Google, Microsoft, Amazon, Meta Should Use Free Time Learning to Trade Stocks, Options

Buying large cap dividend stocks and selling covered calls options and cash secured puts options on them for options premiums can be risky and very rewarding. The secret is to keep it simple.

By Donald E. L. Johnson

Cautious Speculator

GOOG, MSFT, META, AMZN and other Big Tech companies’ laid off employees can replace a lot of their lost income trading options like covered calls on big cap dividend stocks, not on the high fliers.

People who have traded stocks on line can learn to trade covered calls in few days. Brokers are eager to show you how.

Start small, one contract at a time. Do a lot of small options trades to diversify an options portfolio.

The 11 steps to beginning to trade options are outlined below.

This blog’s more than 90 educational articles should help new and experienced traders learn how to generate options premiums trading calls and puts options for income. Reading these articles is like reading a free book on stock picking, options trading.

The more than 200,000 big tech company employees who were laid off in the last year should not only be looking for jobs but also learning how to use their often substantial wealth, smarts and strong work habits to generate good dividend and options premiums income while working from home and on the road.

These smart, tech savvy folks should be able to quickly learn how to evaluate, buy and sell stocks, exchange traded funds (ETFs), but also how to generate income by selling covered calls on stocks they own and cash secured puts (CSP) on stocks they own and want to own.

Big tech alums with from $25,000 to several million dollars in cash, stocks, bonds and other liquid assets should spend a few days reading the more than 90 blogs (newsletters) that I have written in the last 12 months. My mission is to show how to pick stocks and options trades, not to be a financial advisor.

Everything I write here is intended to be educational for beginners as well as moderately to very experienced investors in stocks, ETFs and other equities.

How to Begin

Determine how much money you want to put into stocks, ETFs and options. All trading is risky. Working in big tech can be risky.

Evaluate your stock investments to see how strong they are in the current bear market. Most of you probably are invested in your company and other formerly hot big tech stocks, if you’re in the markets at all.

Grade your trading experience. Are you a beginner or a very active stock trader? Have you traded bitcoin and other highly speculative stocks? If so, trading covered calls will be easy for you.

Do you have an account with TDAmeritrade’s Think or Swim (TOS) platform, Interactive Brokers, Robin Hood, Tasty or other brokers where you can trade stocks and options? If not open and fill out the required forms so you can trade options. I use TOS because it’s built for speculators and options traders and has the technology former big tech employees will respect and use. The secret to trading is to keep it simple. You don’t have to be a quant or use all the metrics brokers offer.

Read about trading covered calls and cash secured puts. See my links below.

Go to your broker’s web site and watch their videos on trading stocks and options. Investing is work. It takes time. You are learners. You’ll get it pretty quickly. This is not computer science. For most options traders, back testing is a waste of time.

Do some paper trades. Post questions in the comments section below. Other readers and I will respond. I’ve been trading stocks for almost 60 years and options for about 17. My first article about the options markets was published about 52 years ago. That was before the CBOE, the first stock options exchange, opened. The story was about plans for the CBOE, which opened in 1973.

Decide that you will trade covered calls for income until you are very comfortable trading options. Don’t waste time or money trying to do complicated and risky spreads trades.

Start small. One monthly covered calls options contract at a time. Diversify by eventually doing 40 to 60 trades on about 20 stocks and ETFs a month. When you become very active, you will know that you have either a very profitable side gig or a good new stay at home job. Home based traders don’t have to worry about bosses, company politics or people who want to take their jobs.

Read this newsletter and others that I’ve linked to below. Some are free like mine and others cost $95 to $1,800 a year. Try different income strategies and use two or three to diversify your opportunities and risks. As you read my articles, you’ll see how I do this. I write about what I do, not just about what you can do.

Equipment. I have MacStudio with four large, high resolution monitors so that I can trade, watch charts, maintain my spreadsheets and write this newsletter and post comments on news sites and social media.

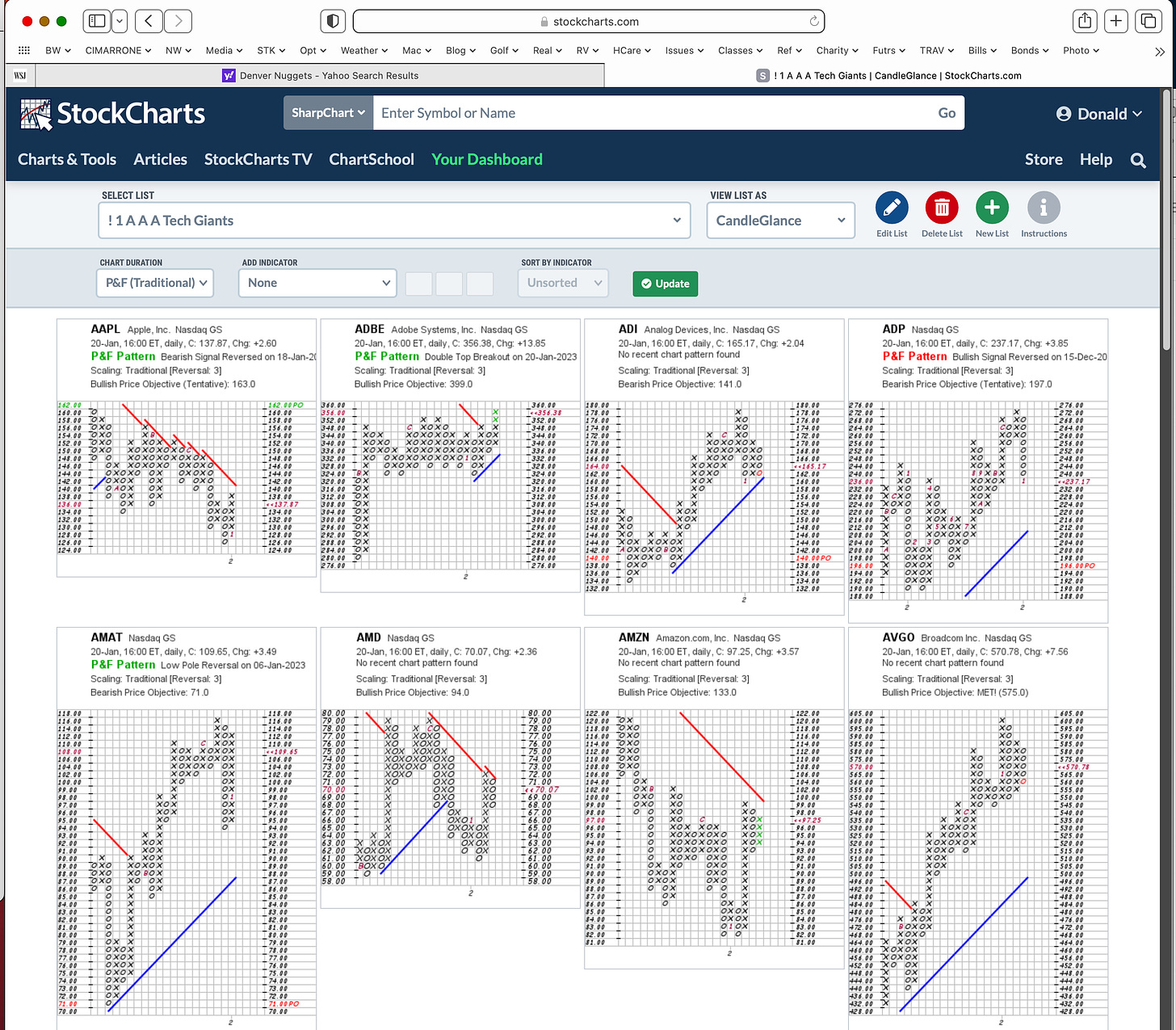

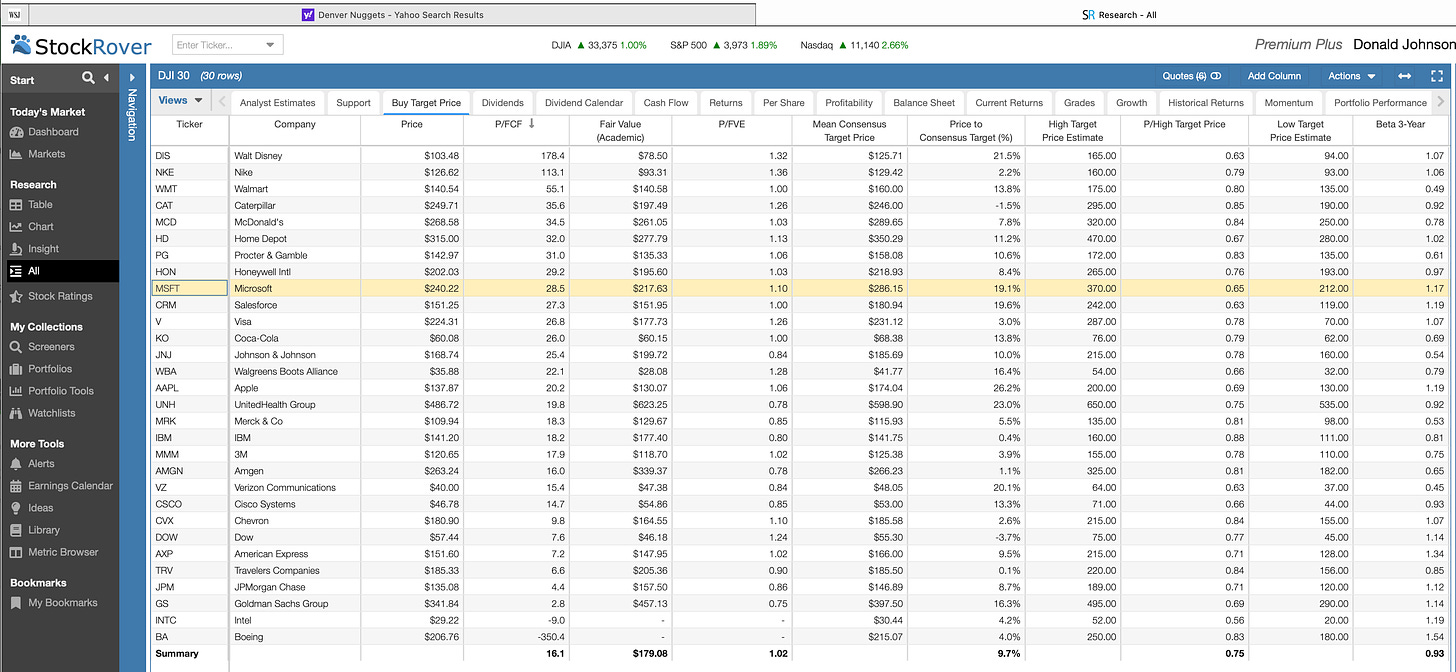

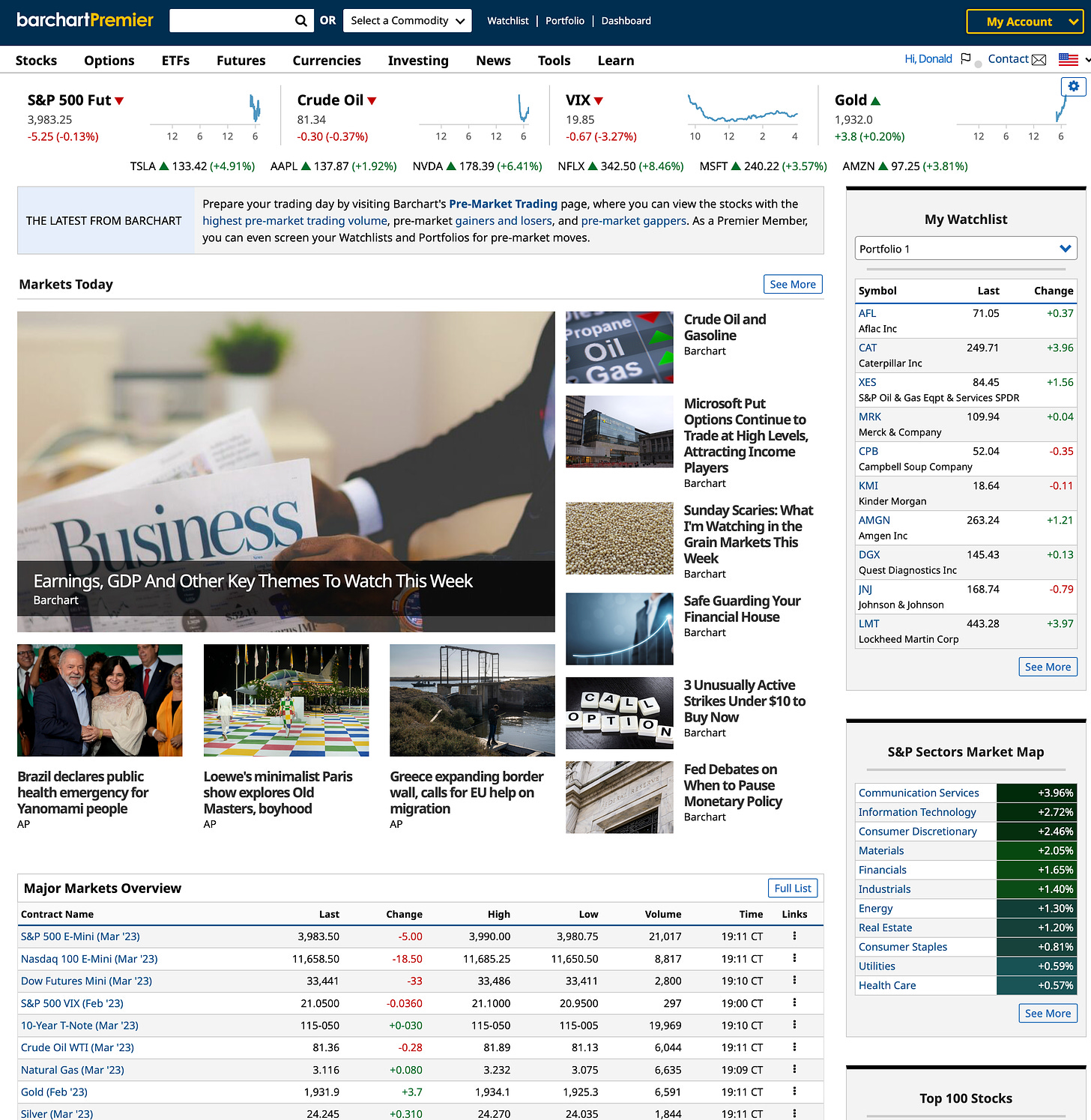

Must have subscriptions include services like StockCharts.com, Barchart.com and StockRover.com that combined give you affordable near equivalents of Bloomberg Terminals, which are used by professional portfolios managers. All three sites offer a lot of trading ideas and educational material. They all are good places to create stock and ETF watchlists as well as multiple portfolios. Their articles and blogs also are very educational.

Besides this free newsletter, I also recommend spending time studying the Covered Calls Advisor site, which also is free. We both post trades that people can do themselves or use as watchlists.

Over the next few days, I’ll write about big tech stocks and discuss why some are good for options trading and some are not.

Ask questions about the stocks you own. We’ll discuss possible covered calls trades in the comments section.

LINKs:

Home Page. See my more than 90 articles on options trades, stocks and watch lists. If you read several of these articles, you’ll learn how my strategy is meant to work. No guarantees. Links to useful web sites are on the lower right corner of the home page. Scroll down.

Follow @realDonJohnson on twitter.com and FaceBook.com.

Selling in The Money Covered Calls Can Yield Big Annual Returns on Risk. By Donald E. L. Johnson

20 Ideas for Adjusting Your Stock and Bond Portfolio, by Christina Lourosa-Ricardo.

How to Beat Inflation Tax, Bear Market Tax With Dividend Stocks, Covered Calls, Cash Secured Puts, by Donald E. L. Johnson.

Wars Breed Inflation, Rising Interest Rates, Market Turmoil, By Donald E. L. Johnson.

Ways to use StockRover.com to analyze stocks

Calls vs Puts Options: What’s the Difference?

A video on how to place options trades on Think or Swim.