8 Stocks With Bullish Price Objectives That Make Them Candidates for ITM Covered Calls Trades

Bear markets discourage stock buying, but income traders look for bullish stocks in bear markets that might allow options traders to consider buying bullish stocks and selling covered calls and puts.

By Donald E. L. Johnson

Cautious Speculator

Last week, SPY fell 4.81%, QQQ 5.79% and IWM 4.49%.

A few stocks have been relatively strong, but they could join the bear market at any time. See FDX, which was down 22.98% last week.

Trading options can be a relatively low risk way to enhance income on good dividend stocks. Bear markets make such trades more risky.

But if covered calls and cash secured puts trades are done on several stocks, it is possible to have a few trades not work out as planned and still make money on the portfolio of options trades.

After last week’s sharp drops in stock prices, stock futures are indicating that there will be only a tiny bounce back Monday, if that.

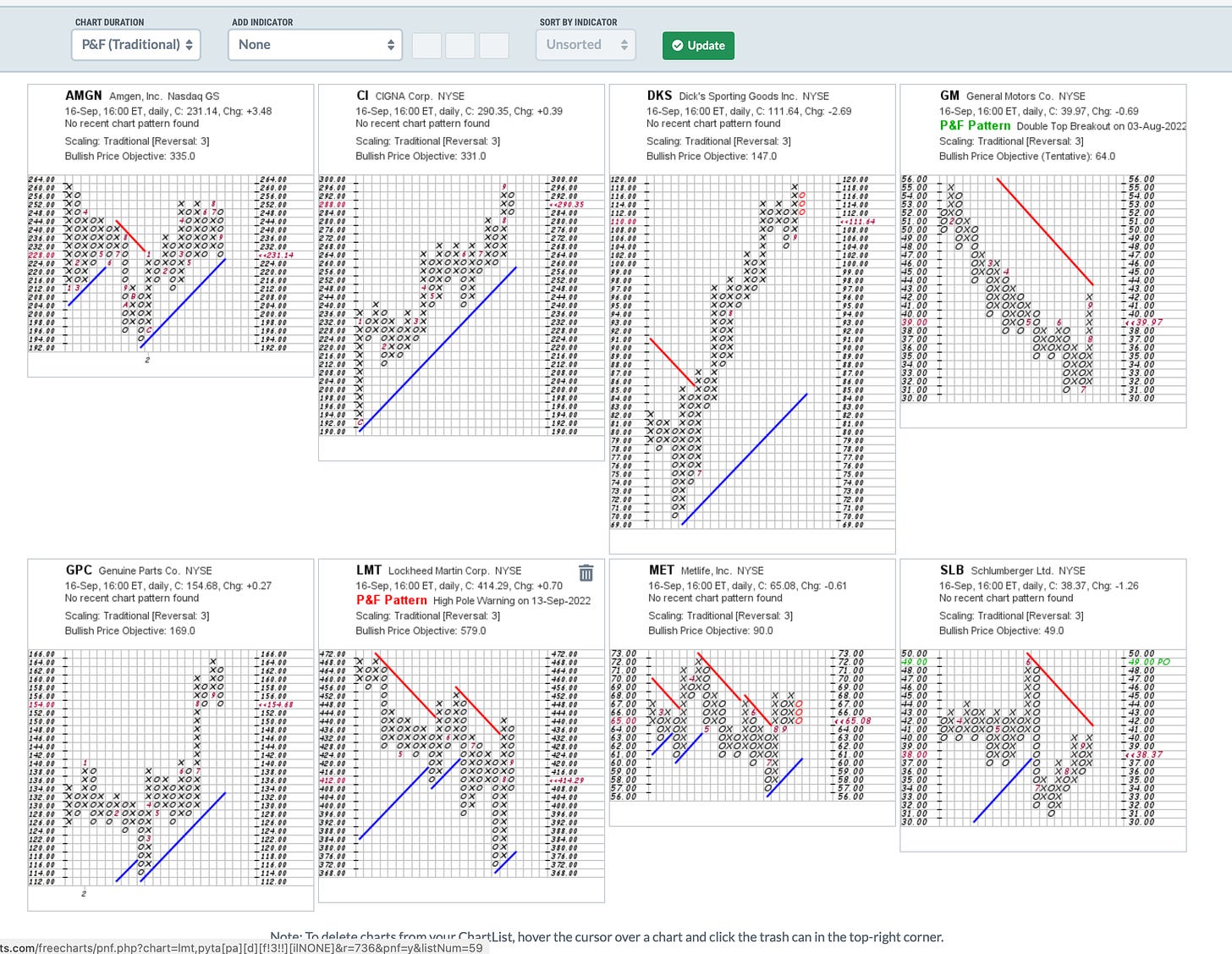

But here are eight stocks with bullish price objectives on their point and figure charts that buy/write income investors might consider for in the money (ITM) covered calls trades.

StockCharts.com’s PnF charts’ price objectives reflect thousands of recent trades, not the opinions or price targets of an analyst or group of analysts or what a guru is buying. These days, analysts’ price targets look pretty out of date. Also, while these stocks all have bullish price objectives, not targets, several are on the verge of turning bearish. See the charts for AMGN, GPC and MET. They all tend to move with the overall market a lot of the time. So be careful. Please click on the image and zoom in.

There are several ways to trade these stocks in this bear market.

b/w the stock. Sell, say weekly or 14- to 21-day calls at the money (ATM) or one strike in the money (ITM).

b/w the stock. Sell the calls two to five strikes ITM, depending on what will provide a decent immediate and annualized return on risk. For this strategy, options with high deltas (.69 to .80) and probabilities of being called and low probabilities of expiring out of the money (20% to 35%) seem (hedge, hedge) to work best. On 11- to 24-day trades, I’ve used 2.4% to 7.35% MOS. The goal is to have the stocks called with a combination of small capital losses that are more than covered by the options premium plus a dividend if a stock goes ex-dividend while the trade is open. If a stock price drops so much that it is not called, a trader can continue to write calls on the stock and reduce its net debit, or the stock can be sold at a loss. It helps to do trades on several stocks so if one trade doesn’t work, the portfolio makes money every month. See my links below and the strategy used by CoveredCallsAdvisor.blogspot.com.

Buy the stock with the idea that if it drops 2% to 3% in this bear market, it will be sold at a small loss. In this bear market, a 5% to 10% quick gain before the stocks roll over again might be worth taking.

Sell puts that expire in 14 to 45 days. In this market, look for liquid puts (narrow bid/ask spreads) with a lot of strike depth. To reduce the risk of having a stock put to you at an unacceptable price, consider trading for a 3% to 5% AROR at a strike with a margin of safety of at least 10% ($100 stock price minus the $85 strike price equals a MOS of 15%).

LINKs:

Home Page. See previous articles on other trades, stocks and watch lists. If you read several of these articles, you’ll learn how my strategy is meant to work. No guarantees. Links to useful web sites are on the lower right corner of the home page. Scroll down.

After Friday’s Plunge, Weak Futures Suggest We Take A Timeout to Find Covered Calls, Puts Trades, by Donald E. L. Johnson.

Selling in The Money Covered Calls Can Yield Big Annual Returns on Risk. By Donald E. L. Johnson

20 Ideas for Adjusting Your Stock and Bond Portfolio, by Christina Lourosa-Ricardo.

How to Beat Inflation Tax, Bear Market Tax With Dividend Stocks, Covered Calls, Cash Secured Puts, by Donald E. L. Johnson.

Wars Breed Inflation, Rising Interest Rates, Market Turmoil, By Donald E. L. Johnson.

Ways to use StockRover.com to analyze stocks

Calls vs Puts Options: What’s the Difference?

A video on how to place options trades on Think or Swim.

Hi Donald. Hope you are well and surviving this bear market. I am looking for an alternative investing site to Seeking Alpha. I would appreciate any recommendations you may have. Thanks, Michael