June Covered Calls Portfolio Update #1

Small and large dividend stock investors can use monthly covered calls to generate steady monthly income from options premiums and options trading.

By Donald E. L. Johnson

Cautious Speculator

Last week while markets rose, my covered calls portfolio of dividend stocks were mixed.

I added Newmont (NEM), closed a Proctor & Gamble (PG) covered calls trade and opened a new PG covered calls position.

Southern Co. (SO) was put to me Friday. I’ll sell calls on that Monday.

My average annualized return on risk on the 13 open June covered calls trades is an estimated 15.3%. Dividend yields average 4.01%.

The 13 stocks in my June expiration covered calls portfolio closed mixed last week while the major averages closed up on the week. I wrote about the June portfolio on May 30.

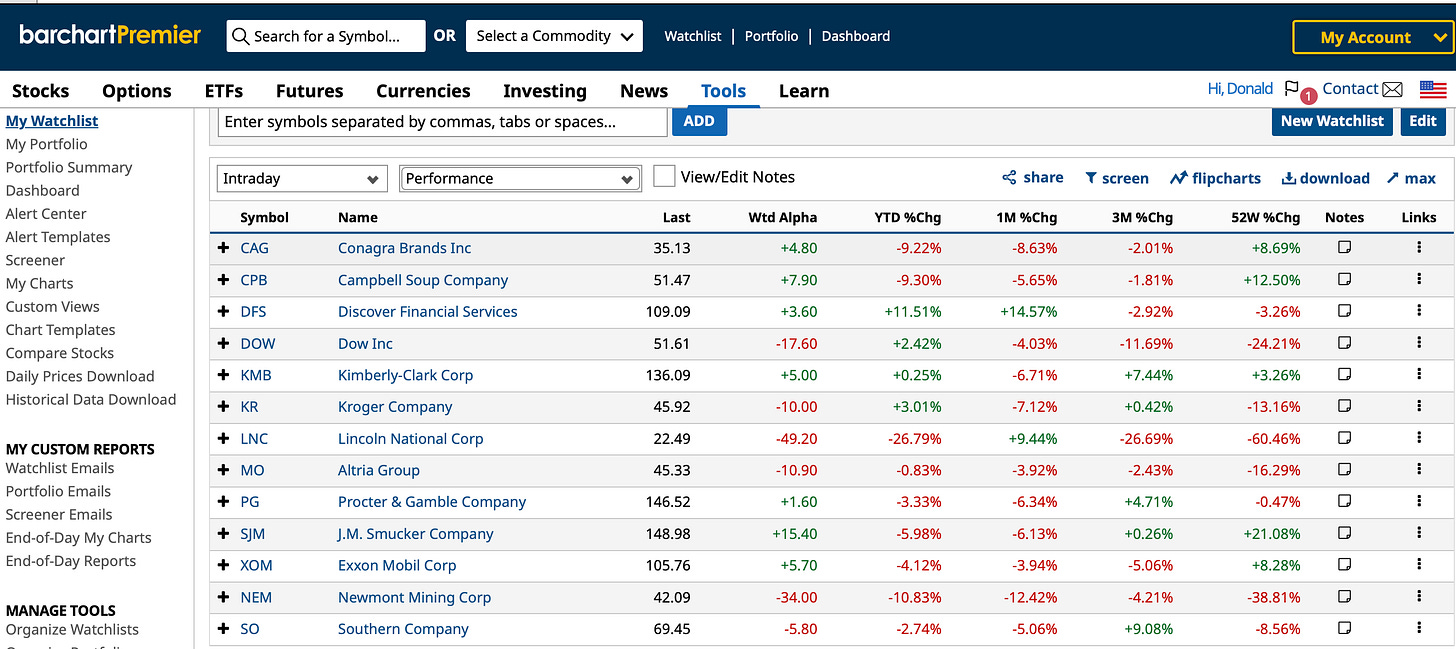

This is how the portfolio closed Friday. The stocks are: Conagra Brands Inc. (CAG), Campbell Soup Co. (CPB), Discover Financial Services (DFS), Dow Inc. (DOW), Kimberly-Clark Corp. (KMB), Kroger Co. (KR), Lincoln National Corp. (LNC), Altria Corp. (MO), Newmont Mining Corp. (NEM), Procter & Gamble Co. (PG), J.M. Smucker Co. (SJM), Southern Co. (SO) and Exxon Mobil Corp. (XOM).

The 13 stocks’ performances during the last 52 weeks are mixed.

Barchart rates four of the stocks as buys. On May 30, KMB was a 40% buy, PG was a 24% buy and KR was a 8% buy. DFS was a 24% sell.

These are my trades.

Most of the portfolio’s stocks are low Beta, defensive stocks that are correcting. I’m accumulating them at current prices for my dividend portfolio.

After the McCarthy-Biden debt limit deal was enacted by Congress, investors shifted money out of defensive stock into higher momentum and more speculative stocks, including big techs.

Last week, I added two stocks that were recently put to me, Newmont Mining Corp. (NEM) and Southern Co. (SO). Both stocks were assigned at lower than my strike prices, which were 3% to 8.9% under the stocks’ prices when I sold the puts.

NEM was purchased at the $45 puts strike price. I sold NEM 6.30.23 expiration $46 puts for a 0.56% RoR on the 30-day trade. If I did trades with the same results 12 times a year, the AROR would be about 6.76%. The dividend yield on the net debit would be about 3.6%. Net debit is the stock cost less puts and calls options premiums and collected dividends.

SO was purchased after Friday’s close at $71. I sold SO 6.2.23 $71 puts for $0.47 on 5.12.23. The ARoR on the 21-day trade was 11.4%. The net debit was $70.53, and the dividend yield on the net debit is 3.97%.

On Monday, I’ll sell SO 6.30.23 $70 calls for about $1.30 per share on a 100-share covered calls option contract. The RoR on this in the money (ITM) trade will be about 1.83%. The ARoR would be about 26.73% if I could do trades with the same results about 15 times over the next 12 months.

On May 18, I sold PG 6.16.23 (29 days) $155 strike covered calls for $1.24 a share. On Friday, I bought the calls back for $0.03 per share. That gave me an AROR of 9.575 on the 14-day trade.

Then on Friday I sold PG 6.30.23 (14-days) $152.50 strike puts for $0.31 a share. That gave me an additional 2.45% in potential annualized return. I chose the $152.50 strike so that I would make a gain on the trade if the stock was called. There is about a 12% probability that the call will be assigned.

That any of these stocks will be is assigned is unlikely because of the uncertainty over whether the Fed will hike rates again in a couple of weeks.

The market seems to be saying the Fed will pause it’s rate hikes, but there are strong arguments for hiking the rates again in June and July. The Fed seems to be more worried about inflation than about a recession even if it comes during a presidential election year.

All of these trades have been done on relatively good dividend stocks that I’m hoping and expecting will rally over the next year or two. I can’t predict prices. All I can do is trade.

The portfolio is not as diversified by sector as much as I would like.

But that lack of diversification is offset by the fact that I have other investments and cash that provides most of the diversification I need at this time.

I’m assuming that most dividend stock investors and options traders sell covered calls on some stocks and puts on others while holding some cash in reserve. At the same time, there are hot stocks and losers that investors don’t want to sell calls or puts on for their own reasons.

I plan to post updates on this post in the comments section along with copies of some of my tweets and posts on Substack.com/Notes. Feel free to comment on the markets and what the Fed might do.

LINKs:

Home Page. See my more than 100 articles on options trading, stocks and watch lists. If you read several of these articles, you’ll learn how my strategies are meant to work. No guarantees. Links to useful web sites are on the lower right corner of the home page. Scroll down.

Follow @realDonJohnson on twitter.com and FaceBook.com. Or follow me on Substack.com/Notes where my byline is my handle.

Selling in The Money Covered Calls Can Yield Big Annual Returns on Risk. By Donald E. L. Johnson

20 Ideas for Adjusting Your Stock and Bond Portfolio, by Christina Lourosa-Ricardo.

How to Beat Inflation Tax, Bear Market Tax With Dividend Stocks, Covered Calls, Cash Secured Puts, by Donald E. L. Johnson.

Wars Breed Inflation, Rising Interest Rates, Market Turmoil, By Donald E. L. Johnson.

Ways to use StockRover.com to analyze stocks

Calls vs Puts Options: What’s the Difference?

A video on how to place options trades on TDAmeritrade.com’s Think or Swim trading platform.

My MRK puts expired worthless on Friday. Cumulative premiums collected were $1.81. Bought MRK for $113.41 and sold MRK 6.30.23 $116 strike covered calls for $1.12. Net Debit is $113.41-1.12-1.81=$110.48. RoR is 0.99% times 15 trades a year gives a potential ARoR of about 14.42%. Dividend yield on net debit is about 2.64% if collected 4 times a year. Ex dividend is 6.14. If the stock is called before then I'll still get a 2.28% gain, or If I got that gain 25 times a year the ARoR would be about 57%.

I might sell MRK puts on the dip. And I'm waiting to sell puts on CAT and ORCL when and if they dip.