June Covered Calls Portfolio Update #3

Small and large dividend stock investors can use monthly covered calls to generate steady monthly income from options premiums and options trading.

By Donald E. L. Johnson

Cautious Speculator

Covered calls on my June portfolio Dividend Stocks averaged a 1.13% return, or about 15.3% annuallized.

LNC was called. RoR on LNC’s covered calls was 31.24% plus about a 31% annualized gain on the sold shares.

I sold LNC July 21 $20 strike puts.

Several blue chip stocks have buy ratings and are candidates for covered calls and cash secured puts trades.

Of the 13 covered calls stock options in my June portfolio of dividend stocks that expired on June 16, two were called and sold to the owners of the calls.

This table shows where the stocks closed on Friday.

My spreadsheet shows my purchase prices, strikes and called stocks.

Discover Financial Services (DFS) was called at my purchase price of $105. There was no gain on the 29-day trade. The RoR was 1.82% and the annualized return on risk (ARoR) was 21.81%. ARoR assumes that the same kind of trade with a 1.82% RoR will be successfully done 12 times in the next 12 months. DFS is down a bit. I’m waiting for it to fall further before I sell puts.

Lincoln National Corp. (LNC) closed Friday at $24.37 was called at $22.50. RoR was 2.65%, or 31.74% annualized. The gain was 6.28%, or another 31.8% annualized. LNC’s dividend yields 7.54% and goes ex-dividend on July 7. At the moment, LNC is down 1.97% at $23.89. It yields 2.44% and goes ex-dividend about August 24.

I could buy the stock and collect the $0.45 dividend or sell LNC 7.21.23 expiration $22.50 covered calls for about $0.90. That would give me a discount on the stock, let me buy it back for the price I sold it and give me about a 43% ARoR. LNC was in my IRA.

About 40% of LNC’s 13 technical indicators tracked by Barchart.com are flashing sell signals. That made me think I should sell LNC 7.21.23 $20 puts for about a 16% ARoR and a margin of safety (MOS), or discount at the strike price of about 13%. If I have the puts assigned, the net debit would be $19.64, or a discount of about 14.6%.

With the LNC 7.21.23 $20 put at $0.30 bid and $0.40 ask and the last price at $0.35, I tried to sell at $0.36 when the stock was at $23.90. LNC is at $23.62 and the order still hasn’t filled. Waiting. Filled one contract at $0.36 when LNC was $23.67. Now the last trade was done at $0.32. The Dow Jones index is down 317 points and the VIX is a very low 14.5, which means options premiums are cheap, which is good for options buyers but not for sellers like me.

Barchart has buy ratings on DFS, Kimberly-Clark Corp (KMB), Southern Co. (SO), J.M. Smucker Co. (SO), Proctor & Gamble (PG) and Merck (MRK).

Nine of the June portfolio’s stocks have Barchart sell ratings: Kroger (KR), LNC, Dow Inc. (DOW), Campbell Soup Co. (CPB), Newmont Mining Corp. (NEM), Exxon Mobil Corp. (XOM), Phillips 66 (PSX) and Conagra Brands Inc. (CAG).

Like LNC, I’ll roll most of these stocks into the July Dividend Stocks Covered Calls watchlist. My July cover calls portfolio will be published as I do the trades, which will be reported in the comments section of that post. See comments for my next trades.

The key to making money trading covered calls and cash secured puts is to find stocks with bullish momentum. While the stocks are down, a trader can sell covered calls out of the money to reduce the net debit over the next several months. Or the trader can take losses on the depressed stocks and put the money in to stocks with better momentum and sell calls on the new stocks. I do both, especially on stocks in IRAs.

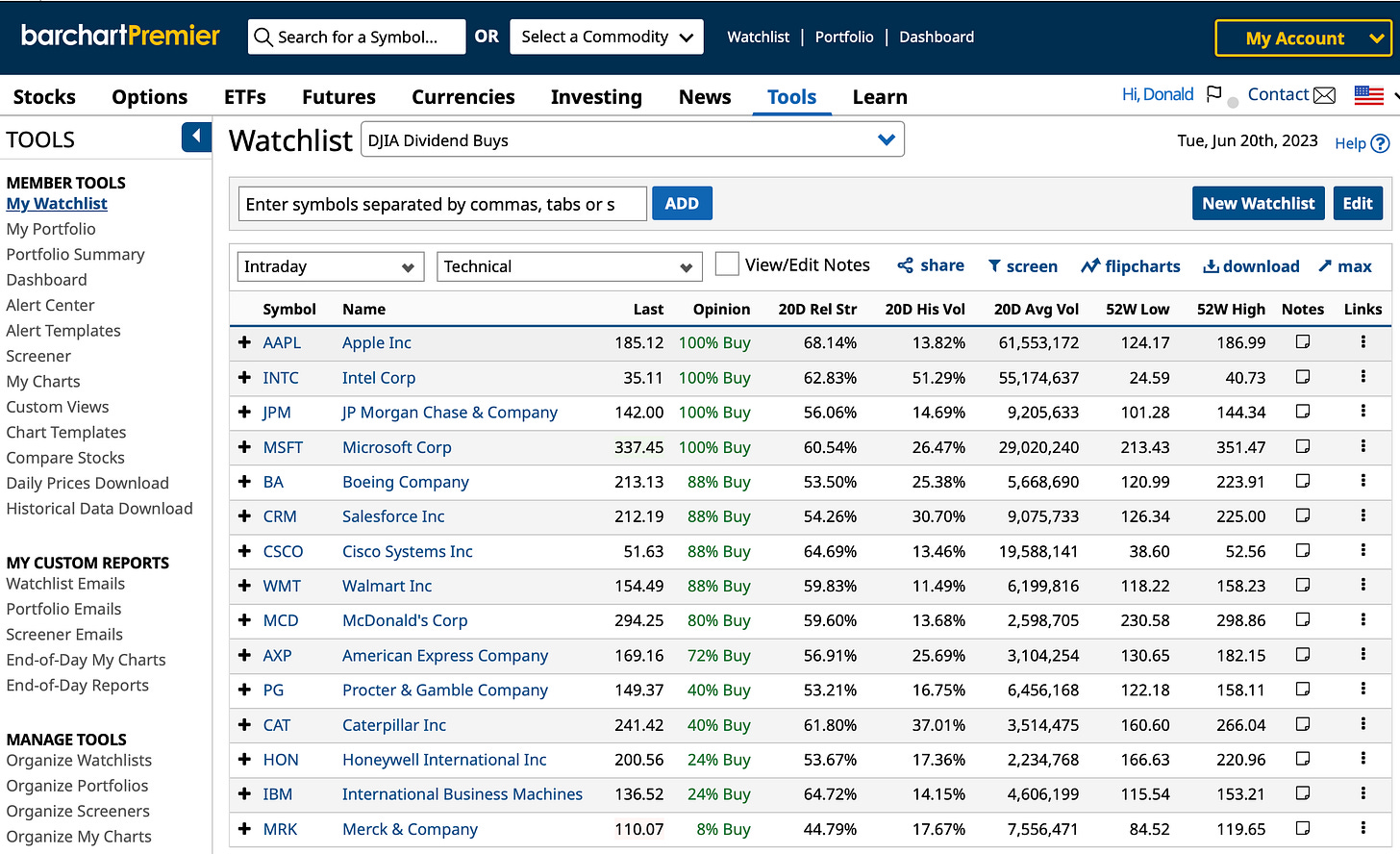

At about 11 a.m. ET, these Dow Jones Industrial 30 Index dividend stocks have Barchart buy ratings.

Most are down so far today. Traders will decide whether and when they will buy these stocks on the dip and sell covered calls on them. They could sell cash secured puts on stocks that dip when it looks like the dip may turn into a bear market rally or a bullish market.

LINKs:

Home Page. See my more than 100 articles on options trading, stocks and watch lists. If you read several of these articles, you’ll learn how my strategies are meant to work. No guarantees. Links to useful web sites are on the lower right corner of the home page. Scroll down.

Follow @realDonJohnson on twitter.com and FaceBook.com. Or follow me on Substack.com/Notes where my byline is my handle.

Selling in The Money Covered Calls Can Yield Big Annual Returns on Risk. By Donald E. L. Johnson

20 Ideas for Adjusting Your Stock and Bond Portfolio, by Christina Lourosa-Ricardo.

How to Beat Inflation Tax, Bear Market Tax With Dividend Stocks, Covered Calls, Cash Secured Puts, by Donald E. L. Johnson.

Wars Breed Inflation, Rising Interest Rates, Market Turmoil, By Donald E. L. Johnson.

Ways to use StockRover.com to analyze stocks

Calls vs Puts Options: What’s the Difference?

A video on how to place options trades on TDAmeritrade.com’s Think or Swim trading platform.

LNC 7.21.23 $20 strike puts closed at $0.225 per share on a 100-share covered call. I sold one option for $0.36. LNC closed at $24.25, up from $23.90 when I sold the put. I could have made more buying the stock, but that wasn't my strategy. I held off selling more covered calls with the hope stock prices will bounce in the next few days.

Previous posts about the June portfolio can be found on the home page: https://djincometrader.substack.com