8 Dow Jones Industrials Stocks' Buy Ratings Make Them Candidates for Covered Calls Options Trading

Dividend stock investors look for bullish stocks when they sell covered calls options to generate options premium income.

By Donald E. L. Johnson

Cautious Speculator

Investors liked the Fed’s quarter point hike in the Federal Funds Rate. Some feared that there would be another half point hike.

Eight Dow stocks are showing strong bullish momentum.

That makes them good candidates for covered calls options trades.

The risk is that the stocks may dip and the bullish momentum and technical buy signals can disappear, sometimes quickly.

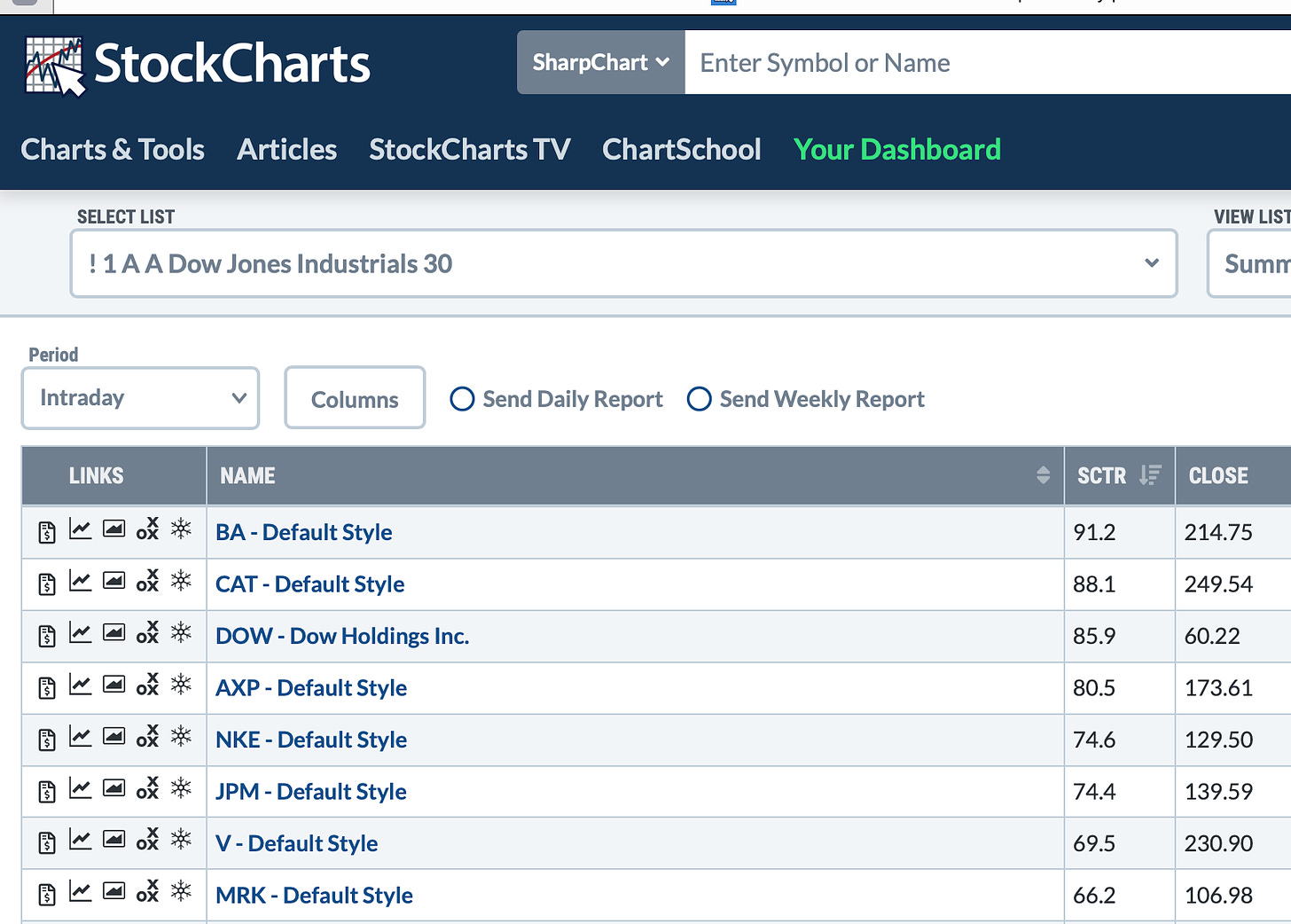

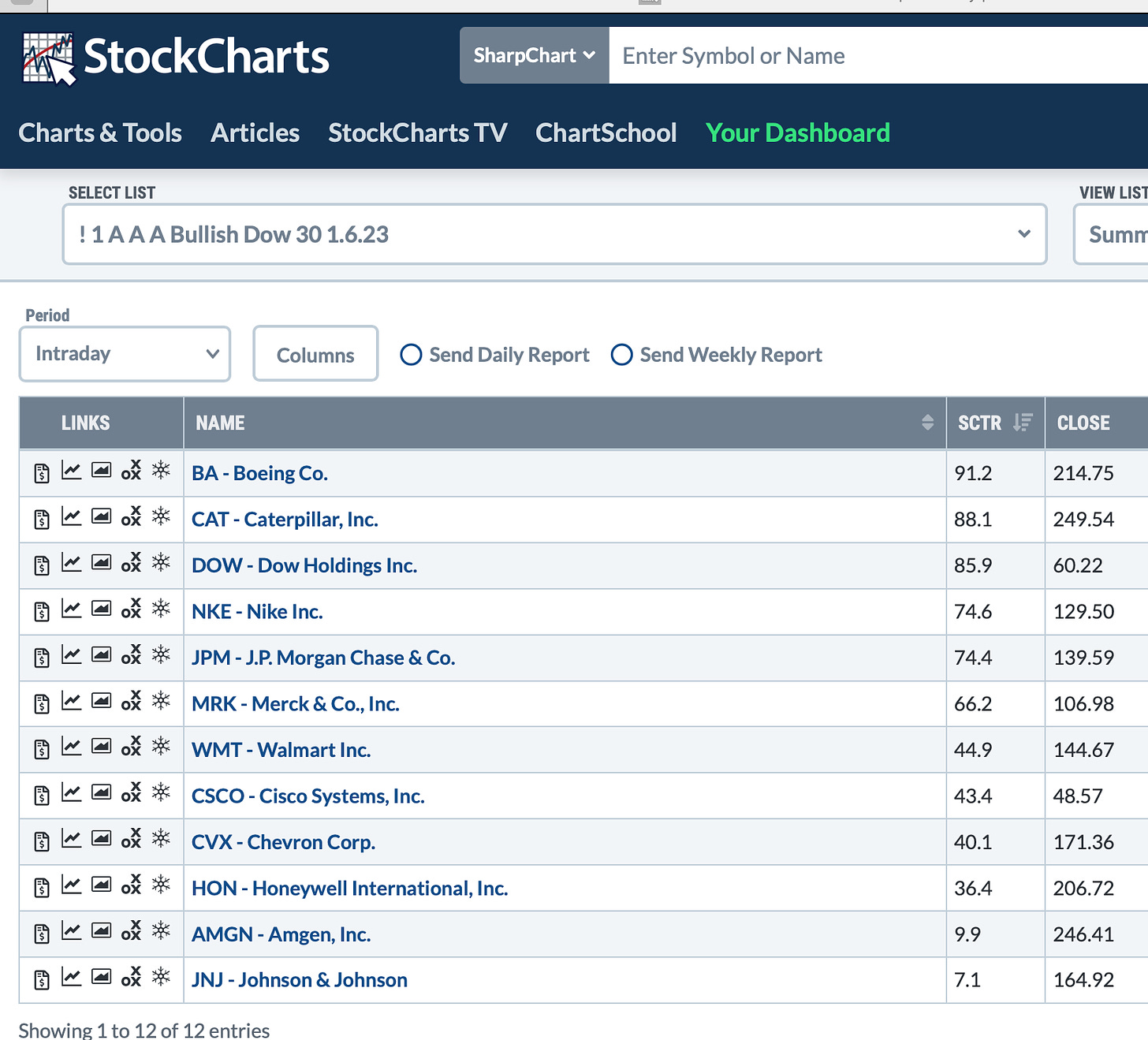

Eight of 30, or 26.7%, of the Dow Jones Industrials Average 30 stock have strong momentum ratings of 60 or more out of a possible 100. Another seven have less impressive buy ratings of 40 or more.

Back on Jan. 8, 2023, 12 DJIA 30 stocks had bullish SCTR momentum ratings.

The eight current winners include Boeing (BA), Caterpillar (CAT), Dow Holdings (DOW), American Express (AXP), Nike (NKE), J.P. Morgan Chase (JPM), Visa (V) and Merck (MRK). I have positions in CAT and MRK.

On point and figure charts, these stocks’ bullish price objectives are: BA ($159-met), AXP ($237), CAT ($441), DOW ($70), JPM ($171), MRK ($138) and V ($273).

Half of the 12 DJIA30 stocks that had SCTR ratings of 60 or above on Jan. 6 still do.

Depending on Thursday morning’s stock earnings reports, many investors will be looking to buy stocks with good momentum and bullish P&F chart price objectives.

Investors in dividend paying stocks that have active and liquid options will sell covered calls on some of the eight high-momentum stocks in the DJIA30.

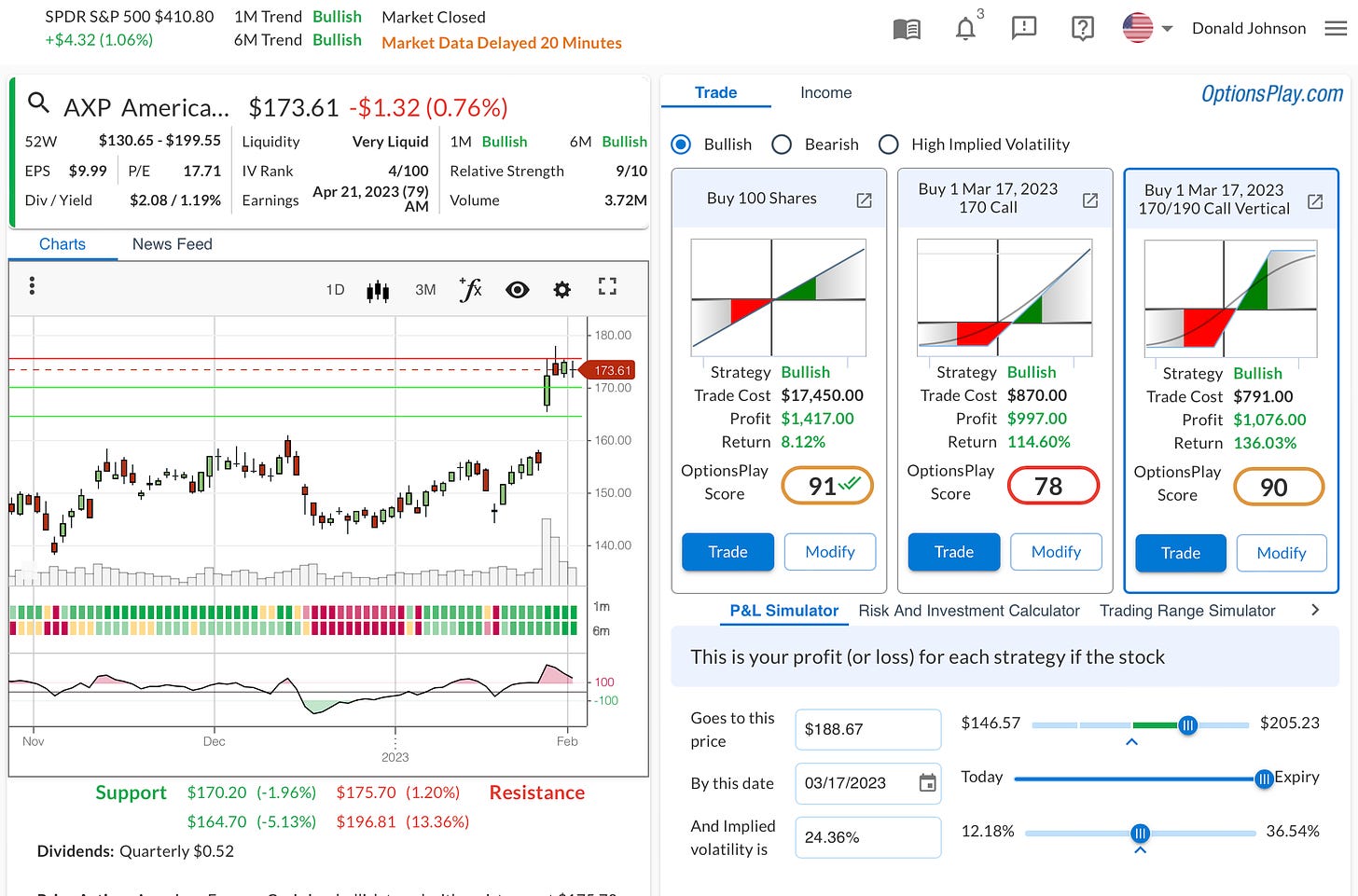

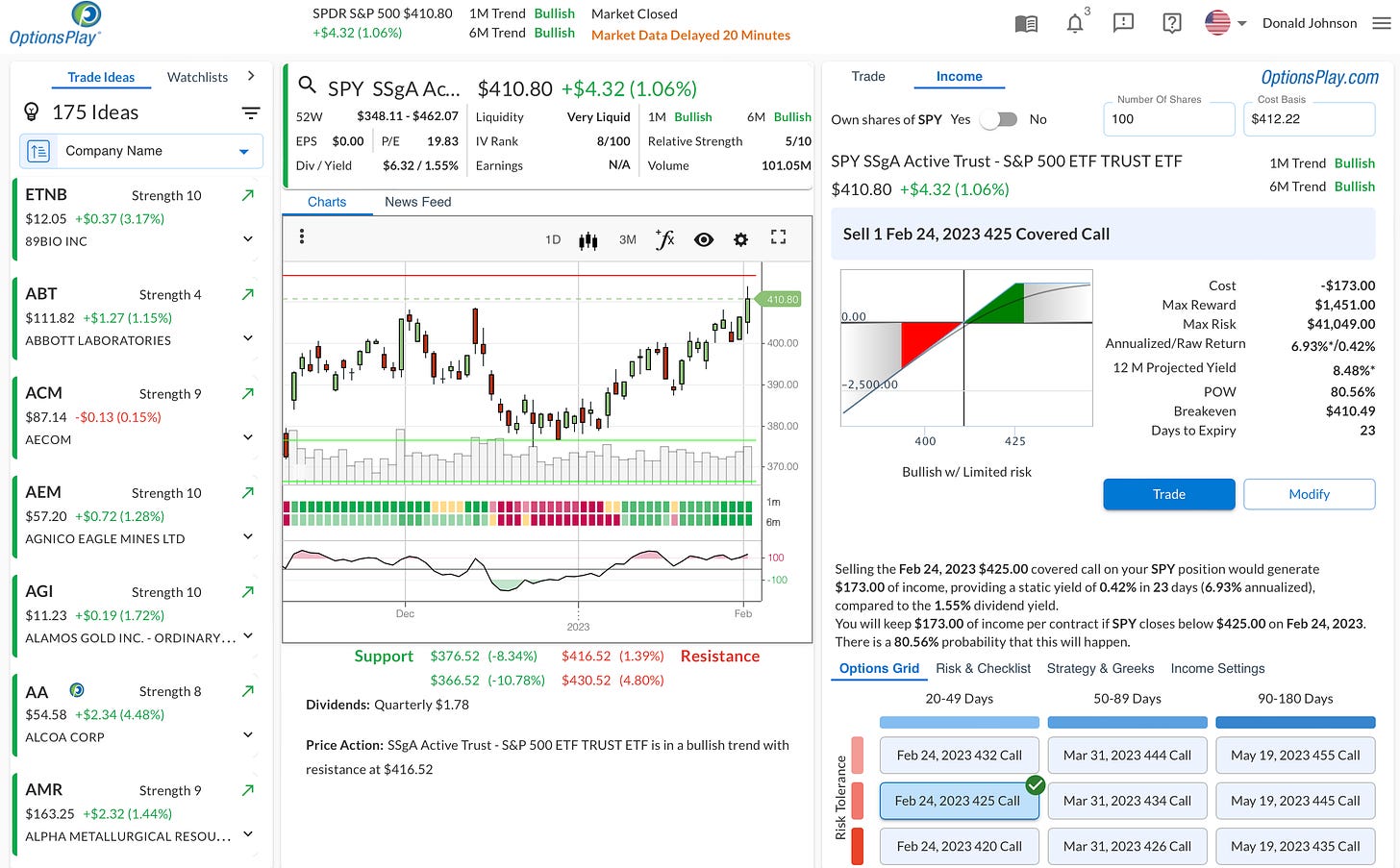

This OptionsPlay.com (paid subscription) panel shows how investors might trade AXP if they don’t own it. Optionplay’s platform is an outstanding calculator that can be used to create and review all kinds of options trading scenarios. The platform is available for free on Schwab.com, I think.

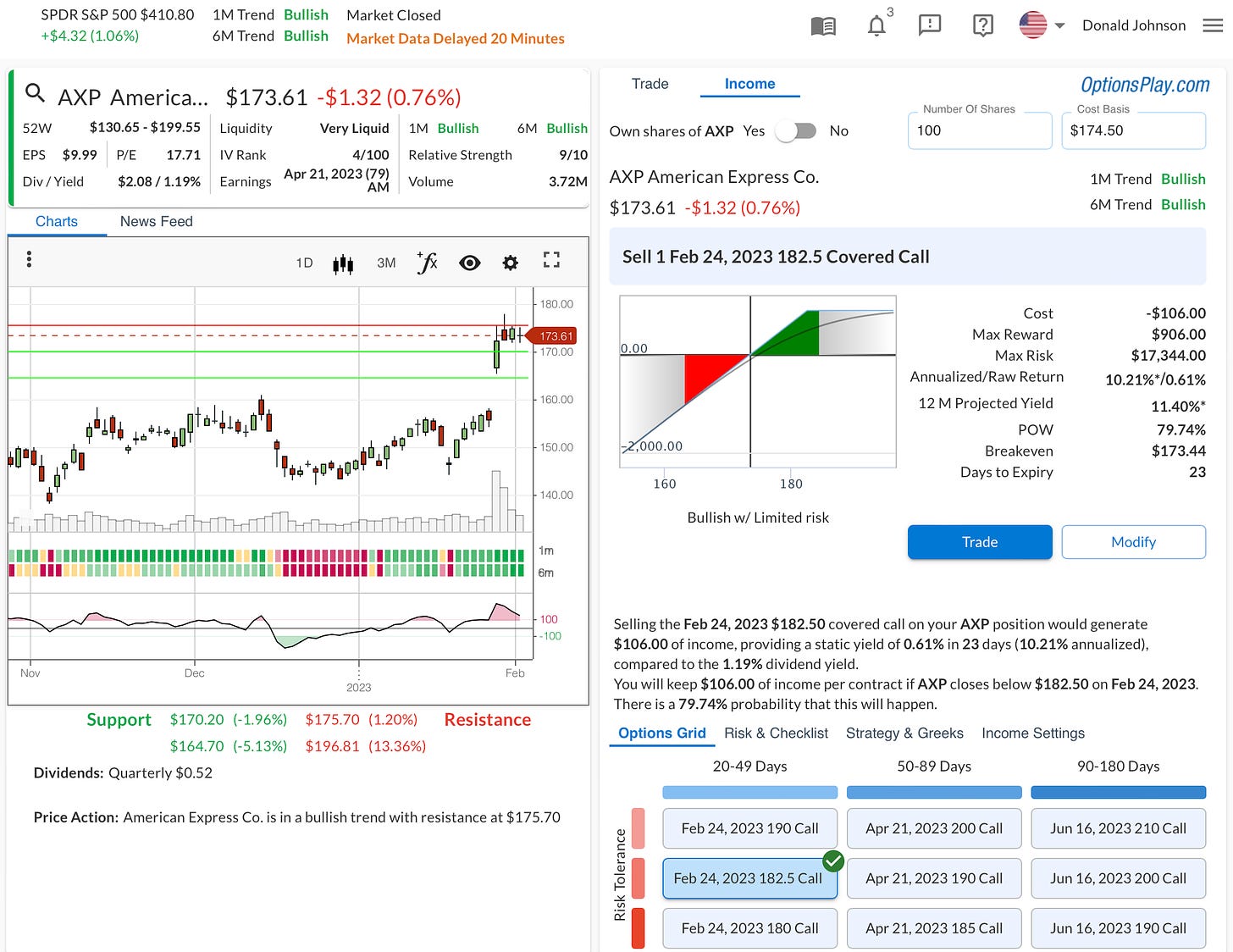

AXP owners looking to sell covered calls for income can check out this income panel.

Investors looking for other trading ideas can review the first column of the page.

Investors also might sell cash secured puts for options premiums income.

My Trades

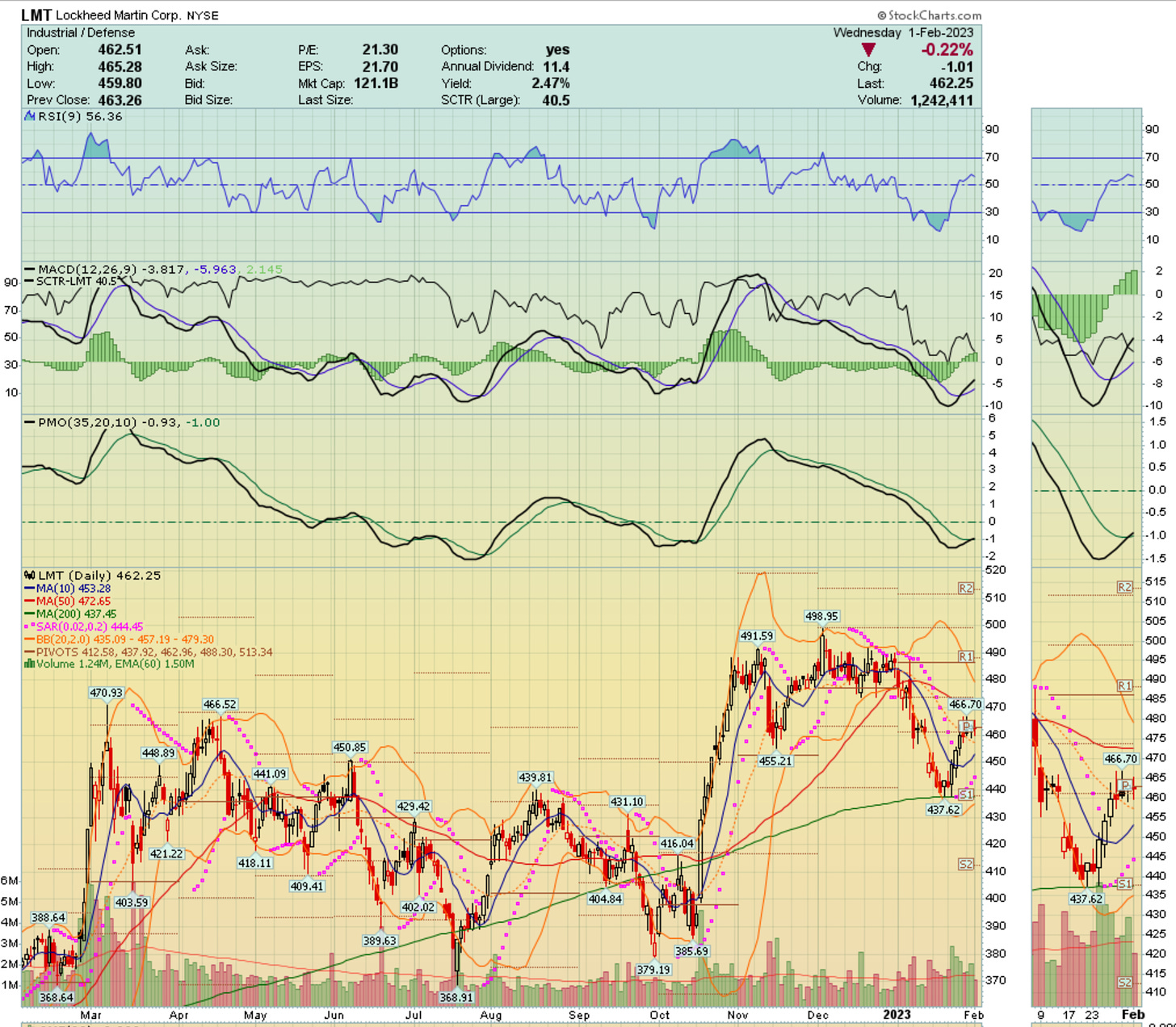

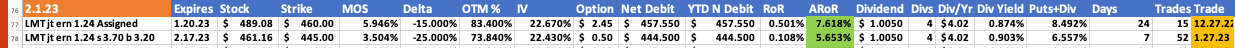

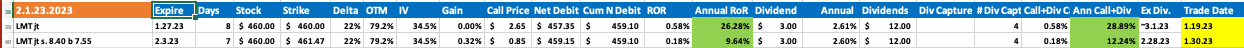

On Dec. 27, I sold Lockheed Martin (LMT 1.20.23) $460 puts when the stock was at $489. The margin of safety (MOS) was 5.946% and the delta was a fairly safe -15%. The stock fell about 15 points and was assigned. That is, with the stock around $440, I bought it for $460.

I then sold LMT $460 (my purchase price ) 1.27.23 $460 strike covered calls. When those calls expired worthless I sold LMT 2.3.23 $465 calls when the stock was back up to $462.

Not sure what the Fed would do today, this morning I bought back the calls at a profit and sold LMT for $461.47.

On Jan. 27, I had also sold LMT 2.17.23 $445 puts when the stock was at $461.16. This morning I bought those puts back at a small profit. Click on the images for better views.

Yesterday, The Wall Street Journal reported that Lockheed and other defense contractors won’t be able to fill Pentagon orders for new weapons inventories until next year. The U.S. has been negligent in maintaining its inventories and keeping contractors and sub contractors in business. Shipments of military equipment to Ukraine are depleting America’s supply of weapons. So, I’m less eager to own LMT for now. The stock rallied with the markets late Wednesday after the Fed announced its quarter point Fed funds rate hike. Its chart looks pretty bullish.

LINKs:

Home Page. See my more than 90 articles on options trading, stocks and watch lists. If you read several of these articles, you’ll learn how my strategies are meant to work. No guarantees. Links to useful web sites are on the lower right corner of the home page. Scroll down.

Follow @realDonJohnson on twitter.com and FaceBook.com.

Selling in The Money Covered Calls Can Yield Big Annual Returns on Risk. By Donald E. L. Johnson

20 Ideas for Adjusting Your Stock and Bond Portfolio, by Christina Lourosa-Ricardo.

How to Beat Inflation Tax, Bear Market Tax With Dividend Stocks, Covered Calls, Cash Secured Puts, by Donald E. L. Johnson.

Wars Breed Inflation, Rising Interest Rates, Market Turmoil, By Donald E. L. Johnson.

Ways to use StockRover.com to analyze stocks

Calls vs Puts Options: What’s the Difference?

A video on how to place options trades on Think or Swim.

Good info Don. I don't see that OptionsPlay filter via Schwab, but if you find it there, please let me know.