Wars Breed Inflation, Rising Interest Rates, Market Turmoil

Cautiously trade stocks, covered calls options and cash secured puts options with me for a year. Then you should have a nice total returns trading business.

By Donald E. L. Johnson

Cautious Investor

Commodity prices soared during the World Wars

After stocks peaked in 1965, they were mostly flat and depressed for the next 15 years.

During the Iraq War, inflation was low and stocks about doubled for about five years, then fell back to pre-war levels.

Buy and hold income investors were mostly frustrated until the early 1980s when inflation and interest rates shrank and stock markets finally entered a long bull market.

It appears the Fed will hike interest rates more than four times this year. If so, inflation could be short lived as long a war doesn’t black swan the markets.

Technicians and short term options income traders should do okay–with a lot of luck.

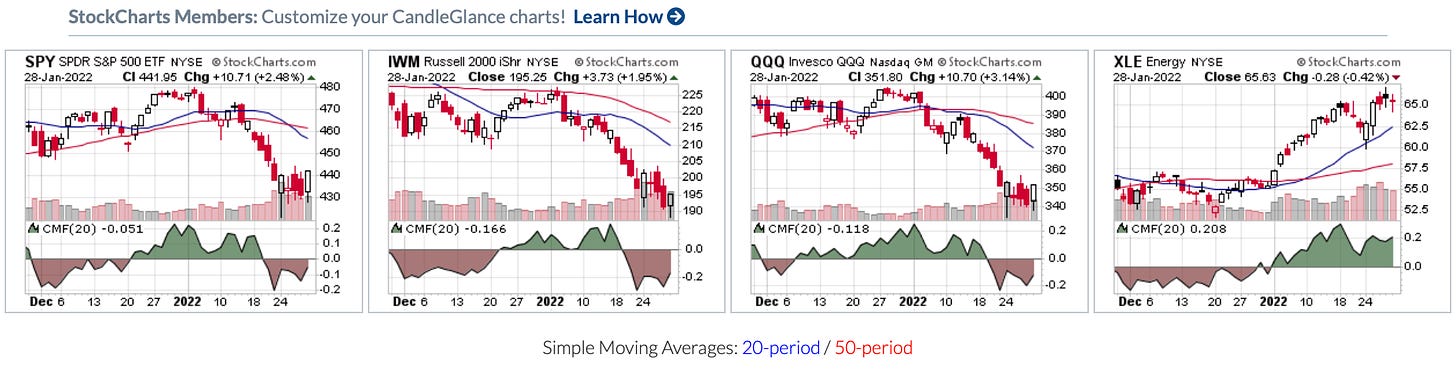

Watch and trade SPY, QQQ, IWM and XLE They are among the most active and liquid stock options markets.

Russia and China along with Iran, N. Korea and ISIS are threatening new wars. Whether they will happen is a hot topic in Washington and around the world.

Please click on the image and zoom in for a better view. Only the XLE chart is bullish.

Traders of stock options along with money market traders, commodity futures traders and currency traders are paying close attention to the war threats and bluffing.

No one knows whether the politicians are moving troops and weapons to prepare for war or they are bluffing to distract voters from their internal political problems.

Thus, speculators are trading their assumptions and beliefs about what will happen and when. Their opinions will change as new information becomes available.

There are a lot of reasons for imperial nations to hold off on getting into hot and financial wars. President Biden is threatening sanctions if Russia invades Ukraine. Russia probably is not only moving troops but also trying to pre-empt and nullify any sanctions the U.S. might impose.

Wars often cause ruinous inflation, volatile stock, options, money and commodity markets and frustration for buy and hold income and total returns investors.

I learned this on August 2, 1964, less than a week into my career as a Wall Street Journal cub reporter assigned to cover the commodity futures markets on the floor of the Chicago Board of Trade.

Standing at the Dow Jones newswire ticker on the floor, I read the first report of N. Vietnam’s attack on the American destroyer, the USS Maddox.

A roar of shouting traders burst out of the wheat, soybeans, soybeans oil and meal and oats pits. Prices jumped the 10 cents per bushel daily trading limit instantly, quieting the floor a bit.

My job was to interview traders the pits and file stories for the paper.

I walked over the the soybeans pit and asked, “What happened?’

The answer: “Wars create huge demand for commodities.” Most of the traders were veterans of World War II and others were in the pits during the war. They knew that agricultural prices also soared during World War I.

That began my 12-year career as a reporter on inflation and the futures markets for the Journal and later other publications. After reporting on the commodities, stocks and money markets for 12 years, I covered inflation in the health care industry for another 40 years. Yes, I’m old and aging well, thank you.

Interest rates are rising and the Fed may hike Federal funds rates two to five or more times this year. Remember, no one, including the Fed chair, can predict interest rates or stock prices.

The question is how will traders behave and what are the gurus on CNBC and Fox Business trading? What they think the markets will do is the wrong question. They don’t know the future. Nobody does.

All we can do is trade, or not.

Early during the Vietnam War, stock prices actually soared. Then inflation took over, interest rates soared. In the early 1980s, the Fed had to quickly and sharply hike interest rates to cool inflation. That caused a short-lived recession. Then the long bull market began.

Markets are about the future, which analysts try to calculate using discounted cash flow calculators to estimate three- and five-year fair values. Fair value estimates (FVE) are estimates of future intrinsic values under different assumptions about companies’ cost of capital and their free cash flow growth rates.

But when it comes to wars, fair value estimates, analysts’ target prices and charts are worthless.

That is when some people make fortunes trading equities, and others lose their shirts. As always, there is a lot of luck involved in investing and trading—not to mention staying out wars.

Beware

Like all investing, trading stocks and options is risky. If you can’t sleep with market risks, you might want to let someone else do your trading. Consider an option trading ETF like XYLD, which I own. I also trade its calls and puts. I’m an active private speculator who trades covered calls and sells puts on stocks for my accounts. I am not a professional analyst nor a financial advisor. I don't take and won't take responsibility for how other people trade. This article is for educational purposes only. It is not advice. The data presented looked accurate at publication time except for intra-day fluctuations, but I can’t guarantee the accuracy. Traders should do their due diligence. I reserve the right to trade any of the listed stocks at any time. I do not own and nor have options on the stocks mentioned in this article.