While Gold, Newmont And Crude Oil Gained, Stocks Continued to Sink Last Week

The strategy is simple. Pick good under valued dividend stocks. We pick stocks with active and liquid options that can be used to generate additional income by selling covered calls and puts.

By Donald E. L. Johnson

Cautious Speculator

SPY, DIA, QQQ are correcting.

NEM rose sharply.

My NEM shares were called at a profit.

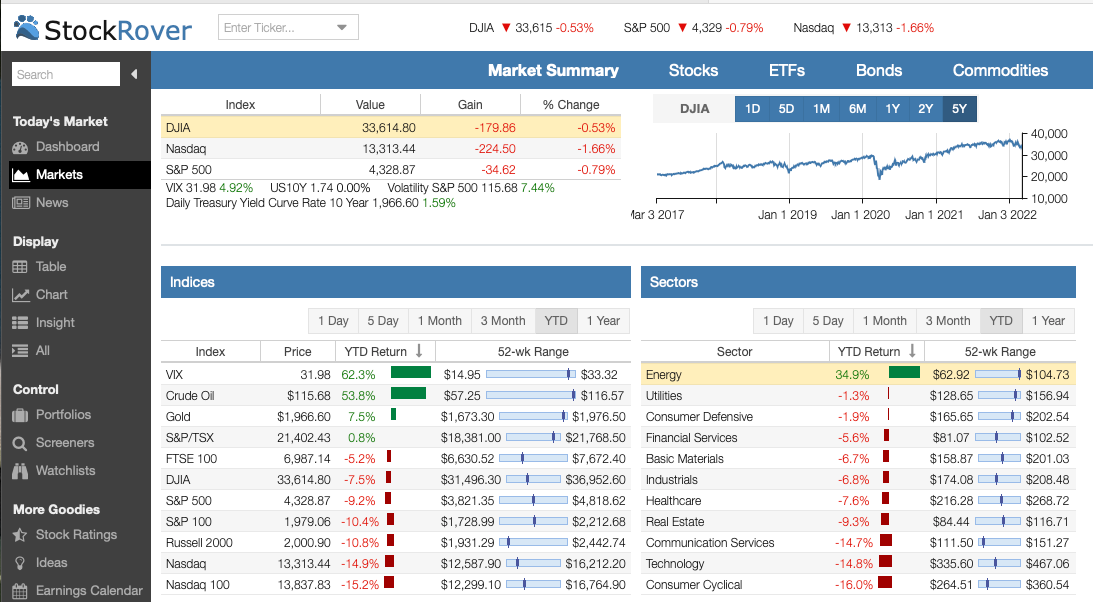

Stocks sank again last week. The VIX, crude oil and gold gained.

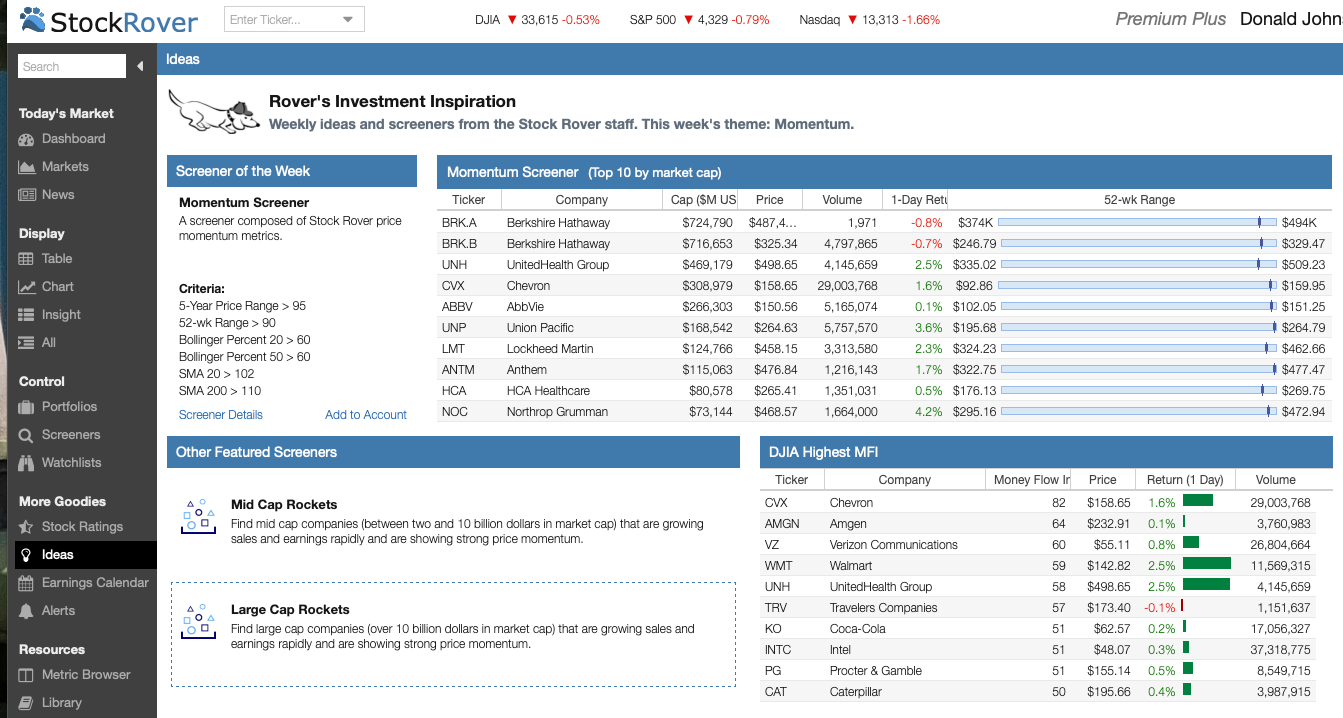

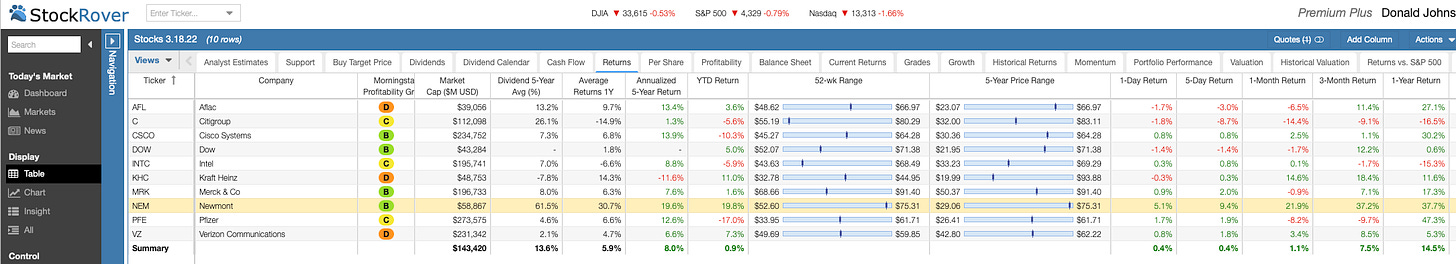

DOW JONES Industrials momentum winners are shown below. Traders looking for bullish mega caps that pay dividends and have active and liquid puts and calls options may find trading opportunities among these momentum stocks.

Please click on the images and zoom in for a better view.

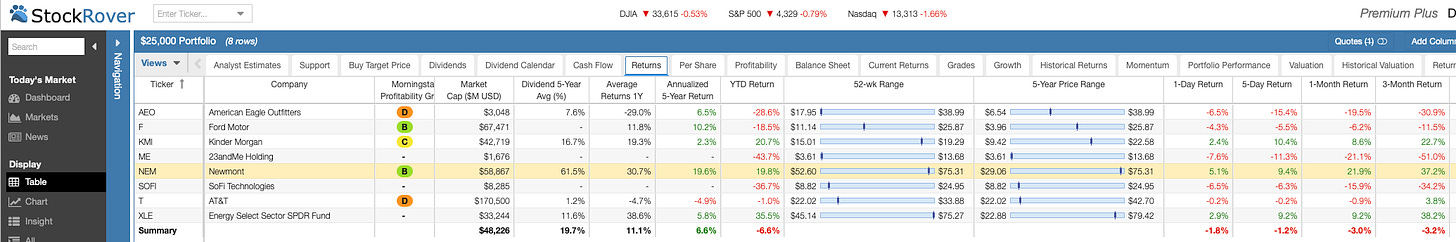

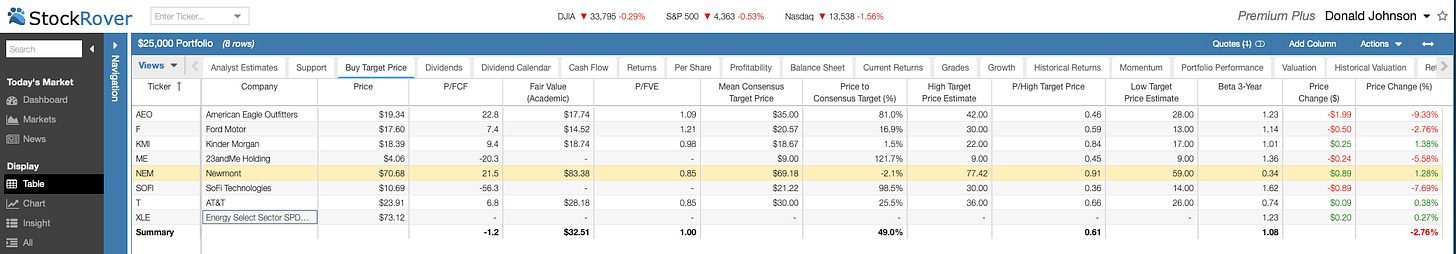

The eight stocks in our $25,000 watch list were mixed.

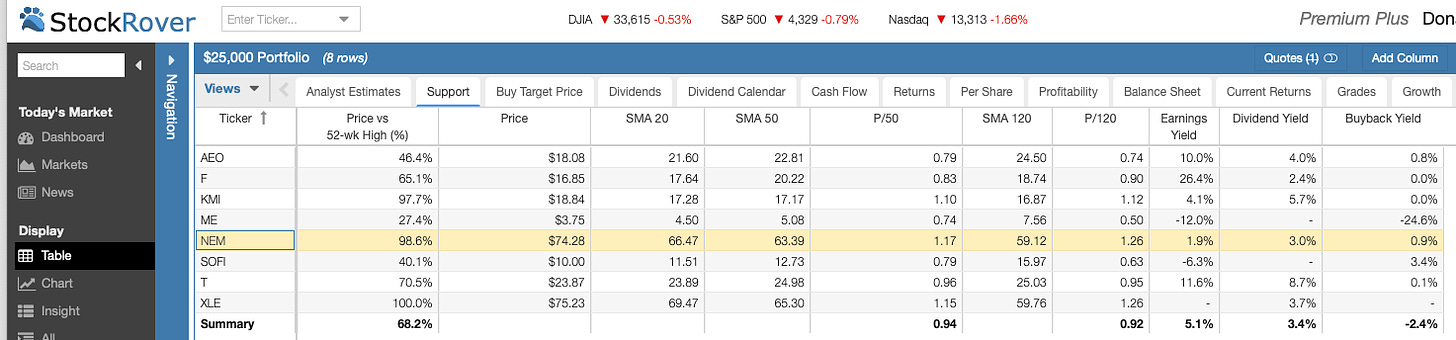

These stocks are trading an average of 94% of their 50-day moving averages.

My NEM shares were called at a profitable $72 Friday, but I left some money on the table on my one-day covered call trade.

I won’t get the dividend Monday, but I pocketed better than a 5.5% gain after spending months working the wheel on Newmont. Next week, I may sell cash secured puts on NEM because it could go higher. However, it is looking a little over bought, and it often is a good idea to take small, short term profits in this kind of market.

And the 10 dividend stocks in our covered calls watch list also were mixed.

Citigroup (C) closed at 88% of its 50-DMA while NEM closed at 117% of its 50-DMA. The 50-DMA is resistance for C and support for NEM, give or take. Banks are weak and gold mining stocks are strong.

Please subscribe. It’s free!

LINKs:

Home Page. See previous articles on other stocks and watch lists. If you read several of these articles, you’ll learn how this strategy is meant to work. No guarantees.

Calls vs Puts Options: What’s the Difference?

8 Stocks on $25,000 Covered Calls Watch List

If You Buy These 10 Stocks And Sell Covered Calls, Your Premiums Plus Dividends Could Top 10%

10 Dividend Stocks That Look Underpriced; Generate Premium Income By Selling Puts

Wars Breed Inflation, Rising Interest Rates, Market Turmoil

A video on how to place options trades on Think or Swim.

Beware

Like all investing, trading stocks and options is risky. If you can’t sleep with market risks, you might want to let someone else do your trading. Consider an option trading ETF like XYLD, which I own. I also trade its calls and puts. I’m an active private speculator who trades covered calls and sells puts on stocks for my accounts. I am not a professional analyst nor a financial advisor. I don't take and won't take responsibility for how other people trade. This article is for educational purposes only. It is not advice. The data presented looked accurate at publication time except for intra-day fluctuations, but I can’t guarantee the accuracy. Traders should do their due diligence. I reserve the right to trade any of the listed stocks and options at any time. I own and have calls and puts positions in AEO, DOW, KMI, ME, PFE, SOFI, T and VZ . I have no business relationships with these companies and I receive no compensation for producing this content.

@realDonJohnson. Because I don’t want to litter subscribers’ in boxes with emails, I write only one or two newsletters a day. I’m active most days on twitter where I tweet about stocks, options trades and other topics.

Dow futures are down 425 points at 8:33 p.m. Sunday. For some traders, that is nibble or buy territory. To me, it looks like a falling knife that I'm not ready to challenge, yet. NEM and XLE look bullish, and I may do something with them.