June Covered Calls Trades Returned 21.6% Annualized

Small and large dividend stock investors can use monthly covered calls to generate steady monthly income from options premiums and options trading.

By Donald E. L. Johnson

Cautious Speculator

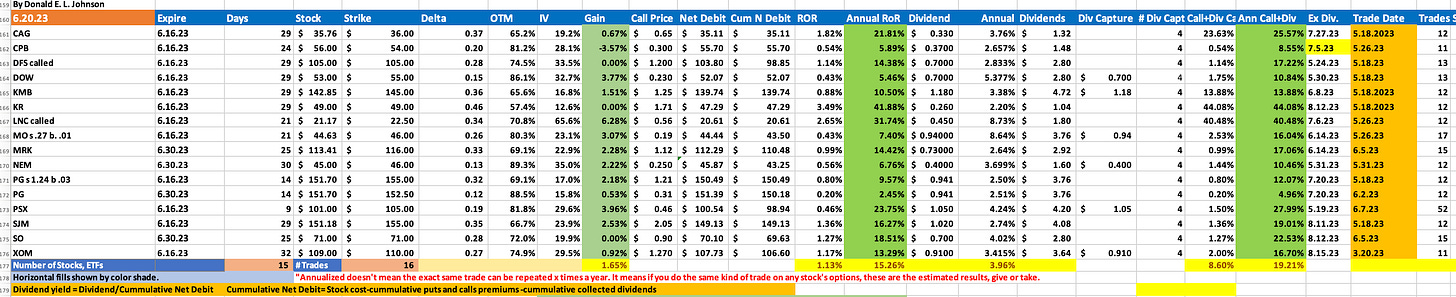

The June covered calls trades on 12 dividend stocks yielded about 21.6% annualized.

Two stocks were called.

Options trades on two stocks were closed early and rolled into July.

Diversification helps traders make money on monthly covered calls trades.

My June covered calls trades average stock options premiums returns on risk were 1.13%, or 15.26% annualized if I can match those returns for 12 months. Collected gains on two called stocks were 0.2% of the net debt investment, or 2.4% annualized. Collected dividends yielded a 0.3% RoR, or 3.6% annualized.

Options premiums plus capital gains plus collected dividends on dividend stocks’ covered calls options that expired in June totaled about 21.6% annualized.

July portfolio returns don’t look as good due to lower volatility in the market and lower options prices. These returns don’t reflect changes in stock prices other than the realized gains on called stocks because I continue to hold those stocks, write covered calls on them and collect their dividends.

If the recent market rally continues in July, I may have more covered calls exercised. Gains on those trades would increase my annualized returns over what I get on covered calls trades and dividends.

My investments in these stocks represent about 65% of my investments in dividend stocks and exchange traded funds that yield more than 8% annually. As a cautious dividend and options premiums investor, I’m about 55% in cash. Most of the cash is in money markets that yield over 4% annualized.

Discover Financial Services (DFS) was called at $105 per share, which is what I paid for it. When I sold the covered calls, the stock was correcting. I sold the covered call at the purchase price strike to so that I could sell DFS for at least what I paid for it. In other words, I chose not to go for higher premiums on in the money strikes. On June 30, DFS closed at $116.85.

The 29-day trade gave me a 1.14% RoR, or 5.46% annualized. I also collected a $0.70per share dividend on DFS, or 2.33% annualized based on the net debit price.

So I missed a $11.85 gain on DFS that I would have if I hadn’t sold the call at $105. But my cumulative net debit after collecting covered calls premiums and dividends on DFS was $98.85. To me, this was a successful covered calls trade. I’m waiting for DFS to dip before I sell cash secured puts on it.

Lincoln National Corp. (LNC) closed June 30 at $25.76. It was called at $22.50, up 6.28% from the $21.17 I paid for it and up from the $20.61 net debit. The 21-day trade gave me a 31.7% annualized ROR on the covered calls plus a 76.6% annualized gain if I could do that kind of trade every month for 12 months. I’m not even dreaming about those kinds of returns.

During June I took profits on my Altria Group (MO) and Proctor & Gamble Co. (PG) covered calls trades before the options expired. Because this meant the trades were open fewer days than expected when the trades were done, the annualized returns were a bit better than I expected.

I rolled both covered calls trades over into the July covered calls portfolio. This allowed me to sell July covered calls options for more than they probably would be worth on July 1, depending on what happened to the stocks’ prices and volatility.

The June portfolio started with 11 stocks, included 15 by the end of the month and wound up with 13 stocks after the called stocks were sold.

This is how the June portfolio stocks have performed during the last month, three months and year to date.

Conagra Brands Inc. (CAG) and Campbell Soup Co. (CPB) fell during June, The rest of the stocks on the list were up. Trading 11 to 15 stocks gives you a better chance of making money every month than putting all of your cash into, say, CPB.

LINKs:

Home Page. See my more than 100 articles on options trading, stocks and watch lists. If you read several of these articles, you’ll learn how my strategies are meant to work. No guarantees. Links to useful web sites are on the lower right corner of the home page. Scroll down.

Follow @realDonJohnson on twitter.com and FaceBook.com. Or follow me on Substack.com/Notes where my byline is my handle.

Selling in The Money Covered Calls Can Yield Big Annual Returns on Risk. By Donald E. L. Johnson

July Dividend Stocks Covered Calls Trades Update #1

12 July Covered Calls Trades on Dividend Stocks.

June Covered Calls Portfolio Update # 3.

June Covered Calls Portfolio Update #2.

June Covered Calls Portfolio Update #1.

11 Dividend Stocks in My June Covered Calls Portfolio.

5 Dividend Stocks for June Covered Calls Trades.

20 Ideas for Adjusting Your Stock and Bond Portfolio, by Christina Lourosa-Ricardo.

How to Beat Inflation Tax, Bear Market Tax With Dividend Stocks, Covered Calls, Cash Secured Puts, by Donald E. L. Johnson.

Wars Breed Inflation, Rising Interest Rates, Market Turmoil, By Donald E. L. Johnson.

Ways to use StockRover.com to analyze stocks

Calls vs Puts Options: What’s the Difference?

A video on how to place options trades on TDAmeritrade.com’s Think or Swim trading platform.