June Naked Puts Trades On Dividend Stocks Returned 10.8% Annualized

Small and large dividend stock investors can use covered calls and puts trades to generate monthly income from options premiums and options trading.

By Donald E. L. Johnson

Cautious Speculator

Naked puts are puts sold on divided stocks and ETFs that investors want to own.

Covered cash secured puts are sold on equities owned by the stock options trader.

During June I sold both naked puts options and covered puts to generate options premium income and get discounts on shares of stocks and an ETF I wanted to own.

I diversify and reduce my risks by doing several puts and covered calls options trades a month instead of investing in only a few trades.

My eight June naked and covered puts trades on seven dividend stocks returned 10.8% annualized on their net debit prices.

Annualized price estimates assume the same results can be achieved every month for the next 12 months. June’s returns on risk were depressed by depressed options prices. The volatility indicator, VIX, is very low. Naked puts are puts sold on stocks I don’t own. Covered puts are sold on stocks I own.

Trading stocks and stock options is risky. Generally trading covered calls and cash secured puts is less risky than buying or shorting stocks, but it all depends on a trader’s definition of risk and his or her experience, skills and risk management strategy. This post is not trading advice. It is written to show readers how I pick stocks and trade puts and calls options.

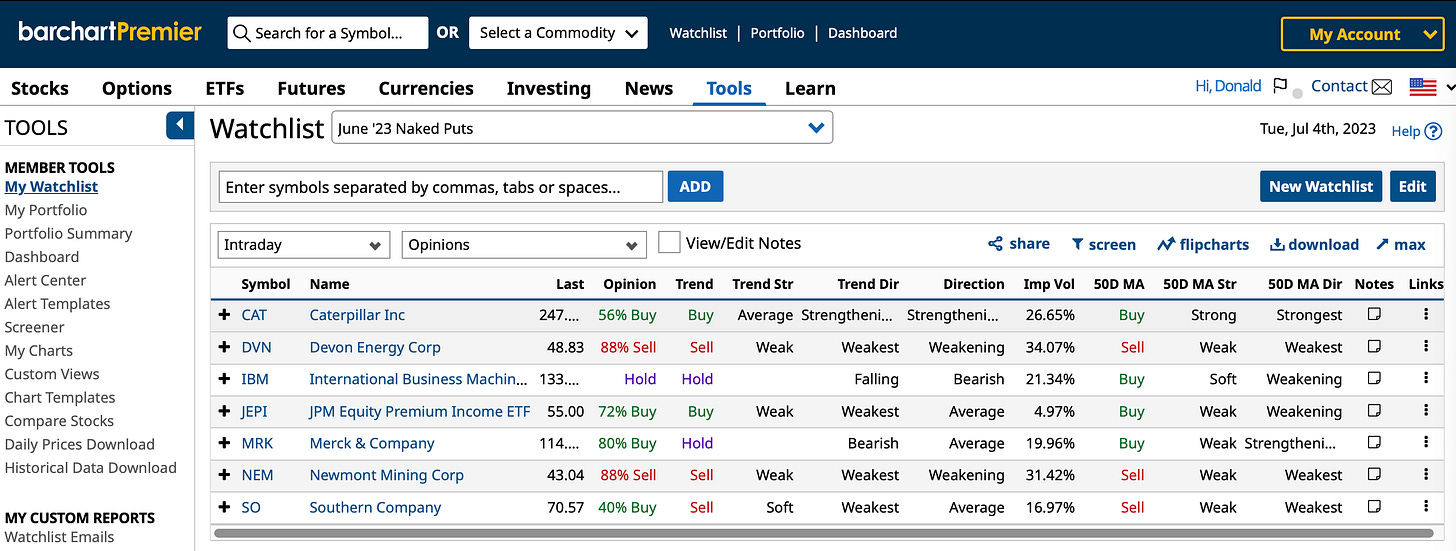

Southern CO. (SO) was assigned, or sold, to me at the $71 per share naked puts strike price, or at a 3.2% discount from where the stock was when I sold the naked puts on the stock when I didn’t own it. Goldman Sachs (GS) added SO to its conviction buy list last week. On Barchart.com, 40% of 13 technical indicators rank SO as a buy. That means that 60% of the indicators don’t rank SO as a buy. I’ll sell covered calls on SO later this week.

I sold Caterpillar Inc. (CAT) naked puts twice with 6.2.21 and 6.30.23 expirations with the stock price above the puts strike prices. So the puts expired worthless, and I’ll sell July naked puts on CAT later this week because, as usual, I want to buy it at a lower price.

Based on Barchart’s indicators shown above, CAT is the only stock on the list that I want to buy. I’ll sell naked puts on other stocks not on the list for the July puts portfolio. Meanwhile, I’ve sold covered calls on most of the stocks as shown in my July covered calls trades report.

My International Business Machines (IBM) 6.30.23 $129 strike naked puts closed worthless and at a profit on the 28-day trade. Its technicals are looking weak, so I won’t sell puts on it until it starts to rally.

I own Devon Energy Corp. (DVN), JPM Equity Premium Income ETF (JEPI), Merck & Co. (MRK) and Newmont Mining Corp. (NEM) and sold covered puts on them because I wanted to buy more shares at discount prices.

LINKs:

Home Page. See my more than 100 articles on options trading, stocks and watch lists. If you read several of these articles, you’ll learn how my strategies are meant to work. No guarantees. Links to useful web sites are on the lower right corner of the home page. Scroll down.

Follow @RealDonJohnson on twitter.com and FaceBook.com. Or follow me on Substack.com/Notes where my byline is my handle.

Selling in The Money Covered Calls Can Yield Big Annual Returns on Risk. By Donald E. L. Johnson

July Dividend Stocks Covered Calls Trades Update #2

July Dividend Stocks Covered Calls Trades Update #1

12 July Covered Calls Trades on Dividend Stocks.

June Covered Calls Trades Returned 21.6% Annualized.

June Covered Calls Portfolio Update # 3.

June Covered Calls Portfolio Update #2.

June Covered Calls Portfolio Update #1.

11 Dividend Stocks in My June Covered Calls Portfolio.

5 Dividend Stocks for June Covered Calls Trades.

20 Ideas for Adjusting Your Stock and Bond Portfolio, by Christina Lourosa-Ricardo.

How to Beat Inflation Tax, Bear Market Tax With Dividend Stocks, Covered Calls, Cash Secured Puts, by Donald E. L. Johnson.

Wars Breed Inflation, Rising Interest Rates, Market Turmoil, By Donald E. L. Johnson.

Ways to use StockRover.com to analyze stocks

Calls vs Puts Options: What’s the Difference?

A video on how to place options trades on TDAmeritrade.com’s Think or Swim trading platform.