September Puts Options Trades Update #4

Small and large dividend stock and ETF investors can use covered calls and puts trades to generate monthly income from options premiums and options trading.

By Donald E. L. Johnson

Cautious Speculator

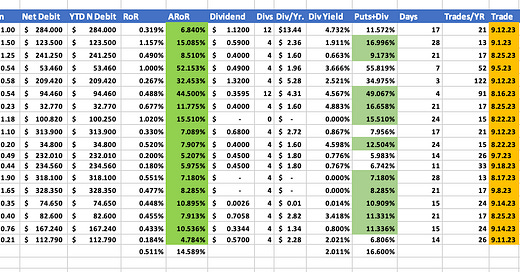

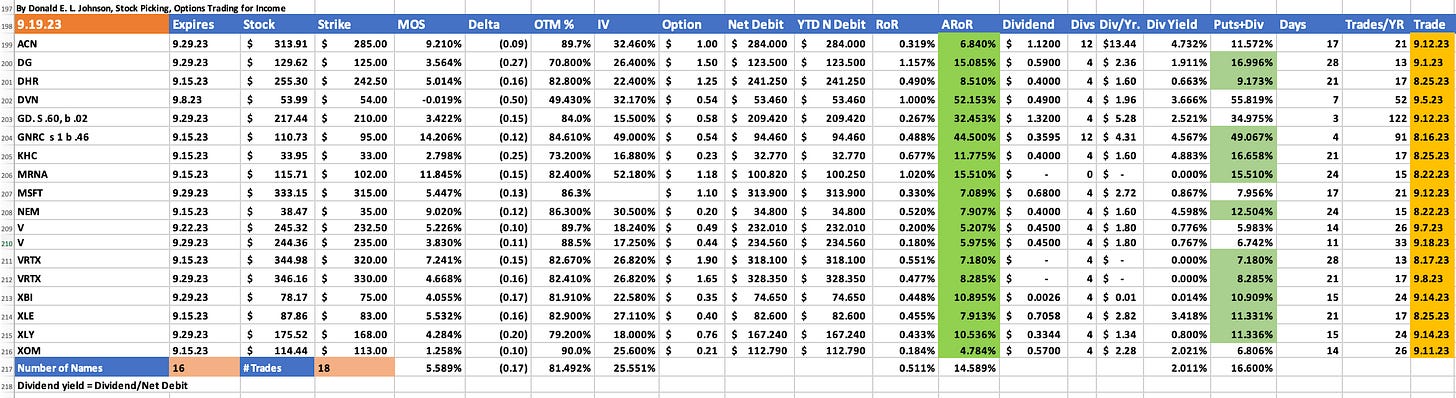

Septembers return on risk on cash secured puts sales will be about 14.6%.

Four of the 18 trade look like they will be assigned.

After the stocks and ETFs are assigned, I’ll sell covered calls on them.

September’s 16 cash secured puts trades on 18 stocks will return about a 14.6% return on risk.

Since Update #3, the Visa Inc. (V) 9.22.23 puts expired and I sold V 9.29.23 $235 puts.

On Friday, V closed at $235.08 and it may be assigned this week. It was at $244.36 on 9.22.23 when I sold the latest puts. Analysts rate V a strong buy with a 4.68 out of a possible 5 rating. The high target price for V is $320. The mean target price is $261 and the lowest target price is $88. It is a 56% buy on Barchart.com.

On Valuentum.com, the fair value estimate for V is $236. On Morningstar.com, the FVE is $241. On Stockchart.com, the bullish point and figure chart price objective is $286. If V is assigned, I’ll take the assignment and sell covered calls on the stock for options premiums income.

The September puts on the S&P Biotech SPDR ETF (XBI) and the September puts on the S&P 500 Consumer Discretionary Sector SPDR ETF (XLY) also look like they will be assigned. On Friday XBI closed at $72.96 a share, and XLY closed at $160.93. I’ll probably take assignments on those stocks and sell covered calls on them next week.

The month’s biggest disappointment is Data General Corp. (DG). When I sold DG 9.29.23 expiration $25 puts, the stock was at $129.62 a share. On Friday, it closed at $108.14 after it reported disappoint earnings. DG has gone from being seen as a top discount retailer to one of the weakest retailers because its target customers are relatively low income, and they are being hit hard by the inflation tax. DG is down 32.35% in the last month and 56% year to date. With DG’s relative strength at 14.8, it looks very over sold.

On Barchart.com, DG is a strong 100% sell. Analysts give DG a moderate buy rating of 3.41. The high target price for DG is an optimistic $270, which probably will be reduced. The mean target price is a still optimistic $152.76, and the low target is $96. That also could be optimistic in this market.

I respond to comments on the comments section where readers’ comments are posted. That is, if you have a question about this article or other comments, I'll discuss your questions with you in the comments section below this article.

Thanks for reading Stock Picking, Options Trading for Income! Subscribe for free to receive new posts and support my work.

LINKs:

Home Page. See my more than 150 articles on options trading, stocks and watch lists. If you read several of these articles, you’ll learn how my strategies are meant to work. No guarantees. Links to useful web sites are on the lower right corner of the home page. Scroll down.

Follow @RealDonJohnson on twitter.com and FaceBook.com. Or follow me on Substack.com/Notes where my byline is my handle.

September Puts Options Trades Update #3

September Puts Options Trades Update #2

September Puts Options Trades Update #1

5 September Cash Secured Puts Trades on Dow Jones Index’s Good Dividend Stocks

September Covered Calls Trades On Dividend Stocks Update #2

September Covered Calls Trades On Dividend Stocks Update #1

September Puts Options Trades on 4 Stocks

5 September Cash Secured Puts Trades on Dow Jones Index’s Good Dividend Stocks

Selling in The Money Covered Calls Can Yield Big Annual Returns on Risk. By Donald E. L. Johnson

How to Beat Inflation Tax, Bear Market Tax With Dividend Stocks, Covered Calls, Cash Secured Puts, by Donald E. L. Johnson.

How I Analyze Bullish Puts Options Trades With Stock Rover, By Donald E. L. Johnson.

Wars Breed Inflation, Rising Interest Rates, Market Turmoil, By Donald E. L. Johnson.

Calls vs Puts Options: What’s the Difference?

A video on how to place options trades on TDAmeritrade.com’s Think or Swim trading platform.

This Business Week cover story about Dollar General probably explains why the stock is in the tank and probably is headed lower. https://www.bloomberg.com/news/features/2023-09-20/dollar-general-employees-say-it-s-a-terrible-place-to-work