12 Dow Stocks Have Buy SCTR Momentum; 18 of 30 Have Bullish Charts Price Objectives

Bullish stocks and ETFs work best for dividend and stock market options traders who sell covered calls and cash secured puts

By Donald E. L. Johnson

Cautious Speculator

DOW stocks offer good dividend and options trading income opportunities when they have bullish momentum and price objectives.

18 of the 30 stocks in the index have bullish price objectives.

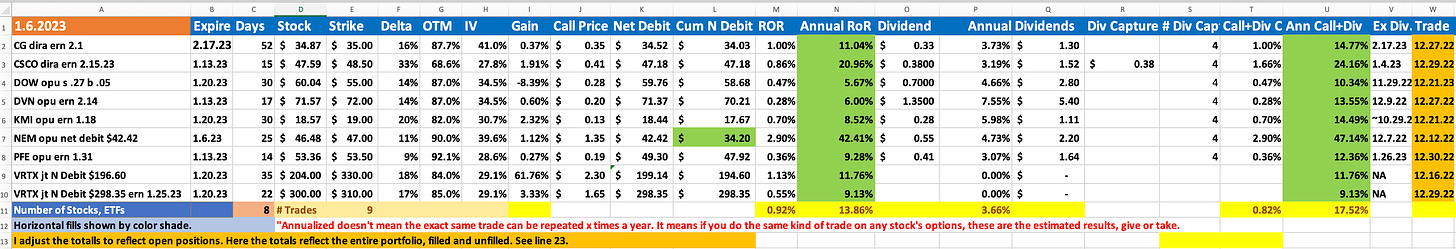

My spreadsheets show how I’m trading some Dow stocks and others.

As part of risk management, it helps to diversify by holding cash and several stocks, ETFs and positions in covered calls, in the money calls and cash secured puts.

Diversifying by doing trades and scheduling options expirations several times during a week and month also helps reduce risks.

This is all about generating dividends and options premiums income.

Most of the 30 stocks in the Dow Jones Industrials Average (DJIA30) are good candidates for dividend stock investors and options traders who sell covered calls and cash secured puts for steady streams of options premiums income–especially when the underlying stocks have bullish momentum and price objectives.

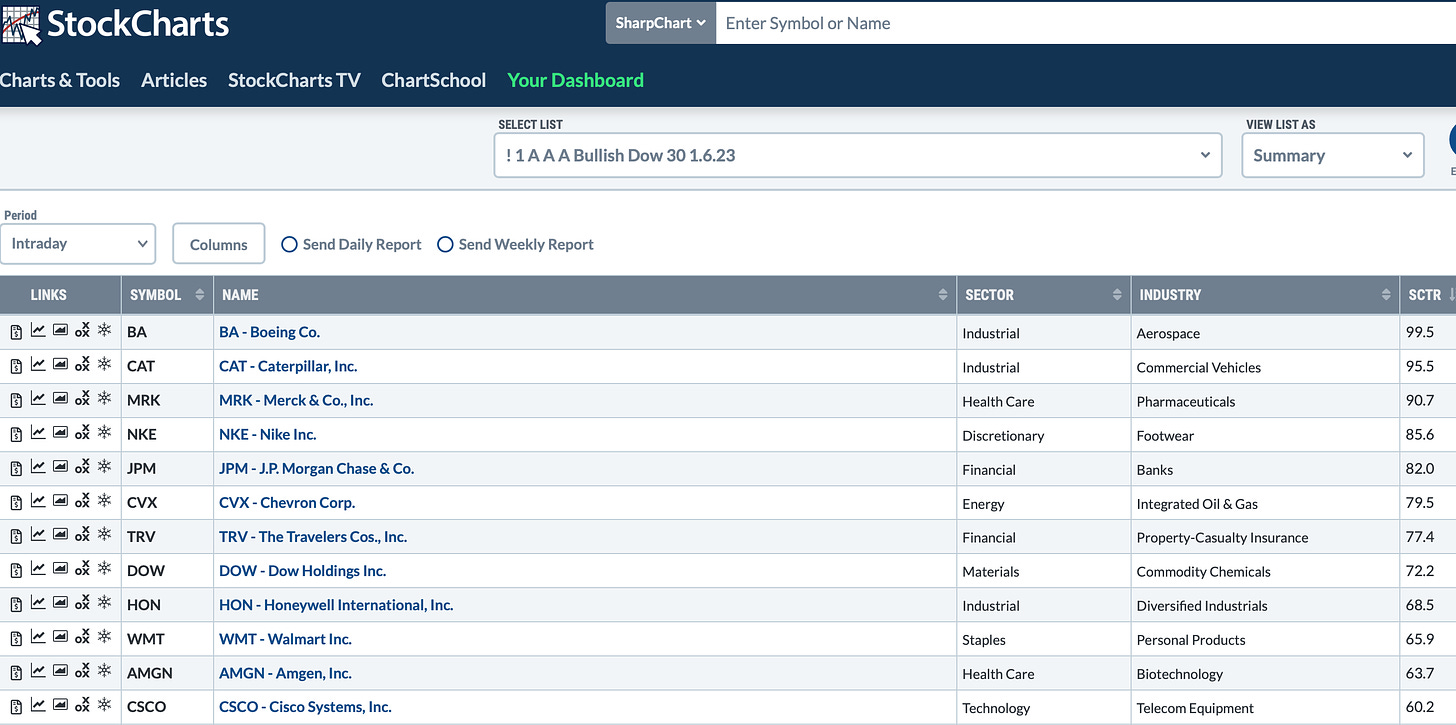

Twelve of 30 Dow stocks have bullish momentum as measured by Stock Charts Technical Ratings (SCTR) on StockCharts.com.

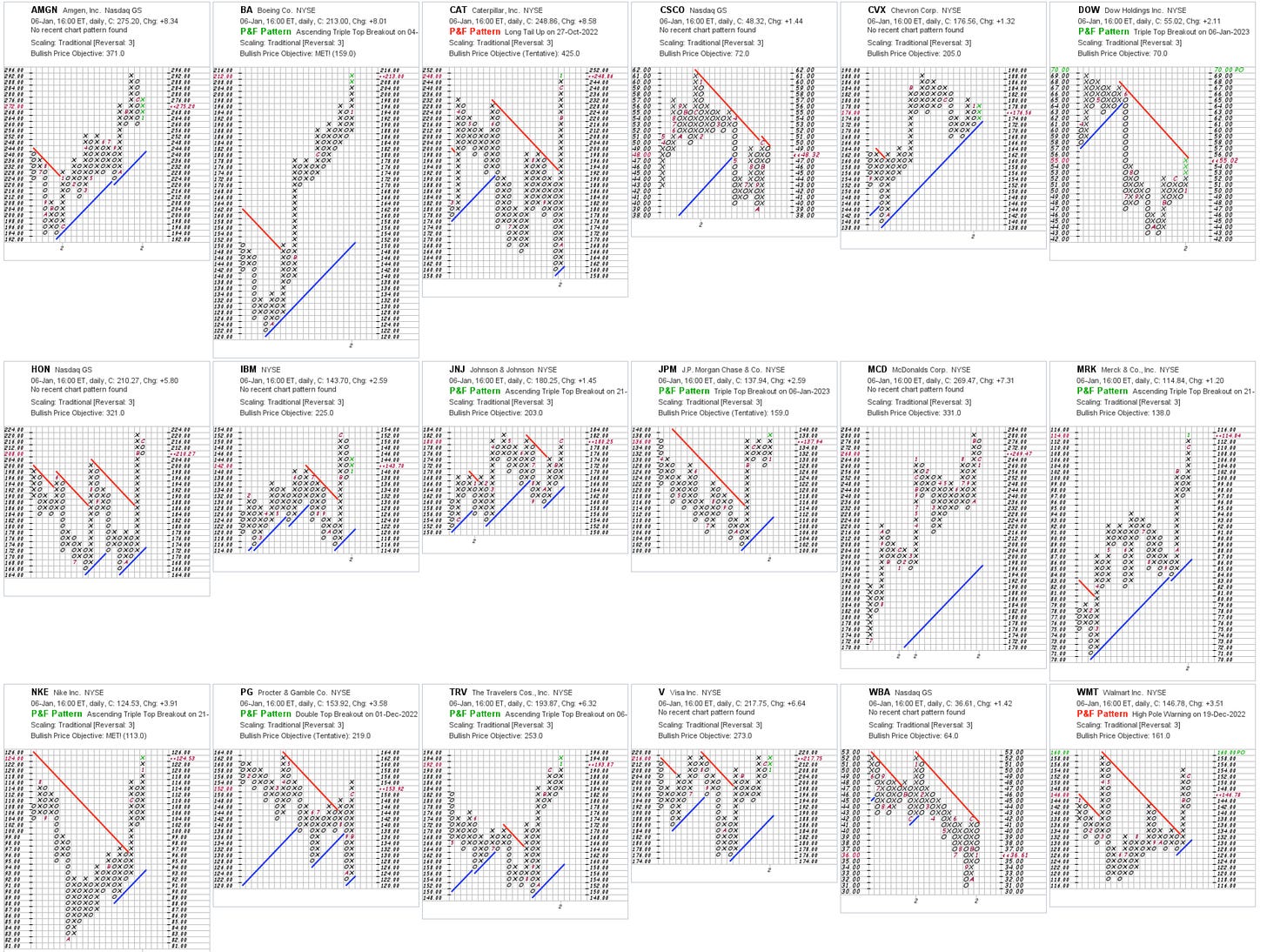

Eighteen of the 30 Dow stocks have bullish point and figure charts price objectives. Please click on the images and zoom in for better views.

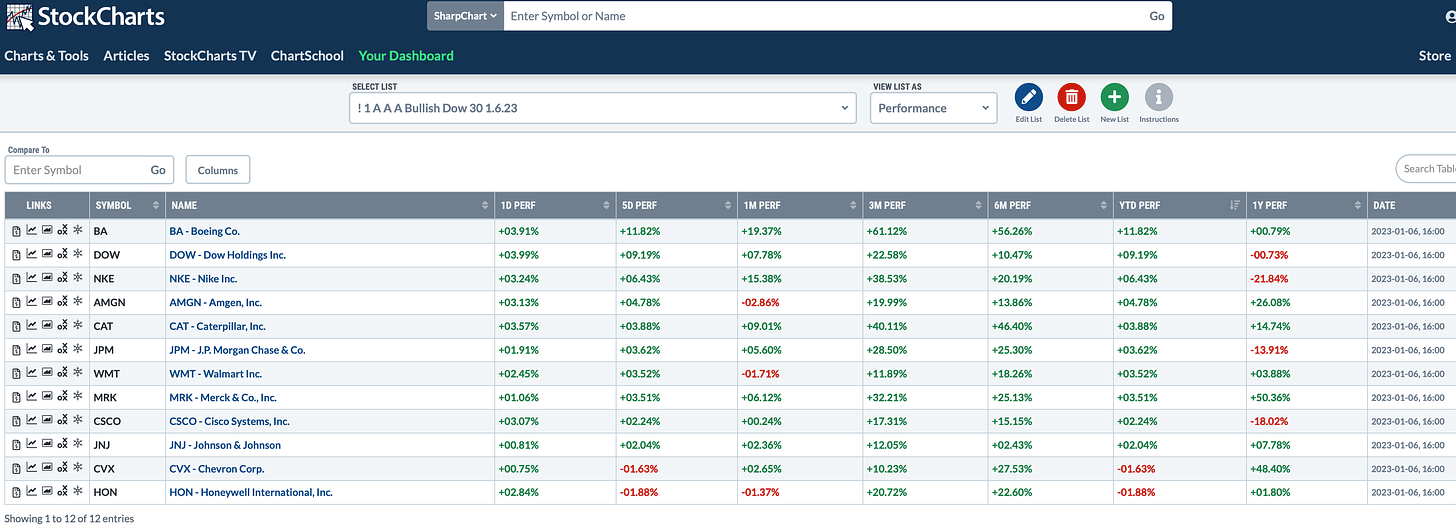

Boeing (BA) was the best performer of the bullish Dow stocks last week, up 3.91%. It also has been the best performer over the last six months.

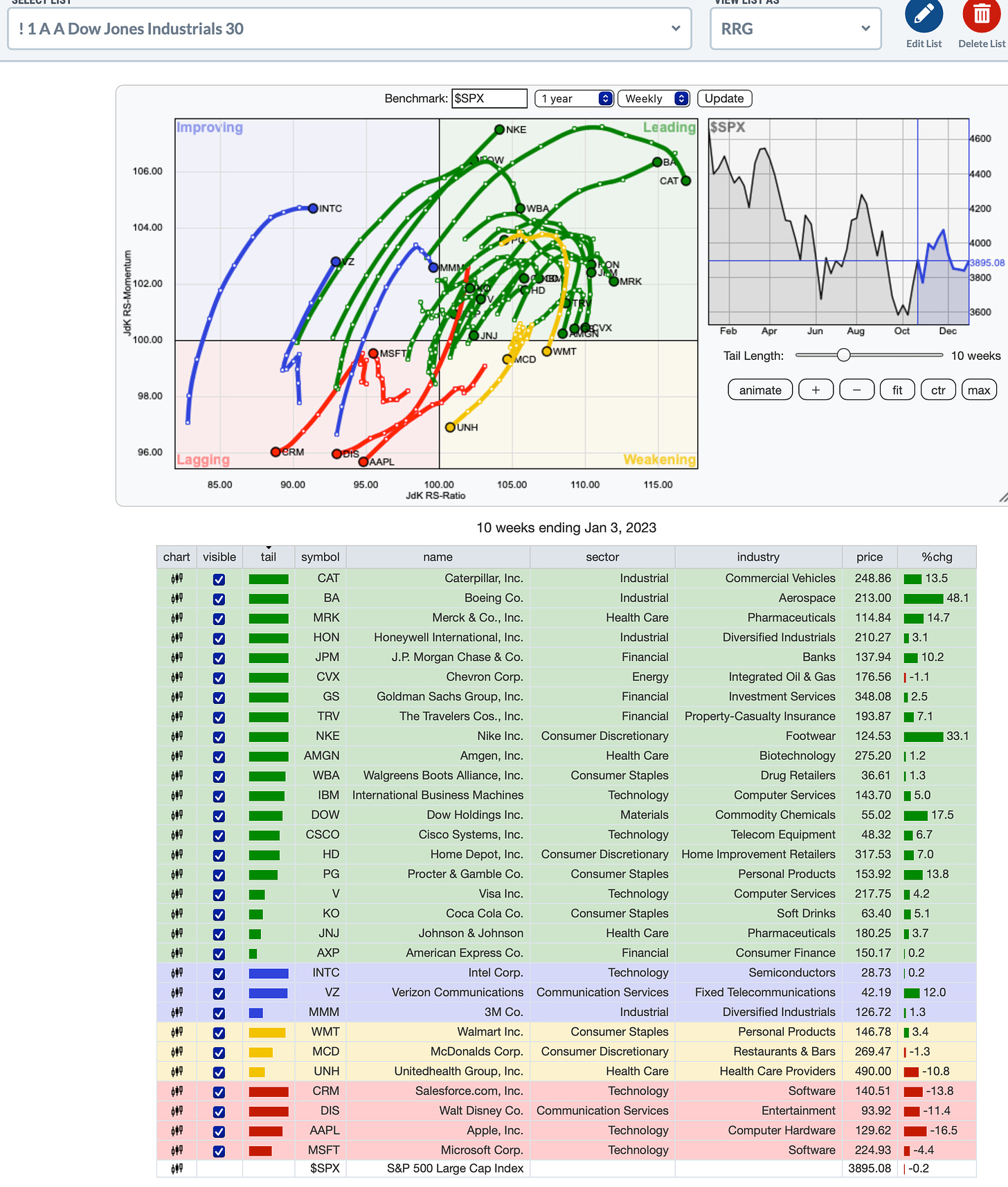

During the 10 weeks ended Jan. 3, CAT, BA and MRK have been the DJIA30 leaders. INTC, VZ and MMM have been improving, WMT, MCD and UNH have lost ground and the laggers have been CRM, DIS, AAPL and MSFT.

This is a thee-year chart for DIA, the exchange traded fund that tracks the DJIA30. This a bullish chart. DIA is also a pretty good equity for trading covered calls and puts.

My Trades

Because I’m bearish, I haven’t bought stocks for out of the money (OTM) or at the money (ATM) covered calls trades yet this year. My NEM 1.6.23 $47 strike calls were exercised and the stock was called at $47.

NEM closed Friday at $52.69. I would have made more money if I had not written the calls, but that is what happens. I made a small profit, and I’m short NEM puts as shown below. Since I bought the stock for early last year, I’ve sold NEM covered calls 10 times for $5.44 per share in options premiums and collected its dividends four times for another $3.00 per share. In March NEM was called for a $3.84 per share profit. Bought back in August. So on a net debit, options premiums and dividends plus capital gains basis, the trade was reasonably profitable. I plan to buy the stock at a lower price.

Note the “earnings” note column A. I want to be out of most of these options trades on the days these companies report their fourth quarter and full 2022 earnings provide new guidance for 2023.

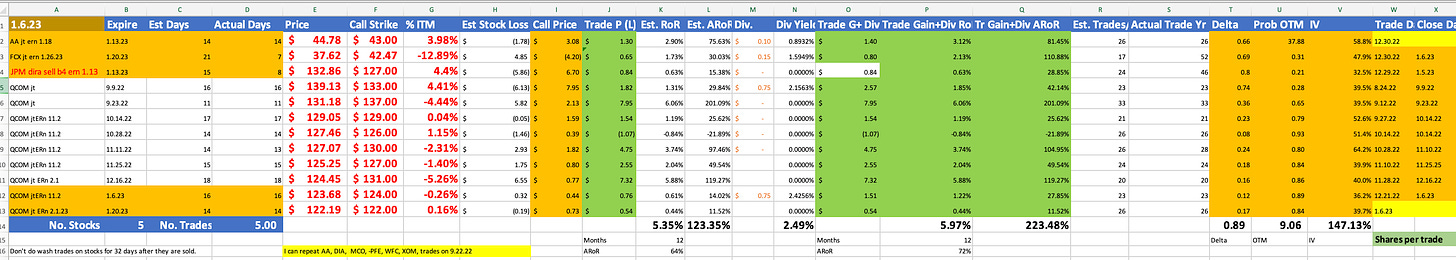

I did four ITM covered calls trades last week. I closed my trades on FCX, JPM, and QCOM and rolled the QCOM trade to selling QCOM 1.20.23 $122 strike covered calls.

In August I bought QCOM for $139.13 and sold QCOM 9.9.22 $133 strike ITM covered calls. The calls were not called. Since then, I’ve been writing OTM QCOM calls, lowering the net debit (purchase price minus options premiums and dividends collected) and waiting for the stock to rally. QCOM’s options are liquid and deep enough so I can write calls at about the net debit price or higher and collect premiums once or twice a month.

Note that I rolled the QCOM calls late Friday just before the QCOM 1.6.22 call options expired. It helps to be heavy in cash so trades like this can be done.

Qualcomm Inc. is a major chip supplier to Apple and other computer and auto makers, and sales have been hurt by inflation, recession and supply chain problems in China and elsewhere. China is opening. QCOM has a bearish price objective of $89, so I may sell QCOM calls for quite awhile. I’m also short QCOM $103 strike puts as shown below.

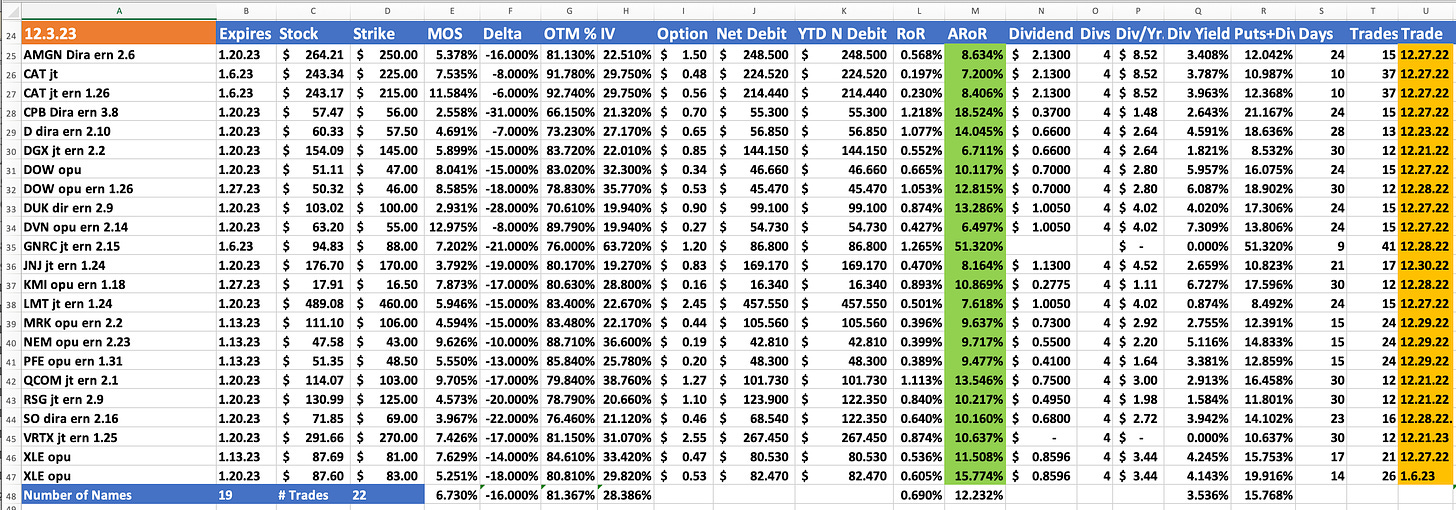

This spreadsheet shows my puts positions on several DJIA30 stocks. They include AMGN, CAT, DOW, JNJ, and MRK. Again, selling puts is for traders who have the cash required to secure the puts options trades. I also have covered calls on CSCO and DOW.

Last week I rolled my XLE 1.13.23 puts to 1.20.23 early. XLE pays a 4.143% dividend based on the $82.40 net debit I would get if the 1.20.23 puts were exercised. I don’t expect XLE will be put to me this month, but who knows?

LINKs:

Home Page. See previous articles on other trades, stocks and watch lists. If you read several of these articles, you’ll learn how my strategy is meant to work. No guarantees. Links to useful web sites are on the lower right corner of the home page. Scroll down.

Follow @realDonJohnson on twitter.com.

Selling in The Money Covered Calls Can Yield Big Annual Returns on Risk. By Donald E. L. Johnson

20 Ideas for Adjusting Your Stock and Bond Portfolio, by Christina Lourosa-Ricardo.

How to Beat Inflation Tax, Bear Market Tax With Dividend Stocks, Covered Calls, Cash Secured Puts, by Donald E. L. Johnson.

Wars Breed Inflation, Rising Interest Rates, Market Turmoil, By Donald E. L. Johnson.

Ways to use StockRover.com to analyze stocks

Calls vs Puts Options: What’s the Difference?

A video on how to place options trades on Think or Swim.