked Puts Options Trades Yield About 12.8% In Options Premiums.

How Owners of AT&T, Verizon, T-Mobile Can Use Covered Calls, Dividends To Offset Losses Update #1

Selling in The Money Covered Calls Can Yield Big Annual Returns on Risk. By Donald E. L. Johnson

How to Beat Inflation Tax, Bear Market Tax With Dividend Stocks, Covered Calls, Cash Secured Puts, by Donald E. L. Johnson.

How I Analyze Bullish Puts Options Trades With Stock Rover, By Donald E. L. Johnson.

Wars Breed Inflation, Rising Interest Rates, Market Turmoil, By Donald E. L. Johnson.

Calls vs Puts Options: What’s the Difference?

A video on how to place options trades on TDAmeritrade.com’s Think or Swim trading platform.