Most Critical Stock Market Sectors Up; Bull Trends Weakening

Small and large dividend stock investors can use covered calls and puts trades to generate monthly income from options premiums and options trading.

By Donald E. L. Johnson

Cautious Speculator

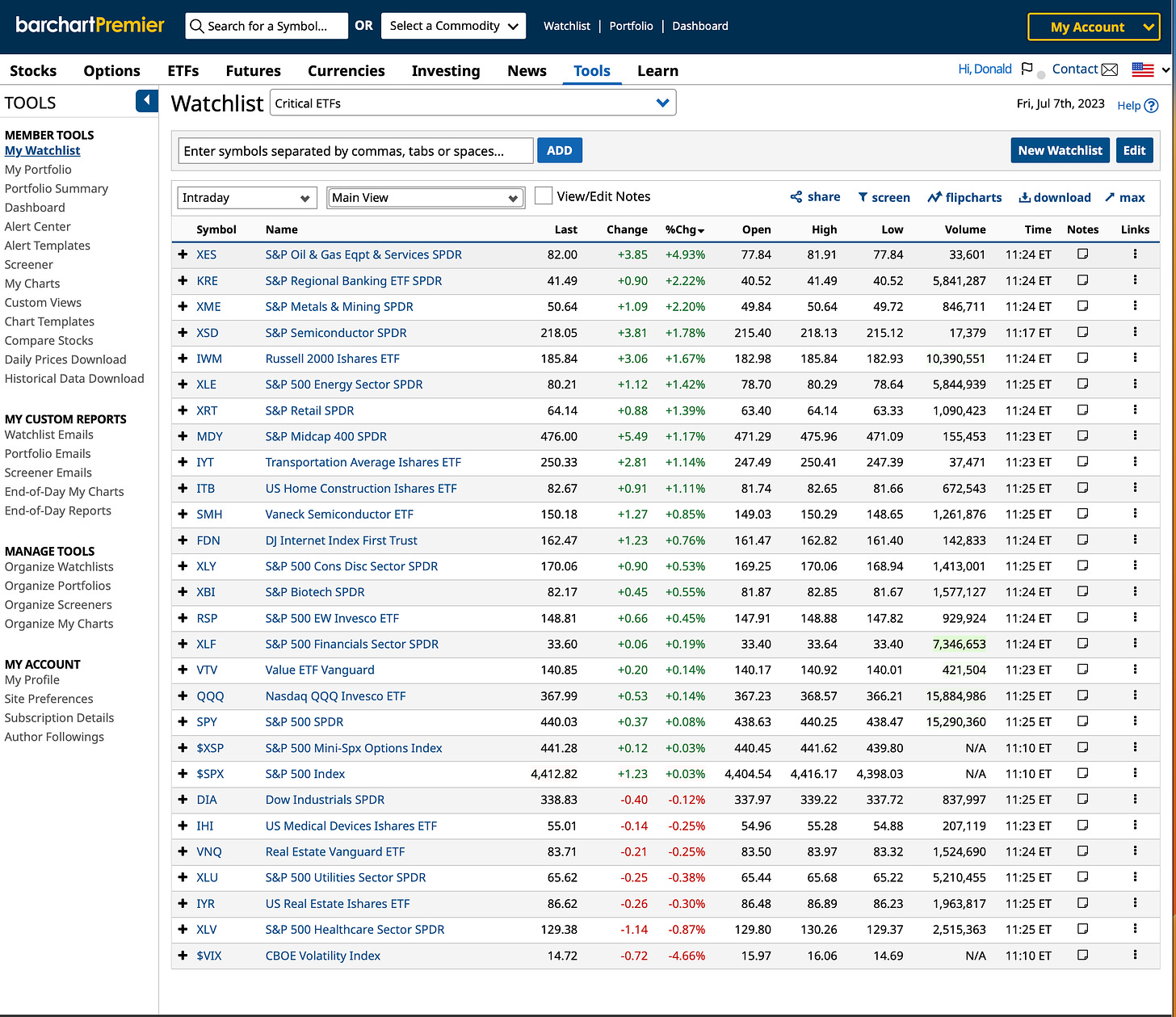

Stocks are mixed today with a lot of critical ETFs up on the day.

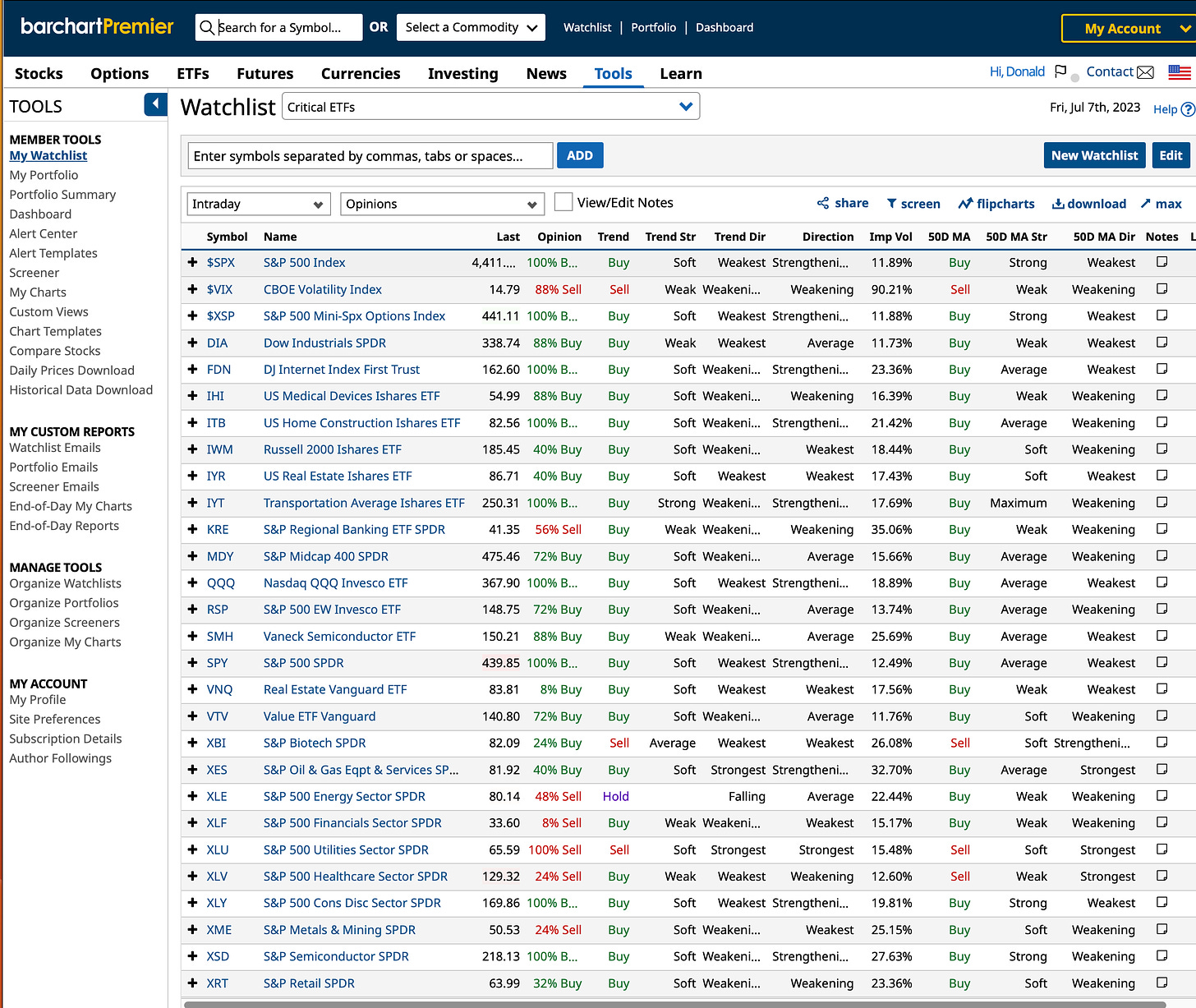

ETFs with buy ratings are shown below.

Dig deeper and Barchart shows that those buy trends have been weakening.

Today’s jobs reports are bullish for the economy short term and look bearish longer term because the Fed is more likely to hike interest rates again to cool inflation.

See my trades today below.

Critical stock market sector exchange traded funds (ETFs) look pretty bullish so far today, but Barchart.com trend indicators suggest the rally may not have legs.

To keep things in perspective, we have to look at the ETFs that have good buy ratings. None of their bull trends look that strong. Many of their trends are weakening.

Contrast those trends with what is happening today after new jobs reports showed that the economy did pretty well last month. That is bullish, until you factor in the idea that a strong economy means that the Fed will keep interest rates high and will continue to hike rates. That is bearish for a lot of investors.

My Trades

With Microsoft Corp. (MSFT) at $339.05, I sold MSFT 7.28.23 $300 strike puts for $1.12 per share, or $112 per 100-share contract to buy $30,000 worth of MSFT if the puts are assigned at $300.

With Newmont Mining Co. (NEM) at $72.70, I sold NEM 7.28.23 $40 puts for $0.41 a share, or $41. per contract.

With U.S. Home Construction IShares ETF (ITB) at $82.64, I sold ITB 7.28.23 $78 puts at $0.40 per share, or $40 per contract, less commissions.

With Southern Co. (SO) at $70.86, I sold SO 7.28.23 $73 strike covered calls for $$0.36 per share or $36 per 100-share contract. I added to my JPM Equity Premium Income ETF (JEPI) holdings at $54.70 a share. I sold SO 7.28.23 $73 puts for $0.30.

Look for more information about these trades in my July covered calls and puts trades updates over the weekend. If I do any more trades today, I’ll report them in the comments section.

LINKs:

Home Page. See my more than 100 articles on options trading, stocks and watch lists. If you read several of these articles, you’ll learn how my strategies are meant to work. No guarantees. Links to useful web sites are on the lower right corner of the home page. Scroll down.

Follow @RealDonJohnson on twitter.com and FaceBook.com. Or follow me on Substack.com/Notes where my byline is my handle.

Selling in The Money Covered Calls Can Yield Big Annual Returns on Risk. By Donald E. L. Johnson

July Dividend Stocks Covered Calls Trades Update #2

July Dividend Stocks Covered Calls Trades Update #1

12 July Covered Calls Trades on Dividend Stocks.

June Covered Calls Trades Returned 21.6% Annualized.

June Covered Calls Portfolio Update # 3.

June Covered Calls Portfolio Update #2.

June Covered Calls Portfolio Update #1.

11 Dividend Stocks in My June Covered Calls Portfolio.

5 Dividend Stocks for June Covered Calls Trades.

20 Ideas for Adjusting Your Stock and Bond Portfolio, by Christina Lourosa-Ricardo.

How to Beat Inflation Tax, Bear Market Tax With Dividend Stocks, Covered Calls, Cash Secured Puts, by Donald E. L. Johnson.

Wars Breed Inflation, Rising Interest Rates, Market Turmoil, By Donald E. L. Johnson.

Ways to use StockRover.com to analyze stocks

Calls vs Puts Options: What’s the Difference?

A video on how to place options trades on TDAmeritrade.com’s Think or Swim trading platform.