How to Trade Microsoft's Bearish Trends For Income While Holding on to the Stock

New investors in MSFT can sell covered calls options ITM or ATM for nice returns on risks. Owners who bought MSFT at lower prices can get even bigger RoR.

By Donald E. L. Johnson

Cautious Speculator

Even though MSFT’s stock price is depressed, current trends suggest it could go lower. Technicals are not predictive, hower.

New investors in MSFT who are worried that it will decline near term can sell ITM or ATM covered calls for good returns on risk. See my spreadsheets below.

Owners of MSFT who bought at lower prices can sell calls at higher strikes to reduce the risk of having the stock called and still get good returns on their purchase prices. The spreadsheets show several trade scenarios.

Traders have to decide whether they think stock markets are bearish or bullish and pick their stocks and trade their options accordingly.

Microsoft (MSFT) stock charts and other technicals are looking bearish in a bearish market.

I wrote about selling covered calls and cash secured puts on Big Tech stocks on Jan. 22, 2023.

MSFT is trading about 24% below its 52-week high, and it still is not cheap. The price/earnings ratio (PE) is a moderately expensive 26.7, and its price to free cash flow ratio, a more reliable ratio than the PE, is a fairly high 28.6.

With MSFT at $240.61, Wall Street analysts yesterday lowered their target prices a tiny bit after the company released its earnings report and gave new guidance.

The mean consensus target price of Wall Street analysts is $286 per share with the high target at $370 and the low at $212, according to StockRover.com. Upside resistance is between $249 and $260 and support is between $212 and $230, according to OptionsPlay.com.

On StockChart.com’s point and figure chart, MSFT’s bearish price objective is $177.

Barchart.com’s technical rating “is a 72% sell with a weakening short term outlook on maintaining the current direction.”

OptionPlay.com’s relative strength rating for MSFT is a weak 3 out of a possible 10.

While the company’s main businesses are showing mixed results, and its guidance for its core businesses is looking bearish, MSFT is dealing with the Department of Justice’s Anti-Trust Division over its proposed acquisition of Activision. A lot of people don’t think it will happen.

And Microsoft’s recent investment of billions in the creator of ChatGPT won’t pay off for years, if ever. Yet, this deal is bringing a lot of money into the stock.

Trading covered calls for Income

Investors who are bullish on the stock and are ready to buy it can do a buy/write (b/w) covered calls trade. Many of my more than 90 previous posts explain how to trade covered calls.

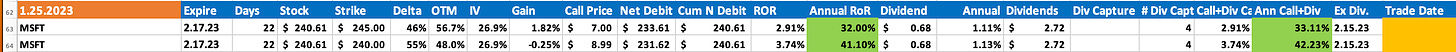

An investor Thursday could buy MSFT for $240.61 and plan to hold it until it reaches, say, $286. To enhance her income, she could sell MSFT 2.17.23 options expiration (22 days) $245 strike covered calls (delta 46% with a 56.7% probability that the option will expire uncalled and out of the money). Each option is a contract for 100 shares.

The mid point between the bid and ask price would be about $7 per share, or $700 per 100-share option contract. That would provide a 2.91% return on risk (RoR). If that kind of trade was done on MSFT or another equity every 22 days for 12 months, the annualized return (ARoR) would be about 32% plus the 1.13% annual dividend.

The 46% delta estimates the probability. of having the stock called and sold is about 46%. While the trade is open, that probability will fluctuate with time decay and the stock’s price changes.

The second line in the table above shows a possible trade that could be done in anticipation of a drop in the price of the stock. The investor would buy MSFT for $240.61, give or take, and sell MSFT 2.17.23 $240 at the money calls for $9.60 minus the $0.61 loss that would be taken if the stock was bought at $240.61 and called (sold at $240). Some traders do in the money covered calls trades at, say, a $430 strike, but they want the stock to be called.

The immediate RoR would be 3.74%, or about a 41.1% ARoR.

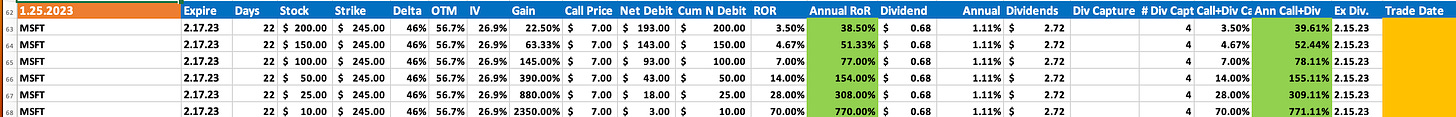

How would the trade look for an investor who years ago bought MSFT for between $10 and $200 a share? This spreadsheet shows the potential returns.

To reduce the risk of having the calls assigned and the stock sold to the owner of the calls at expiration, an investor might sell the calls at much lower deltas, say under 10% or 15% with higher probabilities that the stock wouldn’t be called. Higher strikes and lower deltas yield lower return on risks.

My Trades

Today, I took the covered calls trade I could get on Campbell Soup (CPB), which was put to me at $56 a share on Jan. 20. I sold CPB 2.17.23 $56 calls for $0.10. That would let me break even on the stock if it were called. If not called, it would return 0.18%, or about 1.96% annualized. The cumulative net debit, including the income from selling the puts, is $55.60. So, if called, I’d make $0.40 less commissions over the 46 days since I sold CPB puts for $0.70 a share. If the stock is called, okay. If it’s not called, I’ll keep selling calls and lowering the net debit until it is called. CPB closed Wednesday at $51.66.

Last week, Lockheed Martin (LMT) was put to me for $460. On Jan. 23, I sold LMT 1.27.23 $460 strike covered calls for $2.65. That gave me a 0.58% RoR, or 26.3% ARoR on the eight-day trade. I took the lower return by selling the calls at a strike that would let me out of the trade with a profit from selling puts at $2.45 and calls for $2.65. The net debit is $460 minus $5.10, or $454.90. LMT closed today at $454.16, up from about $440 when I sold the calls.

Because their earnings were coming due this week and next week, on Monday I bought back weekly puts on Caterpillar (CAT) and Abbott Labs (ABT) at nice annualized returns on risk. I thought the stocks might be put to me at prices I’m not interested in paying for them. So I got out of the puts trades.

I’m not planning to do any major trades until the Fed announces its rate hikes on Feb. 1, but that doesn’t mean I won’t. On Friday, my puts on KMI, NEM, XLE and XLI will expire. My covered calls will expire on MRK, LMT, and LOW.

LINKs:

Home Page. See my more than 90 articles on options trading, stocks and watch lists. If you read several of these articles, you’ll learn how my strategies are meant to work. No guarantees. Links to useful web sites are on the lower right corner of the home page. Scroll down.

Follow @realDonJohnson on twitter.com and FaceBook.com.

Selling in The Money Covered Calls Can Yield Big Annual Returns on Risk. By Donald E. L. Johnson

20 Ideas for Adjusting Your Stock and Bond Portfolio, by Christina Lourosa-Ricardo.

How to Beat Inflation Tax, Bear Market Tax With Dividend Stocks, Covered Calls, Cash Secured Puts, by Donald E. L. Johnson.

Wars Breed Inflation, Rising Interest Rates, Market Turmoil, By Donald E. L. Johnson.

Ways to use StockRover.com to analyze stocks

Calls vs Puts Options: What’s the Difference?

A video on how to place options trades on Think or Swim.