Momentum Beats Fundamentals In 'Confusing Markets'

Small and large dividend stock investors can use covered calls and puts trades to generate monthly income from options premiums and options trading.

By Donald E. L. Johnson

Cautious Speculator

Bullish dividend stocks and cash in confusing markets probably are best for traders of covered calls.

Covered calls scenarios for bullish, high volatility and high dividend Dow stocks are shown.

Do it yourself traders who are nimble and experienced stock pickers and covered calls options traders will do best in these confusing markets.

The economic outlook is confusing stock and bond traders, writes The Wall Street Journal’s James Mackintosh.

One thing that is confusing speculators and investors is the very bullish bias of the hosts and most guests on the cable TV business channels.

The channels and their guests are desperate for bull markets, which are much better for their careers and bottom lines than bear markets. That is shown in their attacks on the Fed's rate hikes and their defense of Biden economics, I think.

Another thing that is confusing speculators is that fundamental data is pretty worthless in this market. More so than usual. Further, predictions about earnings and other fundamentals are predictions that can't be trusted.

Nobody can predict markets, interest rates or what selfish and criminal politicians around the world will do to their economies and the world.

Domestically, we're the captives of politicians who think only of themselves when it comes to government spending, inflation and what happens to the economy, stock market and retirees.

I am in cash, high yield ETFs, dividend stocks, covered calls and cash secured puts.

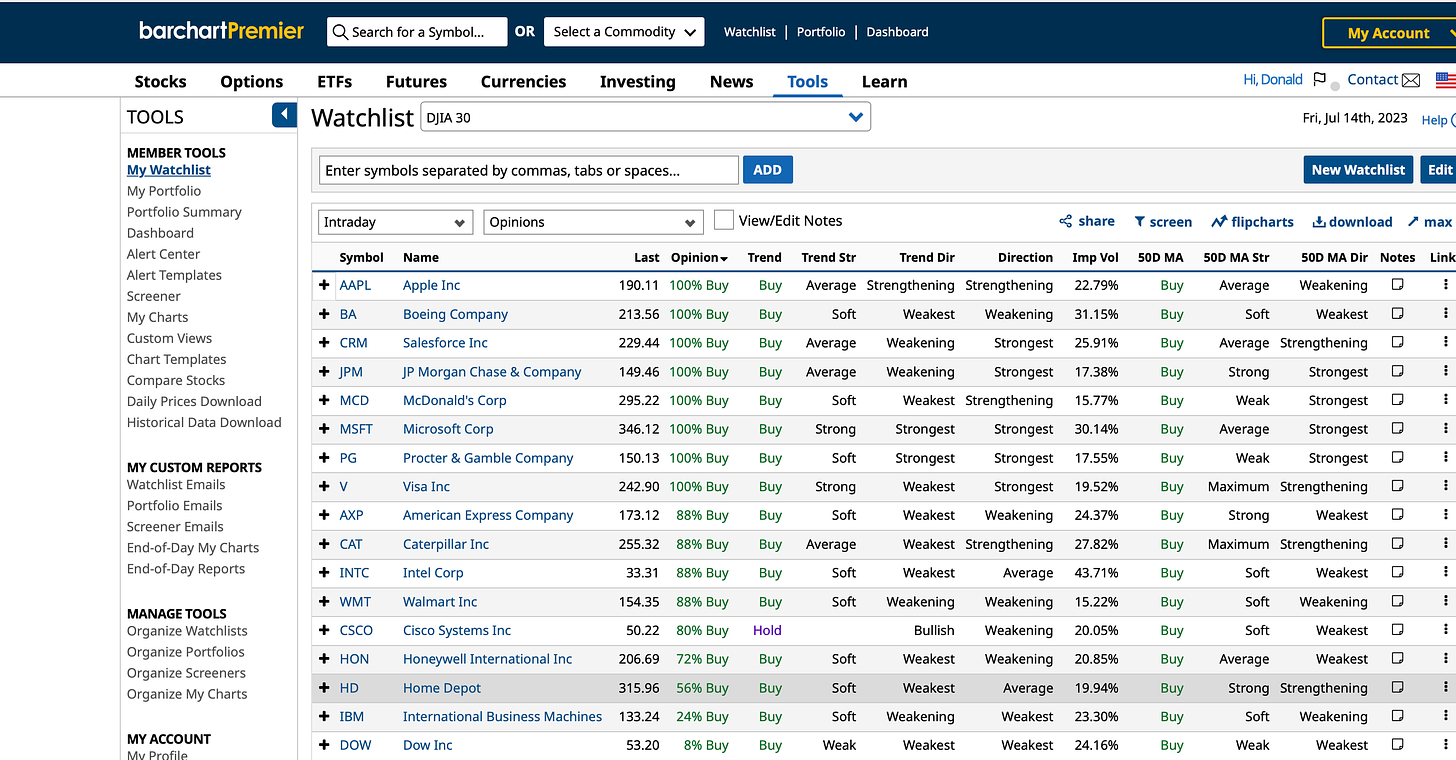

To me, the only way to trade is to watch the charts, look for stocks and ETFs that have strong and strengthening bullish momentum and be ready to manage risks by taking small losses and profits. The table above shows the strongest stocks in the Dow Industrials index, or DJIA30.

For example, a speculator can buy JP Morgan Chase (JPM) for $149.69 and sell JPM 7.28.23 expiration (14 days) $150 strike covered calls for an annualized return on risk of about 31%. Or the $160 strike calls can be sold for a 2.04% ARoR.

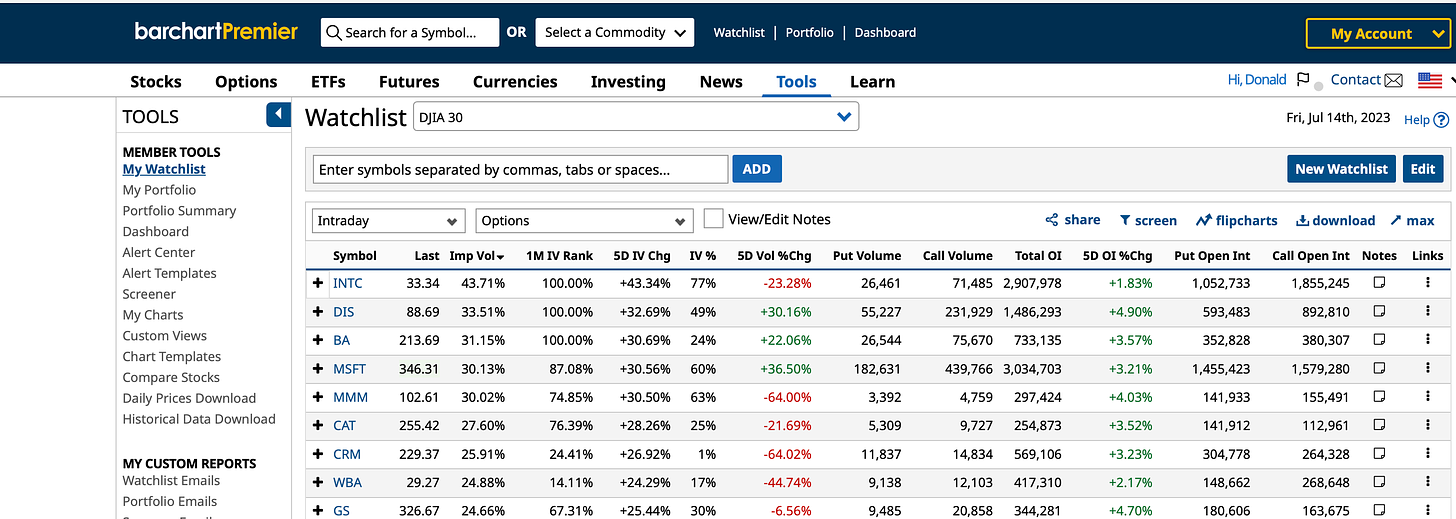

High volatility stocks’ covered calls and cash secured puts options prices are higher than those with low volatility.

An investor can buy Intel (INTC) for $33.20 and sell INTC 7.28.23 $33.50 covered calls for a 91.5% AROR or $35 strike calls for a 51.8% ARoR.

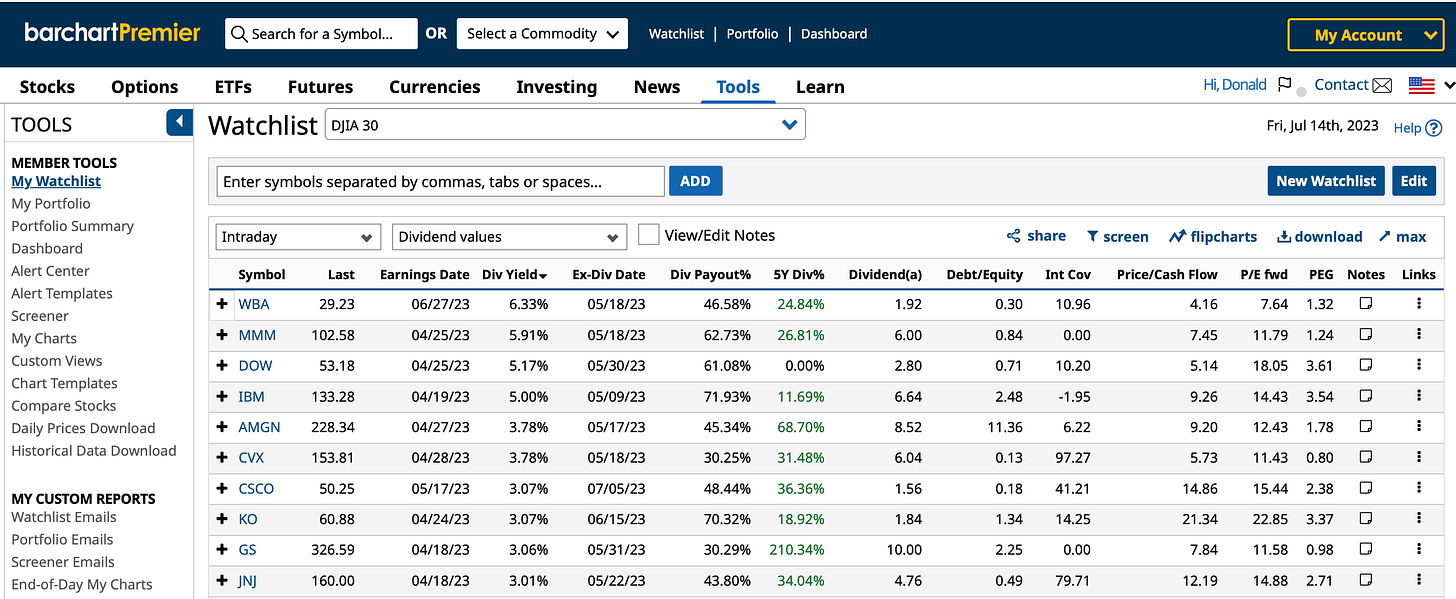

These are the highest dividend yielding stocks in the DJIA 30. Owners of these stocks can manage the risk of having them exercised, or called, by trading covered calls with strikes that are 5% to 10% out of the money with durations that are two to four weeks long.

An investor can buy Walgreens (WBA) for $33.17 and sell WBA 7.28.23 $33.50 calls for a 91% ARoR or $35 calls for a 51% ARoR.

This is not a good time to be a buy and hold investor who never looks at the markets or pays much attention to what your investments are doing.

The people who will do best in these markets are do it your self investors who have the flexibility and experience needed to thrive regardless.

LINKs:

Home Page. See my more than 100 articles on options trading, stocks and watch lists. If you read several of these articles, you’ll learn how my strategies are meant to work. No guarantees. Links to useful web sites are on the lower right corner of the home page. Scroll down.

Follow @RealDonJohnson on twitter.com and FaceBook.com. Or follow me on Substack.com/Notes where my byline is my handle.

Selling in The Money Covered Calls Can Yield Big Annual Returns on Risk. By Donald E. L. Johnson

July Covered Calls Trades on Dividend Stocks Update #3

July Dividend Stocks Covered Calls Trades Update #2

July Dividend Stocks Covered Calls Trades Update #1

12 July Covered Calls Trades on Dividend Stocks.

June Covered Calls Trades Returned 21.6% Annualized.

June Covered Calls Portfolio Update # 3.

June Covered Calls Portfolio Update #2.

June Covered Calls Portfolio Update #1.

11 Dividend Stocks in My June Covered Calls Portfolio.

5 Dividend Stocks for June Covered Calls Trades.

20 Ideas for Adjusting Your Stock and Bond Portfolio, by Christina Lourosa-Ricardo.

How to Beat Inflation Tax, Bear Market Tax With Dividend Stocks, Covered Calls, Cash Secured Puts, by Donald E. L. Johnson.

Wars Breed Inflation, Rising Interest Rates, Market Turmoil, By Donald E. L. Johnson.

Ways to use StockRover.com to analyze stocks

Calls vs Puts Options: What’s the Difference?

A video on how to place options trades on TDAmeritrade.com’s Think or Swim trading platform.

Great piece, very insightful. Keep them coming!