After Friday's Plunge, Weak Futures Suggest We Take A Timeout to Find Covered Calls, Puts Trades

Pick good undervalued dividend stocks with active and liquid stock options that can be used to generate weekly and monthly income by selling covered calls and puts options.

By Donald E. L. Johnson

Cautious Trader

When the markets have really bad days, it pays to give them time to settle down before doing new covered calls and cash secured puts trades.

Futures look weak Sunday evening, but who knows what will happen Monday or later this week?

Last week I sold covered calls and puts, but those trades are not worth discussing now even though they still look like they could work out okay, I think.

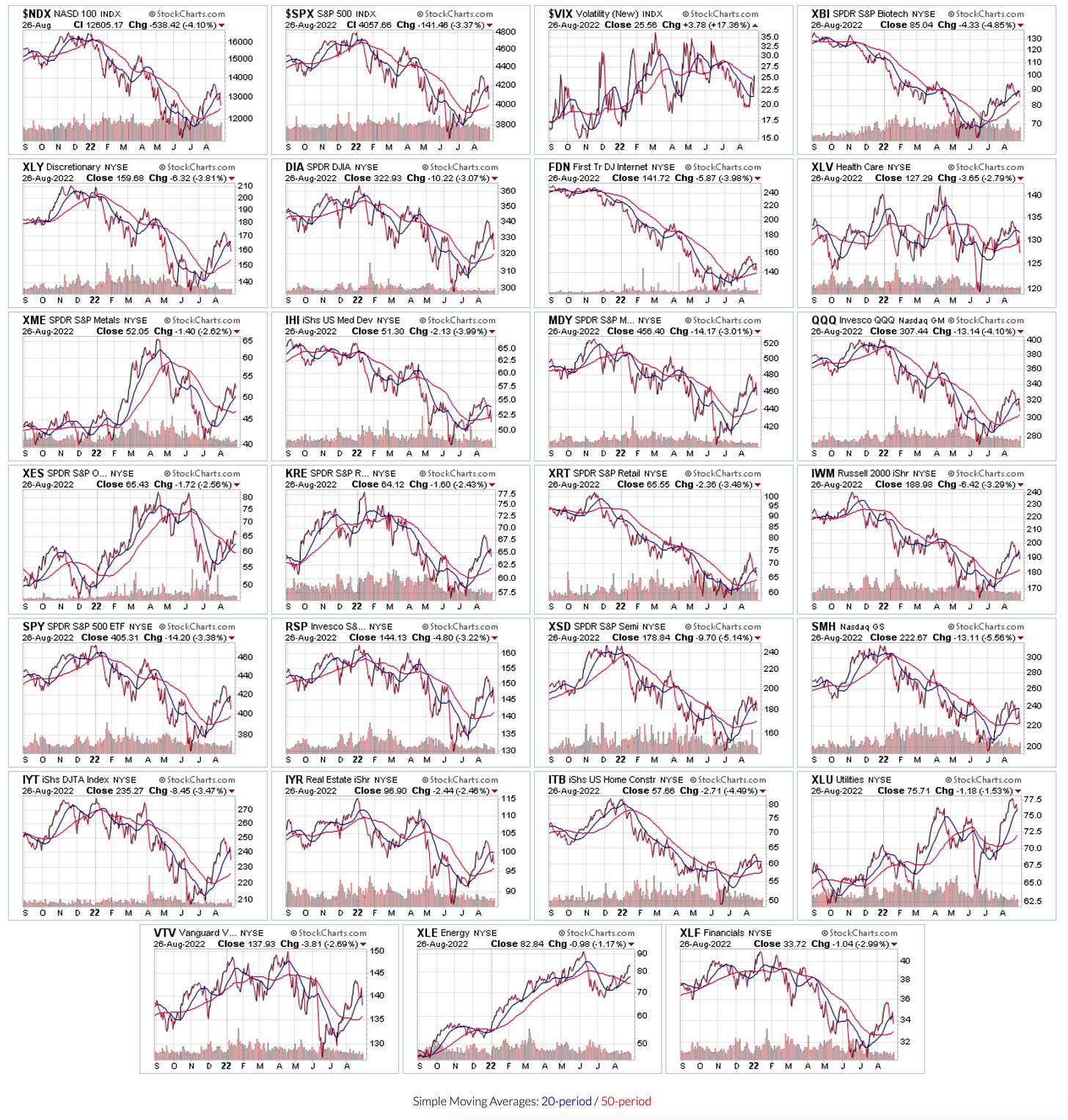

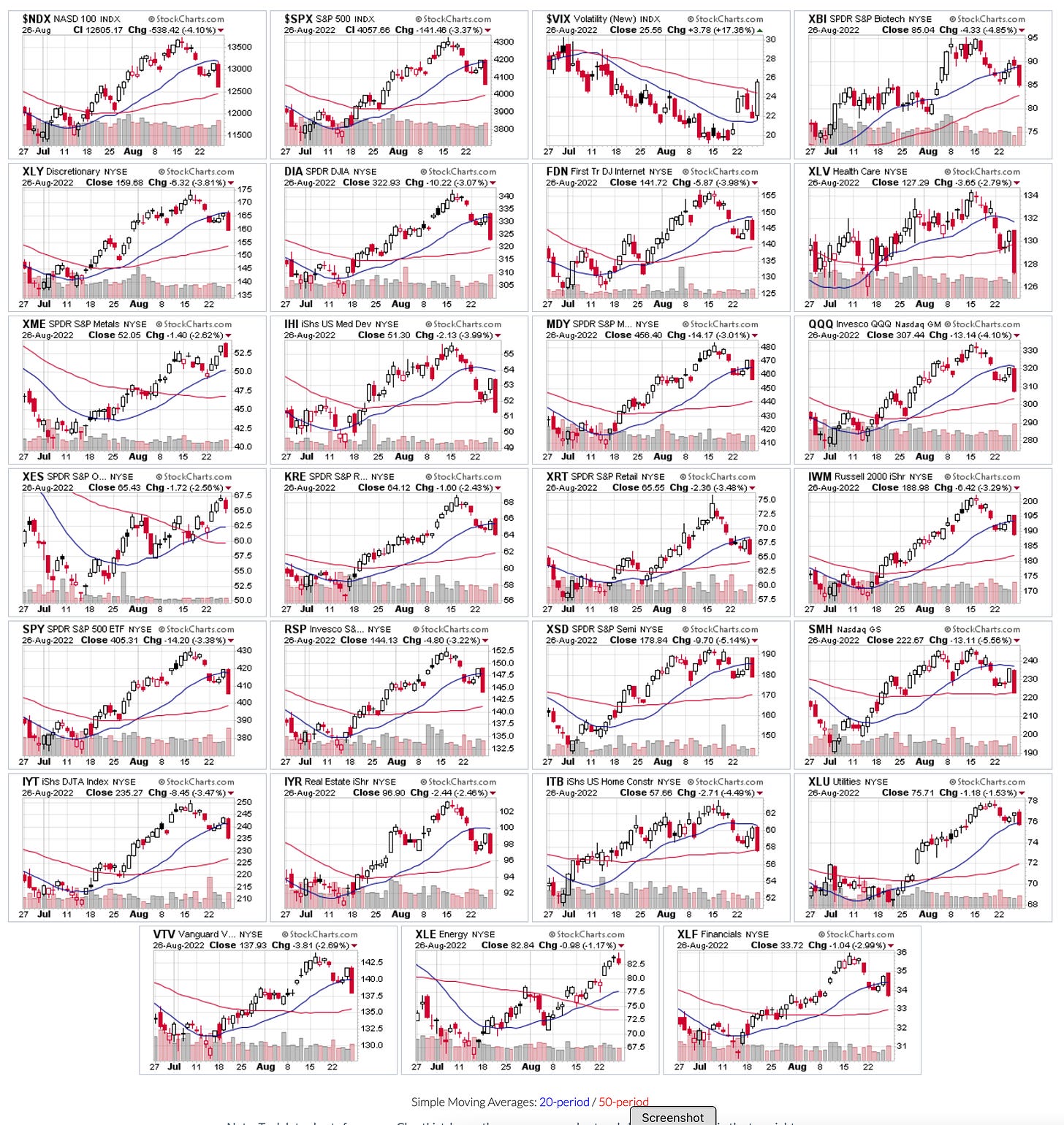

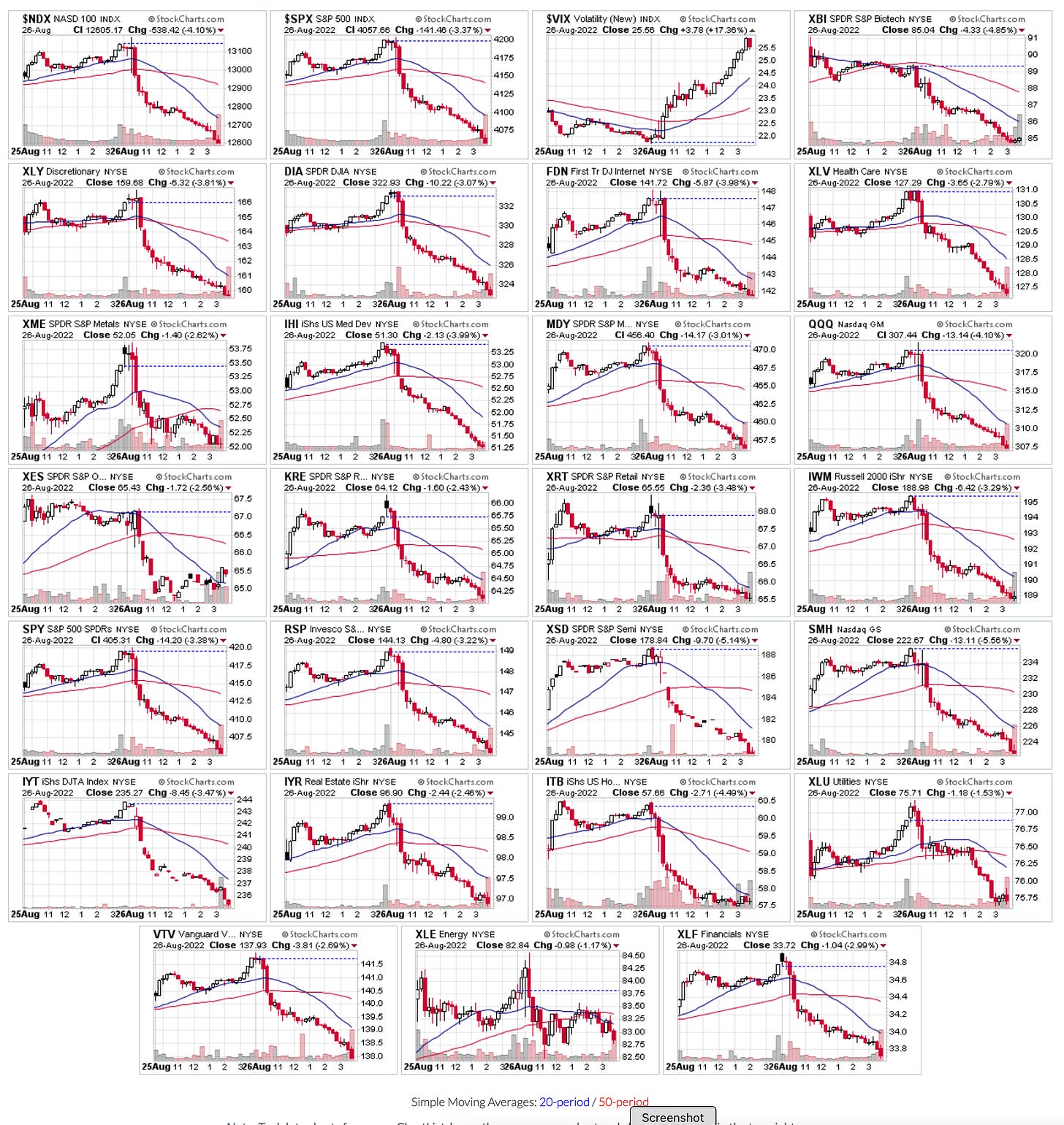

Check out the charts below to get a better feel for the markets.

It may take a few days or weeks to figure out whether the hawkish Federal Reserve Board’s promise to use higher federal funds interest rates to tame inflation will send stock prices sharply lower.

I am short in the money and other covered calls and way out of the money cash secured puts on stocks and ETFs. Those trades were done before Friday’s crash and really aren’t worth discussing here after Friday’s correction and in light of tomorrow’s weak futures. I’m waiting to see how bad this correction will be. The bear market rally seems to be over for now.

Here are the one-year charts for crucial exchange traded funds. Please click on the images and zoom in for better views.

These are the two months charts.

And here are the two-day candleglance charts from StockCharts.com.

On July 18, I wrote about selling cash secured puts in bear markets.

On July 21, I wrote about selling in the market (ITM) covered calls for income.

LINKs:

Home Page. See previous articles on other trades, stocks and watch lists. If you read several of these articles, you’ll learn how my strategy is meant to work. No guarantees. Links to useful web sites are on the lower right corner of the home page. Scroll down.

20 Ideas for Adjusting Your Stock and Bond Portfolio, by Christina Lourosa-Ricardo.

How to Beat Inflation Tax, Bear Market Tax With Dividend Stocks, Covered Calls, Cash Secured Puts, by Donald E. L. Johnson.

Wars Breed Inflation, Rising Interest Rates, Market Turmoil, By Donald E. L. Johnson.

Ways to use StockRover.com to analyze stocks

Calls vs Puts Options: What’s the Difference?

A video on how to place options trades on Think or Swim.