September Covered Calls Trades On Dividend Stocks Update #2

Small and large dividend stock and ETF investors can use covered calls and puts trades to generate monthly income from options premiums and options trading.

By Donald E. L. Johnson

Cautious Speculator

How to use covered calls to save bad trades.

It often takes months to turn a losing trade into a winner.

CG may be a buy for other traders.

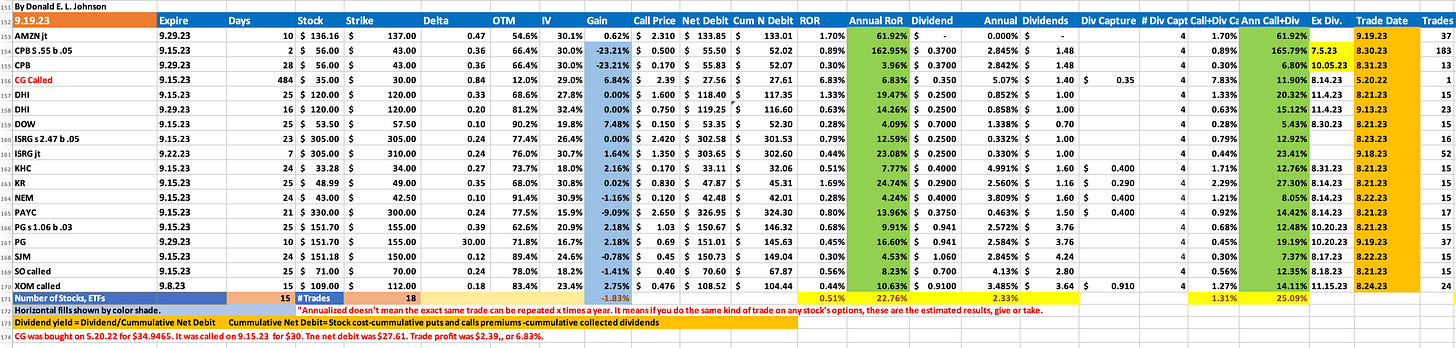

Sometimes a trader has to work the spreadsheets to figure out how to account for a losing trade that was saved by hedging the trade with covered calls plus dividends over, say 484 days.

On May 20, 2022, I bought The Carlyle Group (CG) for $34.9465 a share and sold covered calls on it. Over the next 484 days I collected CG dividends and covered calls options premiums that totaled $7.34 a share.

On Aug. 30, I thought the market would sink after its recent rally. So I sold CG 9.15.23 expiration $30 calls when the stock was at about $32.03. My bet was that on 9.15.23 the stock would close below $30. That would have allowed me to pocket a high premium and sell calls on the stock again.

The market rallied and on Sept. 15, CG was at $32.68. My net debit was $27.61. This means that when I sold CG at $30 minus $27.61 my profit on the trade, thanks to $7.34 per share individends and mostly out of the money covered calls options premiums was $2.39, or 6.83%. I may have also sold some out of the money puts along the way that reduced the net debit. I did these trades only when the premium prices were high enough to make the trades relatively safe from being assigned, until this month.

The lesson is that when a stock or ETF trade becomes a loser, a trader can sell covered calls and puts while collecting dividends to generate enough income to turn a 14% or worse loser into a winner. This may be known as a Jackson Street Hedge, thanks to the Chicago Board Options Exchange.

That CG is rallying may mean that it’s a good time to buy the stock and sell covered calls. But even though this trade was done in an IRA, I’ll wait about 32 days to make sure that I don’t turn the loss into a wash trade in the eyes of the tax collectors.

Now you know why the red type entry and red type footnote are in the above image.

On Barchart.com, CG is a 56% buy. Amazon.com Inc. (AMZN), which I bought today and sold covered calls on, is an 88% buy. The buys on the list are my bullish momentum trades and the sells are former buys that I’m trading calls on like I did with CG. And some of the sells are speculative bottom fishing trades.

I respond to comments on the comments section where readers’ comments are posted. That is, if you have a question about this article or other comments, I'll discuss your questions with you in the comments section below this article.

Thanks for reading Stock Picking, Options Trading for Income! Subscribe for free to receive new posts and support my work.

LINKs:

Home Page. See my more than 100 articles on options trading, stocks and watch lists. If you read several of these articles, you’ll learn how my strategies are meant to work. No guarantees. Links to useful web sites are on the lower right corner of the home page. Scroll down.

Follow @RealDonJohnson on twitter.com and FaceBook.com. Or follow me on Substack.com/Notes where my byline is my handle.

September Puts Options Trades Update #3

September Puts Options Trades Update #1

August Naked Puts Options Trades Yielded About 16% In Options Premiums Annualized

August Covered Calls Options Trades Yielded 14.6% In Options Premiums

September Puts Options Trades on 4 Stocks

September Covered Calls Trades On 4 Dividend Stocks

August Covered And Naked Puts Options Trades Update #3

16 Jim Cramer Stocks Are Up 12% to 205% Year To Date

AAPL, AXP, CAT, CSCO, FDX, HON, ICE, OPRA, TJX Covered Calls Update #1

August Covered Calls Trades On 14 Dividend Stocks Update #2

August Covered Calls Trades On 13 Dividend Stocks Update #1

August Covered Calls Trades On Dividend Stocks Yield 12.2% in Options Premiums

August Covered And Naked Puts Options Trades Update # 2

August Covered And Naked Puts Options Trades On Paycom And Other Stocks Update #1

August Covered And Naked Puts Options Trades Yield About 12.8% In Options Premiums.

How Owners of AT&T, Verizon, T-Mobile Can Use Covered Calls, Dividends To Offset Losses Update #1

Selling in The Money Covered Calls Can Yield Big Annual Returns on Risk. By Donald E. L. Johnson

How to Beat Inflation Tax, Bear Market Tax With Dividend Stocks, Covered Calls, Cash Secured Puts, by Donald E. L. Johnson.

How I Analyze Bullish Puts Options Trades With Stock Rover, By Donald E. L. Johnson.

Wars Breed Inflation, Rising Interest Rates, Market Turmoil, By Donald E. L. Johnson.

Calls vs Puts Options: What’s the Difference?

A video on how to place options trades on TDAmeritrade.com’s Think or Swim trading platform.