Walmart Beats Earnings, Revenues Estimates; Raises Dividend 2%; Good Covered Calls, Puts Stock

Dividend and income investors seeking a relatively safe haven in the face of a Russian invasion of Ukraine, worsening inflation and rising interest rates may flock to WMT.

By Donald E. L. Johnson

Cautious Speculator

Walmart is one of the few stocks up today because it turned in a solid fourth quarter and raised its dividend 2%.

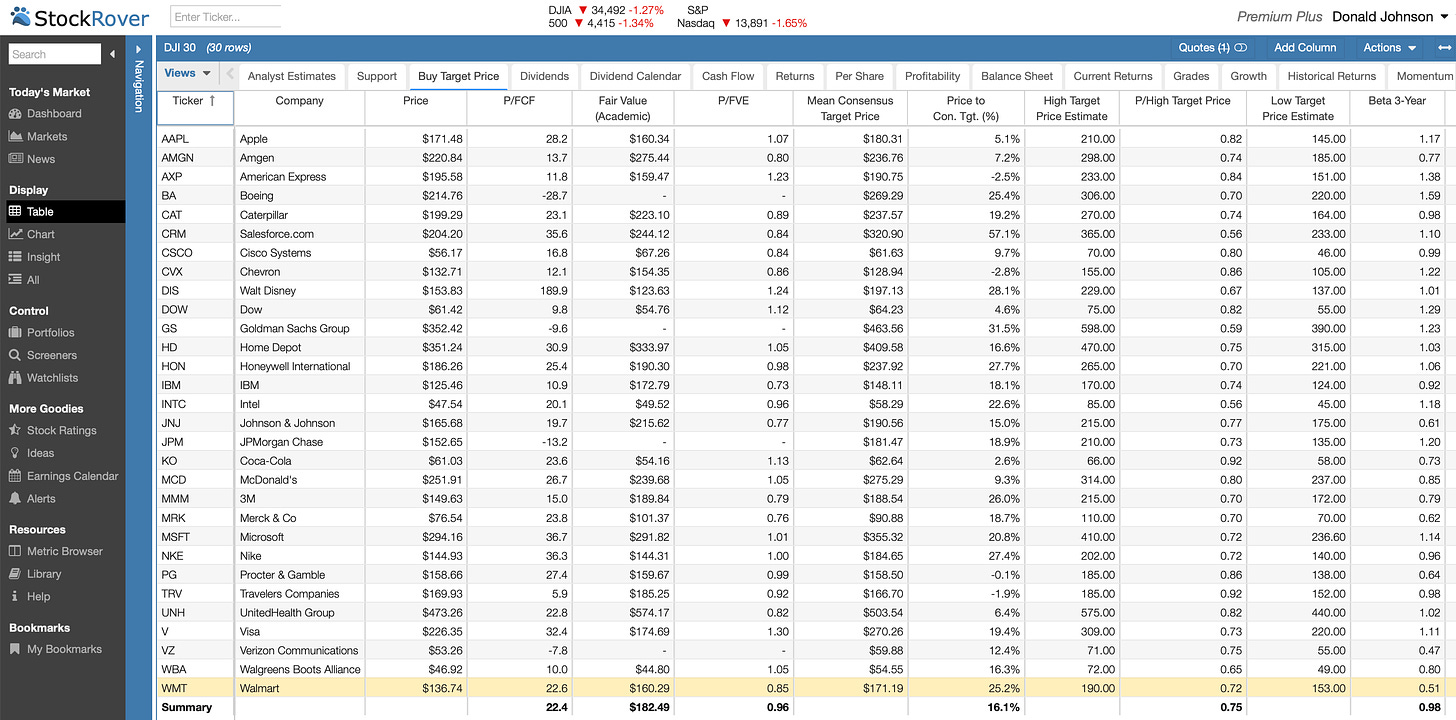

Trading at $135.79, up $2.38 at this writing, WMT is below its estimated fair value ($160) and the average target price ($171) of Wall Street analysts. WMT has a 22.4 P/FCF ratio, which is almost the same as this critical valuation metric’s current average for the Dow Jones 30 Industrials stocks according to the StockRover.com data shown above. Please click on the image and zoom in.

It’s three-year beta is .51, which means it is not a very volatile stock and can be considered a “safe haven” in down markets.

The stock’s puts and calls options are very active, liquid and deep. This gives investors a lot of ways to trade the stock and its options. The dividend yield is 1.6%. WMT goes ex-dividend on 3.17.22.

While WMT is up on its earnings news, it is likely to dip over the next several days if the market continues to weaken. At the moment it is off it’s high for the day.

Thus, instead of buying WMT, dividend and income traders may prefer to sell WMT 3.18.22 expiration (29 days) $120 strike (delta -.07) cash secured puts for $0.38 per share on a 100-share option.

The trade would provide a 0.279% return on risk (RoR), or 3.2% annualized. The low delta suggests that the probability of having the stock assigned is only about 7%. That is why the RoR is low, which is what you want in a weak market. The margin of safety (MOS = stock price minus strike price) is a cautious 12%. In other words, the stock will have to drop more than 12% to be assigned.

In this market, that could happen regardless of the company’s fundamentals and analysts’ target prices.

Investors looking to “nibble” at WMT while it’s off it’s highs and target price, could do a buy/write trade. They could buy WMT for $136.221, or $13,222.10, and sell one WMT 3.18.22 $140 strike (delta .33) for $1.79 a share. The RoR would be about 0.13%, or about 14.5% annualized if the same kind of trade was done 11 times over the next year. It is impossible to replicate trades because prices change.

More aggressive traders would give themselves an annualized hedge or cushion against a stock price drop of about 26% by doing both the puts and covered calls trades at the same time.

I’ve previously written about inflation here.

Question: What questions do you have about Walmart? We can discuss it in comments.

LINKs:

Home Page. See previous articles on other stocks.

Calls vs Puts Options: What’s the Difference?

A video on how to place options trades on Think or Swim.

Beware

Like all investing, trading stocks and options is risky. If you can’t sleep with market risks, you might want to let someone else do your trading. Consider an option trading ETF like XYLD, which I own. I also trade its calls and puts. I’m an active private speculator who trades covered calls and sells puts on stocks for my accounts. I am not a professional analyst nor a financial advisor. I don't take and won't take responsibility for how other people trade. This article is for educational purposes only. It is not advice. The data presented looked accurate at publication time except for intra-day fluctuations, but I can’t guarantee the accuracy. Traders should do their due diligence. I reserve the right to trade any of the listed stocks and options at any time. I don’t own or have options positions in WMT or business relationships with Walmart.

@realDonJohnson. I’m active on twitter where I tweet about trading and other things and link to tweets about stocks.